MUMBAI: Regional cinema just turned a corner, and Gujarati films are leading the way. Jojo Movies, a rising force in vernacular content, has partnered with Prime Video to make its acclaimed film library available on the platform’s movie rentals offering starting May 2025. The rollout marks a landmark moment for Gujarati cinema, which now finds itself accessible to a pan-Indian audience on demand.

Films such as 3 Ekka, Veer Esha Nu Seemant and other recent crowd-pullers will now stream as paid rentals, adding a fresh layer of visibility and viability to the regional film industry. The model lets viewers across India rent these films without subscription barriers, opening a direct monetisation channel for creators while broadening exposure for Gujarat’s cultural narratives.

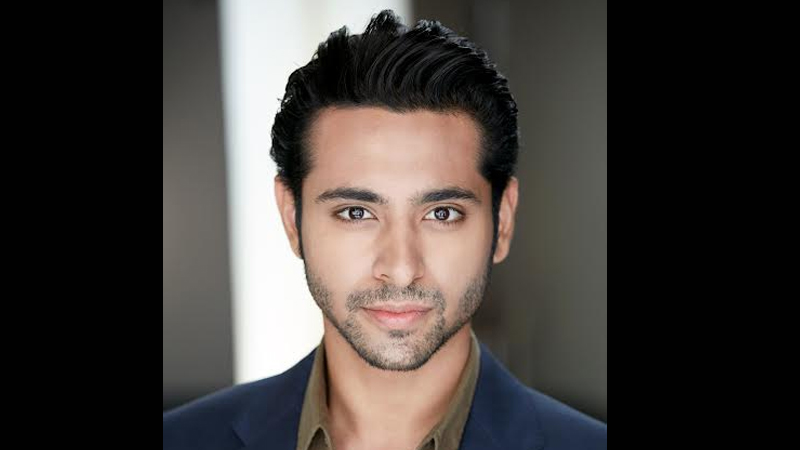

“We are at a turning point in the evolution of regional cinema, and our collaboration with Prime Video is a game-changer for both Gujarati cinema and regional content as a whole”, said Jojo Movies founder & CEO Dhruvin Shah. “This isn’t just about distribution—it’s about redefining how regional stories are shared, valued, and experienced nationally. The availability of Gujarati films via Movie Rentals on Prime Video underscores the rising demand for culturally rooted storytelling. Our vision has always been to take powerful regional narratives to wider audiences, and this launch is a significant step in making Gujarati cinema a cultural force”.

The move is part of a larger strategic pivot by OTT platforms to tap regional growth engines. As internet penetration deepens and linguistic audiences seek relatable content, vernacular storytelling is no longer a side note—it’s a mainstage act. Jojo’s catalogue hitting Prime Video isn’t just about renting films; it’s about renting pride, culture and a slice of the state to the rest of India.

The digital release also sets the stage for new business models, giving filmmakers a chance to earn directly from pay-per-view audiences instead of relying solely on theatrical or subscription-led returns. For regional storytellers, that could be a ticket to creative independence.