Mumbai: Sonata, a renowned name in the watchmaking, is excited to announce the debut of its newest sub-brand, Poze. Aiming to capture the essence of contemporary...

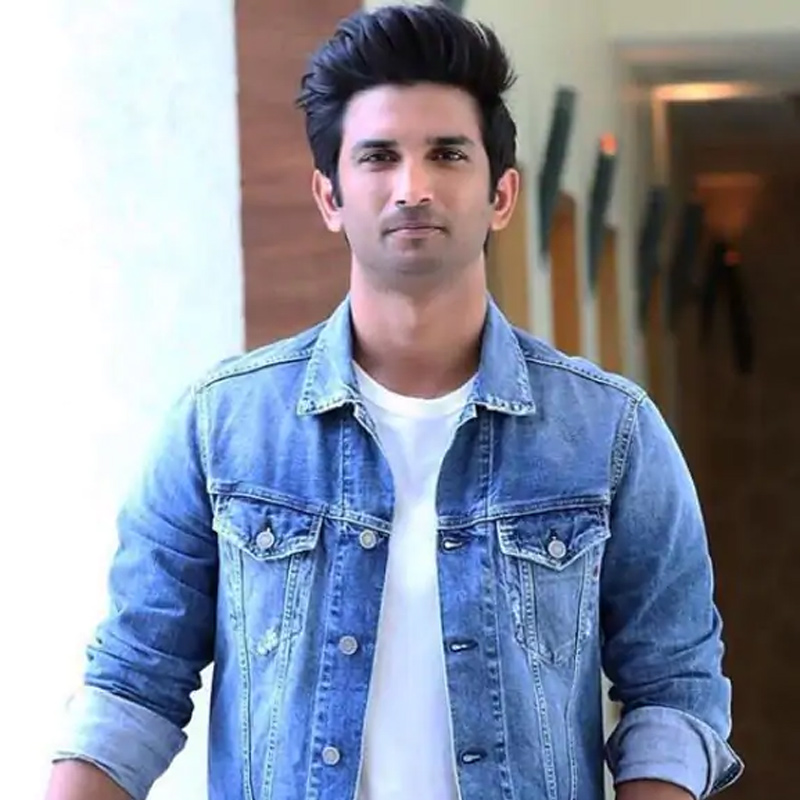

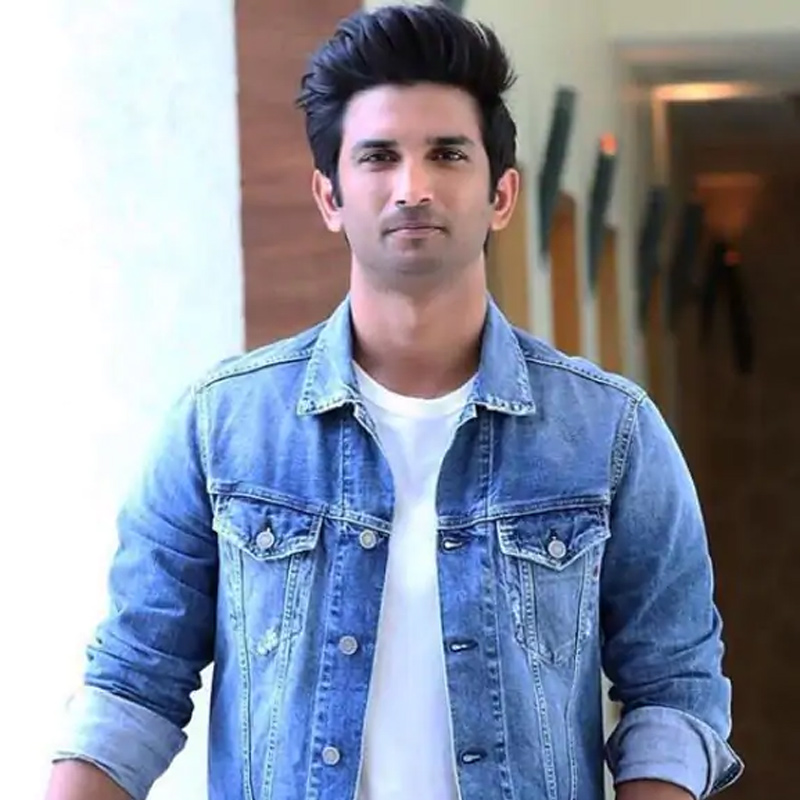

NEW DELHI: The sudden demise of popular actor Sushant Singh Rajput has shocked the entire nation. The beloved actor who successfully transitioned from television to films...

BENGALURU: The Titan Company Limited (Titan) which believes in delivering value through brands had higher advertising spends (ad spends) in the quarter ended 30 September 2016...

BENGALURU: The Titan Company Limited (Titan) which believes in delivering value through brands had higher advertising spends (ad spends) in the quarter ended 30 September 2016...

BENGALURU: Last quarter (Q1-2016) Titan Company Limited (Titan) spent the highest amount towards advertisement (Ad spend) both in terms of absolute rupees and percentage of Total...

BENGALURU: Titan Company Limited (Titan) spent the highest amount in absolute rupees and in terms of per centage of Total Income from operations (TIO) towards advertisements...

BENGALURU: Titan Company (Titan), formerly known as Titan Industries, reported a (-25.98) per cent drop in advertisement expenses (Advt Exp) in Q4-2014 at Rs 87.37 crore...

MUMBAI: Myntra.com, India’s largest fashion e-tailer has appointed Lowe Lintas as its communications partner. The decision to appoint Lowe Lintas is seen as a significant step...

BENGALURU: India’s largest specialty retailer, Titan Company (Titan), formerly known as Titan Industries, reported a 25.11 per cent increase in ad spends to Rs 118.04 crore...

MUMBAI: Titan Industries Limited has consolidated it’s media planning and buying with Group M’s Maxus. The Titan account is pegged at Rs 400 million. According to...