Connect with us

MUMBAI: Being in the toys business is no child’s play. But KA Shabir is willing to take on the challenge. From 1 January 2025, he has...

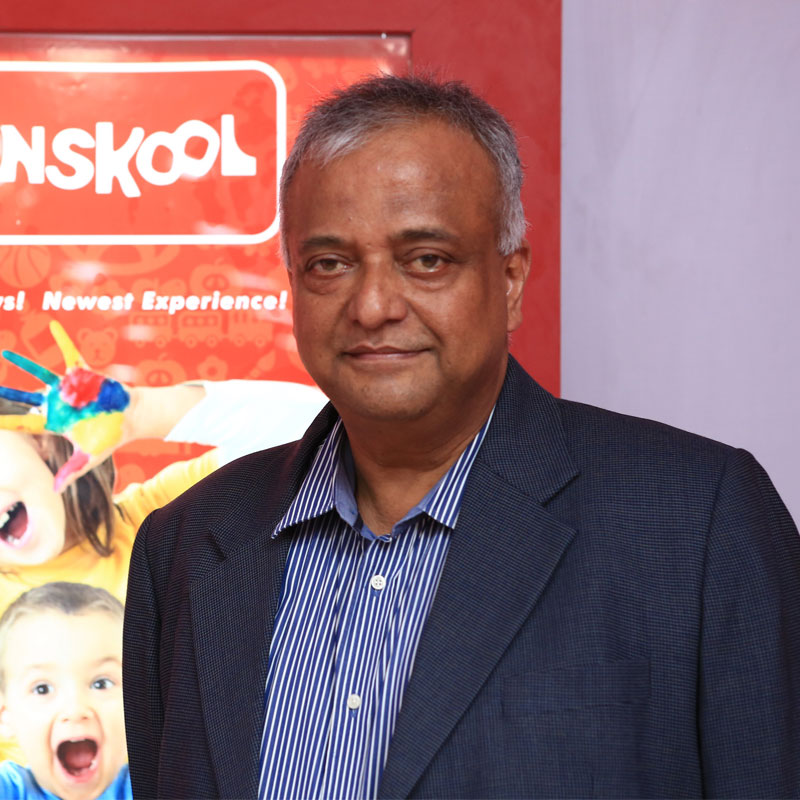

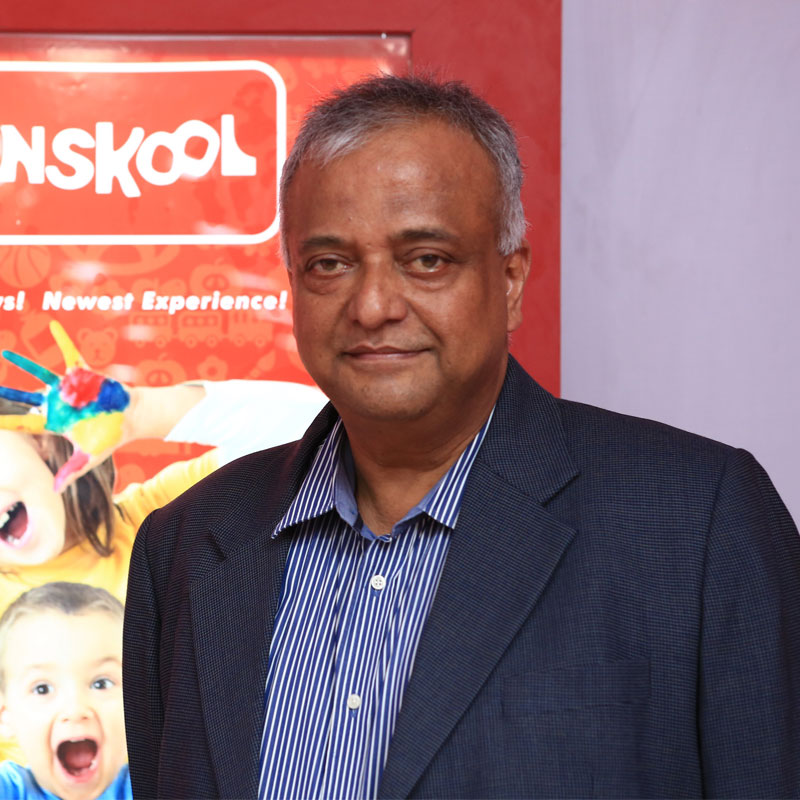

MUMBAI: Funskool (India) Ltd, recently welcomed R Jeswant as its chief executive officer on board, following the retirement of John Baby. Baby, who was the CEO...

MUMBAI: The Indian toy market is currently estimated at Rs 3000 crore at retail, which makes it only around 0.5 per cent of the world toy...