Mumbai: Axis My India, a leading consumer data intelligence company, reveals the latest insights into shifting media consumption habits in India. The survey highlights a notable 23% families report media consumption, resulting in a 3% increase from last month. Focusing on the ICC World Cup 2023 viewership, the study exposes diverse preferences, with 31% opting for traditional television and a significant 22% choosing the mode of mobile phones. The analysis of daily time allocation on media presents a clear trend toward digital platforms, especially for shorter durations, indicating a dynamic transformation in media consumption patterns. Axis My India’s findings offer a comprehensive view of the evolving media landscape, influencing the future of consumer behavior in India.

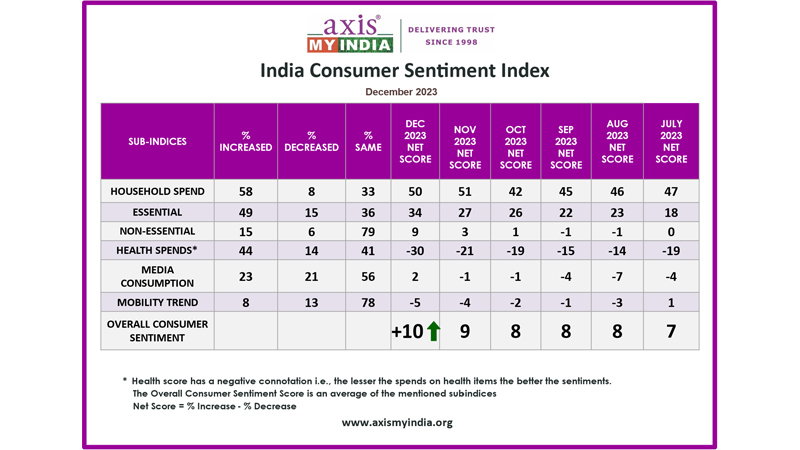

The December net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +9.9, which is an increase of +0.9 from the last month.

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey used Computer-Aided Telephonic Interviews and included 5,143 participants from 35 states and UTs. Among them, 72% were from rural areas and 28% from urban areas. In terms of regions, 23% were from the North, 24% from the East, 28% from the West, and 25% from the South of India. Among the participants, 60% were male and 40% were female. Looking at the largest groups, 30% were aged between 36 and 50 years old, while 25% were aged between 26 and 35 years old

Commenting on the CSI report, Axis My India chairman & MD Pradeep Gupta said, “The vibrant media landscape illuminates the ever-shifting preferences of our audience. A dynamic surge is witnessed in media consumption surrounding the excitement around the ICC World Cup 2023, showcasing the immense and diverse appeal of this global event. Delving deeper into the fabric of media consumption, our study also uncovers a decisive move towards digital platforms, with viewers now carving their own unique paths. The average daily time spent on TV and Video Streaming Platforms/OTT unveils a fascinating narrative, signaling a pronounced tilt towards the latter, notably among the vibrant youth spending 96 minutes daily on OTT compared to 60 minutes on TV. These insights serve as a compelling call to advertisers and marketers”

Key findings

1. Overall household spending has increased for 58% of the families, which is a decrease by 2% from last month. Consumption remains the same for 33% of families. The net score, which was +51 last month, has dipped to +50 this month.

2. Spends on essentials like personal care & household items have increased for 49% of families, which marks an increase by 5% from last month. Consumption remains the same for 36% of families. The net score, which was at +27 last month, has surged to +34 this month.

3. Spends on non-essential & discretionary products like AC, Car, and Refrigerators have increased for 15% of families. Consumption remains the same for 79% of families. The net score, which was +3 last month, is at +9 this month.

4. Expenses towards health-related items such as vitamins, tests, and healthy food have surged for 44% of the families, which marks an increase by 7% from last month. Consumption remains the same for 41% of families. The health score which has a negative connotation i.e., the lesser the spends on health items the better the sentiments, has a net score value of -30 this month.

5. Consumption of media (TV, Internet, Radio, etc.) has increased for 23% of families which is an increase by 3% from last month. The net score, which was -1 last month, is at +2 this month.

6. Mobility has increased for 8% of the families, which is a increase of 1% from last month. The net score, which was -4 last month, is at -5 this month. Mobility remains the same for 78% of the families.

On topics of current national interest

1. The survey delved into identifying the top milestone missions for India in a year filled with significant events, including the ICC World Cup and the G20 Summit. A significant 54% of respondents identified the Chandrayaan-3 lunar mission as the most defining milestone of the year. This sentiment is underscored by the remarkable success of Chandrayaan-3, India’s ambitious lunar mission. The event not only garnered widespread acclaim and also set a new record with 8.06 million concurrent views during its live stream, highlighting the nation’s growing prowess and interest in space exploration and scientific achievements.

2. The survey unveiled that a significant 62% of respondents watched the ICC World Cup 2023, showcasing the event’s wide-reaching appeal. Delving deeper into the modes of viewership, it was found that 31% of the respondents followed the matches on television, while a notable 22% of the respondents opted to watch the games on their mobile phones, highlighting the diverse ways in which audiences are consuming sports content in the digital age.

3. The study delved into the average daily time spent on TV and Video Streaming Platforms/OTT across various time brackets. The overall time spent on TV is 65 minutes per day compared to 61 minutes on OTT. The younger age group spend significantly higher time spent on OTT (96 minutes per day) compared to TV (60 minutes per day)

4. For those allocating less than 30 minutes, 14% of respondents reported spending their time on TV, while 15% preferred Video Streaming Platforms/OTT

5. In the 30 minutes to 1-hour category, 16% indicated TV usage compared to 13% for Video Streaming Platforms/OTT

6. Moving on to the 1-2 hour bracket, 24% opted for TV, while 18% chose Video Streaming Platforms/OTT

7. The percentages decrease for longer durations, with 10% on TV and 9% on Video Streaming Platforms/OTT for 3-4 hours

1. 2% on TV and 3% on Video Streaming Platforms/OTT for 5-8 hours, and

2. Merely 1% for both TV and Video Streaming Platforms/OTT for 9 or more hours

This breakdown illustrates the varying preferences in media consumption habits, emphasizing a notable shift towards digital platforms, especially for shorter durations.

Expanding on the findings regarding age-wise distribution, the data from Axis My India provides insights into the percentage of individuals within different age groups who spend ‘1-2 hours’ watching TV on a typical day:

1 23% of 18-25 age group dedicate this time to TV

2 21% of 26-35 age group dedicate this time to TV

3 27% of 36-50 age group dedicate this time to TV

4 26% of 51-60 age group dedicate this time to TV

5 25% of above 60 age group dedicate this time to TV

This suggests a fairly even distribution of TV watching habits across different age groups, with a slightly higher inclination in the 36-50 age category.

1 Examining the data on a typical day’s OTT viewership, distinct patterns emerge across various age groups:

2 Among individuals aged 18-25, a notable 25% engage with OTT platforms,

3 Slightly lower yet significant 24% from the 26-35 age group do the same.

4 The prevalence decreases in the 36-50 age group, with 17% of individuals choosing OTT for their media consumption.

Further down the age spectrum, the 51-60 age group and those above 60 exhibit similar preferences, with 12% from both demographics tuning into OTT platforms

These findings highlight the varying degrees of adoption of OTT platforms across different age brackets, indicating a higher affinity among younger individuals for on-demand streaming services. This suggests a fairly even distribution of TV watching habits across different age groups, with a slightly higher inclination in the 36-50 age category.

1. The survey provided insightful data on household income, spending, and consumption patterns bringing to light a spectrum of sentiments regarding the nation’s economic conditions this year. 46% of the participants expressed a sense of financial upliftment in 2023 compared to 2022 terms of financial well-being. Meanwhile, 36% still hold 2022 in higher regard, feeling that the previous year offered better financial stability. Additionally, 18% of the respondents viewed 2023 as being on par with the previous year, indicating a sense of consistency in their financial experiences.

2. The survey offered valuable insights into the spending patterns of consumers over the past and upcoming six months, highlighting shifts in purchase priorities. According to the findings, a significant 49% of respondent s are leaning towards investing in mobile phones, signalling a strong inclination towards technology and connectivity. Following closely, 37% of the respondents are focusing on financial prudence, with choosing a bank account being a top priority, reflecting an increased awareness and emphasis on financial management. Additionally, personal mobility emerges as a significant factor, with 30% of the respondents showing a preference for acquiring two-wheelers, underlining the growing importance of personal transportation in daily life.

3. In the wake of BJP’s notable victories in recent state elections, the survey tapped into the public’s perception of influence in India’s political sphere. Reflecting on this political landscape, 60% of the respondents identified Prime Minister Narendra Modi as the most influential figure of 2023. This perception has been further bolstered by the Prime Minister’s active international engagements, including his pivotal role in the G20 summit and efforts towards elevating India’s presence on the global stage. These events have clearly struck a chord with many people, contributing to the increased recognition of Narendra Modi as a significant influencer this year.

4. The survey shed light on public awareness and participation in the Ayushman Bharat – Jan Arogya Yojana, a pivotal health insurance scheme by the Government of India. It was revealed that 27% of respondents are aware of the scheme but have not taken the step to enroll. This indicates a significant level of awareness about the scheme, yet highlights a gap between awareness and action. On the other hand, 28% of respondents are aware of the scheme and have actively enrolled in the scheme, suggesting a proactive approach towards availing the health benefits offered.

5. The survey provided insights into the public’s awareness and adoption of the 14-digit Ayushman Bharat Health Account (ABHA) card, a key component of India’s health digitisation efforts. It revealed that 84% of respondents, are unaware of the ABHA card, indicating a significant knowledge gap in this critical health initiative. This suggests a considerable gap in public knowledge regarding the ABHA and its benefits. On the other hand, 9% of respondents have actively obtained the ABHA card, indicating some level of engagement and uptake among the populace. Meanwhile, 7% of respondents, although aware of the ABHA, do not possess the card.

6. With the five state elections seen as a prelude to the 2024 Lok Sabha elections the December CSI Report highlights the keen interest among the public in political trends. A significant 67% of respondents had expressed their intent to watch the exit polls of these crucial state elections, indicating a high level of engagement and curiosity about the potential outcomes and their implications. In contrast, 32% of the surveyed population are not planning to tune in for the exit polls, suggesting varying levels of political interest and engagement across the public.