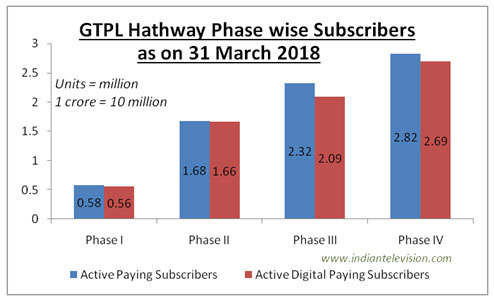

BENGALURU: As mentioned by us earlier, Indian multi-system operator and internet service provider GTPL Hathway Ltd’s(GTPL) consolidated total revenue for FY 2018 (fiscal 2018, yearunder review, year ended 31 March 2018) had increased 18.2 percent as compared to the previous year (FY 2017). The company’s investor presentation for FY 2018 says that its active cable TV subscriber base in fiscal 2018 increased 1.42 million (0.142 crore) in the year under review to 7.4 million (0.74 crore) from 5.98 million (0.598 crore) in the previous year. The company says that it seeded 1.8 million (0.18 crore) digital set top boxes in the FY 2018. In FY 2018, GTPL’s cable TV digital paying subscriber base increased by 2.07 million (0.207 crore) to 7.0 million (0.7 crore).

Average revenue per user (ARPU) in phase II, phase III and phase IV by 6.25 percent, 1.64 percent and 1.96 percent respectively during the quarter ended 31 March 2018 Q4 2018 as compared to the quarter ended 31 December 2017 (Q3 2017). Phase-wise ARPU increased in FY 2018 as compared to FY 2017 as follows: phase I increased to Rs 103 from Rs 100; phase II increased from Rs 95 to Rs 105; phase III increased from Rs 54 to Rs 62; phase IV increased from Rs 41 to Rs 52.

Over 38 percent of the company’s subscriber base in phase IV areas, which for GTPL has seen the highest increase in ARPU during FY 2018, both in terms of absolute rupees and in terms of percentage growth. Arising from the above, share of GTPL’s cable TV business to revenues and profits has gone up.

Please refer to the figure below

Further, the company says that it has added 40,000 broadband internet subscribers in fiscal 2018, taking its broadband subscriber base to 0.28 million (0.028 crore). The company’s broadband ARPU remained the same in FY 2018and FY 2017 at Rs 480. Hence broadband revenue will have increased to an extent on account of the increased broadband subscriber base in fiscal 2018. The company has revealed that data consumption per user has increased from 38GB per month in March 2017 to 62 GB per month in March 2018.

The company’s consolidated total income increased 18.2 percent during the year under review to Rs 1,113.35 crore from Rs 941.83 crore in the previous year. GTPL’s consolidated operating revenue for fiscal 2018 at Rs 1,091.27 crore was 20.2 percent higher than the Rs 907.70 crore for FY 2017. Other income reduced 35.3 percent in FY 2018 to Rs 22.09 crore from Rs 34.13 crore in FY 2017.

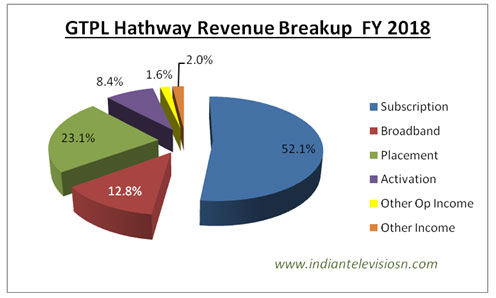

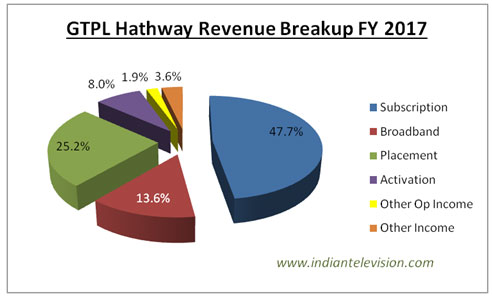

Please refer to the figures below the company’s total revenue breakup in FY 2018 and FY 2017:

Consolidated operating profit (EBIDTA) excluding other income increased 29.6 percent in FY 2018 to Rs 383.12 crore (35.1 percent of operating or op revenue) from Rs 295.71 crore (32.6 percent of op revenue) in the previous fiscal. Consolidated EBIDTA including other income increased 30.7 percent to Rs 314.43 crore (28.2 percent of total revenue) in FY 2018 from Rs 240.56 crore (25.5 percent of total revenue) in the previous year.

However, the company’s profit numbers still depend upon placement and activation revenue. It is heartening to note that the shares of placement and activation revenue to total revenue in FY 2018 as compared to FY 2017 have gone down as is obvious from the above figures. If one were to calculate EBIDTA without placement and activation revenue, the company has incurred a lower operating loss of about Rs 35 crore in FY 2018 as compared to an operating loss of about Rs 72 crore in the previous year.

The board of directors of GTPL has mooted dividend of Re 1 or 10 percent per equity share of face Rs 10 each subject to approval from shareholders for the year ended FY 2018. The outstanding capital of GTPL as on 31 March 2018 was Rs 112.463 crore.