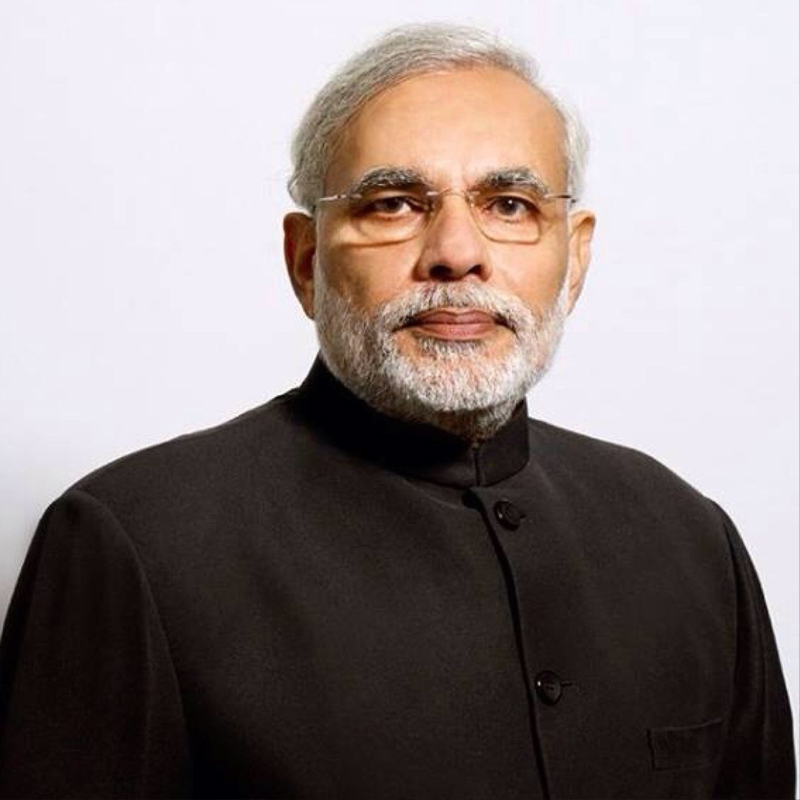

MUMBAI: It’s been close to a month since PM Narendra Modi announced the demonetisation of higher currency notes and the buzz around the topic hasn’t receded still. After all, several sections of the market remain affected by the scarcity of liquidity in the economy.

While the country debates on whether the move has been successful in curbing black money or not, one thing is for certain, it caught everyone’s attention.

Maxus Kaleidoscope has released data that reveals the location-wise mood of India from Twitter and Instagram.

The conversations were mapped between the 8 to the 24 of Nov 2016 by when we would get a clear picture of the how the initial euphoria of the demonetization panned out over time.

Location based Tweets and Instagram Posts oscillated largely between Action oriented and Calm Moods in the fortnight since the demonetization from an All India basis. Calm moods were dominant in the North Eastern states of Mizoram and Meghalaya as depicted in the map below.

Nearly 5 Lakh conversations on Twitter & Instagram made up the top 10 trending topics. Demonetization accounted for 6 of the top 10 trending topics since the announcement, of which the PM accounted for half of the trending topics. #IamwithModi and #Modi were the topics that made up for 19% of the conversations within the top 10 trends. Cricket shared a bit of the spotlight from demonetization thanks to the ongoing England-India test series.

Brands too shared some of the light light that demonetization drew. A total of 23 brands of were linked to the top 10 trending topics during the past fortnight. These brands factored in slightly over 30 per cent of the total conversations. PayTM leading the bunch (avg. 53% association) and SBI (avg. 16% association) carved out the larger part of the Brand Share of Conversation.

The top 5 metros reflected similar patterns of Moods where Action dominated the moods however there were some days especially like 17 Nov in Delhi when the expression of Calm gave way to Action. Additionally Tamil Nadu showed a blip towards Anxiety on the 18, 19 and 21 Nov 2016 when subsequent announcements of the demonetization easing by the government and news of the CM Jayalalithaa seemed to have driven up the specific mood.

According to Maxus Kaleidoscope’s mapped data over Twitter and Intagram, there is a sense of patient restraint in cities across India as the demonetization moves on into the 3rd week and nears the critical end of the month period when cash flows really come into play.