BENGALURU: Television viewership dipped slightly in week 29 of 2020 (Saturday, 18 July 2020 to Friday, 24 July 2020, week or period under review) according to Broadcast Audience Research Council Research on India (BARC) weekly data as compared to the previous week. BARC reported 17.3 billion impressions as Television viewership for week 29 of 2020 as compared to 17.4 billion weekly impressions during the immediate trailing week – week 28. BARC releases weekly data for the top two, three, four, five or 10 channels of a language, genre or sub-genre in the public domain. Besides, BARC also releases data for the Top 10 channels on all platforms across genres on all platform, on the pay platform and on the free platform. Similar data is also split up for the top Hindi GECs on these platforms along with further segmentation of the combined urban and rural Hindi speaking market or HSM (U+R), in HSM (U) and HSM (R). For regional and other genres such as news, languages, BARC publishes data for the top 5 or lesser channels.

The analysis in this paper is limited to BARC data available in the public domain – the top two, three, four, five or 10 channels of the genre/sub-genre/language/platform/market.

Despite the small dip in television ratings, GECs viewership in general seems to have continued climbing, while the News genre seems to have continued the trend of reduction in eyeballs. BARCs’ data for week 29 for the Top five channels in Assamese, Bangla, Bhojpuri, Malayalam, Marathi, Oriya, Punjabi, Tamil and Telugu channels shows that their combined ratings increased as compared to week 28. Only the combined weekly ratings of the top five Gujarati and Kannada channels fell as compared to the previous week. It must be noted that some of the channels in the above genres are movie channels, news channels, etc. However, BARC does publish data in the public domain of the Top five News channels in Hindi, English, Assamese, Bangla, Kannada, Malayalam, Marathi, Oriya, Telugu and Tamil languages. The combined weekly impressions of the top 5 News channels in all these languages declined except for Bangla and Oriya News channels, which increased by 1.8 percent and 2.2 percent respectively in week 29 of 2020 as compared to week 28. The combined weekly impressions of the other two major genres – Movies (almost flat growth – increased by 0.5 percent) and Kids (declined by 4.2 percent) in week 29 of 2020 did see some changes, but not enough to make a major impact to overall weekly television viewership. These four genres – GEC, Movies, News and Kids generally constitute 90 percent of the overall television ratings according to BARC reports.

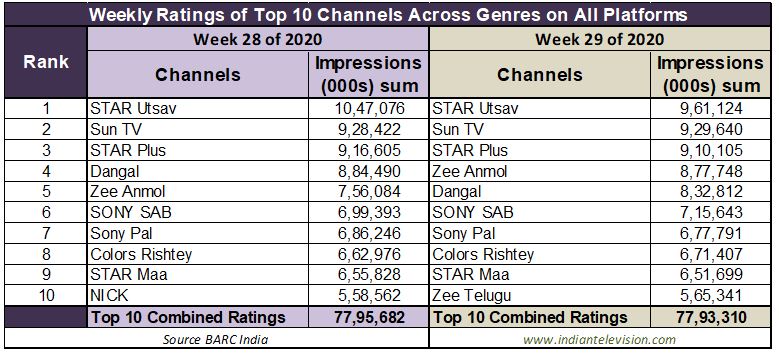

Top 10 Channels on All Platforms Across Genres

Since its return to DD Free Dish, Zee Entertainment Enterprises Ltd’s second Hindi GEC Zee Anmol has seen viewership climb. The channel was ranked fourth in BARC’s weekly list of Top 10 Channels om All Platforms Across Genres in week 29 of 2020. Long time numero uno on this list – Enterr 10 Television’s Dangal had lost its peak position when many of the Hindi GECs returned to DD Free Dish a few weeks ago. Dangal was now ranked 5 in week 29 of 2020.

Seven Hindi GECs, two Telugu channels and one channel made up BARC’s weekly list of Top 10 Channels on All Platforms Across Genres in week 29 of 2020. There were 3 Star India channels, two channels each from Sony Pictures Network India (SPN) and one channel each from Enterr 10 Television, Sun TV Network (Sun TV) and Viacom18 in the list for Top 10 Channels on All Platforms Across Genres in week 29 of 2020.

Please refer to the chart below:

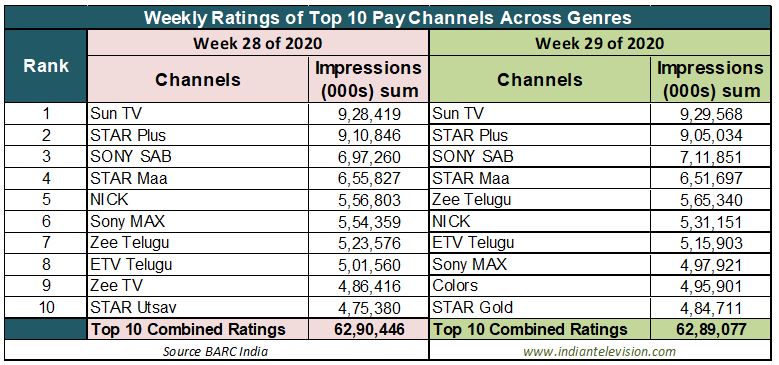

Top 10 Pay Channels Across Genres

Two channels -ranked ninth and tenth in the previous week (week 28 of 2020) exited BARC’s weekly list of Top 10 Pay Channels Across Genres in week 29 of 2020 to be replaced by Viacom18’s flagship Hindi GEC Colors and Star India’s Hindi Movies channel Star Gold. The other 8 channels in BARC’s weekly list in week 29 of 2020 were the same in the previous week, with a slight juggling of ranks. There were three channels each from the Hindi GEC and Telugu genres, two channels from the Hindi Movies and one channel each from the Kids and the Tamil genres in BARC weekly list of Top 10 Pay Channels Across Genres in week 29 of 2020. There were three channels each from Star India and Viacom18 (or associated with Viacom18 through its parent Network 18), two channels each from SPN and Zeel and one channel from Sun Tv.

Please refer to the figure below:

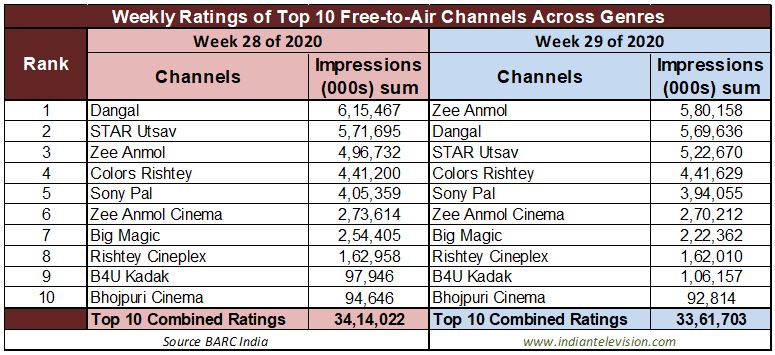

Top 10 FreeChannels Across Genres

Zee Anmol clawed its way to the top spot in BARC’s weekly list of Top 10 Free Channels Across Genres in week 29 of 2020. All the channels in the weekly list for week 29 of 2020 were the same as in week 28 with some shuffling of ranks. There were 3 channels each from Viacom18 and Zeel, two channels from Enterr10 Television and one channel each from B4U Network and Star India in BARC’sweekly list of Top 10 Free Channels Across Genres in week 29 of 2020. There six Hindi GECs, three Hindi movies channels and one Bhojpuri channel in BARC’s weekly list of Top 10 Free Channels Across Genres in week 29 of 2020.

Please refer to the chart below: