The Olympic motto `Citius Altius Fortius’ a Latin phrase when translated means Faster-Higher-Stronger. We see strong parallels between the motto and the Indian Entertainment & Media (IEM) Industry. India is among world’s largest media consuming and content creating markets. Paradoxically, IEM is just 0.7 per cent ($10 bn) of the global $1.4 trillion industry. Till now, poor policies, fragmented markets, low investments and leakages have kept the moolah remarkably elusive. However, with sweeping changes in distribution, convergence and integration of models, we see IEM growing to $21 billion by 2010. We are bullish.”

The above mentioned observations of SSKI research aptly sums up the present upbeat scenario on the television and distribution sector in India. 2007 has been full of various significant developments in the television industry, which have laid the foundation for technological convergence, digitisation and addressability, thus ushering a new era in the sector which would revolutionalise the television viewing experience in the ensuing years.

The most significant and landmark development of the year has been the successful implementation of Conditional Access System (Cas) in notified areas of Delhi, Mumbai and Kolkata. This is being regarded as a big leap towards migration from analogue regime to digital regime. The regulatory framework is acting as a catalyst in the process of digitization. Trai has already recommended to the government for extension of Cas in remaining areas of these three Metros.

Trai has also submitted to the government a report of the Group on digitization for introduction of voluntary Cas in 55 more cities in a well defined time frame. It is now up to the information & broadcasting ministry, to trigger off the said process by laying down a clear cut road map.

|

Prior to 2007 the digitisation rollout in cable was virtually negligible. However, now we expect it to be happening at an accelerated pace. It is estimated that by 2010, the total C&S homes are likely to increase to 90 million from present level of 68 million. It is expected that out of those homes, 37 million would be digitised.

In October 2007, Trai had also sent its recommendations to the I&B ministry on the policy framework for licensing and issues pertaining to headend-in-the-sky (HITS), which too is a digital distribution platform. The ministry is examining them and once a final decision is taken on these recommendations, it is expected that the digitization in the cable segment will take off at a faster pace as HITS has potential of digitising the entire country within a short span of time.

In addition to various benefits of digitization such as capacity augmentation and provision of Value Added Services (VAS) to consumers, digitisation also results in bringing transparency in the cable sector, which not only leads to better tax compliance and realisation of due taxes by revenue authorities, but also ensure equitable distribution of revenue across the value chain.

The government is the biggest beneficiary of the shift from analogue to digital cable, as digitisation releases significant spectrum. The spectrum can be utilised for other services like telecommunications, defence, emergency, interactive platform and value added services. This is possibly what is driving the government to take the steps necessary for the evolution of digitisation.

For instance, in Germany, the government subsidised Set Top Boxes for the low income group, whereas in Ireland, the government launched a company (Digico) to introduce digital terrestrial services.

| Digitisation in the cable segment will take off at a faster pace as HITS has potential of digitising the entire country within a short span of time _____****_____ |

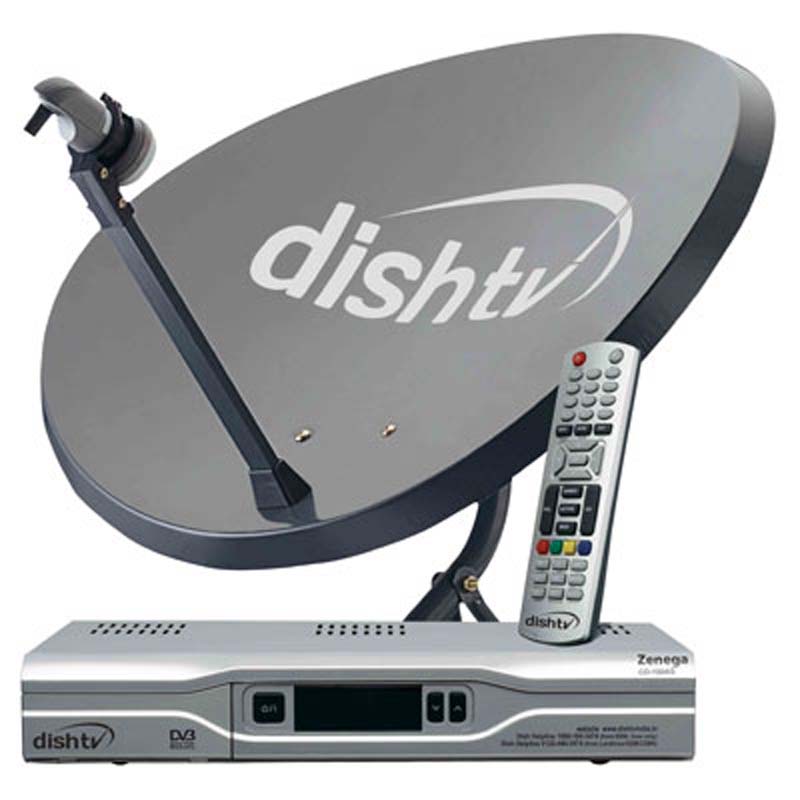

Similarly in DTH distribution, the market is going to witness fierce competition amongst five to six players. In addition to the existing DTH operators DD Direct, Dish TV and Tata Sky, new entrants Bharti, Reliance, Sun TV and Videocon are also expected to launch their services shortly. It is expected that by 2010 the DTH segment would also have about 16 million digital subscribers.

Similarly, IPTV and Mobile TV both emerging digital technologies are also expected to register an impressive growth by 2010.

The year 2007 also witnessed lot of activities and developments on the content front. Though already about 270 channels are existing yet, unfazed by the large number of existing channels, several new channels of different genres were launched during the year.

However, on account of bandwidth constraints on analogue network, the new channels are required to spend heavily on carriage fee in order to ensure their placement on the visible band in the cable network. The existing channels also witnessed intense competition and the entertainment/current affair channels were mainly dominated by “reality shows”.