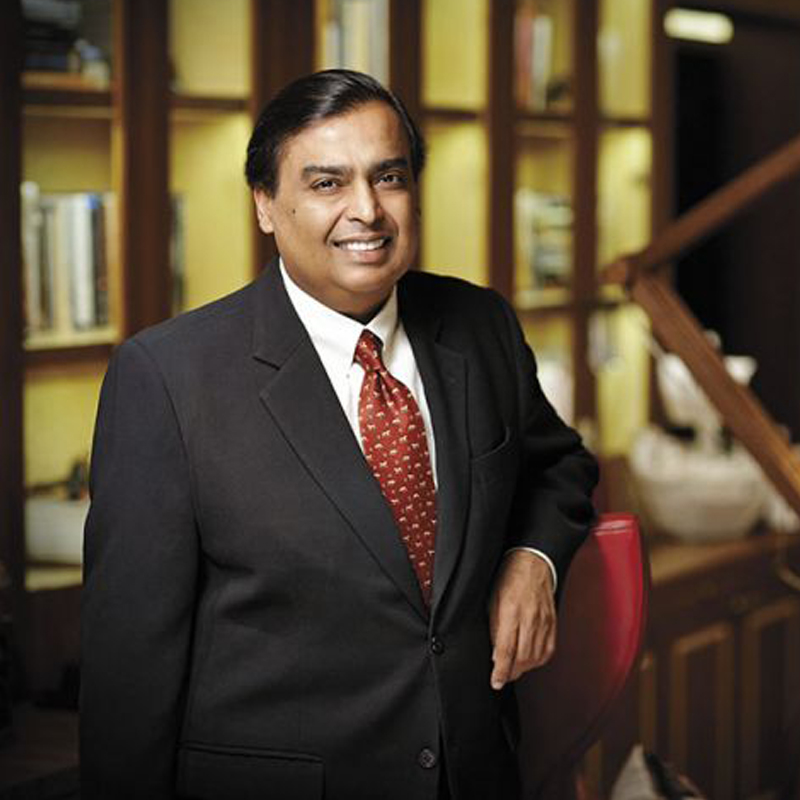

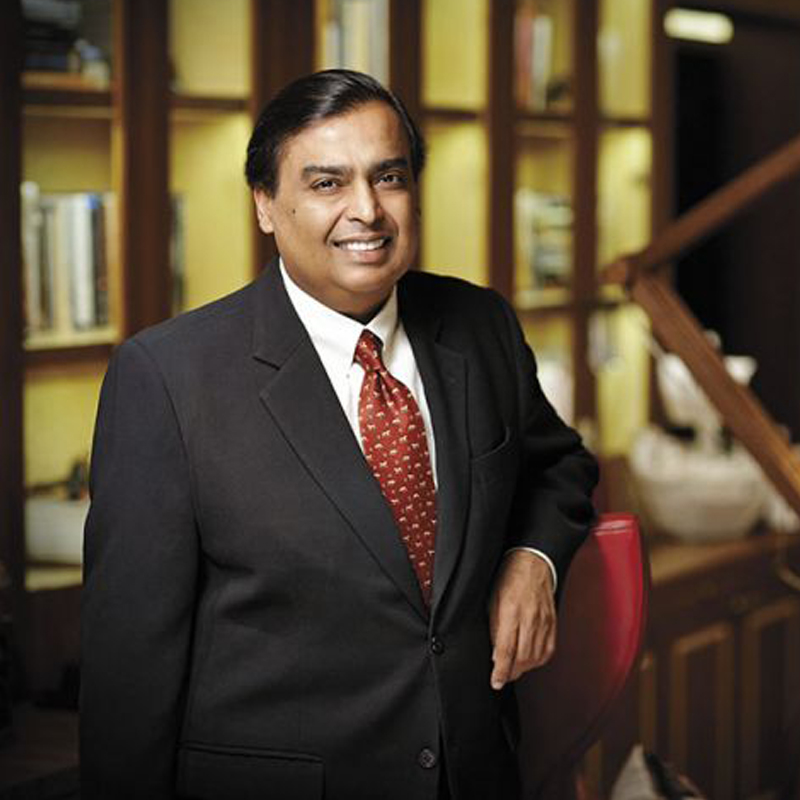

BENGALURU: The Mukesh Dhirubhai Ambani controlled MSO and broadband internet services provider Hathway Cable and Datacom Limited (Hathway) reported consolidated profit after tax (PAT) at Rs...

BENGALURU: Mukesh Ambani’s Reliance Industries Limited-owned Indian multi-system operator and internet services provider Hathway Cable and Datacom Limited (Hathway) reported consolidated profit after tax (PAT) of...

BENGALURU: Mukesh Dhirbhai Ambani’s largest start up in the world, Reliance Jio Infocomm Limited (Jio) reported 62.5 percent growth in standalone profit after tax (PAT) for...

BENAGLURU: Hathway Cable and Datacom Ltd (Hathway) reported 38 percent growth in subscription revenue from its cable TV business (CATV) for the quarter ended 30 June...