Mumbai: Beginning with the blockbuster M&A deal between Discovery and AT&T in May which created the world’s second-largest media company by revenue after Disney, intensifying streaming...

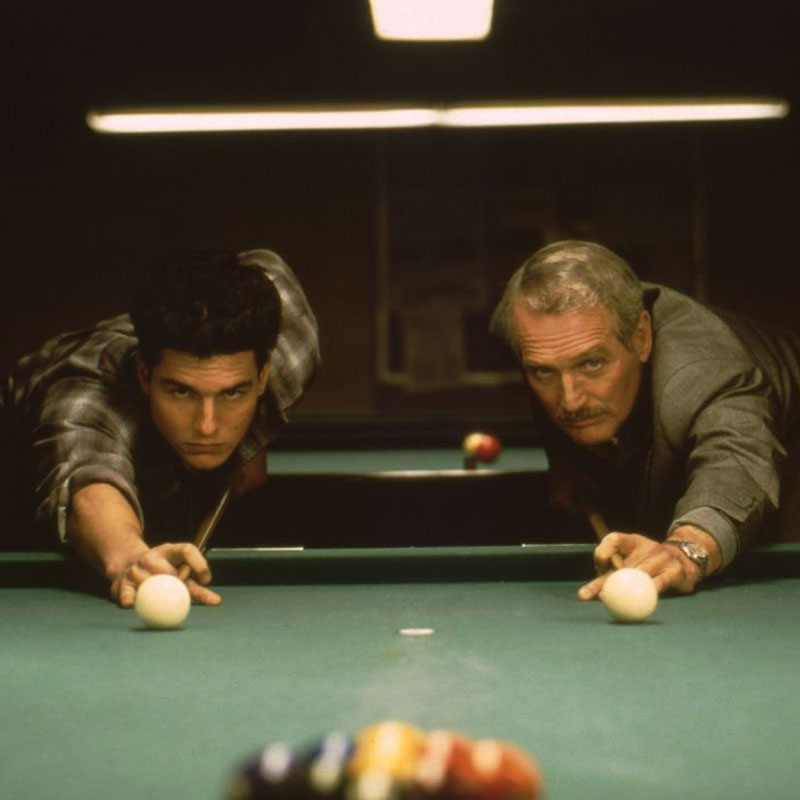

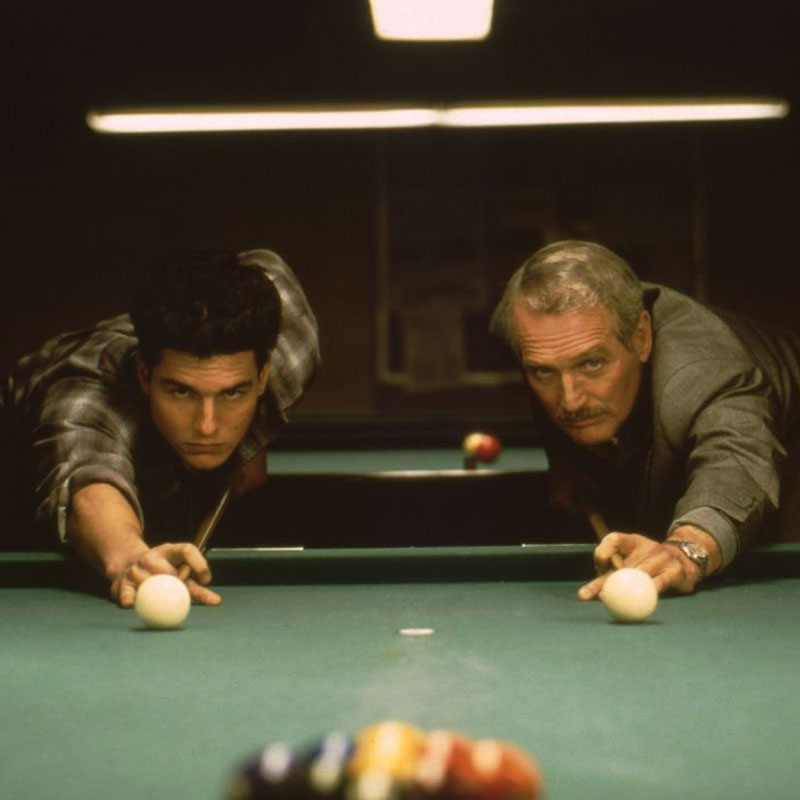

KOLKATA: It is a mega $8.45 billion deal that has helped Amazon build a bond with that awesome fictional British secret service agent James Bond. Eyebrows...

KOLKATA: E-commerce giant Amazon is all set to close the MGM Studios acquisition deal for $9 billion according to a Wall Street Journal report, which says...

SINGAPORE/MANILA: Rewind Networks has launched HITS MOVIES on Cignal, Philippines’ premier DTH satellite provider. The channel is available on Channel 58. HITS MOVIES joins sister channel...

MUMBAI: Metro-Goldwyn-Mayer Studios Inc. (MGM) announced the revitalisation of MGM’s domestic theatrical distribution business with a new strategy that calls for the release of several high...