|

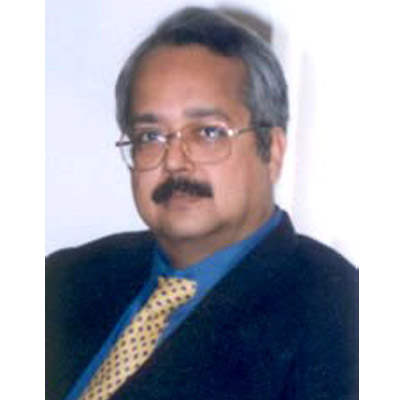

Punit Goenka is in control of the media empire that patriarch Subhash Chandra built assiduously over almost two decades. He is quick to take decisions, is unruffled by temporary ups and downs, and believes in continuity.

The elder son of Chandra digs deep into the Zee culture, has his own ways of finding solutions and does not hesitate to bet on sports as he takes up the responsibility of shaping Zee‘s broadcasting business.

“I have learnt a lot from my dad. He is no more hands-on. See, he has not called me for over an hour (during the interview). I have my own style,” says Goenka, a grin on his face.

Soft-spoken and shy, Goenka is a people‘s man. He backs his senior team, even when certain decisions do not work in the short run.

In an environment of raunchy reality TV shows, he believes in clean content and explains that Zee TV, the flagship channel, is designed for family viewing.

Goenka crafts strategies that focus on profitability; he hardly plays to the gallery.

Under his leadership, Zee ended its 12-year-old rivalry with Star to float a joint venture distribution company named Media Pro Enterprise India. The aim of the JV: to pave the path for consolidation and hasten the need for digitisation in the sector.

In an interview with Indiantelevision.com‘s Sibabrata Das, Zee Entertainment Enterprises Ltd managing director and CEO Goenka talks about the lack of opportunity in the marketplace to make the right purchase, the need to bet on sports broadcasting and to stick to profitability in a high-cost environment.

Excerpts: |

|

|

Zeel is sitting on a cash pile of Rs 14 billion (as of 30 June 2011). Are you looking at acquisition opportunities?

As a company philosophy, we have decided to keep aside a cash of Rs 10 billion at any stage for organic or inorganic growth opportunities. |

|

|

But isn‘t this the right time for consolidation in the industry?

However, for the benefit of the industry, consolidation is the answer. The sector is sized at Rs 300 billion and there are 500 television channels in the country earning an average ARPU (average revenue per user) of $3. That is why we have become an unprofitable industry. |

|

|

In a drive to consolidate and digitise the industry, Star India and Zee Group recently ended their 12-year divorce to create a distribution company. Has the joint venture been able to shake up the pay-TV market? |

|

|

How deep in terms of percentage growth?

A large part of the deal plays out in analogue cable. In case of DTH, both of us are in any case growing independently. |

|

|

|

|

How painful has been the integration process? |

|

|

Media analysts say Zeel’s share price will get a boost if the sports broadcasting business is hived off and capital raised by offloading equity. Has any investment bank got the mandate to hunt for an investor for the sports business? |

|

|

When do you expect the sports business to turn around? |

|

|

Zeel‘s sports losses for FY‘11 stood at Rs 2.08 billion on a revenue of Rs 4.4 billion (excluding a one-time revenue gain of Rs 700 million as one-time fee for the pre-mature termination of rights for AIFF). So what will drive this to profitability?

Ad revenue is heavily dependent on cricket. And within that segment, it is India cricket. While advertising revenue is cyclical, subscription income is consistent throughout the year. |

|

|

Zeel has bagged the eight-year Cricket South Africa (CSA) television rights for $180 million. Considering that the earlier five-year rights went for $75 million, isn’t the new price tag on the higher side? |

|

|

We get to learn from sources that the Zimbabwe board rights have been retained for $20 million (earlier it had gone for $6 million for four years). But Zeel will be able to give its sports business maximum firepower when it is able to retain the telecast rights for the other three boards – Sri Lanka, Pakistan and West Indies. So will you bid aggressively? |

|

| When is the golf channel getting launched ? We are awaiting government approval. We are ready to launch the golf channel within 60 days of obtaining the regulatory clearances. |

|

|

Will Comcast be a partner for the channel? |

|

|

When are you launching a full-fledged HD channel in sports? |

|

| Are there other HD launches planned? Zee TV, Zee Cinema and Zee Studio will be launched in HD format soon. |

|

|

Zeel has posted a measly 0.5 per cent ad growth in the fiscal first-quarter. Do you see the market improving?

Subscription revenues will continue to have a similar growth trajectory, both on analogue cable and DTH. Our international revenues should stay flat. |

|

|

International subscription income actually de-grew two per cent in FY’11. Do you have any plans to fix the international business?

In the other markets like the US, We are seeing growth. |

|

|

Is your localisation strategy working?

The other experiment we have carried out is in Russia. The audiences there love Bollywood, soaps and dramas. However, it is early days yet.

We are also planning to launch in 3-4 other markets. |

|

|

Zee TV has slipped to fourth position as Sony Entertainment Television rejuvenated on the back of its big-ticket game show Kaun Banega Crorepati (KBC). Will you change the programming strategy and bring in celebrity-backed reality shows?

A large part of a particular channel‘s growth still comes from one show. A reality show may bring in spikes but we will wait to see what happens after that concludes. We will not take to celebrity-based reality shows unless we feel that we have a concept that needs to engage them. We are happy with our homegrown formats.

Our prime competitor is Star. And as a network, we are in close competition. |

|

|

|

| Will you increase the programming hours of Zee TV as you fight back to regain market share? We will be increasing our original hours of content from 28 to 33 hours per week. There has been some delay in that because we have had a few bad launches and we want to first fix those slots. We have also had a slowdown in the advertising market. |

|

|

Zee has kept away from purchasing big movie titles. Will that affect Zee Cinema when Viacom18 launches its movie channel?

Big titles give rating spikes but they are first run on GECs rather than on movie channels. The Hindi movie channel genre has become cluttered and unprofitable due to high acquisition costs. But we have stayed profitable. |

|

| Star Gold has reduced ad inventory on the channel by 33 per cent and is showing six fresh movies a day. Will you follow suit? Such a move has to be compensated with an increase in ad rates. In the current market scenario, this may not be easy. But we are working on reducing the ad time on the channel. And don’t forget that Zee Cinema was the first channel to show five fresh movies a day. |

|

| Sun TV is under attack from the Jayalalithaa government. With the launch of the state-owned Arasu cable, will you make aggressive investments in the Tamil Nadu market? With Zee Tamizh, we have a foot in that market. Arasu has got presence in some pockets of the state. It is still early days and we have to wait and see how the market gets impacted. But if we get more distribution, we will get more aggressive. |

|

|

Isn’t Zee under attack from Star in the Bengali and Marathi regional language markets?

Regional news, on the other hand, is easily doable. |

|

|

Isn’t the news genre too cluttered?

There should be more stringent norms in this genre as entertainment is also passing as news. We have positioned ourselves as a serious news channel and are seeing decent growth. Unlike other players, we also have a strong pay revenue from our news business.

It is the regional markets that are getting cluttered. The Andhra market, for instance, has seen too many launches. Some national news broadcasters are also having issue over cost structures. |

|

| Will you launch an English general news and business news channel or you feel the balance sheet of Zee News Ltd has to further strengthen before you go in for these high-cost launches? The balance sheet can support these launches. But strategically, we will focus on Hindi and regional news channels. Yes, we have two critical genres left. But we will first fill up the regional space. |

|

| Are you looking at expanding through the franchise route? We will take the franchise route only if editorial content is with us. After all, that is what impacts our brand. |

|

| When you started, you were part of the Agrani satellite project. Do you still nurture the ambition of owning a satellite? Agrani was a good project but the policies were not supportive. Banks also had no clue how satellite funding works. Owning a satellite doesn’t make sense now; it is more feasible to lease transponder space on a satellite. |

Tag: indiantelevision

-

‘We will keep aside Rs 10 bn for organic or inorganic growth opportunities’ : Zeel MD and CEO Punit Goenka

-

‘If you are up in the hierarchy, you will get pricing power’ : Star India president ad sales Kevin Vaz

Leading broadcasters will continue to post strong ad revenue growth while the long tail will be severely hurt as advertisers tend to consolidate their spends in a cautionary environment.

Genre leaders will benefit as advertising monies get rejigged. It is the weaker performers that will not find support from advertisers; they will degrow.

The television sector will see a 13-15 per cent growth in ad revenue this fiscal while print will be pushed back in a slowing economy.

Star India, which has leader channels in most genres, has done more annual and network deals this year. Its top 10 clients, for instance, have done deals stretching from a minimum of 12 months to three years.

The Hindi general entertainment channel (GEC) genre is on an upswing even as ad monies are moving away from cricket.

The Hindi movie channel genre is set to grow at 15-20 per cent. The news genre will, however, continue to struggle this year.

In an interview with Indiantelevision.com‘s Sibabrata Das, Star India president ad sales Kevin Vaz talks about the changing equations in the television advertising space.

Excerpts:

Is India‘s leading broadcasting network ready to announce that the advertising economy is slowing down?

The ad market is not as buoyant as it was in January. The television sector will not see a 20-25 per cent growth in ad revenue this fiscal as was forecasted earlier. But it will still post a 13-15 per cent growth while print will be pushed back in a slowing economy. With print crawling at a 0-3 per cent growth rate, ad monies will move to television.Even then it is a slower growth for the TV broadcast segment. Is Star beginning to feel the heat?

Leading broadcasters will continue to post healthy growth while the long tail will be severely hurt as advertisers tend to consolidate their spends in a cautionary environment.Genre leaders will benefit as advertising monies get rejigged. It is the weaker performers that will not find support from advertisers; they will degrow.

Aren‘t Star‘s top advertisers noticing a slowdown?

We have actually done more annual and network deals this year. Our top 10 clients, who account for 30 per cent of our revenues, have done deals stretching from a minimum of 12 months to 36 months. We will buck the trend and grow much faster than the industry. Having leader channels in most genres has helped us stitch long term deals.The fiscal first-quarter is indicating a slowdown for certain listed media companies. So isn‘t there a negative sentiment already prevailing in the market?

The April-June quarter has been good for us. And the July-September quarter is even better. Of course, the channel performance has also improved. If you are up in the hierarchy, you will get pricing power.‘The hard core press categories are shifting more to TV. The automobiles category is now spending 60 per cent of its ad budgets on

TV, up from 30 per cent. The consumer durables segment is also

following this trend‘But aren‘t we seeing a small dip in FMCG spending in the first quarter?

The FMCG category is going to be aggressive this year. Some of them may have issues, but as a whole they will continue to spend more. P&G, Marico and ITC, for instance, will not shrink their promotional budgets. There are variants being launched and competition in the category is fierce. TV is the last thing they will cut down on as it is the most efficient medium for the category. And within TV, they will consolidate their spends.In a toughening economy, advertisers tend to flirt less; they commit their spends to the bigger players and keep aside a lesser amount for shopping with the rest.

Are Hindi general entertainment channels going to benefit because cricket is not delivering due to India‘s poor performance?

Cricket is hit in a big way. GECs are on an upswing even as ad monies are moving away from cricket. The Hindi GEC genre, pegged at Rs 37-40 billion, will grow at 12-15 per cent this year.It is important to note that cricket is losing out because of India‘s dismal performance; this has nothing to do with a slowdown. In fact, the Indian Premier League (IPL) will be tested next year; as ratings slip, there will be a churn.

So what is working well for us? Cricket and print are on the losing side this fiscal.

Are tentpole properties bringing in revenue spikes in GECs?

Advertisers are supporting tentpole properties as they look at buying impact. Brands like Maruti and Cadbury, who are on cricket, are sponsors of Just Dance. Kaun Banega Crorepati has got Idea. If cricket was doing well, we could have come under some pressure. Even in regional language channels, we are seeing tentpole properties being created.What about the Hindi movie channel space?

The ad revenue market for this genre is around Rs 8 billion. It is set to grow this year at 15-20 per cent.Star Gold will capitalise heavily as the channel is performing very well. We have cut the ad inventory time by 33 per cent with effect from 15 August to give it a Hindi GEC environment (Channel V saw a similar ad cut time from 1 January) and ramped up our investment on movie acquisitions.

How will the launch of a Hindi movie channel by Viacom18 impact the market?

We will see a huge erosion in viewership for some channels who have not invested in movies. But from a revenue perspective, we must remember that it is a very efficient genre.In the Bengali and Marathi regional markets, it is becoming a three-horse race with Star performing well. So how will this fragmentation impact?

The successful launch of Star Jalsha has actually grown the market. The Bangla GEC advertising market has grown from Rs 3 billion two years ago to a size of Rs 6 billion. Even in Marathi, there will be a revenue expansion as we start monetising the growth of Star Pravah. In these stand-by-itself markets, advertisers had only limited GRPs to buy. Now that the supply has increased, we expect a 30-40 per cent expansion. National brands are going deeper and deeper and local brands are getting more aggressive.Now that Star is also handling ad sales of NDTV, how do you see the growth in the news genre?

The news genre will continue to struggle this year. Banking, finance and automobile categories are seeing a huge hit; so news television will feel the impact. With the resurgence of GECs, the news genre has actually stagnated for the last few years.Regarding NDTV, we are selling it along with the network. So we are bringing in a wider range of advertisers.

Do you see consortium selling growing as a concept?

Yes, leading broadcasters will become the rallying point. It has happened in the case of distribution (Star and Zee merger) because they sensed value; we will see it in the advertising arena as well.Is the English entertainment segment under pressure?

English general entertainment channels will benefit as the premium segment grows. High-end cars, for instance, will increase their exposure to TV. The English GEC genre will see a 30 per cent growth this fiscal.So is TV gaining at the cost of print?

The hard core press categories are shifting more to TV. The

automobiles category is now spending 60 per cent of its ad budgets on TV, up from 30 per cent. The consumer durables segment is also following this trend. -

‘Food chnnls have tremendous potential to grow’ : FoodFood COO Karthik Lakshminarayan

FoodFood, one of the three recently launched food specialty channels in India, is completing six months on 24 July. With Sanjeev Kapoor and Astro as promoters and Madhuri Dixit as the lifestyle promoter, the channel took up the challenge of growing a new genre in India.

Indiantelevision.com‘s Gaurav Laghate caught up with FoodFood COO Karthik Lakshminarayan to talk about the plans ahead and the journey so far.

Excerpts:

FoodFood is completing six months of operations. Has it been a bumpy or a smooth ride for a channel that is exploring a new genre in India?

We are on track as per our business plan. We launched in January and as we are completing our first phase, we are seeing a healthy growth in terms of ratings as well as revenues.Being a speciality channel in Hindi, our connectivity in the Hindi speaking markets is approximately 60 per cent, which is quite good. Also if you see our reach, we have a 5.7 per cent reach in C&S households, while in the core TG of Female 25+ Sec ABC, our reach is almost 9 per cent.

Isn‘t the ratings too narrow at this stage?

Our reach is growing and in the core TG we are in the 8-12 GRPs (gross rating points) band. We are more than double of the competition (Zee Khana Khazana and Food First) in terms of ratings as well as time spent on the channel. Our weekly average time spent is over 30 minutes per user, which is extremely healthy.So, you see, there is no immediate competition. However, having said that, we do feel there is more potential for the genre to grow. But there is no benchmark as such. If you see the US market, the food channels are doing really well, and we see similar potential here also.

So are you planning to take the channel overseas?

There are definitely plans to take the channel to the international markets. We have already signed carriage deals in the Middle East and will launch FoodFood there soon. We are a Hindi food channel and will cater mainly to the Indian diaspora.FoodFood seems to be the only channel in this genre that is spending on distribution. How big is your carriage payout?

I do not call it spend. It is an investment me make for distributing the channel. And as far as our position on the cable platform is concerned, we try to get in the Hyper-band and we are also available on S-band in certain markets.The industry is very dynamic and one has to always fight for the right band.

Having said that, we are now entering into the second phase of growth. We will step up our investments in distribution, marketing and content.

‘We are now entering into the second phase of growth. We will step up our investments in distribution, marketing and content. ‘And in content?

When we launched the channel, the buzz generated by Bollywood actress Madhuri Dixit (lifestyle ambassador of the channel), and Sanjeev Kapoor (promoter, celebrity chef) took us to a certain level. Now with our programming, we are going to cash on it.Very soon, you will see the launch of our biggest reality show – Maha Challenge which will have both Dixit and Kapoor and their teams of women and men battling it out to answer who is the better cook – men or women. It is a battle of sexes in its true sense. The 13-part series is being produced by Fremantle India. We will launch it in September and you will see Dixit for the first time in this role on television.

We will also launch another reality show Secret Recipes in which people will come with their recipes and will cook with Kapoor.

How many advertisers do you have on board now?

We have over a dozen advertisers right now including Amul and Samsung. Most of them are either kitchen appliances or food related clients, who get perfect exposure on FoodFood.And all these get integrated seamlessly in the shows that we air. We do not want to clutter our shows with advertisements at this time and we have only 4-5 minute ads in the half-hour slots.

-

‘We are now in a very strong position to overcome any new challenges in the Indian marketplace’ : WWE International executive VP Andrew

Earlier this year to better reflect its business, World Wrestling Entertainment rebranded as WWE. Among other things, it is looking to develop new television products including scripted, non-scripted and animated programmes as well as the launch of a new WWE Network in the next 12-18 months.

Recognising the importance of India, the company this month set up an office here with Rukn Kizilbash as its head. The company has a strong association with Ten Sports and is also exploring possibilities of putting its content on regional channels.

In an interview with Indiantelevision.com‘s Ashwin Pinto, WWE International executive VP Andrew Whitaker talks about the company‘s growth plans in India.

Excerpts:

You recently opened an office in Mumbai. Given that this is an important market, why did it take so long?

India has been one of our most successful television markets for a number of years now. In line with our global strategy, since we have begun to introduce our other lines of business, the time is now right to begin building a more local presence in the market. The Mumbai office is the first step of that process.Could you talk about the opportunities and challenges that you will face in India?

With our new Mumbai office and Rukn Kizilbash in place as general manager India, as well as our strong TV penetration with Ten Sports and other lines of business, we are now in a very strong position to overcome any new challenges in the marketplace.We have an extremely loyal and extensive fan base in India and are highly confident about the opportunities open to us in this important market.

How have you built upon the relationship with Ten Sports?

Ten Sports is pivotal to our success in the market. We deliver fresh original content 52 weeks of the year and are able to provide new content to meet with the growing demands in the market. The promotional strategy we deploy with Ten Sports includes implementing regular local consumer promotions and bringing WWE Superstars to market every year.Are you talking to regional channels regarding having your content being seen there?

We are working with Ten Sports to see if we can make some content available on regional channels.Live events will play a big role in terms of growing the fan base here. What can we expect?

We have held live events in India in the past and I think this is something we will consider for the near future.“We are working with Ten Sports to see if we can make some content available on regional channels”You now have a talent development department. Is India going to be a part of this?

We have seen a number of non-American talent prosper within WWE, from The Great Khali to Rey Mysterio and more recently Alberto Del Rio, Sin Cara and Sheamus. In fact this year we signed a new talent from India, Jinder Mahal.This success indicates a significant appetite and opportunity for us to actively recruit international talent and it is an area we will continue to invest in across all markets, including India.

How have you grown the studio side of the business over the past couple of years?

From 2010 through 2012 we have a full slate of nine movies, four of which have been released so far. These are ‘Legendary‘, ‘Knucklehead‘, ‘The Chaperone‘ and ‘That‘s What I Am‘.We have successfully deployed a deal by deal model which allows us to achieve structural efficiencies per movie. This model has seen our movies released through multiple platforms around the world including theatrical, home video, pay-per-view, VOD/Pay TV and Free TV. The remaining releases for this year include ‘Inside Out‘ and ‘Family Reunion‘.

Is there a chance of doing a film co-production in India?

It‘s certainly something we may consider. We enjoyed a successful partnership last year with Viacom whereby one of our top WWESuperstars, The Great Khali came runner up on Bigg Boss.There are a number of parallels to be drawn between WWE and Bollywood and we see great opportunities for us in this area.

What strategy has WWE followed to grow the brand globally over the past couple of years?

Our global growth strategy on a market by market basis is first to bring WWE‘s television programming into the marketplace, which is usually the starting point to begin engaging fans and bringing our unique form of entertainment into people‘s homes. Once we have established a strong television audience, we then look to introduce our other multiple lines of business, from live events where fans can see our Superstars live and in person to our vast lines of consumer products, digital media and publishing.WWE is a global business, seen in more than 145 countries in 30 different languages, and key to our successful global growth is our local office presence. We have offices in Stamford, New York, Los Angeles, London, Shanghai, Singapore, Tokyo and now Mumbai, which are fundamental to our local level operations.

Has there been any change in terms of how fans in India and globally perceive WWE?

I think that our fans have always understood that WWE is fundamentally an entertainment business. In India our partnerships with the likes of Ten Sports, Sify and Mattel provide our fans with multiple brand touch points across TV, online and consumer products and our fans have responded well to our evolution and growth as a family-friendly integrated entertainment business.To what extent has the share of revenue from international markets grown? Which are the top three markets?

When we set up our first international office in London in 2002, international revenues were worth $32 million. That figure has now grown to over $133 million.Outside of the USA and Canada, our biggest markets are the United Kingdom, Mexico and France.

In terms of your various divisions, which has shown the healthiest growth and why?

Internationally, our television business continues to grow and remains our most profitable division. We have also expanded our global live events business, now scheduling more than 70 international live events on an annual basis.Since 2006 international consumer products revenue has doubled, meaning that the retail brand value of WWE now exceeds $1 billion per year globally.

In terms of the new business model, which are the key focus areas?

There are two key components to WWE‘s recently announced brand expansion plans. First, the company will maintain a strong focus of growing its core business on a global basis and announced that Paul “Triple H” Levesque will be heading a new talent development programme.In addition, innovation will be the key to the long term growth through new consumer product launches, new television programming and international growth.

The second component will be the active pursuit to acquire entertainment content companies and the outsourcing of WWE‘s core competencies – television and film production, live event production and licensing.

What targets has WWE set for this year?

Internationally, our focus continues to be on the Bric markets on the back of our recent TV launches with 2×2 in Russia and EI in Brazil and the growth of our already established business operations in India and China.As mentioned above, our new talent development department will be another key focus for us in 2011.

What growth has there been in terms of doing international tours and holding ‘Raw‘ and ‘Smackdown‘ abroad?

As I mentioned above, we operate over 70 live events internationally each year and are continuously exploring potential new live event markets. In the last five years, we have held live events in 35 different countries.To date, we have taken our Raw and SmackDown TV events that you mention to three markets outside of the USA and Canada – the UK, Japan and Italy – and in May of this year we announced that in October 2011 Mexico will become our fourth international market to host our Raw and SmackDown TV events.

You recently rebranded as WWE. What was the aim?

WWE is constantly evolving and this is simply the next step in that evolution to provide a ‘bigger, badder and better‘ – as we say in our advertising campaign – entertainment product for our fans.There has been talk about mixed martial arts and boxing now providing more competition for your viewership globally. I would appreciate your take on this?

We don‘t view MMA or boxing as competitors for our viewership globally. Their product is completely different to WWE. Whilst they may borrow from various elements of WWE‘s production to entertain their own fans more, what they provide is a pure sporting spectacle.We view our competition as any live or televised family entertainment event.

You have stars of the past returning briefly like Bret Hart. Is the aim to reinforce WWE‘s brand value?

We are fortunate enough to have an extremely loyal and diverse fan base on a global basis, spanning all ages. As such, WWE has the ability to bring back stars of the past and feature them in programming from time to time, thereby creating both nostalgia and new storyline angles.What role is the global tie up with Mattel playing in growing your licensing and merchandising business?

With Mattel, the number one company in toys, WWE has enjoyed impressive growth in its toy revenues. Mattel‘s distribution footprint is unrivalled.Allied to the reality of reaching more fans and customers in more countries is Mattel‘s innovation of various WWE lines.

New play patterns in the action figure segment as well as bringing genuine scaling mean the current line of action figures are as accurate and detailed in their depiction of WWE Superstars than ever before.

How are you growing the consumer products business in India?

We have announced our appointment of the specialist licensing agency Dream Theatre to undertake the task of developing a scaled up programme of branded consumer products.Local licensees in apparel, footwear, stationery, publishing, magazines, nightwear, underwear and novelties are due to be added over the next two years to compliment the efforts of Mattel, THQ and Topps. We anticipate direct to retail tie ups and traditional licensees representing WWE‘s business as it continues its efforts to grow distribution as India‘s retail landscape continues to change and mature.

Piracy is a big concern especially in markets like China. How are you tackling this issue?

WWE is actively engaged in minimising the impact of piracy and counterfeit products on its businesses. We have a robust and mature trademarks registration and protection policy.The company takes down sites in real time that illegally stream WWE‘s PPV‘s, which otherwise represent a significant segment of annual revenue. The company also ensures that it seizes all counterfeit goods and legally challenges those companies and individuals found guilty of their manufacture and distribution.

Piracy is a problem all over the world and cheats fans of genuine articles. It is a cost burden for brands and limits the investment being made in new lines for those consumers purchasing the genuine and authentic branded products. We are committed to continuing to do our utmost to protect our IP in every country.

How is WWE expanding its presence in the digital space?

WWE has seen 1,000 per cent growth over the last year in worldwide fans to our Facebook pages. We are currently working with Sify, our web partner in India, to create a WWE branded Facebook page with a few simple but powerful goals in mind:To build a direct connection with our fans in the local market, create awareness of our local site (wwe.in), encourage brand loyalty through special offers and promotions, and give fans the opportunity to connect and share their passion for our brand with other fans.

Could you shed light on how social networks are changing the equation between WWE and its fans?

The way I see it, the rapid adoption of social networks gives a large amount of power to the fan. It is less about “selling” and more about engaging with the fans. WWE is taking a more editorial rather than a promotional approach with social networks. The key is to use social networks to entertain and inform while subtly marketing to fans.Are the social networks allowing you to change course and take corrective action quicker?

Absolutely! social media gives us immediate feedback to everything we do as a company.We have Facebook pages for many of our products from the WWE Superstars to our merchandising and the information we receive is shared directly with our creative and editorial teams. Social media feedback is key to our future initiatives.

-

‘The challenge is to differentiate in a cluttered market’ : HDFC Life executive VP marketing and direct channels Sanjay Tripathy

HDFC Life‘s advertising spend will stay flat this year as it seeks to turn profitable for the first time.

The insurance company, which ranks No. 4 among the top 10 advertisers in the category in terms of ad volumes, is looking to spend more judiciously and utilise a 360 degree approach to reallocate money across new mediums like digital and OOH.

While 70 per cent of HDFC Life‘s marketing spend goes towards above the line, 50 per cent of this goes towards television. On television, HDFC uses news and sports for advertising as it fits into the 25-45 male target audience.

Print, radio and OOH play a supportive role. HDFC Life has also started using social media to engage the youth.

In an interview with Indiantelevision.com’s Ashwin Pinto, HDFC Life executive VP marketing and direct channels Sanjay Tripathy talks about how insurance companies need to differentiate in a cluttered market and build a brand equity that includes the youth.

Excerpts:

Why did HDFC Life go in for a brand makeover last year?

We did a brand equity study as we wanted to see where our brand is and how it is faring versus competition. We had last done a similar study way back in 2005. We wanted to see the changes; we wanted to know how through our cmmunication and marketing activities the brand had progressed in people’s minds.Consumers found the brand ethical and the service value was strong. Then we asked about the areas where they felt the brand could be improved upon. They wanted it to look like belonging to the same HDFC family; they felt that the brand could look more modern and dynamic.

Indian consumers are getting younger. People work in areas like BPO and they look at life insurance at an early age. A person buys their first insurance product between 23-28 years of age. As a brand, we wanted to attract the youth towards our products; we needed to be in the youth segment. We spoke to our board and got a favourable response.

Also, the word standard only conveyed the basic level of facilities; it was not giving the message of Standard Life being an international brand. We wanted to be seen as being a customer centric brand. Through the rebranding, we wanted customer centricity to come out more strongly for us. The new logo represents a youthful, energetic HDFC brand.

How do consumers perceive HDFC Life as a brand compared to the competition?

Our awareness has gone up by 30 per cent over last year. Our communication has been well accepted.When marketing to consumers, what challenges do insurance companies like you face?

The market is cluttered. There are over 23 players. The challenge is to differentiate and ensure that consumers can see your service offerings and products.We need to be seen as having products that are more consumer friendly; the challenge is to see that the consumer understands your brand and products.

How do you build and leverage brand equity in the insurance category which is getting more competitive?

We started six years back to find out why consumers buy insurance. We found that they bought it as they do not want to depend on anybody else; they want insurance for self respect. They do not want to depend on their parents; similarly, the parents do not want to depend on their children. This is how the thought for our campaign came about which is – Sar Utha ke Jiyo. We positioned our brand under the ‘self respect’ motive.Over time, we took the thought of Sar Utha ke Jiyo across our platforms – be it for children, pension, youth or home loan cover. It gives you a long term solution for pressing needs and self respect. Insurance operates in a long term savings plan; investment in insurance has to be linked to a long term need. This is what we have focussed on and have built consumer segments.

To what extent will your marketing budget go up for the year?

We are maintaining a similar spend as last year. This is the first year we are trying to become profitable. We are looking to spend more judiciously and utilise a 360 degree approach to reallocate money. New mediums have come in like digital and OOH. The aim is to make a more judicious mix of mediums available.“Our ad spend will stay flat this year. We are looking to spend more

judiciously and utilise a 360 degree approach to reallocate money. New

mediums have come in like digital and OOH”To what extent was this category affected by the economic downturn in terms of sales and marketing spends?

New companies are spending heavily. Some of the older players who want to go for a public listing and want to make marketing money work harder are keeping a check on their spending. Spending in this category went down by around 20 per cent during the downturn.Which marketing vehicle is the most effective for you – print, TV, radio, online?

Seventy per cent of our marketing spend is for above the line activities; fifty per cent of this goes towards television as it is the most effective medium for us.As we are present in over 700 cities, television offers a more cost effective reach. It provides an emotional touch point. You can link the customer with your brand and emotional thought. You can explain your concept in a situation linked to his day to day life.

Print, radio and OOH play a support role. We have started using social media more to engage the youth.

Which genres do you use on television?

News and sports for TG 25-45 males works. Apart from cricket, we also do on-air sponsorship of Euro, Fifa World Cup and Wimbledon. We also spend on regional news and regional entertainment; they are pretty big for us.The aim is to get the top-end audience in metros and mini metros. The cost of contact may be high but cost of impact and cost to the top-end segment is less compared to other vehicles. This is the most profitable customer segment for insurance.

Do you advertise heavily only during the end of the financial year?

We advertise across the year. Our IPL campaign is running at the start of the fiscal. When schools open, we can run a ‘Children Plan’ campaign. Advertising in the insurance category has moved from just being end of the year to being more spread out.What about the festive time?

Advertising at that period does not work. People think about spending and not about saving. It could be a counter campaign to do it in Diwali; this has not worked in the past.Do you use brand ambassadors?

No! HDFC Life is a product for the common people. The thought is powerful when you connect to people; they want to see communication where people like them are investing rather than seeing somebody who does not need life insurance but is still talking about it.What campaigns have been done recently?

The last campaign was a rebranding one. You don’t need to spend Rs 3-5 billion for this if you realise the core thing that you need to convey. It is not that overnight you have to change every single collateral and signage. The consumer has to be convinced that your rebranding is actually being delivered on the ground; they look at rebranding more in terms of on-ground delivery rather than on just an image or a design change.We also did a children’s plan campaign. We used more persuasion which was different from what was done earlier. We explained that while the child is doing fine, seats are limited and competition is severe. Parents need to plan properly; it will help the child reach that goal and get into the institution they like. The aim is to make a parent see that while things are happening normally, they still need to do something.

As a platform, how has the Rajasthan Royals deal worked out for you?

We look at associations where there is a good brand fit. In case of Rajasthan Royals, while Shane Warne is the captain, ordinary Indian players who people might not have heard of are given a platform. Warne helps them think like winners. If you look at the premise of believing in yourself, this goes well with our tag line ‘Sar Uthake Jiyo’.As a team they support youth and some of them have started playing for India. Shane Watson’s career also got revived with this team. It helps youth to think that they can beat world beaters.

In terms of activation with that IPL franchise, what innovations did you do this time around?

We brought a social angle into our activities for the home games. We used to take employees and distributors to meet players. We also used players for ads. We gave fans the opportunity to get tickets to enjoy the match and spend time with the cricketers. We took fans for the toss. This was run on Facebook. We also gave tickets to underprivileged people.Last year the franchise got into trouble with the BCCI. Did that force you to temporarily change tack in terms of your campaign?

Not really! The IPL was over by the time these issues came up. The team management kept us informed about the steps they were taking and why they believed that they were in the right. They said that there were no issues and kept us in the loop all the time. We have a one year deal with them.Rajasthan Royals has not fared well during the IPL. Are you concerned at any negative brand rub off for HDFC Life?

No! For a while, they were in the top rung of the points table. You have to look at the core strength of the association rather than one off wins or losses. The youth looks at ‘Sar Uthake Jiyo’ in a different light. The team has more youngsters compared to the previous year. So we came up with the tag line ‘Sar Utha ke Jeene ka Naya Andaaz’.How many campaigns do you do in a year and are there new audiences that you have started to address?

We will do four to five campaigns and are looking at new audience segments. We have done a lot of research on this.The rural areas have a lot of potential but the marketing vehicles that work in the major metros might not work there. So how do you connect with those consumers?

More than just marketing, the basics of the business have to be in place. Insurance is a long term business – and you need to understand the rural area. We do pilots to understand the rural area much more; this has multiple models that have to be run simultaneously.You need partners like microfinance institutions so that you can reach out to them in a much more cost effective manner. The rural areas consist of the rural rich and poor. You need different products for them while their aspirations are similar.

We are trying to do partner marketing at the moment. We do below the line activities with partners who have the trust factor in that area. The aim is to make the brand relevant and differentiated at a local level. We do things like street plays. We need somebody to carry the message and explain it. That is why below the line activities are important.

Could you give me examples where experiential marketing has worked for you?

We do ‘Spelling Bee’ in 35 cities. Children in classes six to nine participate. We have 300,000 children and over 1500 schools taking part. It allows children to understand things like vocabulary and sentence formation. Parents encourage children to do this. It is a good engagement activity. Parents are also engaged in terms of helping the child spell correctly.Somewhere your brand rub off is also very high. The parent thinks that HDFC Life has brought a competition which they want their children to participate in. Consumer engagement is key for our category. The consumer should keep engaging with you over a longer period of time. What we are seeing is that people buy five to six insurance products over a lifetime.

People like a brand but the decision may be deferred. I need to stay engaged constantly. I may create an engagement now, but later you may buy competition. The engagement has to be done through different methods. That is why we look at a 360 degree approach.

Could you talk about the growing importance of OOH for you?

This has really increased. In metros and mini metros, consumers spend time out of home. TV viewing time has come down. There is innovative media available. Obviously, hoardings have been there for a long time. Airports and stations have OOH media. You have to figure out how you can catch your TG when they spend time away from their home.But isn’t lack of measurement a problem?

This is why it is a support medium. If you utilise it for the right reason and use it to support the main communication, it works well. As a support medium, it gives good ROI. OOH always complements the TVC. I can measure ROI better that way.Do you address women?

In India, most homes have a single income. The male is the breadwinner; women in the working segment are still small and their needs are similar to working men. Their media consumption is similar. The campaign for men works for them also.We addressed upwardly women through an endowment plan campaign. The only segment that is different from men is the unmarried working woman. Other categories for women are similar to men; so I do not need to do a separate campaign for them.

-

“We will be looking into more original productions that are local and relevant to Indian audiences” : Sony Pictures Television SVP, GM, Networks Asia Ricky Ow

Sony Pictures Television is on a major expansion course in Asia. It has widened its portfolio with the launch of a new channel, ONE. AXN HD has also launched in several markets.

The key strategy is to up localisation in language, on-air presentation and local original production so as to make the channels more relevant.

In an interview with Indiantelevision.com‘s Ashwin Pinto, Sony Pictures Television SVP, GM, Networks Asia Ricky Ow elaborates on the company‘s brand positioning, growth, challenges and expansion plans.

Excerpts:

How would you describe the performance of SPE Networks Asia over the past couple of years?

The past few years have been rather busy ones for us at SPT Networks Asia. Not only have we maintained AXN as the No. 1 English general entertainment channel (GEC) in our key markets in the face of increased competition, we have also launched AXN HD services in several markets.In addition, we have expanded our portfolio by entering the Asian GE content space with the launch of our new channel, One. In a nutshell it has been a good couple of years with strong growth and expansion.

What are the priorities and key strategies for it going forward?

The key priorities for us moving forward are expanding our Asian content offerings and gaining a wider share of the audience by increasing localisation in language, on-air presentation and/or local original production to increase relevance of our channels.To what extent was the company affected by the economic downturn?

The impact was not as great as we initially feared because pay-TV in general is relatively resistant to economic downturns. This is because during such periods, consumers actually spend more time at home and watch more pay TV.While there was some loss in ad sales momentum, it was nothing too drastic. We have always had a strong culture of prudence and the downturn actually provided us a great opportunity to further build our brand and engage our audiences by revisiting some of the basics in how we connect with them.

Are things back to normal now or are some Asian markets still feeling the impact?

Things went back to normal very quickly in Asia. Many economies are experiencing good growth and there is a strong momentum at this point in time.How has SPE Networks Asia grown the number of feeds over the past couple of years?

We now operate five linear pay TV channel brands (AXN Asia, Animax Asia, SET, AXN Beyond and One) and a total of 17 feeds.“There is the opportunity to grow our business in India, but we are unable to comment on whether we are launching new channels in this marketplace right now”Could you talk about the growing importance of HD for SPE?

HD is obviously the new standard for broadcast TV. We have seen huge penetration of HD TV sets in many markets, some more than others. This will be the de facto standard in a few years time.AXN is a channel brand that is very relevant to early technology adopters and we have already launched AXN HD in Korea and several Southeast Asian markets. We have plans to bring it to India as well.

When he was in India, Sir Howard Stringer mentioned the importance of 3D for Sony. What role will this technology play in your broadcast business in the coming two to three years?

3D is key to the SPT business globally and there is already an HD content channel launched in the US named 3net. We will explore how we can bring that channel to Asia.The last time we spoke you had mentioned revenue leakage from piracy being a concern. Is the growing digitisation in India addressing this problem?

Leakage has been and continues to be a concern in many Asian markets. Digitisation and the efforts of industry bodies will help to address the problem. But it will take time and there seems to be no simple solution.There are synergies that exist between the broadcast business and other business verticals of Sony in India and across Asia. Could you talk about how this area is being exploited?

One great example of this is Sony Style. It is a lifestyle and gadget magazine programme that is not only highly entertaining, but also showcases the great breadth and depth of Sony offerings to consumers ranging from movies, TV, games, music and electronic gadgets.We are seeing more players enter the English GEC space in India after a long time when there have been just three players. What impact will this have?

We believe that competition can lead to two outcomes. The first is the rising cost of English GE programming, which is something that everyone has to watch out for. In addition, there will be improvement and increased excitement for English GE content. Increased competition is not necessarily a zero-sum game.With greater competition and more choices, the overall English GE viewership can expand and everyone wins.

From a programming perspective is AXN‘s template going to stay the same or are you looking to innovate?

The AXN formula is a winning one and we do not see the need to change it. However, it is necessary to continuously innovate within the channel brand parameters to bring AXN closer to viewers in India.An example comes in the form of AXN‘s Minute to Win It for India, which serves to localise the entertainment experience on the channel and make the content more relevant for Indian audiences.

Other English channels have introduced subtitling. Is AXN also doing this?

AXN currently airs programmes with English subtitles for the benefit of viewers who might face difficulty deciphering words spoken with different accents in shows.With CBS having launched channels in India, how will this affect deals you do with them? Will new seasons still be available?

We are unable to disclose or discuss any contractual terms agreed with CBS. But viewers can rest assured that top shows such as the CSI franchise will continue to broadcast first and exclusively on AXN in Asia.On the localisation front, how has the response been to Minute To Win It India‘?

In India, AXN‘s Minute to Win It is in its debut season and has had a relatively slow start. The show is gaining audiences and is doing well on the whole. There is definitely room for improvement and we have high expectations of the show.We are glad that Indian viewers have readily come forward to offer their honest feedback on Minute to Win It, without our having to ask. This points to real excitement and following for the show and format. We will be taking some of the suggestions to make Minute to Win It even better next season.

What is next on the local front?

We will be looking into more original productions that are local and relevant to Indian audiences and ones that can differentiate our channels from the competition..You devised a social media strategy to push this show. How effective is social media in communicating AXN‘s brand message?

Social media is especially useful not just in ‘pushing‘ AXN‘s brand messaging but more so in engaging viewers and receiving their feedback. It has been an excellent experience getting a feel of the passion of viewers who have offered their opinions of the show. Going forward, we will definitely leverage social media more.Social media means that brands lose control to an extent in terms of how information filters down and is disseminated to the consumer. That makes some companies insecure. How does SPE Networks Asia view this medium?

I believe the reactions of consumers cannot be controlled no matter which medium of information is shared through. We believe in facing up to audiences‘ tastes, preferences and reactions, as we are serving them after all.If responses received are negative, then we know we have to improve. Vice versa, if feedback is positive and we can continue in the direction which we know is right. We are never afraid of negative reactions and welcome all feedback.

Only when viewers engage with our channel brand do we understand them better and social media has enabled us to do this like never before and we will continue using it.

How is AXN perceived as a brand by viewers and advertisers? Has the perception changed over the past few years?

The perception of AXN as Asia‘s home of Action and Adventure has remained strong and the channel continues to be a premium brand in the marketplace with an extensive reach across the region.However, the definitions of ‘Action‘ and ‘Adventure‘ have probably evolved over the years. As audiences have grown increasingly sophisticated and mature in their choice of content, ‘Action‘ and ‘Adventure‘ may no longer be the same hard-boiled, head-on action in AXN programmes of yesteryear.

Instead, we find viewers embracing values such as courage, determination and irreverence embodied by key characters of popular AXN shows such as the CSI franchise, NCIS: LA, Leverage and Justified. This is also true when you consider the great support and following for local heroes from across the region who embark on the race of their lives in AXN‘s original production, The Amazing Race Asia.

What work has been done in the new media area by SPE Networks Asia in other Asian markets like Taiwan and Korea and what have the learnings been?

Online content from AXN‘s The Amazing Race Asia has been available to consumers across Asia and we have even launched the first episode of the most recent season online prior to its premiere broadcast. We are very encouraged that it has not cannibalized viewership but has instead grown the base of fans in the region.For SPT Networks Asia, we operate the Animax Mobile 3G streaming service as well as online catch-up TV for selected channels and programmes in various markets. We have found that these work for the youth who tend to be more active online and on mobile.

Is SPE Networks Asia going to launch more channels in India like AXN Beyond with digitisation growing?

There is the opportunity to grow our business in India, but we are unable to comment on that right now. -

‘Buyout valuations will now be decided in terms of ARPU rather than carriage growth’ : IMCL MD and CEO Ravi Mansukhani

IndusInd Media and Communications Ltd (IMCL), the media subsidiary company of Hinduja Ventures Ltd, plans to raise $100 million, a major chunk of which will be used to fund acquisitions.

Operating its cable TV business under the InCablenet brand, IMCL had earlier planned an initial public offering (IPO) but changed its stance as the newly listed cable TV entities, Den Networks and Hathway Cable & Datacom, dropped in market value.

Even on the acquisition front, IMCL has changed gears. Earlier, the focus was to buy small-sized cable TV networks and expand geographies. Now it targets big-ticket acquisitions, expecting the sector to consolidate as the government chalks out a schedule for digitisation across the country.

Slow on the broadband path, IMCL is experimenting on new technologies where it will not have to entirely overhaul its network to load on broadband capability.

In an interview with Indiantelevision.com’s Sibabrata Das, IMCL managing director and chief executive officer Ravi Mansukhani talks about how the acquisition game is going to move from carriage calculations to valuations based on ARPU (average revenue per user) growth as the cable TV sector transitions into the digital era.

Excerpts:

Why is IMCL taking so much time in readying its IPO?

We are in the market to raise $100 million ahead of the IPO and have mandated Deutsche Bank for this. We want to first build a solid valuation base. We believe the value of the top-rung MSOs will get a significant boost once the government fixes up a schedule for digitisation. We want to also expand on our size before we go for a public float.We have separately raised Rs 1 billion of debt from General Electric. So funding is being taken care of. We are getting ready to move into top gear.

Have you finalised on how you are going to raise this amount?

We are weighing various options. We are looking at mezzanine structures. The final structuring will depend on what fund-raising instrument we select.Are we going to expect acquisitions or a drive to greater digitisation?

We plan to use three-fourth of the amount raised for acquiring cable TV networks. We are looking at small and big-ticket acquisitions. We believe there is going to be consolidation in the industry. For digitisation, we have a separate funding plan to meet the capex requirements.Why has there been a change in stance as the earlier focus was to buy small-sized cable TV networks and expand geographies?

We see an opportunity out there as the other leading MSOs like Hathway Cable & Datacom and Den Networks are not on a buying spree. The valuations have dropped and we are ready to make big-ticket acquisitions ahead of the government‘s digitisation schedule. The acquisition focus now will be not on expanding into new geographies but on consolidating and growing in existing operational cities.Will the acquisition game change even as the government lays out a roadmap for digitisation across the country?

The game will definitely change. A few years back, when the pace was set by new entrants such as Den and Digicable, acquisitions were based on carriage calculations and TRP cities were favoured. Now, as digitisation creeps in, buyout valuations will be decided in terms of ARPU growth. So we have decided to consolidate and expand in areas where we already exist like Maharashtra. There is no point in spreading lean.“We are in the market to raise $100 mn ahead of the IPO. We want to first build a solid valuation base. We believe the value of the top-rung MSOs will get a significant boost once the govt fixes up a schedule for digitisation. We want to also expand on our size before we go for a public float”Do you see MSOs fighting amongst each other once the digitisation programme is announced?

MSOs would rather consolidate and expand where they are strong; their focus would be on digitising their existing network. MSOs can‘t create a fight today without being attacked; too much is at stake.How will MSOs counter the DTH invasion?

India will remain primarily a cable country. Yes, in a diversified and fragmented market, DTH will have space. But being the incumbent player, cable TV has a distinct advantage. Besides, it is cheaper priced, bandwidth is no issue and it can be interactive. MSOs will also start launching server-based local channels as in the digital era, space will open up for more channels. There will be need for local news and events. DTH can‘t offer these channels.How much of IMCL‘s network is digitised?

We have over half a million digital set-top boxes (STBs) installed. Out of the 28 cities that we operate in, we provide digital services in 17 cities via 10 digital head-ends.If the government‘s digitisation plan is on stream, we will deploy close to two million additional boxes in Phase 1. We are going to fund our digitisation through lease and vendor financing.

Why is IMCL‘s broadband story yet to emerge?

Our focus has not been on broadband in the past because the franchisee operators have been providing it. Though we provide broadband in nine cities, our revenues from this segment stood at just Rs 50-60 million in FY‘11.We plan to have a strong broadband story once the digital path is properly spelt out. We are currently experimenting on new technologies where we will not have to entirely overhaul our network to load on broadband capability.

We won‘t have a problem building up broadband revenues once we have pushed the digital STBs in. The script will change after the government announces the sunset date for the digitally notified areas. It is companies like You Telecom who will need to grow their cable TV presence in order to provide broadband.

Hathway has announced it would launch its HD service in June. When are you getting into this segment?

Our first priority is to offer digital service. We will then graduate to HD. The market is still not ready for it. HD boxes are on the anvil and we will introduce them into the market in the next few months.IMCL‘s total income jumped 23 per cent to Rs 4.03 billion in FY‘11. What growth do you estimate in FY‘12 and what is the outlook on carriage income?

We expect revenue to grow between 20-25 per cent. This will be higher if we raise capital fast and make big-ticket acquisitions.We saw 18-20 per cent growth in carriage income in FY‘11. We expect strong growth from this stream as more and more channels get launched in the fiscal.

-

‘India’s diversity makes distribution a big challenge’ : Brandscapes CMD Pranesh Misra

In a rapidly changing business environment where brands need to be constantly rejuvenated, it is not only important to analyse but also interpret data from a marketing agenda perspective.

The most significant change that has happened in India is the growth of the services over the consumer products sector. Mobile is also emerging as a strong personal medium, which marketers and advertisers have not fully exploited yet.

In an interview with Indiantelevision.com’s Ashwin Pinto, Brandscapes Worldwide chairman & managing director Pranesh Misra talks about how there is need for a marketing data centric company to build profitable growth strategies.

Excerpts:

When you started Brandscapes Worldwide in 2008, what was the aim?

The vision was to be a marketing data centric company. Our difference would be to not only analyse but also interpret data from a marketing agenda perspective.What progress has been made so far?

We have got success with global clients. We work with clients across different markets like Carlsberg, Citibank and Coca-Cola. They employ us in different geographies across the world. We work with their issues in over 40 markets and we do projects there. In India, we get clients who are not only interested in the analytics part of it but also want us to advise in the marketing and brand strategy.How are you addressing this need?

We have announced five different practices that we will focus our attention on. These are market research, data mining, marketing science, involving advanced statistics modelling to project the future. The fourth practice is dashboards which is putting all the information together in an easy-to-digest manner. The fifth strategy is the strategy planning dimension.What are the challenges that you face?

The primary challenge is that when you start with data analytics, there is not enough good quality data available. In international markets it is easily available as people have invested a lot of money behind it. We have worked with clients in the SME sector here who have not done any research. This is where we felt that doing customised research for these clients would be useful. We set up our own discipline in the area of research.The second challenge is finding the right caliber of people. This is a people driven business. It is about understand marketing and how data can be applied to it. I have been able to put together a solid team of 10 leadership team members. Each member has 20-30 years of experience in fields like research, marketing, media strategy, sales and distribution. It is this eclectic mix of talent that I have gotten together. These are the leaders who recruit the next generation of talent and create an organisation.

What is the advantage you offer to clients vis-a-vis competitive services?

We are trying to create a new area. I don’t think that marketing consulting is being offered the way that we offer it. Many companies offer brand consulting which is more into the brand strategy area. Then there are large companies like McKinsey and PriceWaterHouse Coopers who are management consultants and who also do marketing consulting. Our focus is on marketing and we have people with experience in this domain. We have holistic knowledge of all areas and so play in market research, data mining.We are trying to carve out a niche for ourselves between the bigger consulting houses and narrow focussed marketing consulting players. We give holistic solutions around marketing problems. We are not general consultants nor are we very specific. We are not just analytics focussed or market research focussed.

“The biggest mistake that has riddled many big companies is that their

thinking moves slower than the consumers”Could you give me some examples where clients have benefited?

As a consultant I cannot give specific examples; I can give broad ideas. There was a global FMCG client looking at a particular category. They wanted to do 20/20 planning on this category. This involved looking at 60 countries, collecting data of different natures like demographics, category penetration, competitive strength and weakness data and category development index data. Then we created a model around which data could be simplified and synthesised. On this basis we created clusters of countries. Then we did deep dive analysis in these clusters to see a common link. This was a macro level solution.On a micro level there was an FMCG whose brand was not doing well. We got access to retail data. We had to find an insight to take the brand further. One big pack size was not doing well while the others were growing. This size accounted for 25 -30 per cent of sales and was declining. This was the first clue and we dug deeper. Competition was coming with a slightly smaller pack size at a much cheaper price while this company had pushed the price up. We did price sensitivity testing which led to the right price point being found.

A Marketing Dashboard was developed for a shopping mall. This helps it keep track of Key Performance Indicators relating to its tenants – and take strategic and tactical action on an ongoing basis. Strategy Maps were used to guide a global NGO on how to change its branding approach for better success in some countries.

How have you grown over the past couple of years?

We started with 15 people. Now we have around 85 people. We have grown at an average of 45 per cent in terms of revenues. The client roster has grown from three cornerstone clients to around 12.Which sector is the most challenging to deal with?

No sector is particularly more challenging than another. It comes down to your domain knowledge. Since we have domain knowledge on consumer goods and services, banking and financial, retail and in healthcare, we are focusing in these segments. We have knowledge there. If you tell us to look at an industrial sector, it would be a challenge,. We don’t understand the topography of that sector.What mistakes do companies make when they go about their marketing?

The biggest mistake I would say that has riddled many big companies is that their thinking moves slower than the consumers. Consumers move ahead very fast in terms of their attitudes. Companies sometimes focus on the unchanging consumer and lose ground. You fail to move with the consumer in this scenario. Information availability is so much that consumers accept new information very quickly. This is a big challenge.What other obstacles do companies face?

In a country like India, sales and distribution is a challenge, especially for new companies. How do you reach out to big markets? When multinationals come in, the challenge is about pricing. They believe that the same prices that are in the developed markets should work here. They get a shock when nobody picks up their product. This is a pitfall that you have to work around.Which categories will spend the most on advertising and marketing this year?

It would be the service sector. Telecom will be one of the biggest drivers in terms of mobile telephony, followed by consumer durables and financial products.During the downturn did the spends of clients on research get affected?

We didn’t feel the pinch as we are still a young organisation. But I know that a downturn does not mean that research spending will fall. In fact research happens more as people want to be more careful about spending more ad money and marketing money. Research takes place more in downturns.How is India different as a market from other countries?

In India, distribution is a big challenge. There is a lot of diversity compared to a country like the UK which is fairly homogeneous. It is not about where do you enter in India but about how do you get going. India’s complexity is a challenge in terms of distribution, pricing, target segmentation. You have to be careful in terms of deciding which markets do you go to and which audience do you address.You have a JV with Design Bridge. How has this worked for you?

It has worked out well. We have worked for several clients together. They bring the actual design part of it. We don’t have any creative resource here. So what we do is the first part that is strategy planning. Then you have to create a look and feel, logo design for a product. They do that creative part of it.In the healthcare category we have a JV with Healthy Marketing Team. They are focussed on helping clients quickly zoom into the brand positioning strategy in the healthcare segment. We partnered with them, have trained our people on their system and have brought that to

our clients here.What marketing strategies work well for alcohol companies in India, given that direct advertising on television and print is not allowed?

Associating with a sporting event like Golf works. Spirit brands want to have a lifestyle association; they want to project a certain lifestyle and be in a premium space. Alcohol companies also take space in retail outlets. Besides, a lot of attention is spent on packaging of the product, which works towards effective brand building.In the financial and insurance sector a lot of companies follow a guilty tag to get parents to buy products. Is that a wrong way to go about selling products like insurance?

It depends on the situation. Too much of guilt can be counter productive. In some situations, guilt might work. But from my perspective, a positive outlook is better than guilt. Consumers after a while do not want to receive too many negative messages.Which marketing avenue is most effective in terms of ROI – print, television, radio, online?

It differs from category to category and brand to brand. This is what our marketing modeling mix practice estimates. We are able to pinpoint for a market which element gives higher ROIs.Is new media becoming more important?

Yes! It is credible as a medium as people share their opinions and experiences here. It is becoming a credible source of information. A lot of companies, especially international, go to new media first to get answers about consumers.But are companies tapping into this medium properly in India?

It is still a new medium here. Some companies are doing it well while others are experimenting. Mobile is about SMS at the moment. I think that as rich media comes in through 3G, marketers will use it a lot more.As far as online is oncerned, Indian consumers are already using that medium in categories like hotels and airlines. They want to find out what others feel about a particular brand. This is an area where a dramatic change will happen in the next three to four years. Companies have to understand that the Internet will play a critical step in the decision making process. Companies will need to have a larger presence online.

They can be a part of the online conversation, at least in terms of keeping track of what consumers are saying, and then take corrective action if there is negative feedback. They can also find out what consumers feel works for the brand and why they choose it over competition.

When you look at the marketing and advertising scenario what are the two biggest changes that have happened over the past five years?

The growth of the services over the consumer products sector is a big change that has happened in India. Also, the emergence of mobile as a personal medium is a change. This has not been totally exploited by marketers and advertisers, but I think that this is a life changer today. Younger consumers have evolved. -

‘We share cordial relations with the BCCI’ : Kings XI Punjab co-owner Mohit Burman

Amid controversies surrounding shareholding issues and a termination notice from the BCCI, the spirit of Kings XI Punjab hasn‘t dampened. The Indian Premier League franchise expects to break-even this year as it targets a 15–20 per cent increase from all revenue channels.

Though the drama off the field and the court proceedings caused damage to the brand, Kings XI Punjab has fought back and managed to retain four of its existing sponsors.

In an interview with Indiantelevision.com’s Ashwin Pinto, Kings XI Punjab co-owner Mohit Burman talks about the hard times the franchise had to go through while staying on course to turn profitable.

Excerpts:

The BCCI had terminated its IPL contract with Kings XI Punjab and now the team is back. What is the current relationship with the BCCI?

We share cordial relations with the BCCI. After all, it is in both our interests to run the league smoothly.What was the argument that you made in court over the BCCI‘s abrupt termination?

The BCCI had a certain opinion about the shareholding structure of the company, which was factually incorrect. The court in its interim order has accepted our position on the issue.Amid all the controversies including the one for overseas broadcast rights, are you concerned that the IPL‘s brand value might take a hit?

Brand IPL has only been growing these past three years. We believe that this will further grow with each passing season.Does the BCCI need to adopt a more inclusive approach and involve franchises when it takes big decisions?

The BCCI and franchisees form the IPL. Hence, it is only right that both engage with each other in the best interests of the league.There are now 74 matches as opposed to 94 envisioned earlier. What impact will this have on your revenue?

Each franchise shall still play 14 games at the league stage. I do not, therefore, see any great impact on revenues. We are confident of breaking even this year.‘Though there are 74 matches as opposed to 94 envisioned earlier, there will not be any great impact on revenues. Each franchise shall still play 14 games at the league stage. We are confident of breaking even this year‘Some feel that the BCCI should not have added two new franchises. Do you agree?

I don‘t see 10 teams as problem. It was always known that two new teams would be added in 2010.Yuvraj and Mahela are match winners in their own right and we did try to bring both of them back into our team. But after a point, the costs for individual players affect the composition of the team. At the end of the day, one has to formulate a team vis a vis spending the bulk of our purse on individual players. We have added 12 uncapped players including Nitin Saini, Sunny Singh, Siddharth Chitnis and Paul Valthaty.

How would you describe the progress that Kings XI Punjab has made over the past three seasons of the IPL?

We have come a long way since the first auction when nobody was sure if this format would work at all. Over the past three years, we have seen a number of ups and downs.

The first season was a good season for us from a cricketing perspective as we reached the semifinal, but then we slipped and our performance has been below par in the last two seasons. But with the learning’s from the previous seasons, we have now worked out a very balanced cricket team under an IPL winning captain – Adam Gilchrist. We strongly believe that our new team has the potential to win the IPL and make all our fans and supporters very proud of us. With three seasons behind us, we have only learnt more and understood how the business of sport and entertainment works. We are now in a better position to plan and execute effectively with clear objectives.What have the key learnings been?