INDIA: FanCode has extended its exclusive broadcast partnership with Formula 1, securing rights in India until the end of the 2028 season and tightening its grip...

BENGALURU: The World Tennis League is making a loud India entry. The team-based tournament, presented by Iconik Sports & Events and powered by SpiceJet, will be...

MUMBAI: Dream11 is swapping cash contests for creator content. The fantasy sports platform, which once commanded a user base of over 250 million punters, is transforming...

MUMBAI: If streaming had galaxies, Tata Play Binge just opened a wormhole. In its latest move to become India’s most sprawling entertainment universe, the platform has...

MUMBAI: The Abu Dhabi T10 has announced its most expansive broadcast line-up yet for the 2025 season, locking in partnerships that will take the tournament to...

MUMBAI: Talk about putting the pedal to the metal. Heineken 0.0 and Fancode are shifting Indian Formula 1 fandom into top gear with a new partnership...

MUMBAI: Stormy seas or smooth sailing? The Carabao Cup’s second round promises a splash of drama as Manchester United head to League Two minnows Grimsby Town...

MUMBAI: When the house always wins, sometimes the only move left is to change the game. That’s exactly what India’s biggest online gaming giants are scrambling...

MUMBAI: Mat talk turns money talk and UPKL is wrestling its way to the top of India’s sports scene. The Uttar Pradesh Kabaddi League (UPKL) has...

MUMBAI: Get ready to grip your screens, India’s fiercest arm battles are back and bolder than ever. The Pro Panja League is flexing for a powerful...

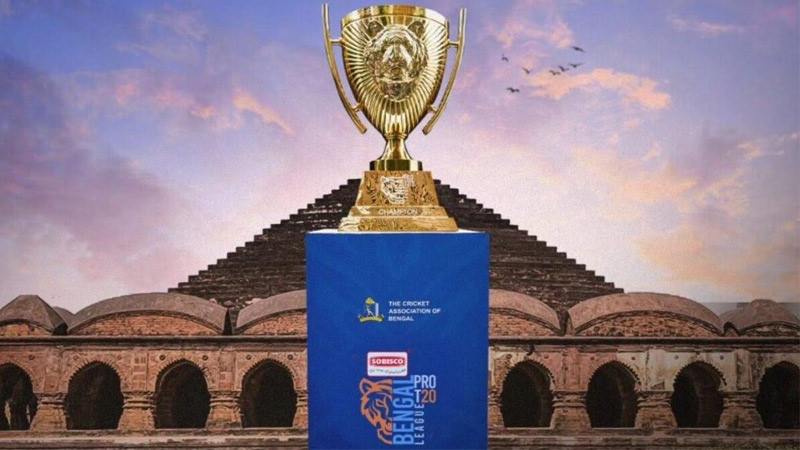

MUMBAI: India’s cricket summer just got hotter. Fancode is all set to exclusively stream the Bengal Pro T20 League starting 11 June. The move brings back-to-back...

MUMBAI: FanCode, India’s go-to sports platform, has clinched a five-year exclusive deal with Laliga, bringing Spanish football’s top-tier action to Indian screens. Starting with this weekend’s...

MUMBAI: In a move set to stir up the digital entertainment space, DishTV’s Watcho and RailTel’s broadband arm RailWire have announced a partnership to launch bundled...

MUMBAI: Sports fans, start your engines! FanCode has just turbocharged its motorsport lineup by securing exclusive digital rights for MotoGP in India. This high-octane three-year deal...

MUMBAI: Selling airtime and digital can be fun – not just a job – for some. Like it has been for Ashish Naik. The latest move...

MUMBAI: FanCode has officially made history. Crowned India’s most-downloaded sports app and ranked ninth globally, it continues to redefine how fans experience sports, as per the...

MUMBAI- BSNL isn’t just about dial tones and broadband anymore, it’s now in the business of binge-watching! The state-run telecom giant has teamed up with OTTplay...

MUMBAI: In a world where sports like pickleball—once considered a backyard pastime for paddle-wielding dreamers—are now commanding global attention, India’s FanCode has picked up the ball...

MUMBAI: Golf fans can swing their clubs in glees. Sports streamer FanCode has signed a deal with the PGA Tour to broadcast a plethora of golf...

MUMBAI: There was a gap in the entertainment offerings that mobile telco Vi was giving to its subscribers under its Movies & TV section: that of...

MUMBAI: No more frantic googling or last-minute scrambles for the remote—FanCode is here to kick off your football dreams. Whether it’s the roar of the crowd,...

MUMBAI: This has been some time in the works. College and high school sports are massive money spinners for all in the US. Indian platforms too...

Mumbai: The highly anticipated Hong Kong Cricket Sixes returns from 1 to 3 November, promising thrilling matches at the Tin Kwong Road Cricket Ground with 12...

Mumbai: FanCode, a sports destination, will be the streaming the upcoming Hong Kong International Cricket Sixes. Cricket’s most exciting format is set to return after a...

Mumbai: DD Sports, the key public sports broadcaster in the country, along with FanCode will broadcast the highly anticipated two-match bilateral hockey series between the Indian...

Mumbai: Dish TV’s new OTT aggregation platform, Watcho – OTT Super App, a one-stop solution for OTT entertainment for all generations, urban and rural alike including...

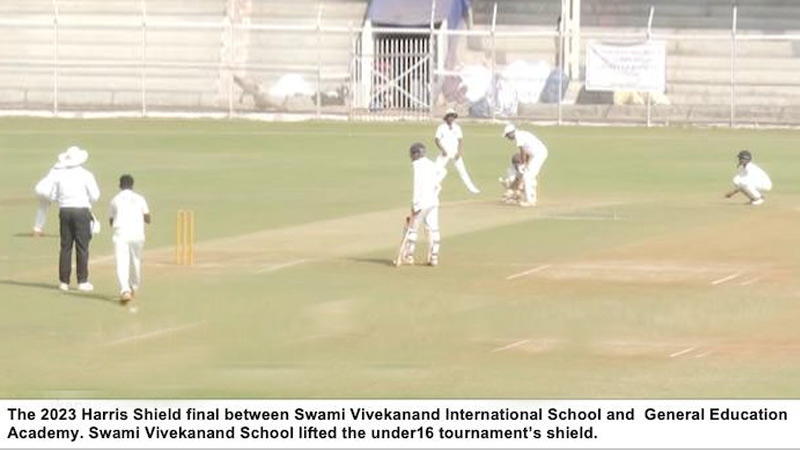

Mumbai: Board of Control for Cricket in India (BCCI) is all set to have an auction on 31 August 2023, for the media rights of international...

Mumbai: With the Legends League Cricket (LLC) underway in India, the spectacle of various cricketing legends playing together is set to have a global footprint. The...

MUMBAI: Digital sports fan destination FanCode from the house of Dream Sports, has appointed Nishant Nayak as its chief product officer (CPO). He will lead the...

Mumbai: From 22 July 2022 digital sports destination FanCode will stream the Indian cricket team’s tour of the West Indies. In the just launched campaign, FanCode...

MUMBAI: Last year the Dream Sports owned digital platform FanCode had taken the media rights for the West Indies Cricket Board (WICB) till 2024. The Indian...

MUMBAI: The Indian cricket team will play with West Indies in an eight-match series comprising three ODIs and five Twenty20 Internationals. The series will run from...

Mumbai: India’s premier digital sports destination FanCode has become the exclusive broadcaster for CWI until 2024, and will be the only platform streaming these matches live...

Mumbai: India’s premier digital sports destination FanCode is initiating a slew of new offerings on its platform. FanCode deals in three major areas like live content,...

Mumbai: Premium sports travel and experiences platform DreamSetGo have expanded its portfolio of partners becoming the official travel agent of the much-awaited ICC Men’s T20 World Cup...

Mumbai: Digital sports platform FanCode has announced that it will exclusively live-stream Afghanistan’s tour of Bangladesh in India. The tour, comprising three ODIs and two T20Is, will...

Mumbai: Digital sports platform FanCode will exclusively live-stream the Ireland tour of the USA in the Indian subcontinent. The series will feature two T20Is followed by...

Mumbai: Digital sports platform FanCode will exclusively livestream all matches of Pakistan’s tour of Bangladesh commencing 19 November, with the first match of the T20I series...

Mumbai: Homegrown digital sports platform FanCode has bagged exclusive digital broadcasting rights for the Hero Caribbean Premier League (CPL) 2021 in India. Cricket fans across the...

Mumbai: Digital sports platform FanCode has announced that it will be exclusively live streaming the 2021 Pakistan tour of the West Indies. The tour will be available...

Mumbai: Dream Sports’ FanCode has bagged exclusive four-year broadcast rights for England and Wales Cricket Board’s (ECB) new format cricket competition, The Hundred. The partnership between...

New Delhi: Home-grown digital sports streaming platform FanCode will be exclusively live streaming Sri Lanka’s tour of Bangladesh for cricket lovers in India. The Sri Lankan...

MUMBAI: FanCode a multi-sport aggregator platform by Dream Sports, has partnered with Hero Caribbean Premier League (CPL T20) to exclusively live stream all the cricket matches...

After a long hiatus, the National Basketball Association (NBA) is back with a ‘Whole New Game’, a campaign that inspires fans to reimagine the game of...

MUMBAI: FanCode has successfully completed one year with over 15 million app installs. Since its inception in March 2019, FanCode has partnered with some of the...

MUMBAI: FanCode, a multi-sport aggregator platform for every sports fan, has partnered with WICB (West Indies Cricket Board), to exclusively live stream all cricket matches from...