2014 many would say has been a year of more downs than ups, especially for the cable TV industry. But, if one peels off the superficial...

MUMBAI: The leading multi system operators (MSOs) in Mumbai, except Hathway Cable and Datacom, have agreed to put all Star channels on a la carte. With...

MUMBAI: When Maharashtra Cable Operators Federation (MCOF) stepped into the office of IndusInd Media & Communications Limited (IMCL) today the agenda was clear: to get the...

MUMBAI: Starting 19 November 2014, Epic channel, distributed by Indiacast, will be available on some of India’s leading DTH service providers; Tata Sky on SD channel...

BENGALURU: Den Networks Ltd (Den Networks) reported that its cable business operational revenues stood at Rs 286.22 crore, up 11 per cent y-o-y from Rs 258.06...

NEW DELHI: Who is meant to maintain the monthly log of the activations of a particular channel: the multi system operator (MSO) or manufacturer, vendor or...

MUMBAI: It was first Hathway Cable & Datacom that complied with the Telecom Disputes Settlement Appellate Tribunal’s (TDSAT) order of putting Star India channels on a...

MUMBAI: In a significant move to organise the digital cable industry for the overall benefit of all stakeholders and to facilitate and further create momentum for...

NEW DELHI: The Telecom Disputes Settlement and Arbitration Tribunal (TDSAT) today issued notice to multi-system operators Siti Cable and Den Networks to file their viewpoint on...

MUMBAI: Looking at the growth of e-commerce sector in India, shopping at a click of a button seems to be the favourite pastime of the millions...

MUMBAI: DEN Networks CEO SN Sharma has decided to quit from his current position. Sharma, one of the founding members of DEN, resigned today, which was...

MUMBAI: NAGRA, the Kudelski Group (SIX:KUD.S) digital TV business and the world’s leading independent provider of content protection and multiscreen television solutions, announced today that DEN...

MUMBAI: In one big development multi system operator (MSO) DEN Networks has announced its joint venture with Jasper Infotech, the entity that owns and operates the...

MUMBAI: In line with its philosophy of creating a difference in the sphere of sports, especially soccer, Delhi Dynamos Football Club announced the launch of a novel...

BENGALURU: Den Networks Ltd (Den Networks) reported almost flat q-o-q result in Q1-2015. The company reported a slight drop in consolidated Total Income from Operations (TIO)...

MUMBAI: “I will be seeking the moon,” says Multi Screen Media CEO NP Singh, as he announced the launch of the network’s much talked about new...

NEW DELHI: Delhi Dynamos FC, the national capital’s football team for the Hero MotoCorp Indian Super League, have announced Harm van Veldhoven as its manager. Harm...

MUMBAI: In this season of football frenzy, the national capital is seeing the birth of its very own football movement. DEN Soccer a wholly owned subsidiary...

NEW DELHI: After multi system operator (MSO) Hathway Cable and Datacom launched DOCSIS 3.0 technology in October 2013, it is now DEN Networks that has selected Cisco’s...

MUMBAI: Enhancing its set top boxes (STBs) and gateways for its six million subscribers, DEN Networks has tied up with STMicroelectronics (ST), the global semiconductor manufacturer...

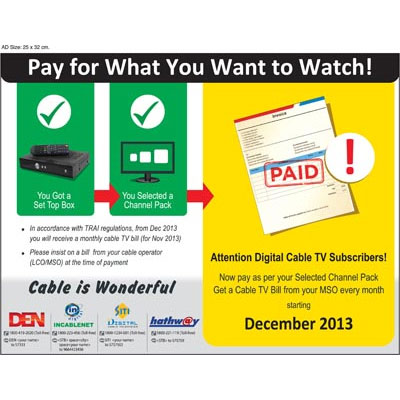

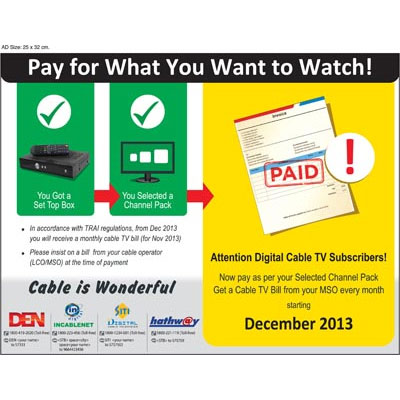

MUMBAI: The Telecom Regulatory Authority of India (TRAI) will not see any further delay in implementation of billing. And it is with this aim that the...

MUMBAI: Multi system operator (MSO) Den Networks is not only expanding its business, but with that is looking at enhancing customer experience as well. And with...

BENGALURU: At a time when most companies involved in carrying television signals from the broadcaster to the consumer via cable have reported losses and are complaining...

MUMBAI: DEN Networks is looking at serving its Kochi subscribers better. The multi system operator (MSO) has announced the launch of its HD package comprising 22...

MUMBAI: DEN Networks has appointed Gaurav Tikoo as general manager, Brand to accelerate its transformation from a B2B business into a leading consumer facing digital cable...

BALI: Viren Raheja is a man with a mission: to change the culture at India’s leading cable TV multi system operator Hathway Cable & Datacom. With...

MUMBAI: As India slowly inches towards 100 per cent digitisation, it is the various cable and multi system operators who are to be applauded for the...

KOLKATA: Viewers in West Bengal will get to see one more Bengali satellite entertainment channel starting today. Named Orange TV, the new channel will be...

MUMBAI: Multi system operator (MSO), DEN Networks, today announced the appointment of Sheetal Garg as the vice president finance for its broadband division. The announcement has...

NEW DELHI: Three multi-system operators were given interim relief in January in the entertainment case issue. In January, the case was adjourned to 13 March and...

MUMBAI: Public notices seem to have become a norm in the present time. Facing the ire this time is the multi system-operator – DEN Networks, which...

MUMBAI: Digitisation is set to change the way television channels are packaged. In addition to the subscriber getting the option to pick and choose channels, multi-system...

MUMBAI: The MSO Alliance comprising Hathway Cable & Datacom, SitiCable, DEN Networks and IndusInd Media and Communication Limited (IMCL) has condemned the attack on Delhi-based senior...

BENGALURU: Indian cable TV distribution company Den Networks Limited (Den Networks) reported 22.9 per cent consolidated revenue growth to Rs 297.24 crore in Q3-2014 as compared to...

MUMBAI: The multi-system operators (MSOs) in Bengaluru are determined to do all that is needed to be in the good books of the Telecom Regulatory Authority...

MUMBAI: When the entire process of digitisation started in the country, nobody would have thought it would be such a tough nut to crack and there...

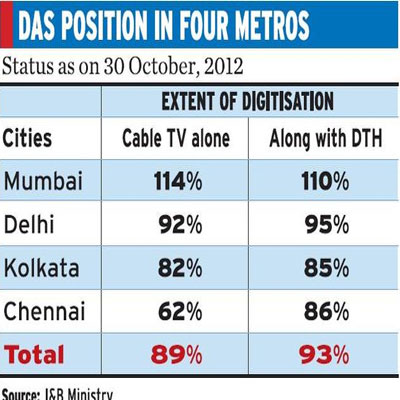

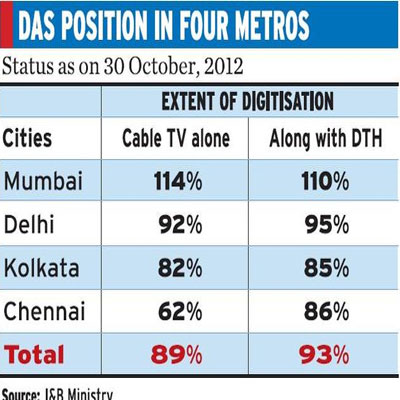

NEW DELHI: Digitisation has given an opportunity for cable to compete with direct-to-home (DTH). There was a time when digital meant DTH and cable was largely...

KOLKATA: The multi system operators (MSOs) seem to be in full swing to bring the gross billing system in place. This time, to discuss the smooth...

NEW DELHI: It was a day when the stalwarts of the Indian cable, broadcast and direct to home television industry converged to witness the best or...

MUMBAI: The big four of Indian cable TV – DEN Networks, Hathway Cable and Datacom, InCable and Siti Cable – heaved a sigh of relief as...

MUMBAI: The government mandate to digitise roughly 130 million Indian cable TV homes has been progressing in stops and starts over the past year. But with...

MUMBAI: The national multi-system operators (MSOs) don’t want any more delay in starting the gross billing in the phase I cities. While gross billing has already...

MUMBAI: Soon consumers will find bills coming to them for using cable TV service. And the message will be reaching them loud and clear through a...

MUMBAI: Exset India has got a new director. Exset BV, the Netherlands based broadcast solutions company, today announced that it has promoted its regional director- South...

KOLKATA: With the Telecom Regulatory Authority of India (TRAI) pressuring service providers in Kolkata to disconnect the television connections of customers for not submitting the subscriber...

KOLKATA: Multi System Operators (MSOs) and local cable operators (LCOs) in Kolkata are busy collecting the consumer application forms (CAF) and feeding in details for the...

MUMBAI: Tomorrow is an important day for TRAI chief Rahul Khullar. Reason: the deadline for cable TV subscribers to send in their customer application forms (CFAs)...

MUMBAI: India‘s multisystem operators (MSOs) got a dressing down yesterday from TRAI boss Rahul Khullar about the lack of KYC or CRF forms giving details about...

MUMBAI:India‘s pay TV operators are coming of age. And they are bursting on to the global pay TV scene, if one goes by data released by...

MUMBAI: India‘s John Malone is on a roll. Earlier this week, the Sameer Manchanda headed cable TV MSO Den Networks announced that it was going for...