BENGALURU: DB Corp Limited (DB Corp), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported 10.5 percent higher consolidated revenue...

BENGALURU: DB Corp Limited (DB Corp), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported 10.5 percent higher consolidated revenue...

BENGALURU: DB Corp Limited (DB Corp), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported 2.1 percent increase in Total...

BENGALURU: DB Corp Limited (DB Corp), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported 2.1 percent increase in Total...

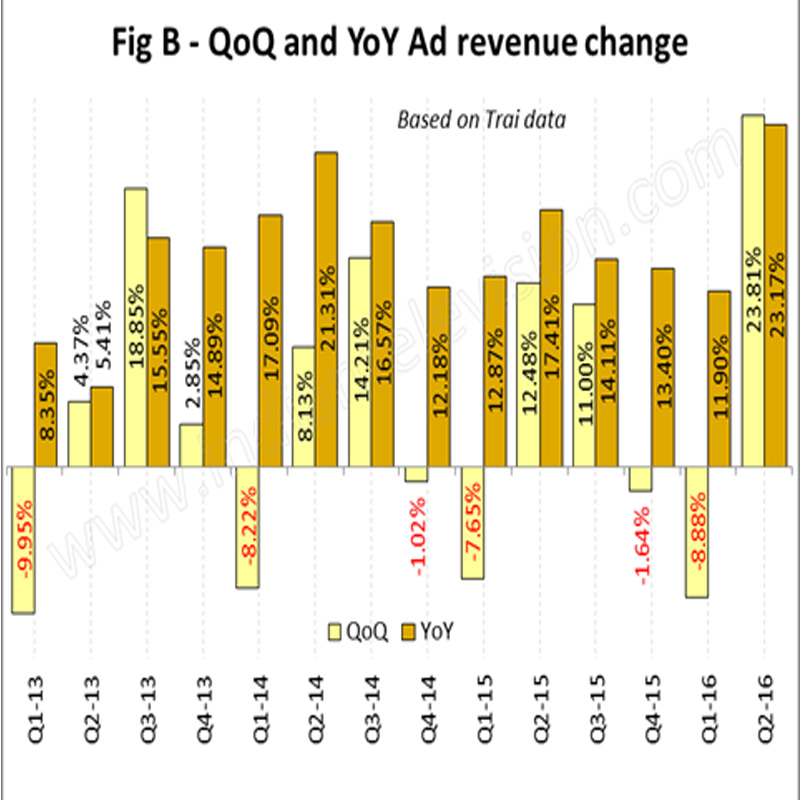

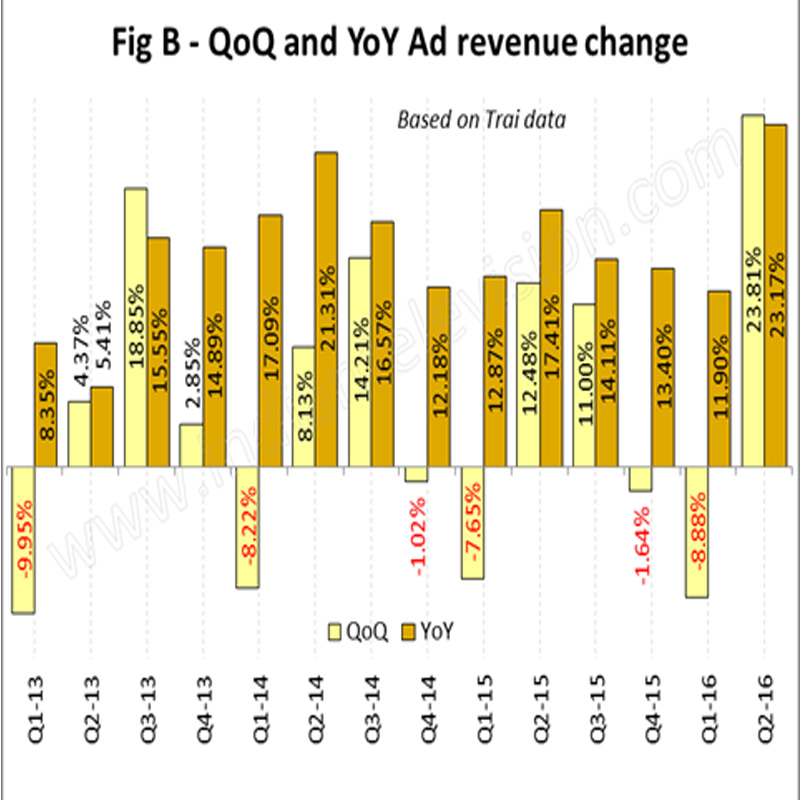

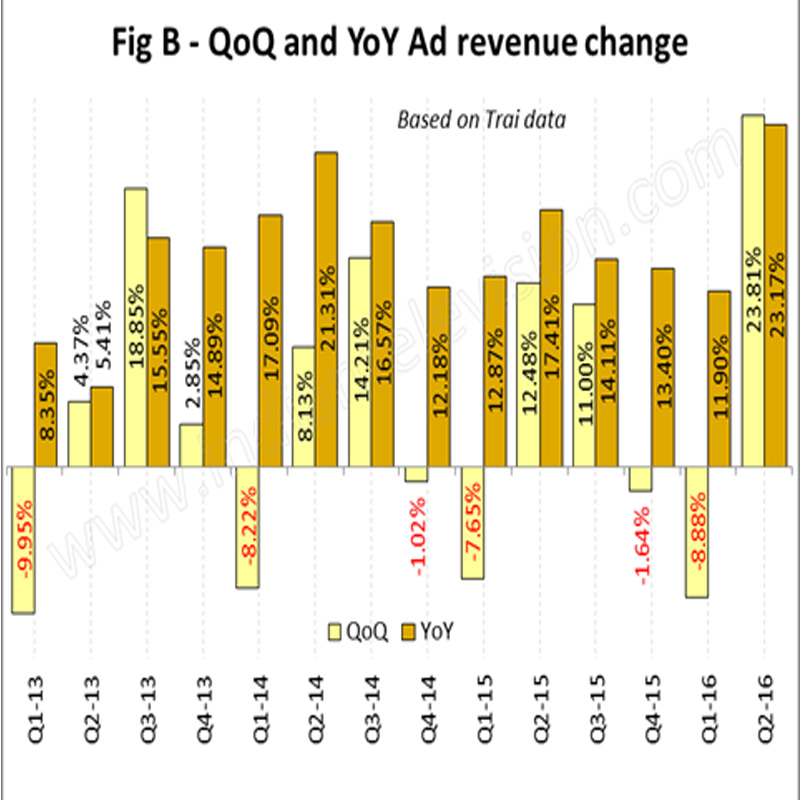

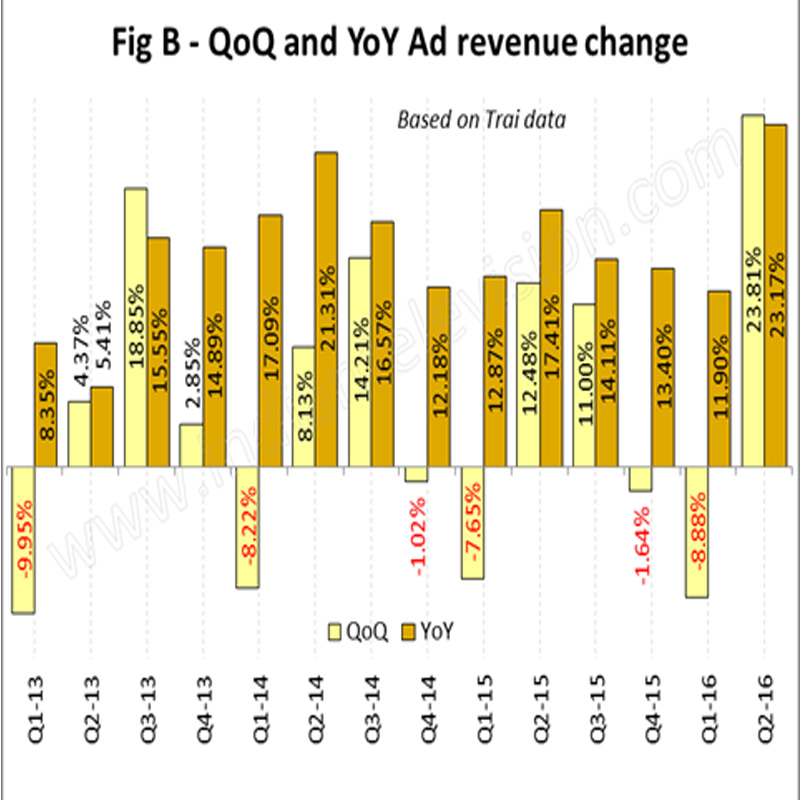

BENGALURU: DB Corp Limited (DB Corp), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported 22.5 per cent QoQ increase...

BENGALURU: DB Corp Limited (DB Corp), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported 22.5 per cent QoQ increase...

BENGALURU: DB Corp Limited (DB Corp), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported a 0.4 per cent fall...

BENGALURU: DB Corp Limited, home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported an 8.1 per cent increase in Total...

BENGALURU: DB Corp Limited (DB Corp), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar, reported a 54.3 per cent increase...

BENGALURU: DB Corp Limited (DB Corp), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported a 1.8 per cent drop...

BENGALURU: DB Corp Limited (DB Corp), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported improved results in Q1-2015, both...

BENGALURU: DB Corp Limited (DB Corp), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported improved results in Q4-2014 and...

BENGALURU: DB Corp Limited (DBCL), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported good standalone results for Q3-2014 (Quarter...

BENGALURU: DB Corp Limited (DBCL), home to flagship newspapers Dainik Bhaskar, Divya Bhaskar, Dainik Divya Marathi and Saurashtra Samachar reported a good result for Q2-2014 and...

Mumbai, August 12, 2013: DB Corp Limited (DBCL), India's largest print media company today announced the launch of its 7th edition of Dainik Divya Marathi from...