MUMBAI: IN10 Media Network has pressed refresh in the grandest way, rebranding itself as The Epic Company and unveiling a future-ready storytelling engine designed to power...

MUMBAI: When the digital world calls, Madison Media answers with a double click and its newest hire is set to hit refresh on the agency’s future....

MUMBAI: The Indian media and entertainment business is experiencing something of a convulsion. At the heart of the storm sits television, a medium once considered impregnable,...

MUMBAI: In a media industry obsessed with the limelight, Mahesh Shetty remains an anomaly. No splashy interviews, no endless conference panels, no constant social media updates....

MUMBAI: With Ajit Varghese heading back to Madison Media, this time as partner and group CEO of Madison Media & OOH, questions were being asked about...

MUMBAI: Ajit Varghese is set to return to the world of advertising, taking the reins at Sam Balsara’s Madison as partner and chief executive officer. The...

MUMBAI: Ajit Varghese has quit as head of revenue, entertainment and international at JioStar, the Reliance–Disney joint venture created in November 2024. His departure, confirmed via...

MUMBAI: The much-anticipated return of Kyunki Saas Bhi Kabhi Bahu Thi has sent waves of excitement across living rooms and boardrooms. Ahead of its July 29...

MUMBAI: JioStar Entertainment is turning up the volume on India’s Connected TV (CTV) revolution with the launch of its first-ever CTV Playbook — a glossy, data-rich...

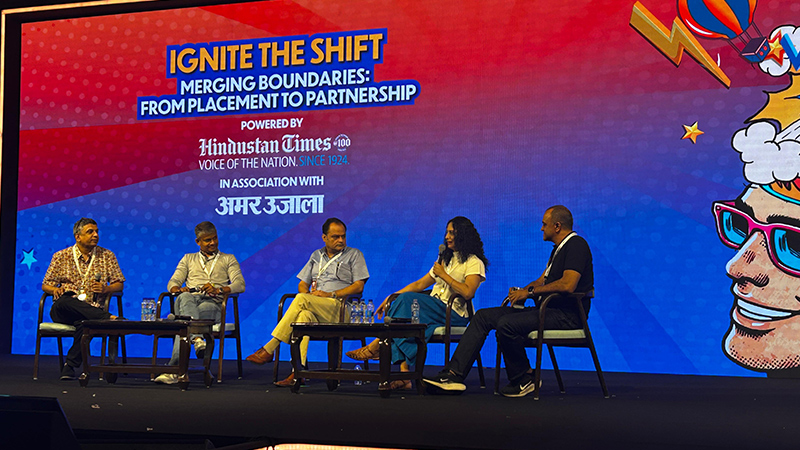

MUMBAI: Goafest 2025’s marquee session, ‘Ignite The Shift’, powered by Hindustan Times and Amar Ujala, staged a spirited conversation on marketing’s evolving ecosystem. The panel, titled...

MUMBAI: Who said stardom can’t be strategic? JioStar is flipping the influencer playbook with the launch of JioStarverse, a savvy, data-fuelled marketing platform designed to help...

MUMBAI: Just when you thought the drama in Pushpa 2 couldn’t get any more intense, a mysterious damp patch crept across the screen and no, it...

MUMBAI: Once upon a brand… In a world flooded with content, the magic of storytelling remains the ultimate spell to captivate audiences and cash in on...

MUMBAI: Another season of drama, strategy, and nail-biting eliminations has come to a close, and Bigg Boss Season 18 has done it again—breaking records, dominating screens,...

Mumbai: The Pro Kabaddi League (PKL) returns for its eleventh season, to enhance the growing popularity of Kabaddi in India. Disney Star, the official broadcaster, has...

Mumbai: Mother Dairy, India’s leading milk and milk products major, has today announced its official association as the dairy partner for the upcoming 2024 season of...

Mumbai: With the ICC Women’s T20 World Cup 2024 starting on 3 October, Disney Star unveiled its impressive sponsorship line-up, reflecting the growing enthusiasm and anticipation...

Mumbai: Beatgrid, the global advertising effectiveness currency has collaborated with Disney Star to provide cross-platform measurement insights. This collaboration leverages Beatgrid’s cutting-edge deterministic measurement technology to...

Mumbai: As the 2024 Wimbledon Championships commences today, Disney Star announces an impressive lineup of sponsors for the world’s oldest and most prestigious tennis tournament. This...

Mumbai: Star Sports, the official broadcaster of Tata Indian Premier League (IPL), has announced an association with Tata Play, India’s leading DTH operator. Together, they are...

Mumbai: Star Sports, the official TV broadcaster of the Tata Indian Premier League (IPL), brings a one-of-a-kind opportunity ‘Startup Power Play’ for start-ups in India. This...

Mumbai: Disney+ Hotstar, India’s leading streaming platform, has launched a handbook for effective brand building on the platform. Titled Winning in the OTT era with Disney+...

Mumbai: The India Brand Summit, held on November 28, 2023, at The Lalit Mumbai, brought together leaders, marketers, entrepreneurs, and experts to discuss current trends in...

Mumbai: Disney+ Hotstar, India’s leading streaming platform, is back with an exciting new season of its marquee celebrity talk show Hotstar Specials’ Koffee With Karan. The...

Mumbai As the ICC World Cup 2023 approaches, Disney Star reveals its 26 esteemed sponsors, featuring prominent brands including PhonePe, Mahindra & Mahindra Ltd, Dream11, Hindustan...

Mumbai: India’s homegrown beverage brand The Coca-Cola Company, is excited to announce the launch of ‘Thums Up Fan Pulse’, an innovative and immersive cricket experience in...

Mumbai: As cricket fever grips the nation with only days to go to the Asia Cup followed by the ICC Men’s Cricket World Cup 2023, the...

Mumbai: Media investment company GroupM India and media aggregator ShareChat, with 400 million monthly active users (MAU) across ShareChat and Moj, has announced entering into a...

NEW DELHI: ShareChat has appointed Ajit Varghese as its chief commercial officer. Varghese brings in a track record of 25+ years of leading large-scale business transformations...

KOLKATA: Wavemaker global president Ajit Varghese has stepped down from his position after a stint of more than 13 years. He joined WPP’s media buying arm...

MUMBAI: Maxus India today launched ‘Maxus Kaleidoscope’, a unique mood based planning tool. Inspired by British physician Dr Liz Miller’s mapping principle of defining one’s mood,...

MUMBAI: Maxus India today launched ‘Maxus Kaleidoscope’, a unique mood based planning tool. Inspired by British physician Dr Liz Miller’s mapping principle of defining one’s mood,...

MUMBAI: Rose Huskey has joined the Maxus regional team as Maxus APAC client leadership head. Prior to this, Huskey spent four years as the Maxus Vietnam managing...

He took charge in January this year and since then there has been no looking back. The humble and calm, Kartik Sharma, the managing director...

MUMBAI: Media vet Ajit Varghese has more than one reason to celebrate. He has been going max at Maxus South Asia and his efforts are being...

Mothers. Moms.They are the most wonderful people in the whole world. From our victories to our failures, mothers are always besides us. She is our first friend,...

MUMBAI: Nestle India has consolidated its digital and social media Duties with GroupM’s Maxus Digital. The FMCG major has been successfully executing various digital initiatives on...

MUMBAI: Maxus, a GroupM media agency, has announced the appointment of Shailja Vohra as ESP head. She will be based out of Delhi office and will...