BENGALURU: DAS, especially phases 3 and 4, was supposed to be a great growth opportunity for television direct-to-home (DTH) service providers. Has that been the case? Not if one were to go by data released by the Telecom Regulatory of India (TRAI) and three of the six private DTH players in India.

The status quo

At present, there are six private pay-TV players (five active in the true sense of the word) and one government free-TV player DD FreeDish. The five players are: Airtel Digital TV or Airtel DTH, Dish TV, Sun Direct, TataSkyand Videocon DTH–the sixth player being Reliance Digital TV or Big TV.

Reliance Big TV has been acquired by Pantel Technologies and Veecon Media. Normal operations have to recommence as yet. A number of Big TV customers were acquired by other players and the true status of its operations and current subscriber numbers are still unclear at the time of writing.

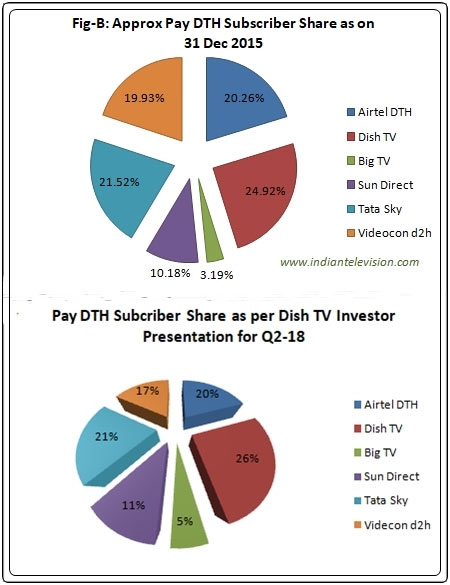

Please refer to the figure below for subscriber share of the six private players at the end of 30 September 2017 (Q2-18 or Q2-2108).

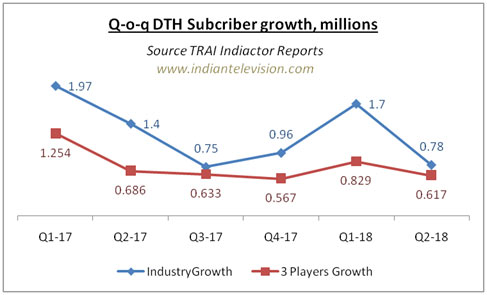

DTH subscriber acquisition seems to have petered down in calendar year 2017 (CY2017, 1 January 2017 to 31 December 2017) as compared with CY 2016. Please refer to the chart below for active subscribers addedas per TRAI data until 30 September 2017 (Q2-2018) and data reported by the three private players – Airtel DTH, Dish TV and Videocon d2h until 31 December 2017. It may be noted that these three players had almost 63 percent share of subscribers according to the above-mentioned Dish TV investor presentation.

The continuous blue curved line in the chart below represents the total number of net active subscribersaddedfor each quarter – this number has been obtained by deducting the number of active subscribers in a quarter from the number of subscribers in the previous quarter. The combined total number of the three subscribers has been obtained by addition of net subscribers added by each of the three players – Airtel DTH, Dish TV and Videocon d2h – as declared by them in their financial/other releases and presentations. Thesecombined subscriber additions are represented by the continuous maroon line in the figure. The broken grey line represents the percentage of the combined net subscriber additions by the three players of the total subscriber additions as per TRAI data.

The chart below indicates the subscriber base of the three players and all private DTH players as per quarterly data released by TRAI. TRAI data for the October-December 2017 quarter has not been released at the time of writing. Subscriber data for each of the three players mentioned below has been obtained from their respective financial releases and presentations. The numbers have been rounded off to the nearest lakh by the author.

As is obvious, Dish TV is the biggest player in the country in terms of subscribers followed by Airtel DTH and Videocon d2h in that order. It may be noted that Tata Sky subscriber base could be higher than Airtel’s subscriber base. Tata Sky data is not available in the public domain, and hence this cannot be verified.

Overall, the players are faced with declining monthly average revenue per user (ARPU). In absence of complete ARPU data, the author has taken the liberty to calculate ARPUs of each of the three players by using quarterly operating revenue/subscription revenue of the players and dividing it by the subscriber base at the end of that quarter and then calculating the ARPU per month. Similarly, the quarterly operating/subscription revenues of the three players have been added and then divided by the combined subscriber base of the three players at the end of that quarter and then the average monthly average ARPU has been arrived at. In each case calculated ARPU numbers have been rounded off to the nearest rupee.

The combined four quarter average monthly ARPU of the three players across four quarters of 2017 has declined by Rs 9 to Rs 183 from Rs 192 in CY-2016. Airtel DTH is the premium player – its four quarter average monthly ARPU in 2017 increased by Rs 2 to Rs 230 from Rs 228 in 2017. Dish TV is a value player, its average declined by Rs 18 in 2017 to Rs 143 from Rs 161 in 2016. Videocon d2h four quarter average monthly ARPU in 2017 declined by Rs 9 to Rs 186 from Rs 195 in 2017. It must be reiterated here that the ARPU numbers mentioned in this paper have been calculated by the author and may vary from the actual numbers. The numbers in the graph below are just indicative numbers.

Besides the six private pay DTH players, FreeDish is a major player in terms of subscribers with an estimated 2.2 crore as per the numbers available in the public domain. It must however be noted that an exact number for registered or active subscribers is not available even with DD, since this is a free DTH service. If and when the announced Dish TV Videocon d2h merger happens, the merged entity will probably be one of the largest DTH players in the world in terms of subscriber numbers.

According to an E&Y report titled ‘India’s Free TV’ released in July 2017, among the DTH operators in India, FreeDish has grown to become the largest with its estimated 2.2 crore subscribers which E&Y predicted could cross 4 crore over the next two to three years.

A number of reasons can be attributed to this dismal performance–two of the chief ones that have been touted over the recent past by most players in media and entertainment industry are demonetisation in November 2016 and the implementation of the new GST regime. Given that most of India faced a cash crunch for a few months post demonetisation, money spends for entertainment took the least priority for the common man.Subscriber acquisition seems to have picked up in the April-June 2017 quarter, only to be dampened in the July-September 2017 – the quarter in which the new GST regime was implemented. The glitches of the new GST are slowly being ironed out. In the absence of TRAI data for the October-December 2017 quarter, numbers reported by the three players seem to indicate that DTH subscriber acquisition should have improved. Despite this, it seems unlikely that the industry was able to surpass or even match subscriber growth of CY-2016.

Another important reason could be that DTH is considered a premium service – by all the stakeholders in carriage ecosystem with the resulting perception that procurement as well as monthly subscription will be premium and hence a deterrent for the consumer. While some players such as Dish TV have been making attempts to come up with packages that it perceives should attract the masses, but, results as per TRAI data seem to indicate otherwise. Yes, Dish TV is the largest private player in the country that has come up with different pricing models under different brands, whether unwittingly or not, most of the other players present themselves as premium players and seem to have done little in that direction.

Also Read :

Recalibrating India’s DTH sector after Airtel DTH-Warburg Pincus deal