MUMBAI: Even in the absence of Fox News’ star Bill O’Reilly, 21st Century Fox earnings for the year and quarter ended 30 June, 2017, have beaten expectations, narrowly missing revenues, however.

International affiliate revenue increased seven per cent driven by strong local currency growth at both FNG International channels and STAR, partially offset by a four per cent adverse impact from the strengthened U.S. dollar. International advertising revenue decreased three per cent due to the effect of the Indian government demonetisation initiatives on the general advertising market, a lower volume of cricket matches broadcast in the current year at STAR and the negative impact of foreign exchange, partially offset by local currency growth at FNG International. Annual OIBDA at the international cable channels increased four per cent reflecting higher affiliate revenues at both FNG International and STAR and lower sports programming costs at STAR due to lower volume of cricket matches broadcast in the current year.

The increase in expenses was primarily due to higher domestic sports programming costs driven by higher professional team rights costs at the regional sports networks (“RSNs”) and increased MLB and National Association for Stock Car Auto Racing (“NASCAR”) rights costs at FS1, higher programming and marketing costs at FX Networks and National Geographic and higher entertainment programming costs at Fox Networks Group International (“FNG International”) and STAR India (“STAR”).

The Company continued the expansion of its video offerings by introducing non-linear packages in Europe, Asia and Latin America under the labels FOX+ and FOX Premium, all tailored for specific markets and offering consumers more choice, and re-launching its domestic suite of authenticated entertainment apps through a unified FOX NOW app, and through further penetration and engagement of its Hotstar platform in India, where watch time has increased over the prior year by 300 per cent.

The Company reported annual income from continuing operations attributable to 21st Century Fox stockholders of $3.00 billion ($1.61 per share), compared with $2.76 billion ($1.42 per share) in the prior year. Excluding the net income effects of Impairment and restructuring charges, Other, net and adjustments to Equity losses of affiliates1, adjusted annual earnings per share from continuing operations attributable to 21st Century Fox stockholders2 was $1.93, a 12 per cent increase compared to the adjusted year-ago result of $1.73.

The Company reported annual revenues of $28.50 billion, an increase of $1.17 billion, or four per cent, from the $27.33 billion of revenues reported in the prior year. This revenue growth reflects higher affiliate and advertising revenues at both the Cable Network Programming and Television segments partially offset by lower theatrical and home entertainment revenues at the Filmed Entertainment segment.

Full Year Highlights

The Company continued to grow its cable channel and television businesses through eight per cent growth in affiliate revenues and 5 per cent advertising gains while positioning these businesses for the future through the inclusion in the core bundles of new digital MVPD entrants.

The very successful broadcasts of Super Bowl LI and the Major League Baseball (“MLB”) World Series, which delivered the most watched baseball game in a quarter century, grew Fox Sports broadcast viewership by approximately 25 per cent over the prior year driving a 20 per cent increase in television segment contributions.

Fox News Channel was the most watched basic cable network over the last twelve months during which it achieved its highest-rated quarter ever in 24-hour viewership.

The Company strengthened its core domestic cable brands with the successful first seasons of Taboo, Legion, and Feud on FX and the global event series Mars and Genius on National Geographic.

The Company continued the expansion of its video offerings by introducing non-linear packages in Europe, Asia and Latin America under the labels FOX+ and FOX Premium, all tailored for specific markets and offering consumers more choice, and re-launching its domestic suite of authenticated entertainment apps through a unified FOX NOW app, and through further penetration and engagement of its Hotstar platform in India, where watch time has increased over the prior year by 300 per cent.

The box office successes of Logan, an extension of the X-Men franchise, and Hidden Figures underscore the range and quality of what the Company’s studio brings to its audiences.

Twentieth Century Fox Television production studio produced the number one show on five different networks, including Empire on FOX, American Horror Story: Roanoke on FX, Modern Family on ABC, This Is Us on NBC, and American Dad on TBS.

Fox Television Stations sold broadcast spectrum in the Federal Communications Commission’s completed reverse auction for which the Company received approximately $350 million in proceeds in July 2017.

The Company reached an agreement with Sky plc (“Sky”) on the terms of an offer to acquire the Sky shares which the Company does not already own, which the Company believes will result in enhanced capabilities of the combined company, underpinned by a more geographically diverse and stable revenue base, and an improved balance between subscription, affiliate fee, advertising and content revenues. The acquisition of Sky remains subject to certain customary closing conditions, including approval by the UK Secretary of State for Digital, Culture, Media and Sport and the requisite approval of Sky shareholders unaffiliated with the Company.

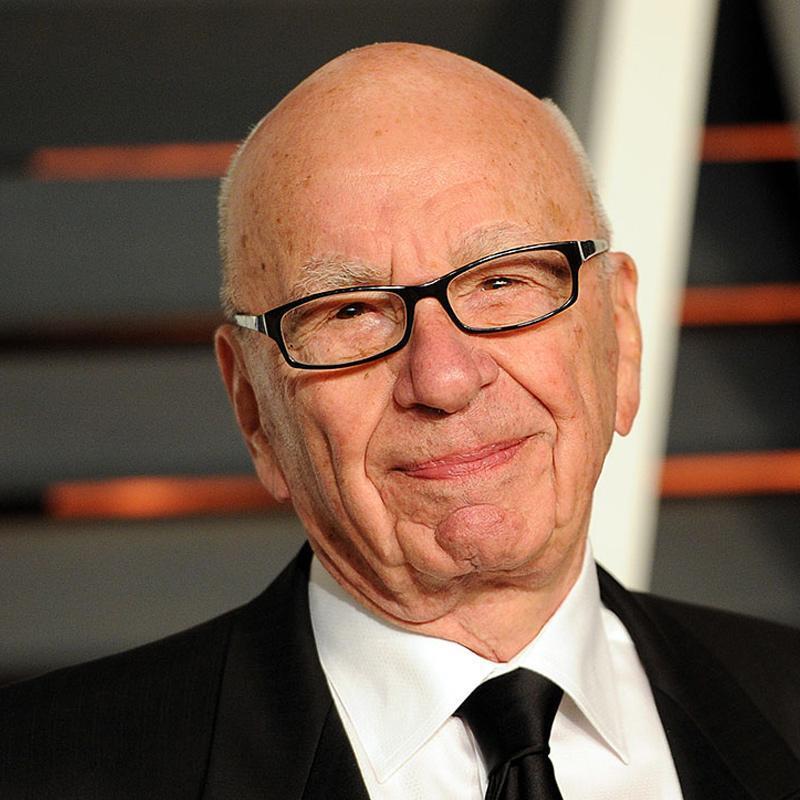

Commenting on the results, executive chairmen Rupert and Lachlan Murdoch said: “We delivered strong financial and operational momentum in fiscal 2017 driven by an acceleration in affiliate revenue growth which fueled fourth quarter cable segment OIBDA growth of 19 per cent. The investment we have made in our video brands, and in programming that truly differentiates, is proving to be the right strategy. It is driving the value of our brand portfolio across both established and emerging distribution platforms and reflects our deep commitment to creative excellence across all of our entertainment production businesses. In addition, the outstanding performance of our live news and sports programming drove advertising growth for the year and continues to set our business apart. What we achieved in 2017 sets us up well for this year and beyond.”

Full Year Company Results

Full year income from continuing operations before income tax expense of $4.69 billion increased $535 million from the $4.15 billion reported in the prior year. Full year total segment operating income before depreciation and amortization (“OIBDA”)3 of $7.17 billion, was $576 million, or 9 per cent, higher than the amount reported in the prior year. The OIBDA growth was driven by higher contributions from the Company’s Cable Network Programming and Television segments partially offset by lower contributions from the Filmed Entertainment segment. The adverse impact of foreign exchange rates impacted annual OIBDA growth by $105 million, or 2 per cent in total.

Fourth Quarter Company Results

The Company reported quarterly income from continuing operations attributable to 21st Century Fox stockholders of $501 million ($0.27 per share), as compared to $567 million ($0.30 per share) reported in the prior year quarter. Excluding the net income effects of Impairment and restructuring charges, Other, net and adjustments to Equity earnings (losses) of affiliates4 adjusted quarterly earnings per share from continuing operations attributable to 21st Century Fox stockholders was $0.36 as compared to $0.45 reported in the same quarter of the prior year. The prior year quarter adjusted earnings per share included a tax benefit of $0.07 per share from the receipt of a favorable tax ruling.

The Company reported total quarterly revenues of $6.75 billion, a $102 million, or 2 per cent, increase from the $6.65 billion of revenues reported in the prior year quarter. This revenue growth reflects higher affiliate and advertising revenue at the Cable Network Programming segment partially offset by lower content revenues at the Filmed Entertainment segment and lower advertising revenues at the Television segment.

Quarterly income from continuing operations before income tax (expense) benefit of $815 million increased $269 million from the $546 million reported in the prior year quarter. Quarterly total segment OIBDA of $1.45 billion was consistent with the amount reported in the prior year quarter. Higher contributions from the Company’s Cable Network Programming segment were offset by lower contributions from the Filmed Entertainment and Television segments.

CABLE NETWORK PROGRAMMING

Full Year Segment Results

Cable Network Programming annual segment OIBDA increased nine per cent to $5.60 billion, driven by a 7 per cent revenue increase led by continued growth in both affiliate and advertising revenues partially offset by a 7 per cent increase in expenses.

Domestic affiliate revenue increased 8 per cent reflecting continued contractual rate increases, led by Fox News, FS1 and FX Networks. Domestic advertising revenue grew 6 per cent over the prior year led by higher ratings and pricing at Fox News and higher postseason baseball ratings at FS1. Domestic OIBDA contributions increased 10 per cent over the prior year led by higher contributions from Fox News, FS1 and FX Networks.

Fourth Quarter Segment Results

Cable Network Programming quarterly segment OIBDA increased 19 per cent to $1.44 billion, driven by 10 per cent higher revenue from strong affiliate, content and advertising growth, partially offset by a 7 per cent increase in expenses. The increase in expenses was primarily due to the broadcast of the International Cricket Council (“ICC”) Champions Trophy in the current quarter and higher programming and marketing costs at National Geographic.

Domestic affiliate revenue increased 10 per cent reflecting higher pricing across all of our domestic cable brands, led by Fox News, RSNs, FX Networks and FS1. Domestic advertising revenue increased 6 per cent over the prior year period as the impact of higher ratings at Fox News and increases at National Geographic were partially offset by the absence of the prior year quarter broadcast of the Copa America soccer tournament at FS1 as well as a lower number of National Basketball Association and National Hockey League playoff games broadcast on the RSNs compared to the prior year quarter. Domestic OIBDA contributions increased 22 per cent over the prior year quarter led by higher contributions from Fox News, the RSNs and FS1.

International affiliate revenue increased nine per cent driven by higher rates and subscribers. International advertising revenue increased 9 per cent from high double digit advertising increases at STAR, led by the current quarter broadcast of the ICC Champions Trophy. Quarterly OIBDA at the international cable channels increased 6 per cent from the prior year quarter primarily reflecting higher contributions from FNG International partially offset by lower contributions from STAR.

TELEVISION

Full Year Segment Results

The Television segment generated annual OIBDA of $894 million, a $150 million, or 20 per cent, increase over the $744 million reported in the prior year. Annual segment revenues were 11 per cent higher than the prior year due primarily to strong sports advertising revenue growth led by the broadcast of Super Bowl LI, the MLB World Series, which benefited from strong ratings and two additional games versus last year, and the inclusion of one additional National Football League divisional playoff game. Higher local political advertising spending at the television stations and continued growth of retransmission consent revenues also contributed to the segment revenue growth. These revenue increases were partially offset by lower network entertainment advertising revenues reflecting lower general entertainment ratings.

Fourth Quarter Segment Results

Television reported quarterly segment OIBDA of $137 million, a $7 million decrease compared to the prior year quarter. Quarterly segment revenues declined as lower national and local advertising revenues from lower general entertainment ratings were partially offset by higher retransmission consent revenues. Total segment expenses were 3 per cent lower than the prior year quarter due to lower entertainment programming costs.

FILMED ENTERTAINMENT

Full Year Segment Results

Full year Filmed Entertainment segment OIBDA of $1.05 billion decreased $34 million from the prior year primarily due to a 4 per cent adverse impact from foreign exchange rate fluctuations. Higher revenue from the television studio was more than offset by lower revenue at the film studio. The television studio’s revenue increased due to higher subscription video-on-demand licensing led by Homeland and The People v. O.J. Simpson: American Crime Story. The film studio’s revenue decline was attributable to difficult theatrical and home entertainment revenue comparisons to the prior year slate which included Deadpool and The Martian.

Fourth Quarter Segment Results

Filmed Entertainment generated a quarterly segment OIBDA loss of $22 million, a $186 million decrease from the $164 million contribution reported in the same period a year ago. The OIBDA decrease in the current quarter was principally driven by lower revenues at both the film and television studios. Quarterly segment revenues decreased $235 million to $1.80 billion, primarily reflecting lower home entertainment revenues due to the strong performance of Deadpool in the prior year quarter and lower pay and free television revenues due to the timing of feature film availabilities and fewer deliveries of returning television series.

Full Year Results

Annual equity losses of affiliates were $41 million as compared to $34 million of equity losses of affiliates in the prior year. The $7 million increase in losses primarily reflects higher equity losses from Hulu and lower equity earnings from Sky partially offset by lower equity losses from Endemol Shine Group.

Fourth Quarter Results

Quarterly equity earnings of affiliates were $16 million as compared to $72 million of equity losses of affiliates reported in the same period a year ago. The $88 million improvement in equity results primarily reflects lower equity losses reported at Endemol Shine Group and higher equity earnings reported at Sky.

OTHER ITEMS

Dividends

The Company has declared a dividend of $0.18 per Class A and Class B share. This dividend is payable on October 18, 2017 with a record date for determining dividend entitlements of September 13, 2017.

Pending Acquisition of the Remaining Shares of Sky

The Company’s pending acquisition of the public shares of Sky has been cleared on public interest and plurality grounds in all of the markets in which Sky operates except the UK, including Austria, Germany, Italy and the Republic of Ireland. The acquisition has also received unconditional clearance by all competent competition authorities. The transaction is subject to certain other customary closing conditions and the requisite approval of Sky shareholders unaffiliated with the Company. In the event that the UK Secretary of State for Digital, Culture, Media and Sport makes a final decision to refer to the Competition and Markets Authority for a phase two review, the transaction is expected to close by June 30, 2018.

Also Read: Vivo sponsors Anand TV Awards on Star India’s Asianet on Sun

PKL effect: New difference between Star Sports First’s viewership & nearest competitor is 7X

PKL 5 aids Star Sports First top chart in maiden week