Budget

Zee Business to bring the most comprehensive budget analysis

MUMUBAI: With the new dispensation in place the aspirations of the common man is soaring high, Zee Business (part of India’s largest News Network, Zee Media Corporation Limited) India’s No. 1 Hindi business news channel will bring the most comprehensive budget analysis for its viewers on the budget day.

Zee Business will telecast the pre Budget discussions and analysis from 7 am onwards and will bring in live and uninterrupted coverage of the Hon’ble Finance Minister Budget Speech from 11 am onwards. The channel will articulate, analyse and keep the common man abreast of all the impacts that Budget is going to have on their daily lives.

Interestingly themed as the “Abki baar, sapne sakaar”, Zee Business will have expert panel, business leaders and corporate captains throughout the day to give their expert advice. Post the Finance Minister’s speech, Zee Business will undertake a series of power packed Budget Bulletins. Some of these bulletins will comprise of high power panel discussions and will involve expert comments from the nation’s top business leaders and policy makers. Some of the key Ministers holding important portfolios have already appeared and shared their views, and will also do so during post-Budget analysis programmes. To name a few are Hon’ble Minister of Power, Coal, New & Renewable Energy, Sh. Piyush Goyal, Hon’ble Minister of Information & Broadcasting, Sh. Prakash Javadekar and Hon’ble Minister of Commerce & Industry, Smt. Nirmala Sitharaman.

Further, special shows has been conceptualized which are thoroughly researched from industry point of view without losing the ground reality and its impact on the common man. Expert opinions, industry perspective viz – a – viz market reaction and informative bulletins will be telecast.

What’s more, Zee Business will focus strongly on adding value to the viewer experience and building interactivity on the day of India’s most important economic event, the channel will organize a viewer’s engagement program throughout the day from different parts of the country. Here, commoners get a voice to air their reaction and feedback on the pertinent issues on budget. The channel will undertake post – budget analysis including, which will help the audiences to decipher their expectations.

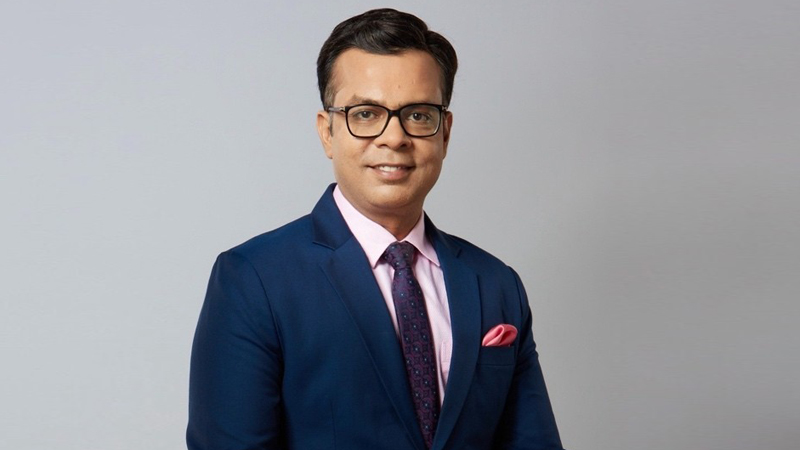

Mr. Samir Ahluwalia, Chief Executive Officer, Zee Media Corporation Limited said, “With clear understanding of the expectations of the India Inc. as well as indications of the common man, Zee Business is poised to present a comprehensive Budget coverage. Through special programming & initiatives focusing on budget expectations, analysis & impact, Zee Business will once again ensure specialized coverage on Budget Day.”

Budget

Decoding Budget 2026’s impact with CNBC-Awaaz’s Anuj Singhal

MUMBAI: Anuj Singhal, managing editor at CNBC- AWAAZ and CNBC BAJAR, operates at the sharp end of India’s business news ecosystem. With over two decades in business journalism, he has earned credibility for decoding policy, markets and macro trends for millions of Hindi-speaking investors. Equal parts newsroom leader and market analyst, he shapes editorial direction while anchoring flagship shows that break down the economy, politics and corporate India in real time.

Known for cutting through jargon and hype, Singhal blends data, discipline and clarity — a mix that has made him one of the most trusted voices in Hindi business news.

In this interaction, he discusses the Union Budget, trade deals, newsroom strategy and what truly moves markets and ratings.

• What was the single most market-moving announcement in this Budget, and why?

The most market-moving element was the clear commitment to fiscal consolidation without compromising capex. The glide path on fiscal deficit reassured bond markets and foreign investors, while sustained public investment kept growth expectations intact. That balance removed a big overhang for both equities and debt.

• Do you see this Budget as growth-oriented, fiscally cautious, or politically calibrated?

This Budget is growth-led but fiscally disciplined. It avoids overt populism, stays within macro guardrails, and prioritises medium-term competitiveness over short-term optics. Politically, it is restrained; economically, it is deliberate. The message is clear: stability over spectacle.

• How is CNBC-AWAAZ programming different, especially in decoding trade deal impact?

CNBC-AWAAZ goes beyond headline reaction. We translate policy into portfolio impact — sector by sector, stock by stock.

On trade agreements, our focus is on:

-Earnings visibility

-Export competitiveness

-Currency implications

-Margin sustainability

We don’t treat trade deals as political milestones. We decode them as profit-and-loss events for corporate India and map them to FY earnings trajectories.

• Which sectors look like clear winners and laggards over the next 12–18 months?

The next 12–18 months favour sectors aligned with structural spending and supply-side strengthening.

– Clear beneficiaries:

Capital goods and infrastructure

Manufacturing linked to export chains and PLI ecosystems

Power, defence, and logistics

– Relative laggards:

Consumption segments dependent on immediate demand revival

Businesses facing margin pressure from global volatility or pricing power erosion

This is not a momentum-driven market environment. It is execution-driven. Balance-sheet strength and order visibility will matter more than narrative.

• One headline to sum up this Budget 2026 for India Inc?

“Steady Hands, Long-Term Vision: A Budget That Rewards Discipline Over Drama”.

• What editorial filters do you apply before calling something ‘market-positive’ or ‘negative’?

We apply three structured filters:

– First: Earnings translation — does this materially change earnings visibility or cash flow outlook?

– Second: Time horizon — is the impact immediate, cyclical, or structural?

– Third: Valuation context — good news priced in or not.

If a policy doesn’t move earnings or risk perception, we don’t oversell it.

• How has business news consumption changed around big policy events?**

There has been a clear behavioural shift. They’re less interested in what was said, more in what it means for their money. There’s also a clear shift toward second-screen consumption, with digital platforms complementing live TV. The audience seeks sharper accountability. Viewers no longer accept broad optimism or pessimism — they want frameworks, numbers, and sector mapping.

• CNBC-AWAAZ decisively outperformed on Budget Day. What editorial and distribution choices mattered most?

Three deliberate strategic choices:

– Preparation depth:

We build scenarios months in advance — deficit ranges, sectoral incentives, tax calibrations — so we’re ready with analysis the moment numbers are announced.

– Language of impact:

We translate macro policy into investor-friendly Hindi without diluting complexity. That bridges accessibility and sophistication.

– Integrated distribution:

Television, YouTube, and digital platforms operate as one editorial grid, not parallel silos. This ensures continuity of narrative.We stayed analytical while others stayed reactive.

• How different is your YouTube audience from your TV audience?

The behavioural differences are subtle but important. TV audiences prioritise authority, structured debate, and context. YouTube audiences want speed, clarity, and actionable insights — often sharper, sometimes more opinionated. However, both share one expectation: accuracy. The format evolves; the trust benchmark does not.

• How do you retain viewers after the budget speech ends?

By shifting from announcements to implications.Retention comes from shifting the narrative from announcement to implication. We break down sectoral breakouts, stock-level impact, and what to do next. The speech is just the trigger; analysis is the destination.

• Is Budget Day your biggest traffic day?

It is one of the biggest — but more importantly, it is among the deepest in engagement. Viewers spend longer durations, revisit segments, and seek follow-up programming. That indicates behavioural trust, not just traffic.

• What’s the first thing you personally track on Budget Day — the speech or the markets?

The markets. They’re the fastest truth-teller. The speech explains intent; markets reveal interpretation.

• Your personal Budget-day ritual?

Early morning prep, minimal distractions, and once the speech begins, complete immersion. For me, Budget Day is less about reaction and more about reading between the lines.

• What drove your Budget-day ratings dominance, and how are Budget and trade deals shaping markets now?

Our dominance came from credibility, consistency, and clarity.

As for markets, both the Budget and recent trade deals are reinforcing a narrative of policy stability and global integration, which supports valuations even amid global volatility.

For Singhal, the market is the final judge. Policies can promise and speeches can persuade, but prices reveal what investors truly believe. As India’s investor class grows more informed and more demanding, business journalism is shifting from commentary to calibration. The premium is on clarity, context and credibility. In a landscape flooded with noise, the real edge lies in interpretation. In the end, the markets listen to numbers, not narratives , and Singhal’s craft is helping viewers tell the difference.

Budget

What is the Tax Holiday announced by FM in Budget 2026?

NEW DELHI: India has rolled out a long-dated tax break to tempt the world’s cloud and AI giants to plant their servers on Indian soil. The lure is simple and bold: base your data centres in India and your overseas cloud income can escape Indian tax until 2047.

A tax holiday, in essence, is a temporary exemption from certain taxes, used by governments to draw investment into priority sectors. It lowers early costs, improves returns and reduces risk for capital-heavy projects. In this case, the target is data centres, the backbone of artificial intelligence and digital services.

Under Budget 2026 proposals, foreign cloud companies can earn revenue from customers outside India without paying Indian tax, so long as those services are delivered through India-based data centres. Revenue from Indian users is excluded. That business must be routed through locally incorporated reseller entities and taxed in India.

An official statement said the proposal aims to “enable critical infrastructure and boost investment in data centres”, offering a tax holiday up to 2047 for foreign firms serving global markets via Indian facilities, while domestic sales are “taxed appropriately”.

The budget also offers a 15 per cent cost-plus safe harbour for Indian data centre operators serving related foreign companies, trimming transfer-pricing disputes and giving multinationals clearer guardrails on profit allocation.

The context is a global capacity crunch. AI workloads are soaring, power and land are tight in the United States and parts of Europe, and data centres are becoming strategic assets. India is pitching scale, skills and policy stability.

The money is already moving. Google has outlined a $15 billion investment in AI hubs and data centres after a $10 billion commitment in 2020. Microsoft plans $17.5 billion in AI and cloud expansion by 2029. Amazon has pledged another $35 billion by 2030, taking its planned India investment to about $75 billion.

Domestic groups are not sitting idle. Digital Connexion, backed by Reliance Industries, Brookfield Asset Management and Digital Realty Trust, plans an $11 billion, 1-gigawatt AI-focused campus in Andhra Pradesh. Adani Group has mapped out up to $5 billion alongside Google for AI data centre projects.

The push stretches beyond servers. A second phase of the India Semiconductor Mission targets equipment, materials and domestic chip intellectual property. Funding for the Electronics Components Manufacturing Scheme has risen to Rs 400 billion. Foreign equipment suppliers to bonded-zone electronics makers get a five-year tax break, while rare-earth corridors are planned to secure supply chains.

The strategy is blunt. Offer tax certainty, pull in capital, build digital muscle. If it works, the world’s data may increasingly be stored, processed and streamed from India. The holiday runs to 2047. The race to host the AI age has begun.

Budget

Union budget 2026 bets big on AI, startups and clean manufacturing

NEW DELHI: Union Budget 2026 marked a decisive shift towards building indigenous deep-tech capacity, decentralised startup growth and industrial efficiency, as finance minister Nirmala Sitharaman unveiled an “intelligence-first” strategy to power India’s next phase of economic expansion.

The budget prioritised operationalising the Anusandhan National Research Fund, rolling out capacity-building AI missions and scaling the Genesis programme, alongside a Rs 10,000 crore SME growth fund aimed at broadening access to capital beyond metro cities.

Technology founders across AI, consumer platforms and manufacturing welcomed the focus on patient capital for research and digital public infrastructure, saying it would strengthen domestic intellectual property and bridge the innovation gap between urban India and Bharat.

In renewable manufacturing, the government announced a historic rise in capital expenditure to Rs 12.2 lakh crore and rationalised duties on solar inputs to correct inverted duty structures. Industry leaders said the measures would cut logistics costs, boost domestic value addition and enhance the global competitiveness of Indian solar brands as new freight corridors reshape industrial supply chains.

-

News Broadcasting1 week ago

News Broadcasting1 week agoMukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

-

News Headline1 month ago

News Headline1 month agoFrom selfies to big bucks, India’s influencer economy explodes in 2025

-

iWorld2 weeks ago

iWorld2 weeks agoNetflix celebrates a decade in India with Shah Rukh Khan-narrated tribute film

-

Hollywood6 days ago

Hollywood6 days agoThe man who dubbed Harry Potter for the world is stunned by Mumbai traffic

-

I&B Ministry3 months ago

I&B Ministry3 months agoIndia steps up fight against digital piracy

-

MAM3 months ago

MAM3 months agoHoABL soars high with dazzling Nagpur sebut

-

iWorld12 months ago

iWorld12 months agoBSNL rings in a revival with Rs 4,969 crore revenue

-

iWorld5 months ago

iWorld5 months agoBillions still offline despite mobile internet surge: GSMA