News Broadcasting

TRAI study reveals telecom sectors growing pains

MUMBAI: With foreign promoters increasing their stakes or purchasing the stakes of Indian promoters in telecom companies such as Aircel, Unitech, Sistema Shyam, Bharti Airtel and Vodafone, the latter’s total shareholding of major telecom access providing companies has dropped from 59.77 per cent in the year 2007-08 to 40.42 per cent in 2011-12. A study paper released today by the Telecom Regulatory Authority of India (TRAI) on shareholding, financing and capital pattern of Indian private telecom access service providers (TSPs) has revealed this.

It attempts to provide an overview of the capital structures (deployment of funds in the form of owners’ equity and loan fund) of companies operating in the telecom sector based on the annual accounts and other information provided by 24 Private Telecom Access Service Providers.

The study paper also points out that while the share of Indian promoters in the equity shareholding declined from 59.70 per cent in 2007-08 to 56.63 per cent in 2011-12, the share of the foreign promoters has increased from 5.30 per cent to 13.90 per cent in the same period. So while Unitech, Tata and Vodafone have reported a decline in Indian promoters’ equity, Bharti, Unitech, Tata, Sistema Shyam, Loop and Vodafone have seen an increase in the stake of foreign promoters in equity shareholding.

The study paper is a comparative study of facts in the year 2007-2008 and 2011-2012. The trend indicates that the preference shareholding of Indian promoters and others has declined from 60.89 per cent (2007-08) to 2.62 per cent (2011-12). This decline is mainly in the case of the Tata group. The share of the foreign promoters in the total preference shareholding has gone up sharply from 0.59 per cent to 95.84 per cent. The increase in foreign promoter’s shareholding is Rs 5,988 crore and is mainly in the Aircel group.

Foreign currency loans for these companies have gone up from Rs 13,929 crore in 2007-08 to Rs 40,045 crore in 2011-12. The increase in foreign currency loans in 2008-09 over the previous year was attributed to the borrowings by Reliance Communications and Idea Cellular. Reliance, Tata, Bharti Airtel and Idea have the major share (88 per cent) in foreign currency loans/bonds outstanding at the end of year 2011-12.

The study shows that Bharti, Vodafone and Reliance have not shown any change in their share capital. Idea’s share capital has increased 26 per cent from Rs 2,635 crore in 2007-08 to Rs 3,309 crore in 2011-12, making it the only TSP showing that kind of growth. Total reserves and surplus in respect of Vodafone have declined from Rs 9,991 crore to Rs 2,975 crore, whereas the total reserves and surplus of other companies have shown an increase. As on 31 March 2012, while Bharti, with Rs 50,470 crore had the highest reserves and surplus; Tata showed negative reserves and surplus of Rs 4,748 crore.

As on 31March 2012, Vodafone had the highest debt of Rs 45,332 crore followed by Reliance at Rs 31,195 crore and Tata at Rs 23,986 crore. Vodafone and Tata have shown persistent increase in debt during the past five years whereas the other three service providers have shown fluctuating trends in debt.

The study also highlights the fall in EBITDA margins for almost all the TSPs over the past five years. Bharti’s EBITDA has gone up from Rs 11,447 crore in 2007-08 to Rs 15,441 crore in 2011-12; however as a margin it has fallen from 41.96 per cent to 33.82 per cent. Vodafone’s and Reliance’s EBITDA has declined from Rs 6,247 crore and Rs 5,175 crore in 2007-08 to Rs 4,248 crore and Rs 3,018 crore in 2011-12 respectively.

Vodafone’s PBIT has declined very sharply from Rs 3,473 crore in 2007-08 to Rs 27 crore in 2011-12 while Tata’s has been negative throughout the period and has declined progressively from a negative Rs 1,194 crore to a negative Rs 2,275 crore over the past five years. Ditto with Reliance which has seen its PBIT fall during 2008-09 and become negative in 2009-10 and 2010-11; however it has improved and become positive in 2011-12.

The study talks about the problems plaguing the TSP sector. It says that “After their initial success, the Indian telecom companies are confronted today with serious growth challenges. The sector is characterised by mounting competition, declining average revenue per user (ARPUs) and rising costs. All these factors have put tremendous pressure on operating margins. The main reason cited by telecom service providers for declining profitability are their inability to pass on cost inflation due to hike in the price of power and fuel, debt servicing burden and the declining value of the rupee. This has been further aggravated by the prevalent tariff competition.”

It goes on to add: “Each telecom service provider is endeavoring to focus on growth and investment, improvement of profitability and cost control without compromising on the quality of service to the customer. Of the several strategies being adopted by the sector to witness growth include: focus on development of network and eco-system for 3G and 4G services; shifting towards outsourcing model where various medium and long term leasing arrangements for towers and other network infrastructure have been made with the third party operators or equipment vendors; maximising share of passive infrastructure in the short-term and initiating efforts to share active infrastructure over the longer term etc.”

The study concludes that the low market tariffs and the presence of large number of service providers in each licence service area have caused profitability to decline and made the telecom sector less attractive for infusion of equity.

New investments are therefore being financed through debt. Sector indebtedness is growing. However, the sector’s debt-equity ratio has not as yet reached alarming proportions. On the other hand, the declining profitability of the sector, which lies at the root of the inability to attract fresh investment, is a cause for deep concern.

The study also indicates that some portion of debt is being utilised for interest payments and other liabilities rather than for acquisition of new assets, which potentially places the companies in a debt trap. Replacing debt financing by equity financing could help increase profitability by reducing the interest burden.

The report published by the TRAI also says that in order to turn around the financing pattern and the deteriorating profitability position of the sector, apart from measures and strategies of individual companies, clarity needs to emerge on the following policy issues and optimal utilization of resources:

· Emergence of an enabling environment for mergers and acquisitions to aid in market consolidation;

· Permission and policy framework for sharing, trading and sale of underutilised or unutilised spectrum by service providers so that spectrum is optimally utilised;

· Liberalisation of spectrum usage to enable flexibility in deployment of alternative technologies;

· Improvement in the availability of power to run telecom networks so that network operations require less fuel and captive power generation.

News Broadcasting

Barc forensic audit in TRP row awaits as Twenty-Four probe gathers pace

KERALA: A forensic audit commissioned by the Broadcast Audience Research Council (BARC) India has emerged as the centrepiece of the government’s response to fresh allegations of television rating point manipulation involving a regional news channel in Kerala, with both the audit findings and a parallel police investigation still awaited.

Replying to a query in the Lok Sabha, minister of state for information and broadcasting L Murugan, said Barc had appointed an independent agency to conduct a forensic probe into the conduct of senior personnel allegedly linked to the case.

The move followed media reports claiming that a Barc employee had accepted bribes to manipulate viewership data in favour of a regional television news channel.

“The report from BARC is still awaited,” Murugan told Parliament, signalling that the forensic exercise remains ongoing.

Industry specialists say forensic audits are crucial in alleged TRP fraud cases, as they examine internal controls, data access trails, panel household integrity, staff communications and financial transactions. The outcome could determine whether the alleged manipulation was an isolated breach or a deeper systemic weakness in India’s television measurement framework.

Running alongside the audit, the Kerala Police has formed a special investigation team to probe the allegations. The ministry has sought a preliminary report from the state’s director general of police, including details of action taken on the first information report. That report, too, is yet to be submitted.

The episode has revived long-standing concerns over the vulnerability of India’s TRP system, particularly in regional news markets where competition for ratings is fierce and advertising revenues hinge on weekly viewership rankings.

India’s sole television audience measurement body Barc, has faced scrutiny before, most notably during the nationwide TRP controversy involving news channels in 2020. While tighter compliance norms were introduced in the aftermath, the latest allegations suggest enforcement challenges may persist.

On regulatory consequences, the government said any punitive action against television channels, including suspension or cancellation of uplinking and downlinking permissions, would be governed by the Policy Guidelines for Uplinking and Downlinking of Television Channels issued in November 2022, and would depend on investigation outcomes and due process.

The ministry also pointed to ongoing efforts to overhaul the ratings ecosystem. Television measurement continues to be regulated under the Policy Guidelines for Television Rating Agencies, 2014. Draft amendments were released for public consultation in July 2025, followed by a revised version in November 2025, aimed at tightening audit mechanisms and improving transparency and representativeness.

In November 2025, Barc said it had taken note of allegations aired by Malayalam news channel Twenty-Four, which linked an internal employee to irregularities in audience measurement. The council said it had engaged a “reputed independent agency” to conduct a comprehensive forensic audit, underscoring the seriousness of the claims.

The ratings system sits at the heart of India’s broadcast advertising economy, shaping billions of rupees in annual ad spends. With trust in audience data once again under strain, advertisers, broadcasters and regulators are closely watching the outcome of the investigations.

Barc has urged industry stakeholders and media organisations to exercise restraint while the probe is underway, calling for an end to “unverified or speculatory claims” and reiterating its commitment to integrity and accountability.

Until the forensic audit and police findings are submitted and reviewed, the government said it would refrain from drawing conclusions.

News Broadcasting

Rajat Sharma defamation row: Delhi court summons Congress leaders Ragini Nayak, Pawan Khera and Jairam Ramesh

NEW DELHI: A Delhi court has ordered the summoning of senior Congress leaders Ragini Nayak, Pawan Khera and Jairam Ramesh in a criminal case filed by veteran journalist Rajat Sharma, sharpening a legal battle over alleged defamation and doctored digital content.

The order was passed on Monday by Devanshi Janmeja, judicial magistrate first class at Saket Courts, after the court found prima facie grounds to proceed under multiple sections of the Indian Penal Code, including forgery, creation of false electronic records and defamation.

Sharma, chairman and editor-in-chief of India TV, had approached the court over allegations made in June 2024 that he had used derogatory language against Congress spokesperson Ragini Nayak during a live television debate. He denied the charge, claiming it was fuelled by a manipulated video circulated online.

According to the complaint, a clipped version of the broadcast carrying superimposed captions, which were not part of the original programme, was first shared on social media platform X by Nayak and later amplified through retweets and public statements by Khera and Ramesh. Sharma said the viral spread caused serious reputational harm and personal distress.

The court took note of forensic science laboratory findings that pointed to visible post-production alterations in the video, including added titles and captions. It also cited witness testimonies from those present during the live broadcast, who stated that no abusive or objectionable language had been used.

In a related civil matter, the Delhi High Court had earlier observed a prima facie absence of abusive remarks and directed the removal of the disputed social media posts.

With criminal proceedings now set in motion, the case adds to mounting scrutiny around political messaging, digital manipulation and accountability on social media platforms.

News Broadcasting

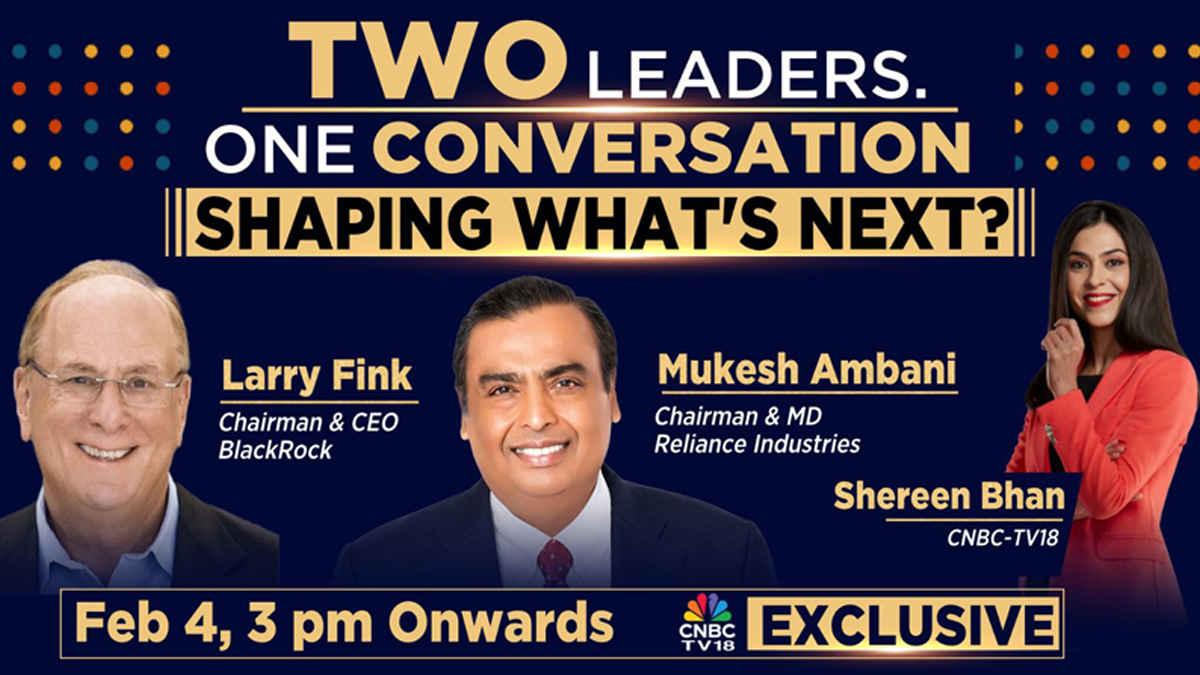

Mukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

Reliance and BlackRock chiefs map the future of investing as global capital eyes India

MUMBAI: India’s capital story takes centre stage today as Mukesh Ambani and Larry Fink sit down for a rare joint television conversation, bringing together two of the most powerful voices in global business at a moment of economic churn and opportunity.

The Reliance Industries chief and the BlackRock boss will speak with Shereen Bhan, managing editor of CNBC-TV18, in an exclusive interaction airing from 3:00 pm on February 4. The timing is deliberate. Geopolitics are tense, technology is disruptive and capital is choosier. India, meanwhile, is pitching itself as a long-term bet.

The pairing is symbolic. Reliance straddles energy transition, digital infrastructure and consumer growth in the world’s fastest-expanding major economy. BlackRock, the world’s largest asset manager, oversees more than $14 tn in assets and sits at the nerve centre of global capital flows. When the two talk, markets tend to listen.

Fink’s appearance marks his third India visit, a signal of the country’s rising strategic weight for the Wall Street-listed firm, which carries a market value above $177 bn. His earlier 2023 trips included an October stop in New Delhi, where he met both Ambani and Narendra Modi.

India is now central to BlackRock’s expansion plans, notably through its joint venture with Jio Financial Services. Announced in July 2023, the 50:50 venture, JioBlackRock, commits up to $150 mn each from the partners to build a digital-first asset-management platform aimed at India’s swelling investor class.

The backdrop is robust. BlackRock ended 2025 with record assets under management of $14.04 tn, helped by $698 bn in net inflows, including $342 bn in the fourth quarter alone. Scale gives Fink both heft and a long lens on where money is moving.

He has been openly bullish on India. At the Saudi-US Investment Summit in Riyadh last year, Fink argued that the “fog of global uncertainty is lifting”, with capital returning to dynamic markets such as India, drawn by reforms, demographics and durable return potential.

Expect the conversation to range beyond balance sheets, into technology’s role in finance, access to capital and the mechanics of sustainable growth in a fracturing world order. For investors and policymakers alike, it is a snapshot of how big money is thinking about India.

At a time when capital is cautious and growth is contested, India wants to be the exception. When Ambani and Fink share a stage, it is less a chat and more a signal. The world’s money is still looking for its next big story, and India intends to be it.

-

e-commerce3 weeks ago

e-commerce3 weeks agoSwiggy Instamart’s GOV surges 103 per cent year on year to Rs 7,938 crore

-

News Headline1 month ago

News Headline1 month agoFrom selfies to big bucks, India’s influencer economy explodes in 2025

-

News Broadcasting2 weeks ago

News Broadcasting2 weeks agoMukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

-

iWorld5 months ago

iWorld5 months agoBillions still offline despite mobile internet surge: GSMA

-

News Headline2 months ago

News Headline2 months ago2025: The year Indian sports saw chaos, comebacks, and breakthroughs

-

Applications2 months ago

Applications2 months ago28 per cent of divorced daters in India are open to remarriage: Rebounce

-

MAM2 years ago

MAM2 years agoCosta Coffee becomes official coffee partner of Olympic Games Paris 2024

-

News Headline2 months ago

News Headline2 months agoGame on again as 2025 powers up a record year and sets the stage for 2030