News Broadcasting

Star Plus seeks its break; Zee improves: Hindi GEC Q3 Study

The Hindi General Entertainment Channel (GEC) space is back in the spotlight. Strategies, counter strategies, experiments and innovations enchant the market, though audiences remain cautious while deciding their staple programming diet.

The ongoing churn owes a lot to the manner in which Subhash Chandra’s Zee TV made its comeback to the reckoning. Because, this turnaround has forced the channel’s rivals (both leader Star Plus and trailing number three Sony Entertainment) to re-think their strategies and hence, we have a real humdinger of a ratings battle going on these days. This exciting range of happenings has inspired Indiantelevision.com to examine the GEC arena a bit more closely, as it completes its 2006 calendar year’s third quarter.

Relative channel share- All Day, CS4+ HSM

A first look at the data gives an obvious picture. Star Plus leads the tally, followed by Zee TV, Sony, Star One, Sahara One and Sab TV (Average market share data, All Day, CS4+ HSM, 1 July to 30 September, Tam).

Star Plus, which maintained an above 50 per cent average when we did an April 2006 (All Day Part) analysis, has recorded an average market share of 46.1 per cent for the three month period (Average market share data, All Day, CS4+ 1 July to 30 September, Tam).

Though the channel made its best efforts to improve its position through various new launches during this period, the market share score missed the 50 per cent mark in this period. In September, it even dropped below the 45 per cent mark for the first time since the KBC phenomenon rewrote Indian television history. From 45.9 per cent of July, the channel improved its position considerably to 47.8 per cent in the month of August. However, in September, the share recorded a slight drop at 44.9 per cent.

However, Star One has recorded an improvement during this period, as compared to its April 2006 share. The channel, which struggled during the first half of the year due to affairs such as cable blackout in certain parts of the country, has now recorded an average channel share of 6.4 per cent, while the April score stood at 5.38 per cent. The channel is now banking on properties such as Nach Baliye 2, Paraaya Dhan and Kadvee Khatti Meethi to better its position by the end of 2007.

“We have launched about three to four shows during this period including Nach Baliye 2, Saathi Re & Paraaya Dhan (Star One) and Antariksh, Karam Apnaa Apnaa and Prithviraj Chauhan (Star Plus) and the effort is to take on any kind of competition in any time band. Star Plus is not going to sit pretty on its relatively strong position. Now, the effort will be to constantly improve the performance. There will be no let off from our side on this front”, says Star India EVP content Deepak Segal.

During this three month period, the number two channel Zee TV has actually improved its position – from an average market share of 19 per cent in April 2006 to an average of 22.9 per cent for the July to September period, according to Tam. The score reads like this: July 23.4 per cent), August (22.1 per cent) and September (23.3 per cent).

“The turnaround started with Saath Phere and Kassamh Se and the kind of innovations and experiments we employed in our storylines have really contributed to this good performance. This way, we managed to get the audience flow. We have steadied our soaps. The launch of Betiyann has completed our soap range for the year and now the focus is on various other genres. Hence, we will have now programmes such as the mythology Raavan and reality show Cinestars coming up. So, the strategy will revolve around non-soap genres for the next phase,” says Zee TV programming head Ashwini Yardi.

Sony’s position hasn’t undergone any drastic changes as the channel recorded an average market share of 12.5 per cent for the three month period as compared to its April 2006 score of 12.36 per cent.

Though flagship channel Sony may be still struggling, but sister channel Sab has been making a slow and steady improvement, on the other hand. The channel which scored an average channel share of 3.04 per cent for April in the All Day Part has improved the score significantly to 4.9 per cent for the June to September period.

Sahara One, which received an April ‘windfall’ in terms of cricket telecast rights and scored an average market share of 10 per cent during that period, has now gone down in the chart. The channel has scored an average market share of 5.3 per cent for the July to September period in All Day Part.

Rating Score Card – Prime Time

Kyunki Saas Bhi… continues to be Star Plus’ channel driver programme. The long running soap of Hindi television recorded its best rating of 14.17 TVR on 31 July, 14.31 TVR on 29 August and 13 TVR on 4 September. The channel has a fixed line up of shows occupying all the top four positions including Kyunki… and the shows are Kahaani Ghar Ghar Ki, Kasauti Zindagi Kay and Kahiin To Hoga. While in July, the fourth and fifth positions were occupied by Baa Bahoo Aur Baby and Kkavyanjali respectively, in August the positons went to special shows Nach Baliye 2 Muh Dekhai and Shaadi Ke Rang Bhabhi Ke. In September, Prithviraj Chauhan (best TVR 7.38) and Karam Apnaa Apnaa (best: 7.12 TVR) made it to the reckoning.

Zee TV has three different soaps recording the channel’s best ratings in the prime time in these three months. In July 2006, Saath Phere recorded the highest 7.32 TVR, while in August it was the Balaji Telefilms soap Kasamh Se (6.16 TVR). The top slot for the month of September escaped both the shows and went to the finals of Saregamapa Lil Champs (6.81 TVR).

Zee TV’s good show in the rating chart has a lot to do with the impressive opening week rating its new launches record these days. For example, Banoo Main Teri Dulhann recorded its best launch-month (august) rating of 3.5. TVR. And in September, Dulhann further consolidated its position with a best of the month rating of 4.37 TVR. Ghar Ki Lakshmi Betiyann’s best of the month (September launch) rating stands at 4.99 TVR.

For Sony, CID continues to be the channel driver with an average rating of 3.5 TVR for the three month period, according to Tam (HSM CS4+). In September, newly launched reality dance show Jhalakk Dikhla Ja has made its appearance in the top 10 chart for Sony. The show has filled the second slot in Sony’s line up with its best rating of 2.95 TVR.

Betiyann Vs Kahaani Ghar Ghar Ki + Naach Baliye 2

The month of September also witnessed an interesting battle between Zee TV and Star Plus in the coveted 10 pm slot. The story was about how Zee TV unpacked its biggest soap launch of the year — Ghar Ki Lakshmi Betiyann and positioned it against Star Plus’ unchallenged 10 pm property Kahaani…

Giving the development to a total new twist was Star One’s strategy to launch Naach Baliye 2 on the same day that Zee scheduled Betiyann’s launch – on 25 September. Though Naach Baliye was slotted in the 8 pm post and it looked the launch had nothing to do with Zee’s 10 pm introduction of Betiyann, Star had different plans in mind. Star One telecast a 2.30 hours special episode of Naach Baliye 2 on 25 September in order to let the celeb dance show’s launch clash with the launch episode of Betiyann. Then on the other side, Star Plus had a spiced up episode of Kahaani…to counter the Zee TV soap.

Now, let’s see how all these three programmes finally delivered as per Tam ratings:

The Star ploy of countering Betiyann with Naach Baliye 2 special episode worked well for the channel. Betiyann’s launch ratings stood at 2.58 TVR, while Nach Baliye 2 opening episode recorded a rating of 4.86 TVR (CS4+ HSM). However, it looks like the ploy had backfired in Kahaani…’s case as the soap could gather only 6.14 TVR for the particular day. (Kahaani… normally records a rating of about 8 TVR on an average).

However, Betiyann recovered from the initial blow quickly and came up with an improved performance during the rest of the week: 3.24 (26 Sept), 4.18 (27 Sept) and 4.99 TVR (28 Sept). And the Betiyann figures also reveal Zee’s success in giving a jolt to Kahaani… in the initial week itself. The Star Plus soap had recorded an average rating of 8.75 TVR in week 38 (17 Sept to 23 Sept). And in the week that Betiyann got launched, Kahaani..’s average rating has slipped to 7.25 TVR, as per Tam.

Post Script:

So what is waiting the GEC market in coming months? One genre that is expected to make its presence felt during this period is Reality. Two big ticket reality shows, Sony’s Bigg Brother and Zee TV’s Cinestars, will be unveiled in November. Star One has just kicked off its Naach Baliye 2 and the show has competition from Sony’s celeb dance show Jhalak Dikhla Ja. So the space will have not less than four reality shows engaged in an eyeball war with each other in this quarter.

Strategy-wise, as Yardi has revealed, Zee TV’s focus will be now on non-soap programmes such as Raavan and Cinestars. Star Plus is looking at the kids genre in a big way and has even accommodated a kids-oriented superhuman show Antariksh in its weekday 8 pm prime time band. The channel has lined up another kids show Lucky for the same slot on Saturdays. As Segal puts it, “We are looking to develop kids also as a key viewer segment of ours. Star has always been popular for its quality kids shows.” Sahara One’s October-November plans will mainly revolve around the upcoming soap Solhah Singaar’.

As the market leader Star Plus is seeking a good break to go back to its old good days of undisputed leadership and Zee TV uncorking fresh concepts to win back its lost glory, the Hindi GEC space is going through one of its best times. Then we have international players such as BBC and Viacom (reportedly in talks with Sahara One for a stake in the channel) and then our own NDTV gearing up their general entertainment channel plans for the Hindi market.

So the big question remains: Will all these high profile suitors be able to come up with path breaking concepts and innovative positioning strategies to help the market really expand further?

News Broadcasting

Barc forensic audit in TRP row awaits as Twenty-Four probe gathers pace

KERALA: A forensic audit commissioned by the Broadcast Audience Research Council (BARC) India has emerged as the centrepiece of the government’s response to fresh allegations of television rating point manipulation involving a regional news channel in Kerala, with both the audit findings and a parallel police investigation still awaited.

Replying to a query in the Lok Sabha, minister of state for information and broadcasting L Murugan, said Barc had appointed an independent agency to conduct a forensic probe into the conduct of senior personnel allegedly linked to the case.

The move followed media reports claiming that a Barc employee had accepted bribes to manipulate viewership data in favour of a regional television news channel.

“The report from BARC is still awaited,” Murugan told Parliament, signalling that the forensic exercise remains ongoing.

Industry specialists say forensic audits are crucial in alleged TRP fraud cases, as they examine internal controls, data access trails, panel household integrity, staff communications and financial transactions. The outcome could determine whether the alleged manipulation was an isolated breach or a deeper systemic weakness in India’s television measurement framework.

Running alongside the audit, the Kerala Police has formed a special investigation team to probe the allegations. The ministry has sought a preliminary report from the state’s director general of police, including details of action taken on the first information report. That report, too, is yet to be submitted.

The episode has revived long-standing concerns over the vulnerability of India’s TRP system, particularly in regional news markets where competition for ratings is fierce and advertising revenues hinge on weekly viewership rankings.

India’s sole television audience measurement body Barc, has faced scrutiny before, most notably during the nationwide TRP controversy involving news channels in 2020. While tighter compliance norms were introduced in the aftermath, the latest allegations suggest enforcement challenges may persist.

On regulatory consequences, the government said any punitive action against television channels, including suspension or cancellation of uplinking and downlinking permissions, would be governed by the Policy Guidelines for Uplinking and Downlinking of Television Channels issued in November 2022, and would depend on investigation outcomes and due process.

The ministry also pointed to ongoing efforts to overhaul the ratings ecosystem. Television measurement continues to be regulated under the Policy Guidelines for Television Rating Agencies, 2014. Draft amendments were released for public consultation in July 2025, followed by a revised version in November 2025, aimed at tightening audit mechanisms and improving transparency and representativeness.

In November 2025, Barc said it had taken note of allegations aired by Malayalam news channel Twenty-Four, which linked an internal employee to irregularities in audience measurement. The council said it had engaged a “reputed independent agency” to conduct a comprehensive forensic audit, underscoring the seriousness of the claims.

The ratings system sits at the heart of India’s broadcast advertising economy, shaping billions of rupees in annual ad spends. With trust in audience data once again under strain, advertisers, broadcasters and regulators are closely watching the outcome of the investigations.

Barc has urged industry stakeholders and media organisations to exercise restraint while the probe is underway, calling for an end to “unverified or speculatory claims” and reiterating its commitment to integrity and accountability.

Until the forensic audit and police findings are submitted and reviewed, the government said it would refrain from drawing conclusions.

News Broadcasting

Rajat Sharma defamation row: Delhi court summons Congress leaders Ragini Nayak, Pawan Khera and Jairam Ramesh

NEW DELHI: A Delhi court has ordered the summoning of senior Congress leaders Ragini Nayak, Pawan Khera and Jairam Ramesh in a criminal case filed by veteran journalist Rajat Sharma, sharpening a legal battle over alleged defamation and doctored digital content.

The order was passed on Monday by Devanshi Janmeja, judicial magistrate first class at Saket Courts, after the court found prima facie grounds to proceed under multiple sections of the Indian Penal Code, including forgery, creation of false electronic records and defamation.

Sharma, chairman and editor-in-chief of India TV, had approached the court over allegations made in June 2024 that he had used derogatory language against Congress spokesperson Ragini Nayak during a live television debate. He denied the charge, claiming it was fuelled by a manipulated video circulated online.

According to the complaint, a clipped version of the broadcast carrying superimposed captions, which were not part of the original programme, was first shared on social media platform X by Nayak and later amplified through retweets and public statements by Khera and Ramesh. Sharma said the viral spread caused serious reputational harm and personal distress.

The court took note of forensic science laboratory findings that pointed to visible post-production alterations in the video, including added titles and captions. It also cited witness testimonies from those present during the live broadcast, who stated that no abusive or objectionable language had been used.

In a related civil matter, the Delhi High Court had earlier observed a prima facie absence of abusive remarks and directed the removal of the disputed social media posts.

With criminal proceedings now set in motion, the case adds to mounting scrutiny around political messaging, digital manipulation and accountability on social media platforms.

News Broadcasting

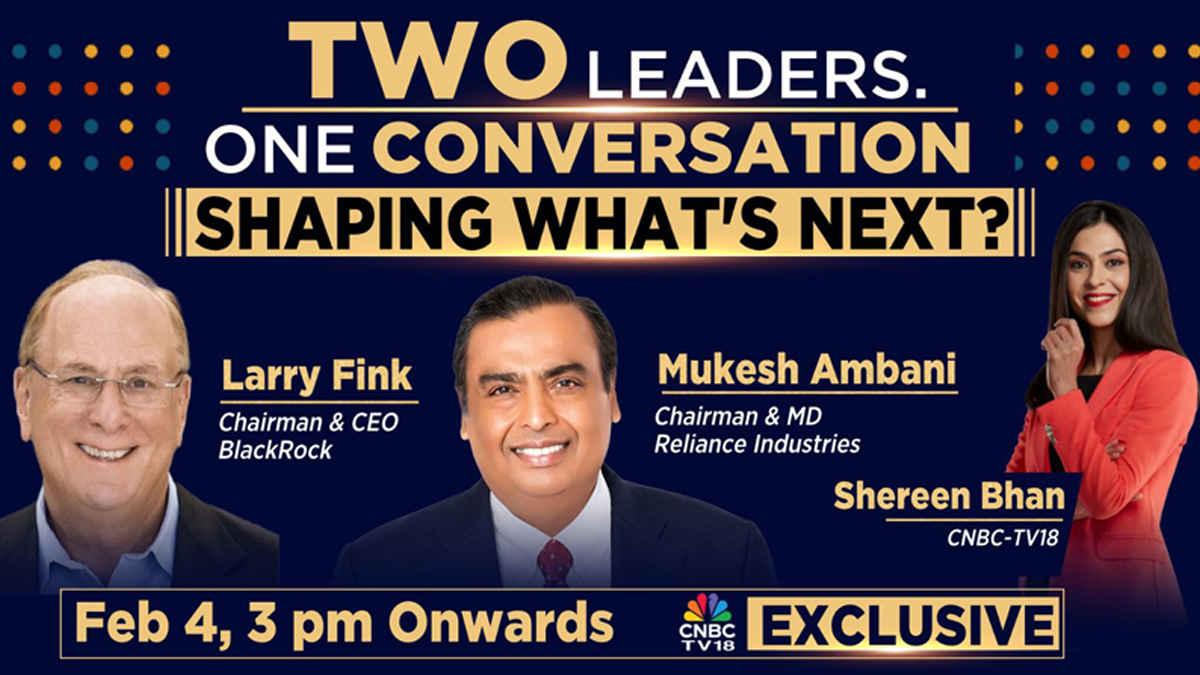

Mukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

Reliance and BlackRock chiefs map the future of investing as global capital eyes India

MUMBAI: India’s capital story takes centre stage today as Mukesh Ambani and Larry Fink sit down for a rare joint television conversation, bringing together two of the most powerful voices in global business at a moment of economic churn and opportunity.

The Reliance Industries chief and the BlackRock boss will speak with Shereen Bhan, managing editor of CNBC-TV18, in an exclusive interaction airing from 3:00 pm on February 4. The timing is deliberate. Geopolitics are tense, technology is disruptive and capital is choosier. India, meanwhile, is pitching itself as a long-term bet.

The pairing is symbolic. Reliance straddles energy transition, digital infrastructure and consumer growth in the world’s fastest-expanding major economy. BlackRock, the world’s largest asset manager, oversees more than $14 tn in assets and sits at the nerve centre of global capital flows. When the two talk, markets tend to listen.

Fink’s appearance marks his third India visit, a signal of the country’s rising strategic weight for the Wall Street-listed firm, which carries a market value above $177 bn. His earlier 2023 trips included an October stop in New Delhi, where he met both Ambani and Narendra Modi.

India is now central to BlackRock’s expansion plans, notably through its joint venture with Jio Financial Services. Announced in July 2023, the 50:50 venture, JioBlackRock, commits up to $150 mn each from the partners to build a digital-first asset-management platform aimed at India’s swelling investor class.

The backdrop is robust. BlackRock ended 2025 with record assets under management of $14.04 tn, helped by $698 bn in net inflows, including $342 bn in the fourth quarter alone. Scale gives Fink both heft and a long lens on where money is moving.

He has been openly bullish on India. At the Saudi-US Investment Summit in Riyadh last year, Fink argued that the “fog of global uncertainty is lifting”, with capital returning to dynamic markets such as India, drawn by reforms, demographics and durable return potential.

Expect the conversation to range beyond balance sheets, into technology’s role in finance, access to capital and the mechanics of sustainable growth in a fracturing world order. For investors and policymakers alike, it is a snapshot of how big money is thinking about India.

At a time when capital is cautious and growth is contested, India wants to be the exception. When Ambani and Fink share a stage, it is less a chat and more a signal. The world’s money is still looking for its next big story, and India intends to be it.

-

e-commerce3 weeks ago

e-commerce3 weeks agoSwiggy Instamart’s GOV surges 103 per cent year on year to Rs 7,938 crore

-

News Headline2 months ago

News Headline2 months agoFrom selfies to big bucks, India’s influencer economy explodes in 2025

-

News Broadcasting2 weeks ago

News Broadcasting2 weeks agoMukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

-

iWorld5 months ago

iWorld5 months agoBillions still offline despite mobile internet surge: GSMA

-

News Headline2 months ago

News Headline2 months ago2025: The year Indian sports saw chaos, comebacks, and breakthroughs

-

News Headline2 months ago

News Headline2 months agoGame on again as 2025 powers up a record year and sets the stage for 2030

-

MAM2 years ago

MAM2 years agoCosta Coffee becomes official coffee partner of Olympic Games Paris 2024

-

Applications2 months ago

Applications2 months ago28 per cent of divorced daters in India are open to remarriage: Rebounce