iWorld

Paramount Skydance vs Netflix; Sarandos & Peters vs Ellison: Hollywood’s highest-stakes poker game

NEW YORK: David Ellison isn’t playing nice anymore. The chairman and chief executive officer of Paramount Skydance continues with his full-throated assault on Warner Bros. Discovery, penning a blistering letter to shareholders that accuses WBD’s board of selling them short—literally.

At the heart of the drama: Paramount’s $30-per-share all-cash tender offer, which Ellison insists makes Netflix’s competing bid look like loose change found down the sofa. He’s not wrong to be miffed. After presenting six proposals over 12 weeks, Paramount was ghosted by WBD’s board, which instead sprinted towards a deal with Netflix without so much as a courtesy call.

The numbers tell a damning story. Netflix’s offer—touted at $23.25 in cash, $4.50 in stock, and a spin-off of WBD’s Global Networks—is, according to Ellison’s maths, worth far less than advertised. For starters, Netflix’s cash component falls $18bn short of Paramount’s. Then there’s Netflix’s stock, which has shed over $110 billion in market value since its last earnings report, dragging the collar on its stock consideration underwater. Factor in a mysterious debt-allocation mechanism buried in an 8-K filing, and the headline value crumbles further.

Ellison reckons the Global Networks spin-off is worth a measly $1 per share, bringing Netflix’s real offer to $28.75—still below Paramount’s $30. And that’s before accounting for the risk that shareholders will be left holding the bag on a declining linear networks business whilst Netflix and WBD’s streaming assets sail off into the sunset together.

Paramount, meanwhile, has its financial ducks in a row. The offer is backed by $41 billion in equity from the Ellison family trust (stuffed with over $250 billion in assets, including 1.16 billion Oracle shares) and RedBird Capital, plus $54 billion in debt commitments from Bank of America, Citi and Apollo. No financing conditions, no material adverse change clauses. Ellison is clearly fed up with suggestions that Paramount isn’t “good for the money”—a claim he deems “absurd”, particularly given that WBD’s advisors never bothered to pick up the phone to ask questions.

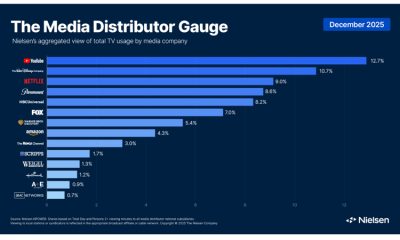

Then there’s the regulatory minefield. Paramount has already filed for Hart-Scott-Rodino approval in America and kicked off discussions with the European Commission. Netflix, on the other hand, faces a Sisyphean task. Combining the world’s number one streaming service (Netflix) with number four (HBO Max) yields a market share of 43 per cent—more than double the nearest rival. In Europe, where Netflix commands 51 per cent of OTT subscription revenue, regulators are likely to sharpen their knives. The Digital Services Act and Digital Markets Act were designed precisely to stop big tech behemoths from gobbling up competitors.

Netflix’s defence—that regulators should lump together YouTube, TikTok, Instagram and Facebook into one giant “internet video” market—strikes Ellison as laughable gerrymandering. No regulator has ever bought such a broad definition, he notes, and doing so would gut merger enforcement entirely. Paramount has pledged to accept remedies up to a “material adverse effect” on the combined company, backed by a $5 billion reverse termination fee. Netflix’s extra $800 million doesn’t bridge the gap.

The WBD board’s behaviour raises eyebrows. Despite prioritising cash and repeatedly telling Paramount that “cash is king,” the board never asked for a re-bid. When Paramount submitted its final $30-per-share offer with full documentation on 4 December, ready to sign immediately, the board didn’t respond. Not a call, not a text, not an email. Instead, they rushed to sign with Netflix, ignoring Paramount’s advisors, who made clear they hadn’t said “best and final.”

Ellison is now taking his case directly to shareholders, urging them to tender their shares and force the board’s hand. The tender offer will remain open for at least 20 business days, with WBD required to respond within 10. Multiple equity research notes have already sided with Paramount, agreeing that its offer is superior.

The message is clear: if you’re a WBD shareholder, it pays to read the fine print. And if you’re on WBD’s board, you might want to start returning your calls.

The letter Ellison sent out to shareholders:

Dear Warner Bros. Discovery Shareholder:

Paramount began pursuing Warner Bros. Discovery (“WBD”) because we, along with our partner RedBird Capital, believe we are the best stewards not only to build long-term value for the asset but also delight audiences and help cultivate a more vibrant creative community.

We funded, founded and then merged Skydance with Paramount and know the sacrifices and investment it takes to capitalize and grow a media business. I am passionate and dedicated to this pursuit, committed to putting my own money in, and that is why I am writing to you today.

Over the past 12 weeks, Paramount presented six proposals to the WBD Board of Directors and management to acquire all of WBD. On Monday, we launched a $30.00 per share all-cash tender offer to present our superior transaction to you directly.

Our tender offer documents filed with the Securities and Exchange Commission include the complete bid package we submitted to the WBD Board of Directors on December 4. We want you to see firsthand what Paramount proposed and what we, along with our equity and debt financing partners, were prepared to execute on that very day.

Our public offer – identical to the terms we presented to WBD privately – delivers superior value and a faster, more certain path to completion than the transaction announced with Netflix. IT IS NOT TOO LATE TO REALIZE THE BENEFITS OF PARAMOUNT’S PROPOSAL IF YOU CHOOSE TO ACT NOW AND TENDER YOUR SHARES.

Paramount’s $30.00 All-Cash Offer for All of WBD Delivers Greater Value Than Netflix

Our offer is financially superior to Netflix’s transaction, which provides WBD shareholders with lower value, less cash and significantly less certainty. On its face, Netflix is offering WBD shareholders $23.25 per share in cash, $4.50 in stock and a share in WBD’s Global Networks spin-off. In reality, however, the total value is materially lower than advertised:

1) Netflix’s cash component is ~$18 billion lower than Paramount’s in the aggregate (~$7 per share).

2) Netflix’s stock price closed at $96.71 on Tuesday and, as of this writing, is trading at $93.81, more than $4 below the low-end of the collar on its stock consideration. This reduces the value of Netflix’s offer.

3) During the pendency of a regulatory review process that could take two years or more, WBD shareholders will be exposed to Netflix stock’s downside risk, including technology sector volatility, a lofty ~25x forward EBITDA multiple and the uncertainty of seven future quarterly earnings results. For reference, Netflix has lost approximately one quarter of its market capitalization ($110+ billion) since its last quarterly earnings report and amid its pursuit of WBD.

4) Buried in an 8-K filing on Friday was a mechanism providing a dollar-for-dollar reduction in the purchase price if more debt gets allocated to Streaming & Studios because of an unspecified cap on Global Networks. While the limit is undisclosed, every $1 billion above it could represent a reduction of ~$0.40 / share.

5) Netflix’s transaction leaves WBD shareholders with 100% of the risk of the Global Networks standalone plan. As outlined on our December 8 investor call, we believe Global Networks is worth ~$1 / share which would mean a total headline value to WBD shareholders in the Netflix deal of $28.75 – below our $30.00 all-cash offer. This is before any risk adjustments described above and any time-value-of-money discounting of Netflix’s offer to account for the substantially longer timeline to close (~$1.25 / share for every six months).1 In addition, the Netflix transaction would further exacerbate the decline of Global Networks.

1 Based on 4.5x consensus next twelve months EBITDA (including allocation of stock-based compensation and corporate overhead) of $3.9 billion as of Q3’26 (expected separation closing date WBD announced as part of Netflix transaction) and net debt of $15 billion. 4.5x multiple is based on equity research analysts who perform a sum-of-the-parts analysis of WBD and is also within range of where research analysts expect Versant to trade, despite the facts that Versant will have materially lower net leverage (~1.25x vs. Global Networks >3x), strong news (e.g., CNBC and MS Now), live sports (e.g., Golf Channel, English Premier League, the Olympics, others) and high-growth digital assets (e.g., GolfNow, Fandango). WBD Linear has also historically struggled to achieve analyst consensus expectations.

Paramount Has Air Tight Financing to Deliver on its Offer to You

Paramount has lined up all necessary financing to deliver its $30.00 per share all-cash offer to WBD shareholders.

As presented to the WBD Board, Paramount’s offer is not subject to any financing conditions and will be financed by $41 billion of new equity backstopped by the Ellison family and RedBird Capital and $54 billion of debt commitments from Bank of America, Citi and Apollo.

On December 3, WBD told us they wanted an Ellison family backstop on our equity financing. We delivered it to them less than 24 hours later. Our December 4 offer included an equity commitment from the Ellison family trust, which contains over $250 billion of assets (more than 6x the equity funding commitment) including approximately 1.16 billion Oracle shares and tens of billions of dollars in other assets. This information is publicly available; and, notably, the trust has been a counterparty in other completed public company transactions including for Twitter, which involved one of WBD’s advisors. In fact, the equity commitment papers submitted to WBD were identical in all material respects to commitments that the advisors to WBD had agreed to in other large transactions such as Twitter and Electronic Arts.

To suggest that we are not “good for the money” (or might commit fraud to try to escape our obligations), as certain reports have speculated, is absurd. That absurdity is underscored by the fact that WBD and its advisors never picked up the phone or typed out a responsive text or email to raise any question or concern or to seek any clarification about either the trust or our equity commitment papers.

Our debt commitments are not conditioned upon Paramount’s financial condition nor is there any “material adverse change” condition tied to Paramount. The conditions dovetail with our proposed merger agreement, which provided maximum certainty to WBD and its shareholders.

Netflix Faces Severe Regulatory Uncertainty & Closing Risk – Paramount Does Not

Paramount’s offer not only delivers superior value and certainty, but also a much shorter and more certain path to completion. To underscore our confidence, we have already filed for Hart-Scott-Rodino (HSR) approval in the United States and announced the case to the European Commission, opening the path to pre-notification discussions. We look forward to working collaboratively with the relevant authorities to work through the review process and deliver this transaction to you and our other stakeholders.

WBD’s transaction with Netflix, on the other hand, appears to be in for a long and bumpy ride as it navigates the global regulatory review process. Netflix is the #1 streaming business globally by subscriber count and HBO Max is #4. Combining these two yields an overwhelming market share of ~43% – more than 2x the #2. This is in addition to the other serious competition concerns raised, including from vertically integrating WBD’s film and TV production studios into Netflix, which will give Netflix greater leverage over theatrical exhibitors and creative talent alike. Notably, and as an indicator of its global dominance, Netflix’s current equity market capitalization dwarfs that of all other major media companies and theatrical exhibitors combined (even after the above-mentioned $110+ billion loss in value):

(1) Based on unaffected price as of September 10, 2025 (prior to WSJ leak).

Outside the United States, Netflix’s regulatory path is particularly challenged in Europe where its dominance is far more entrenched. Our analysis was conducted by the former deputies of merger enforcements for the European Commission and the U.K.’s Competition and Markets Authority. Netflix is by far the dominant streaming service in Europe, accounting for 51% of the total European OTT subscription revenue in 2024, with Disney a distant second at only 10%. The acquisition of WBD’s Streaming & Studios business is a blatant attempt to eliminate one of Netflix’s only viable international competitors in HBO Max. Market share analysis aside, Netflix also needs to satisfy Europe’s new landmark Digital Services Act and Digital Markets Act created for a situation precisely like this – protecting consumers from Big Tech overreach.

The argument being advanced publicly by Netflix and its proxies states that regulators should ignore the SVOD market and instead utilize a gerrymandered market definition that includes services like YouTube, TikTok, Instagram, and Facebook. Netflix’s claim boils down to trying to mask its dominance in SVOD by grouping together all internet-enabled video, media, social media, or otherwise. No regulator has ever accepted such a broad approach to market definition, and to do so would require regulators to give up on merger enforcement in media and social media alike.

It is noteworthy that, unlike Paramount’s willingness to agree to remedies up to a “material adverse effect” on the combined company, Netflix’s regulatory remedy commitments expressly state no remedy whatsoever can be imposed on Netflix’s business. Netflix also has a longer timeline — an “outside date” of 21 months. Paramount backed up its commitments with a $5 billion regulatory reverse termination fee. Netflix’s incremental $800 million over that amount does not close the gap between the differences in regulatory complexity and challenges.

For the avoidance of doubt, our $6 billion synergy estimate does not rely on cuts to content budgets at our studios and we intend to continue running both separately post-close. Our synergy analysis relies on efficiencies elsewhere across the combined organization, including technology, linear networks optimization, and real estate rationalization. Having experienced what it is like to act in and produce films first-hand, I have profound respect for creative talent. This is why we are fully pro-Hollywood, dedicated to supporting a growing theatrical slate of over 30 films per year and investing in the people and storytelling that drive the industry forward.

WBD’s Murky Sale Process

Over the last few days, we have heard from WBD shareholders and other stakeholders all asking the same question—what happened? Frankly, we are asking the same question.

The WBD sale “process” was unusual in that, over the entire period, its advisors never delivered to Paramount a single markup of any of our transaction documents—not our merger agreement nor our equity commitment documents. In addition, there was not a single “real time” negotiating session with us.

When Paramount submitted its fifth proposal on December 1, a proposal accompanied by full transaction documents that we stated we were prepared to sign, we offered $26.50 / share in cash.

On December 3, WBD provided feedback on Paramount’s proposal and communicated that the WBD Board would be “meeting periodically over the course of this week” but they never asked for a re-bid (which is strange if your goal is to maximize value for shareholders). On that call, our advisors asked whether the WBD Board continued to prioritize cash consideration as they had consistently communicated to us. WBD’s lead advisor’s response: “Isn’t cash always king?” One must ask: was that same message being delivered to Netflix?

Despite the opaque process, Paramount proactively submitted a revised offer with full transaction documentation in under 24 hours (at 11:00 am ET on December 4) and stated that Paramount and our funding sources were ready to sign it immediately. This revised offer addressed all of the scarce feedback that Paramount received.

Yet on that final pivotal day when WBD’s fate hung in the balance, we received not a single call, text or email to clarify anything about Paramount’s $30 per share all cash offer. Instead, and while in possession of our superior and fully committed bid and documents that entire day, the WBD Board and its advisors sprinted toward a deal with Netflix (even ignoring two separate texts from myself and Paramount’s advisors stating that we had never said “best and final”).

WBD Shareholders Have the Power to Get WBD on the Right Path

Our proposal represents a compelling opportunity for WBD shareholders. We are committed to seeing this transaction through.

Since Monday, we have had the opportunity to speak with a number of WBD shareholders who have expressed confusion and disappointment at the process that WBD conducted, which appears to have prioritized a deal with Netflix over shareholder value maximization. Multiple equity research notes published over the last 48 hours have also agreed that our offer is superior and that the Global Networks spin-off does not close the gap to $30.00 in cash.

From here, you can expect WBD to respond to our tender offer within 10 business days via a 14D-9 filing with the SEC. Our tender offer will remain open for at least 20 business days. The closing of the tender offer is conditioned upon, among other things, a majority of WBD shares tendering in our favor, receipt of regulatory approvals, termination of the Netflix merger agreement and entry into a definitive merger agreement with us.

WE URGE YOU TO REGISTER YOUR VIEW WITH THE WBD BOARD THAT YOU DEEM PARAMOUNT’S OFFER TO BE SUPERIOR BY TENDERING YOUR SHARES TODAY.

Sincerely,

David Ellison

Chairman and Chief Executive Officer

Paramount Skydance Corporation

iWorld

Netflix celebrates a decade in India with Shah Rukh Khan-narrated tribute film

MUMBAI: Netflix is celebrating ten years in India with a slick anniversary film voiced by Shah Rukh Khan, a nostalgic sprint through a decade that rewired how the country watches stories. The campaign doubles as both tribute and reminder: streaming did not just enter Indian homes, it quietly rearranged them.

Roll back to 2016 and television still dictated schedules. Viewers waited weeks, sometimes months, for favourite films to appear on prime time. Family-friendly filters narrowed options further, and piracy often filled the gaps. Then Netflix arrived, softly but decisively, carrying a catalogue of international titles rarely seen in Indian theatres and placing them a click away. Old blockbusters and new releases suddenly coexisted on the same digital shelf.

The platform’s real inflection point came in 2018 with Sacred Games, a breakout series that refused to dilute India’s grit for global comfort. Audiences embraced its unvarnished tone, signalling readiness for stories that did not need box-office validation or censorship compromises. What followed was a steady procession of relatable narratives. Competitive-exam anxiety fuelled Kota Factory. College relationships unfolded in Mismatched. Everyday pressures, not grand spectacle, proved bankable.

Language barriers thinned as foreign series arrived with Hindi, Tamil and Telugu dubbing, expanding viewership beyond urban English-speaking pockets. Marketing mirrored the shift. For global releases such as Squid Game, Netflix leaned on regional creators and influencers to localise buzz and make international content feel native.

The library widened beyond fiction. Documentaries stepped out of festival circuits into living rooms. Stand-up comedians found scale. Established filmmakers, including Sanjay Leela Bhansali with Heeramandi, embraced the platform’s long-form canvas. Subscriber numbers swelled to 12.37 million in India, according to Demandsage, and behaviour followed suit. Late-night binges became routine. Friday release rituals loosened. Watch parties turned solitary screens into social events.

Economics demanded adjustment. Early subscription pricing carried a premium aura that deterred many households. Over time, Netflix recalibrated plans to align with Indian spending sensibilities, conceding that accessibility is as critical as content. To extend momentum around marquee titles, the platform also experimented with split-season releases, stretching anticipation and watch time.

The anniversary film, narrated by Shah Rukh Khan, captures the linguistic shift that mirrors the cultural one: from “Netflix pe kya dekha?” to “Netflix pe kya dekhein?” The question moved from recounting the past to planning the next binge. In ten years, Netflix morphed from foreign entrant to familiar fixture, exporting Indian stories abroad while importing global ones home. The remote no longer waits; it chooses, clicks and moves on. In the streaming age, patience is out, playlists are in, and the next episode is always one tap away.

e-commerce

Tulasi Mohan Padavala elevated to Associate Director at Blinkit

Gurugram: Blinkit has elevated Tulasi Mohan Padavala to associate director, capping a three-year climb inside the quick-commerce firm and signalling confidence in an executive steeped in ecommerce, category management and on-ground sales execution.

Padavala shared the update publicly, saying he was “happy to share” the promotion, a succinct announcement that nevertheless marks a notable step up within one of India’s fastest-moving delivery platforms. The new role follows nearly three years at Blinkit, where he most recently served as senior category manager from February 2023 to January 2026, focusing on strategic sourcing and assortment planning.

The promotion places Padavala in Blinkit’s mid-to-senior leadership tier at a time when the company continues to expand its rapid-delivery footprint and sharpen category economics. His brief tenure as associate director began in January 2026, with responsibilities expected to span category growth, supplier strategy and cross-functional execution.

Before Blinkit, Padavala spent a short but intensive stint as global ecommerce manager at Wholsum Foods, the parent of Slurrp Farm and Millé, between November 2022 and February 2023. There he worked on digital marketplace expansion and online retail operations, adding a direct-to-consumer and international ecommerce layer to his résumé.

A longer stretch at Amazon shaped much of his cross-border commerce experience. As business development manager for Amazon’s India Global Selling programme from February 2021 to October 2022, Padavala helped Indian D2C brands enter the North American market. His remit ranged from seller recruitment and category revenue management to coordination with industry bodies, regulators and logistics partners. Key outcomes included launching more than 50 D2C consumable brands in the United States, driving a cumulative gross merchandise sales figure of $1m in FY21-22, tripling sales for participating brands during Prime Day through marketing and visibility levers, growing the monthly recurring revenue of more than 10 newly launched sellers from zero to an average $20,000 each, and negotiating ecommerce partnerships that reduced initial launch costs by 20 per cent.

Padavala’s earlier career was forged in the field rather than the dashboard. At Coffee Day Group, he spent close to five years across multiple sales leadership roles. As sales manager in the Greater Delhi Area from July 2019 to January 2021, he led vending-machine and consumables sales for small and medium enterprises with a team of more than 15 assistant and territory sales managers, managed over 2,000 clients, drove upselling and cross-selling, maintained channel partnerships and ensured timely collections. Prior to that, he served as area sales manager in Delhi between May 2018 and June 2019, handling south and east Delhi markets, and earlier in Hyderabad from April 2016 to May 2018, where he led Andhra Pradesh sales for the vending division, supervised service and logistics functions and managed a base of more than 600 machines with a four-member team.

His professional arc began with internships that combined analytics and process improvement. At Boehringer Ingelheim in 2015, Padavala analysed the impact of brand extension on the drug Pradaxa, identified key performance indicators through market research and assessed sales forecasts, recommendations that drew positive responses in pilot studies. Earlier, at Genpact in 2014, he automated manual sales-order backlog reporting using VBA and Excel, increasing efficiency by 800 per cent, and worked on benchmarking metrics within supply-chain planning processes.

From automating spreadsheets to scaling cross-border ecommerce and now steering quick-commerce categories, Padavala’s trajectory tracks the evolution of India’s retail economy itself. Blinkit’s bet is clear: blend data, discipline and delivery speed. The promotion formalises what his career already suggests. In the race for instant commerce, experience that moves from warehouse floors to global dashboards is no longer optional. It is the engine.

e-commerce

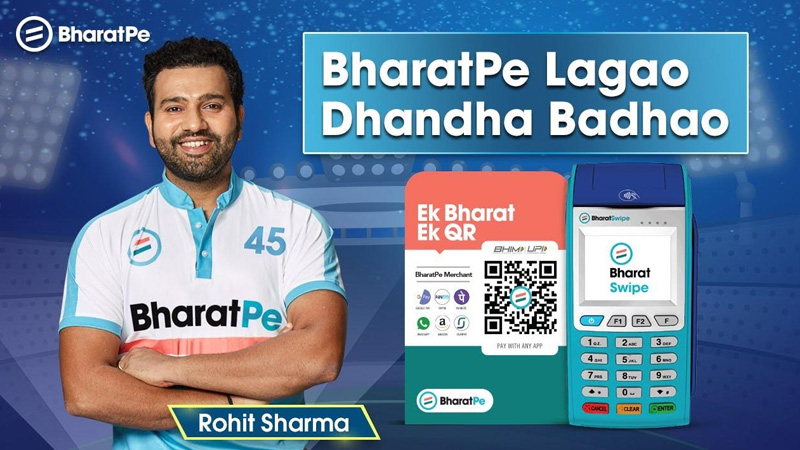

Bharatpe plays a super over as Rohit Sharma fronts T20 push

MUMBAI: When the stakes rise and seconds matter, even payments need a match-winning finish. That’s the cue for Bharatpe, which has rolled out Super Over, a nationwide campaign led by Indian cricket captain Rohit Sharma, timed neatly ahead of the ICC Men’s T20 World Cup.

The campaign draws a straight line between the pulse of cricket and the pace of everyday digital payments. A new brand film taps into India’s emotional bond with the game, while positioning UPI as the quiet hero that keeps daily transactions ticking along at match speed.

As part of Super Over, users making payments via Bharatpe UPI can bag daily rewards ranging from match tickets and signed merchandise to a chance to watch a T20 World Cup fixture alongside Rohit Sharma himself. Both consumers and merchants are also assured Zillion Coins on every eligible transaction, adding a little extra sparkle to routine payments.

Behind the scenes, Bharatpe is also batting for safety. The platform is backed by Bharatpe Shield, a fraud-protection layer designed to offer enhanced security, comprehensive coverage and dedicated support aimed at helping users transact with greater confidence as digital payments scale up.

Announcing the campaign, Bharatpe head of marketing Shilpi Kapoor said Super Over mirrors the aspirations of everyday Indians, combining speed, security and instant rewards to make UPI transactions feel both reliable and rewarding.

The campaign will play out across digital platforms, social media and on-ground activations nationwide, staying live through the T20 World Cup season proof that in cricket, as in payments, timing is everything.

-

iWorld3 months ago

iWorld3 months agoTips Music turns up the heat with Tamil party anthem Mayangiren

-

iWorld12 months ago

iWorld12 months agoBSNL rings in a revival with Rs 4,969 crore revenue

-

I&B Ministry3 months ago

I&B Ministry3 months agoIndia steps up fight against digital piracy

-

MAM3 months ago

MAM3 months agoHoABL soars high with dazzling Nagpur sebut

-

News Headline4 weeks ago

News Headline4 weeks agoPreeti Sahni set to join TV9 Network in senior leadership role

-

GECs4 weeks ago

GECs4 weeks agoBrick by Brick Zee TV Builds a Family Saga With Lakshmi Niwas

-

iWorld2 weeks ago

iWorld2 weeks agoJio shifts gears as 5G, homes and AI deals drive quarter momentum

-

News Broadcasting5 days ago

News Broadcasting5 days agoPalki Sharma leaves Firstpost: Reports