News Broadcasting

M&E stocks take a beating as Sensex crashes 1600+ points; NDTV worst hit

MUMBAI: Triggered by global concerns over China’s falling economy and its impact on global markets, the benchmark BSE Sensex witnessed bloodbath on Monday, 24 August as it closed the day at 25,741.56, down 1,624.51 points (5.94 per cent). This is one of the biggest fall since 2009.

Moreover, the Nifty was also down 490.95 points (5.92 per cent) to close at 7809.

According to media reports, on the back of the market meltdown, investors lost more than Rs 7 lakh crore. The downfall not only left the major oil, goods and bank companies in the red but the Indian Media and Entertainment (M&E) companies were also badly hit.

In the media sector, news company NDTV India was the worst hit as it fell 16.27 per cent to close the day at Rs 88.50. This was followed by TV Today, which witnessed a fall of 13.99 per cent to close the day’s trade at Rs 192.15. On the other hand, multi system operator (MSO) Hathway Cable & Datacom at Rs 40.05 was down 13.78 per cent.

Some of the other major M&E companies like Balaji Telefilms, direct to home (DTH) company Dish TV and Sun TV Network were not spared either. While Balaji Telefilms was down 12.31 per cent to close the day at Rs 72.65, Dish TV was down 11.85 per cent at Rs 96.35. The Maran owned Sun TV dipped 11.63 per cent to close at Rs 298.50.

Eros International Media closed at Rs 441.95 after registering a 11.60 per cent decline. Even music companies were not left untouched from the stock market waves. Shemaroo Entertainment, Saregama and Tips recorded a fall of 10.74 per cent, 9.98 per cent and 9.53 per cent respectively.

Other media companies including DQ Entertainment, Network18, B.A.G Films and Entertainment Network India Ltd (ENIL) were down by 9.38 per cent, 8.78 per cent, 8.59 per cent and 7.33 per cent respectively.

The Dhoot family owned DTH company Videocon d2h was the sole company unaffected by the fall of the Sensex. The company’s stock was up by 0.33 per cent and closed at Rs 137. 75.

Some of the companies, which were not as impacted as much were Zee Entertainment Enterprises Limited (ZEEL), which was down 6.11 per cent to end the day at Rs 359.65, Jagran Prakashan (down 5.20 per cent) and MSO Siti Cable (down 5 per cent).

HT Media bore a loss of 2.84 per cent, whereas the Orissa based MSO Ortel Communications was down 2.27 per cent to close the day’s trade at Rs 202.30.

Ascribing the market crash to global turbulence, finance minister Arun Jaitley said that the government along with the Reserve Bank of India (RBI) was watching the situation and hoped that things will stabilise once the transient impact is over.

News Broadcasting

Barc forensic audit in TRP row awaits as Twenty-Four probe gathers pace

KERALA: A forensic audit commissioned by the Broadcast Audience Research Council (BARC) India has emerged as the centrepiece of the government’s response to fresh allegations of television rating point manipulation involving a regional news channel in Kerala, with both the audit findings and a parallel police investigation still awaited.

Replying to a query in the Lok Sabha, minister of state for information and broadcasting L Murugan, said Barc had appointed an independent agency to conduct a forensic probe into the conduct of senior personnel allegedly linked to the case.

The move followed media reports claiming that a Barc employee had accepted bribes to manipulate viewership data in favour of a regional television news channel.

“The report from BARC is still awaited,” Murugan told Parliament, signalling that the forensic exercise remains ongoing.

Industry specialists say forensic audits are crucial in alleged TRP fraud cases, as they examine internal controls, data access trails, panel household integrity, staff communications and financial transactions. The outcome could determine whether the alleged manipulation was an isolated breach or a deeper systemic weakness in India’s television measurement framework.

Running alongside the audit, the Kerala Police has formed a special investigation team to probe the allegations. The ministry has sought a preliminary report from the state’s director general of police, including details of action taken on the first information report. That report, too, is yet to be submitted.

The episode has revived long-standing concerns over the vulnerability of India’s TRP system, particularly in regional news markets where competition for ratings is fierce and advertising revenues hinge on weekly viewership rankings.

India’s sole television audience measurement body Barc, has faced scrutiny before, most notably during the nationwide TRP controversy involving news channels in 2020. While tighter compliance norms were introduced in the aftermath, the latest allegations suggest enforcement challenges may persist.

On regulatory consequences, the government said any punitive action against television channels, including suspension or cancellation of uplinking and downlinking permissions, would be governed by the Policy Guidelines for Uplinking and Downlinking of Television Channels issued in November 2022, and would depend on investigation outcomes and due process.

The ministry also pointed to ongoing efforts to overhaul the ratings ecosystem. Television measurement continues to be regulated under the Policy Guidelines for Television Rating Agencies, 2014. Draft amendments were released for public consultation in July 2025, followed by a revised version in November 2025, aimed at tightening audit mechanisms and improving transparency and representativeness.

In November 2025, Barc said it had taken note of allegations aired by Malayalam news channel Twenty-Four, which linked an internal employee to irregularities in audience measurement. The council said it had engaged a “reputed independent agency” to conduct a comprehensive forensic audit, underscoring the seriousness of the claims.

The ratings system sits at the heart of India’s broadcast advertising economy, shaping billions of rupees in annual ad spends. With trust in audience data once again under strain, advertisers, broadcasters and regulators are closely watching the outcome of the investigations.

Barc has urged industry stakeholders and media organisations to exercise restraint while the probe is underway, calling for an end to “unverified or speculatory claims” and reiterating its commitment to integrity and accountability.

Until the forensic audit and police findings are submitted and reviewed, the government said it would refrain from drawing conclusions.

News Broadcasting

Rajat Sharma defamation row: Delhi court summons Congress leaders Ragini Nayak, Pawan Khera and Jairam Ramesh

NEW DELHI: A Delhi court has ordered the summoning of senior Congress leaders Ragini Nayak, Pawan Khera and Jairam Ramesh in a criminal case filed by veteran journalist Rajat Sharma, sharpening a legal battle over alleged defamation and doctored digital content.

The order was passed on Monday by Devanshi Janmeja, judicial magistrate first class at Saket Courts, after the court found prima facie grounds to proceed under multiple sections of the Indian Penal Code, including forgery, creation of false electronic records and defamation.

Sharma, chairman and editor-in-chief of India TV, had approached the court over allegations made in June 2024 that he had used derogatory language against Congress spokesperson Ragini Nayak during a live television debate. He denied the charge, claiming it was fuelled by a manipulated video circulated online.

According to the complaint, a clipped version of the broadcast carrying superimposed captions, which were not part of the original programme, was first shared on social media platform X by Nayak and later amplified through retweets and public statements by Khera and Ramesh. Sharma said the viral spread caused serious reputational harm and personal distress.

The court took note of forensic science laboratory findings that pointed to visible post-production alterations in the video, including added titles and captions. It also cited witness testimonies from those present during the live broadcast, who stated that no abusive or objectionable language had been used.

In a related civil matter, the Delhi High Court had earlier observed a prima facie absence of abusive remarks and directed the removal of the disputed social media posts.

With criminal proceedings now set in motion, the case adds to mounting scrutiny around political messaging, digital manipulation and accountability on social media platforms.

News Broadcasting

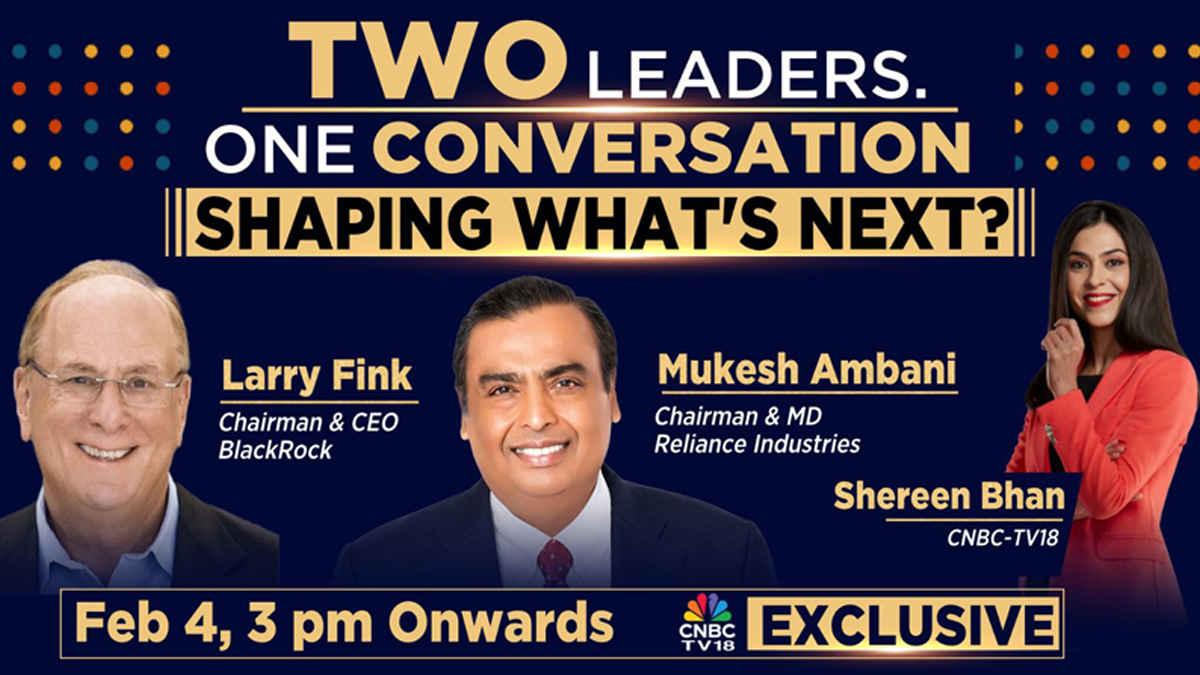

Mukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

Reliance and BlackRock chiefs map the future of investing as global capital eyes India

MUMBAI: India’s capital story takes centre stage today as Mukesh Ambani and Larry Fink sit down for a rare joint television conversation, bringing together two of the most powerful voices in global business at a moment of economic churn and opportunity.

The Reliance Industries chief and the BlackRock boss will speak with Shereen Bhan, managing editor of CNBC-TV18, in an exclusive interaction airing from 3:00 pm on February 4. The timing is deliberate. Geopolitics are tense, technology is disruptive and capital is choosier. India, meanwhile, is pitching itself as a long-term bet.

The pairing is symbolic. Reliance straddles energy transition, digital infrastructure and consumer growth in the world’s fastest-expanding major economy. BlackRock, the world’s largest asset manager, oversees more than $14 tn in assets and sits at the nerve centre of global capital flows. When the two talk, markets tend to listen.

Fink’s appearance marks his third India visit, a signal of the country’s rising strategic weight for the Wall Street-listed firm, which carries a market value above $177 bn. His earlier 2023 trips included an October stop in New Delhi, where he met both Ambani and Narendra Modi.

India is now central to BlackRock’s expansion plans, notably through its joint venture with Jio Financial Services. Announced in July 2023, the 50:50 venture, JioBlackRock, commits up to $150 mn each from the partners to build a digital-first asset-management platform aimed at India’s swelling investor class.

The backdrop is robust. BlackRock ended 2025 with record assets under management of $14.04 tn, helped by $698 bn in net inflows, including $342 bn in the fourth quarter alone. Scale gives Fink both heft and a long lens on where money is moving.

He has been openly bullish on India. At the Saudi-US Investment Summit in Riyadh last year, Fink argued that the “fog of global uncertainty is lifting”, with capital returning to dynamic markets such as India, drawn by reforms, demographics and durable return potential.

Expect the conversation to range beyond balance sheets, into technology’s role in finance, access to capital and the mechanics of sustainable growth in a fracturing world order. For investors and policymakers alike, it is a snapshot of how big money is thinking about India.

At a time when capital is cautious and growth is contested, India wants to be the exception. When Ambani and Fink share a stage, it is less a chat and more a signal. The world’s money is still looking for its next big story, and India intends to be it.

-

News Broadcasting4 days ago

News Broadcasting4 days agoMukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

-

iWorld1 week ago

iWorld1 week agoNetflix celebrates a decade in India with Shah Rukh Khan-narrated tribute film

-

MAM3 months ago

MAM3 months agoHoABL soars high with dazzling Nagpur sebut

-

MAM4 days ago

MAM4 days agoNielsen launches co-viewing pilot to sharpen TV measurement

-

iWorld12 months ago

iWorld12 months agoBSNL rings in a revival with Rs 4,969 crore revenue

-

I&B Ministry3 months ago

I&B Ministry3 months agoIndia steps up fight against digital piracy

-

iWorld3 months ago

iWorld3 months agoTips Music turns up the heat with Tamil party anthem Mayangiren

-

Film Production1 week ago

Film Production1 week agoUFO Moviez rides high on strong Q3 earnings