MAM

Ad spends in the US to slow down in 2012: Study

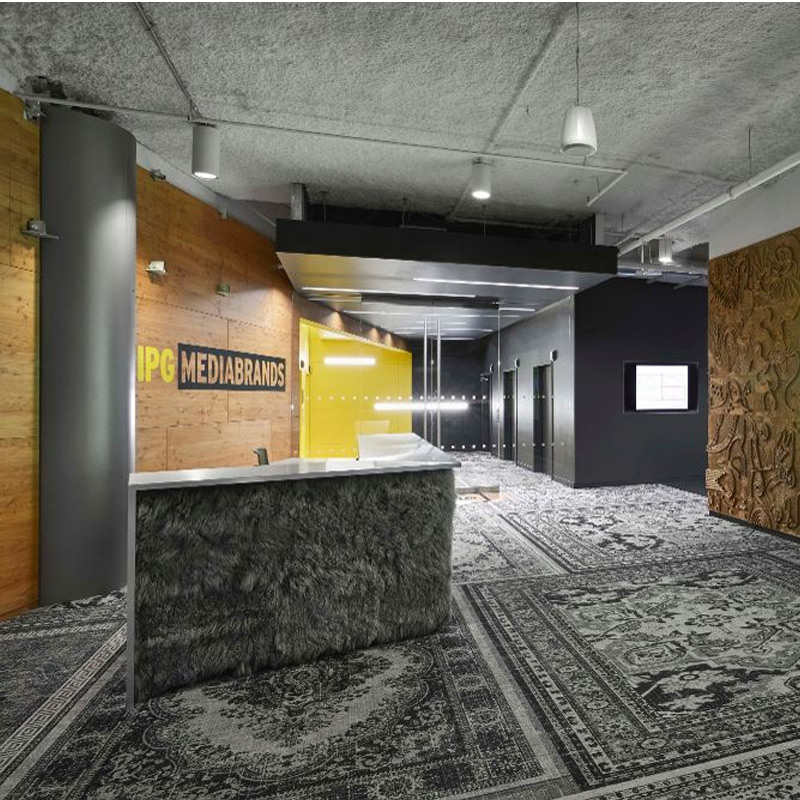

MUMBAI: Magnaglobal a division of IPG Mediabrands has released its updated US Media Owners Advertising Revenue Forecast.

The 2011 forecast remains unchanged at 1.6 per cent growth, including the impact of political and Olympics (P&O) advertising, and it still expects media suppliers to generate $173.5 billion of ad revenues in 2011. Due to persistent weakness in the US economy, however, it has revised the 2012 growth forecast down from 4.8 to 2.9 per cent, including P&O.

A slowdown in real personal consumption expenditures, manufacturing activity, and ongoing problems in the labour and housing markets all contribute to the revised outlook.

The estimates are further impacted by continued disinflation. The forecasts encompass core media categories including Television, Internet, Print, Radio and Outdoor, as well as direct marketing categories (Direct Mail, Directories). Excluding direct marketing components, the revenue growth of core media categories is estimated at 2.9 per cent in 2011 and 4.3 per cent in 2012.

Under the current expectations of a slow-but-positive economic recovery in 2012, media suppliers’ advertising revenues will continue to recover from the severe recession of 2008-2009.

Magnaglobal expects revenues to reach $178.5 billion in 2012, which is still significantly less than the pre-recession level of 2007 ($206.1 billion).

National mass media will continue to gain share due to strength in national online display, online video, mobile and national cable network advertising. Across the three media segments, TV will be the fastest growing medium after Online in 2012, with advertising revenues increasing by 7.1 per cent compared with online’s 11.6 per cent.

Television will benefit from the “quadrennial bonanza.” The agency believes that the 2012 elections and the Summer Olympics will generate incremental revenue of $3.1 billion for television: $2.5 billion in political advertising (the highest spending ever, mostly on local broadcast television) and $633 million around the London Olympics (up 5.5 per cent compared with Beijing 2008, and primarily fuelling National Broadcast TV revenues).

Direct media is exhibiting an increasing discrepancy between traditional activities (Directories and Direct Mail) and digital (Internet Yellow Pages, Paid Search, Lead Generation). Traditional direct media remains significant ($26.2 billion in 2011), but it is increasingly challenged by digital alternatives. Digital direct media, on the other hand, continues to outperform.

Paid Search growth has accelerated this year to 21.7 per cent, and is expected to maintain double-digit growth in 2012 (13 per cent). Recent algorithm improvements have helped accelerate cost-per-click trends and have led brands to rely more heavily on search engine marketing and search engine optimization while eschewing low-quality sites. For 2011, it now expects $31.1 billion in total online advertising, up 19.5 per cent versus 2010.

MAM

Nielsen launches co-viewing pilot to sharpen TV measurement

Super Bowl pilot to refine how shared TV audiences are counted

MUMBAI: Nielsen is taking a fresh stab at one of television’s oldest blind spots: how many people are actually watching the same screen. The audience-measurement giant on February 4 unveiled a co-viewing pilot that uses wearable devices to better capture shared viewing, starting with America’s biggest broadcast stage.

The trial begins with Super Bowl LX on NBC on February 8, 2026, before extending to other high-profile live sports and entertainment events in the first half of the year. The goal is simple but commercially potent: count viewers more accurately, especially during live spectacles that pull families and friends to one screen.

The new approach leans on Nielsen’s proprietary wearable meters, wrist-worn devices that resemble smartwatches. These passively capture audio signatures from TV content, logging exposure to shows, films and live events without requiring viewers to sign in or self-report. In theory, fewer clicks, fewer lapses, better data.

Karthik Rao, Nielsen’s ceo, cast the move as part of a broader measurement push. He said the company’s task is to keep pushing accuracy as clients invest heavily in live programming that draws mass audiences. The co-viewing pilot, he added, builds on upgrades such as Big Data + Panel measurement, out-of-home expansion, live-streaming metrics and wearable-based tracking.

Co-viewing is not new territory for Nielsen, which has long tried to estimate how many people sit before a single set. What is new is the heavier integration of wearables and passive detection to reduce reliance on active inputs from panel homes.

For now, the pilot comes with caveats. Co-viewing estimates from the trial will not be folded into Nielsen’s Big Data + Panel ratings, which remain the industry’s trading currency. Instead, pilot findings will be shared with clients a few weeks after final Big Data + Panel ratings are delivered. Clients may disclose those findings publicly.

More impact data will follow later this year. Full integration into Nielsen’s marketing-intelligence suite is slated as a longer-term play, with a target of bringing co-viewing into currency measurement for the 2026–2027 season. This is only phase one, with further co-viewing enhancements planned beyond 2026 and additional timelines to be announced.

The push fits a wider pattern. Nielsen has in recent years expanded big-data integration, adopted first-party data for live-streaming measurement and broadened out-of-home tracking. It also positions itself as the reference point for streaming metrics through products such as The Gauge and the Nielsen Streaming Top 10.

In a market where billions of ad dollars hinge on decimal points, counting who is in the room matters. If Nielsen can pin down shared viewing, the humble sofa could become prime measurement real estate. The race to count every eyeball just found a new wrist to watch.

Brands

Delhivery chairman Deepak Kapoor, independent director Saugata Gupta quit board

Gurugram: Delhivery’s boardroom is being reset. Deepak Kapoor, chairman and independent director, has resigned with effect from April 1 as part of a planned board reconstitution, the logistics company said in an exchange filing. Saugata Gupta, managing director and chief executive of FMCG major Marico and an independent director on Delhivery’s board, has also stepped down.

Kapoor exits after an eight-year stint that included steering the company through its 2022 stock-market debut, a period that saw Delhivery transform from a venture-backed upstart into one of India’s most visible logistics platforms. Gupta, who joined the board in 2021, departs alongside him, marking a simultaneous clearing of two senior independent seats.

“Deepak and Saugata have been instrumental in our process of recognising the need for and enabling the reconstitution of the board of directors in line with our ambitious next phase of growth,” said Sahil Barua, managing director and chief executive, Delhivery. The statement frames the exits less as departures and more as deliberate succession, a boardroom shuffle timed to the company’s evolving scale and strategy.

The resignations arrive amid broader governance recalibration. In 2025, Delhivery appointed Emcure Pharmaceuticals whole-time director Namita Thapar, PB Fintech founder and chairman Yashish Dahiya, and IIM Bangalore faculty member Padmini Srinivasan as independent directors, signalling a tilt towards consumer, fintech and academic expertise at the board level.

Kapoor’s tenure spanned Delhivery’s most defining years, rapid network expansion, public listing and the push towards profitability in a bruising logistics market. Gupta’s presence brought FMCG and brand-scale perspective during a period when ecommerce volumes and last-mile delivery economics were being rewritten.

The twin exits, effective from the new financial year, underscore a familiar corporate rhythm: founders consolidate, veterans rotate out, and fresh voices are ushered in to script the next chapter. In India’s hyper-competitive logistics race, even the boardroom does not stand still.

MAM

Meta appoints Anuvrat Rao as APAC head of commerce partnerships

At Locofy.ai, Rao helped convert a three-year free beta into a paid engine, clocking 1,000 subscribers and 15 enterprise clients within ten days of launch in September 2024. The low-code startup, backed by Accel and top tech founders, is famed for turning designs into production-ready code using proprietary large design models.

Before that, Rao founded generative AI venture 1Bstories, which was acquired by creative AI platform Laetro in mid-2024, where he briefly served as managing director for APAC. Alongside operating roles, he has been an active investor and advisor since 2020, backing startups such as BotMD, Muxy, Creator plus, Intellect, Sealed and CricFlex through a creator-economy-led thesis.

Rao spent over eight years at Google, holding senior partnership roles across search, assistant, chrome, web and YouTube in APAC, and earlier cut his teeth in strategy consulting at OC&C in London and investment finance at W. P. Carey in Europe and the US.

-

News Broadcasting4 days ago

News Broadcasting4 days agoMukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

-

iWorld1 week ago

iWorld1 week agoNetflix celebrates a decade in India with Shah Rukh Khan-narrated tribute film

-

MAM3 months ago

MAM3 months agoHoABL soars high with dazzling Nagpur sebut

-

MAM4 days ago

MAM4 days agoNielsen launches co-viewing pilot to sharpen TV measurement

-

iWorld12 months ago

iWorld12 months agoBSNL rings in a revival with Rs 4,969 crore revenue

-

I&B Ministry3 months ago

I&B Ministry3 months agoIndia steps up fight against digital piracy

-

iWorld3 months ago

iWorld3 months agoTips Music turns up the heat with Tamil party anthem Mayangiren

-

Film Production1 week ago

Film Production1 week agoUFO Moviez rides high on strong Q3 earnings