DTH

Cable TV carriage fees head south

Carriage fees have been a bane of the Indian television industry. Most broadcasters have been groaning and moaning how they have been choking up their capital, preventing them from investing in content, especially news channels.

Now throwing some light on the trend in carriage fees is five year old television media and distribution audit company Chrome Data Analytics & Media which has just released its Chrome Dii R3 (Distribution Investments Index – Round 3).

Chrome Dii,says the company, has been worked out while tracking deals done by broadcasters over the past year, with information gathered from across various sources including broadcasters as well as distribution platforms. After eliminating high variance deals, an average of six solo deals per cable network were studied for their investments for S band and UHF.

|

|

Jeffrey Crasto…

|

“For the digital scenario, Chrome Dii indicates a benchmark carriage to be available on the basic tier that is channels under BST (mandated FTA channels) along with the first tier of pay channels,” says Chrome Data executive director Jeffrey Crasto. “The study is inclusive of both new launches/new deals done in the last one year and existing deals expiring in April/May 2013.”

Adds Chrome Data founder & CEO Pankaj Krishna: “Digitisation was expected to be a harbinger of correction leading to nullification of carriage fees. As per TRAI, they had anticipated the Chrome Dii to come down to Rs 1, however though there has been a significant drop; it has not come down to Rs 1.As compared to R2, Dii has come down from Rs 20 to Rs 11.6. “

|

|

.. & Pankaj Krishna have attempted to demystify the burden broadcasters have to bear

|

In its third round, the Dii has revealed that north India has emerged as the costliest region with a whopping 16.7 crore in carriage fees for 100 per cent availability across Basic + S band for new channel launches and 13.3 crorefor renewals of existing deals whereas central India is the lowest with 3.11 crore and 2.73 crore for Basic + S band for new launches and renewing existing deals respectively.

While a different image is revealed if the Dii (cost per contact for the television channels) is studied, Chrome Dii R3 data shows the cost (renewals, S-band) per contact (household) is the highest in west India with an average of 17.6 followed by Central at 14.4. The national average for renewals stands at 11.6.

Out of a total universe of 47 million households in Class I India, 42 million are C&S Homes. Chrome Dii study tracks 31 million homes, 2 million remain uncovered and balance 9 million are DTH!

Source: Chrome Data Analytics & Media

|

C&S Households

|

89%

|

DTH

|

74%

|

|

Non TV Households

|

11%

|

Chrome Dii

|

21%

|

|

|

|

Balance

|

5%

|

Chrome Data says that its Dii R3 was pre-subscribed by eight leading TV networks. And it is an addition to the other services that it offers (covering1800+ cities and towns) Chrome Track 2.0, Chrome DPi, Chrome Dii & Chrome SES, Chrome AV, Chrome LC1, Chrome NE and Chrome Language Feed.Some 132 channels subscribe to its various services.

Some interesting facts according to Chrome Dii R3 –

|

Carriage Fee Cost

|

||||

|

Existing

|

New Launch

|

|||

| REGION | Basic + S BAND | Basic + UHF | Basic + S BAND | Basic + UHF |

| CENTRAL | 273,75,000 | 194,70,000 | 311,95,000 | 235,30,000 |

| EAST | 376,65,000 | 281,25,000 | 404,65,000 | 340,00,000 |

| NORTH | 1330,33,300 | 1118,71,800 | 1673,03,300 | 1343,67,800 |

| SOUTH | 549,50,000 | 466,67,000 | 625,65,500 | 527,32,500 |

| WEST | 1099,80,000 | 1014,80,000 | 1320,00,000 | 1195,00,000 |

| Grand Total | 3630,03,300 | 3076,13,800 | 4335,28,800 | 3641,30,300 |

* To cite an example as per the above data, comparing how much a Hindi News channel would spend for 75 per cent HSM availability as per Dii R3 as compared to Dii R2 – it would pay 75% of (Rs 36.30 croe minus Rs 5.49 crore for the south) = Rs. 23.1 crore as per Dii R3, whereas it would have paid Rs 38.2 crore as per Dii R2 – a saving of over 39 per cent! But has the overall pie reduced, not really! As there has been an increase in network bandwidth, hence the number of takers has increased.

North emerged as the costliest region with Rs 16.7 crore for 100 per cent availability across Basic + S Band and Rs 13.4 crore for 100 per cent availability across Basic + UHF for New Launches. Renewals of existing deals for Rs 13.3 crore for Basic + S Band and Rs 11.2 crore for Basic + UHF.

The study also provides a benchmark for carriage fee efficiency with respect to the investment indices that is Chrome Dii that is cost per contact (see tables below). Chrome reveals that the Dii (renewals, S-band, household) is the highest in West India with an average of Rs 17.6 followed by the Central at Rs 14.4. The national average for renewals stands at Rs 11.6.

|

Carriage Fee Cost per contact for existing channels in Rs

|

||||

|

Existing-Basic+S Band |

||||

| West |

17.6

|

|||

| Central |

14.4

|

|||

| North |

14.1

|

|||

| East |

7.1

|

|||

| South |

6.6

|

|||

Source: Chrome Data Analytics & Media

* In terms of highest Chrome Dii, West was followed by North, Central, East and South.

* The gap between Dii for Existing and New Launches has reduced over the years owing to digitization and increase in bandwidth of the networks.

|

Carriage Fee Cost per contact for new channels being launched in Rs

|

||||

|

New Launches – |

|

|||

| West |

21.1

|

|||

| Central |

17.7

|

|||

| North |

16.4

|

|||

| East |

7.6

|

|||

| South |

7.5

|

|||

Source: Chrome Data Analytics & Media

* Further, the gap between Dii for S Band and UHF has also reduced due to digitization

* Chrome Dii for a New Launch in Central and East India has halved.

DTH

Dish TV Q3 revenues fall 20 per cent, Ebitda turns negative

NOIDA: When the remote stops working, you don’t throw it away, you change the batteries. Dish TV is trying something similar. Faced with falling subscription revenues and a fast-shrinking DTH universe, India’s once-dominant satellite broadcaster is flipping channels, betting on smart TVs, OTT aggregation and a hybrid future even as the numbers flash red.

For the quarter ended 31 December, 2025, Dish TV India reported operating revenues of Rs 2,991 million, down 19.8 per cent year-on-year from Rs 3,730 million. Subscription revenues, still the backbone of the business, fell sharply by 32.2 per cent to Rs 2,245 million, reflecting industry-wide cord-cutting and persistent churn. The pain shows up clearly below the line.

Ebitda swung to a loss of Rs 415 million, compared with a profit of Rs 1,227 million a year earlier. Total expenditure climbed 36.1 per cent to Rs 3,406 million, pushing costs to nearly 114 per cent of operating revenues. The quarter closed with a loss before tax of Rs 2,762 million, weighed down further by exceptional items of Rs 700 million. Yet the company insists this is not a business stuck buffering, but one deliberately loading a new format.

Dish TV is repositioning itself from a pure DTH operator into what it calls a connected-home entertainment platform, stitching together live television, OTT apps and smart devices. The centrepiece of that strategy is the nationwide rollout of VZY smart TVs, offering a unified DTH-plus-OTT experience.

Amazon Prime Video has now been integrated across Dish TV’s ecosystem, including Watcho and VZY. Watcho, the company’s in-house OTT super app, has crossed millions of downloads and paid subscribers, aggregating more than 25 content apps.

Fliqs, its creator-driven content platform, is being pitched as a home for premium regional and international programming. Brand visibility has also been boosted through splashy partnerships with Bigg Boss Hindi and Bigg Boss Kannada: high-decibel bets in a crowded attention economy.

“Indian home entertainment is undergoing a structural shift,” said CEO and executive director Manoj Dobhal arguing that Dish TV’s hybrid model improves convenience while keeping customers within a single ecosystem. The revenue mix shows early signs of diversification, even if it is not yet compensating for falling subscriptions.

Marketing and promotional fees rose 27.3 per cent to Rs 399 million, while advertisement income, still small, nearly doubled to Rs 48 million. Other operating income surged 267.6 per cent to Rs 298 million, softening the overall revenue decline.

On costs, the company is tightening the screws. It has renegotiated transponder contracts, rationalised call-centre and general expenses, and improved asset discipline by boosting set-top box recovery beyond 30 days, reducing swap frequency and replacement capex.

New customer activations are being driven through a no-subsidy Rs 999 set-top box, a move management says materially improves unit economics and cash flow. Still, risks remain stubbornly in view. Churn continues to shadow the business, and scaling Watcho while balancing content spend will demand execution discipline.

Cost cuts, the company admits, must not erode service quality: a delicate act in a market where customer loyalty is already thin. For now, Dish TV’s numbers tell a story of strain.

DTH

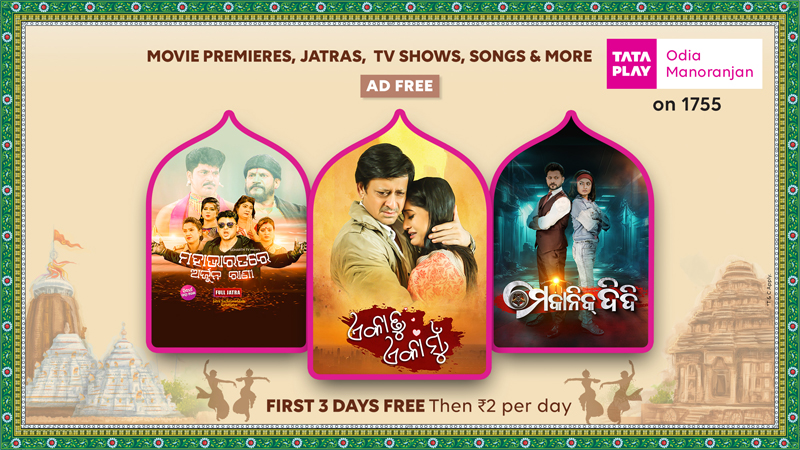

Tata Play deepens Odia push with ad-free ‘Odia Manoranjan’ platform

MUMBAI: Tata Play is doubling down on regional loyalty. India’s leading DTH player has launched Tata Play Odia Manoranjan, a new value-added service that corrals Odia entertainment into a single, ad-free destination, available on television and the Tata Play mobile app.

Powered by Sidharth TV, one of Odisha’s most popular Odia-language GECs, the platform serves up a hefty catalogue: over 180 movies, 100+ Jatras, around 20 television shows and a library of more than 12,000 songs spanning devotional, folk, film and non-film genres. From vintage favourites to contemporary titles, the mix is pitched squarely at Odia-speaking households, with particular pull in tier-3 and tier-4 markets.

Subscribers get 24×7, full-screen SD viewing without ad breaks on channel number 1755, with live TV and VOD access across screens. The price point is deliberately sharp: Rs 2 a day.

Pallavi Puri, chief commercial and content officer at Tata Play, framed the move as a bet on language and culture. “India’s strongest viewing loyalties are rooted in language and lived culture. Tata Play Odia Manoranjan brings together the many expressions of Odia entertainment—from films and Jatras to devotional programming and music—into one clearly defined destination. With this launch, Tata Play further elevates its regional content offering by giving Odia audiences a single, definitive home for their stories and traditions.”

For Sidharth TV Network, the partnership is about reach without compromise. Sitaram Agrawalla, owner and chairman, said: “For decades, Odia families have trusted our entertainment platforms for stories that feel like home, and for moments that bring us together. Tata Play Odia Manoranjan builds on this trust by placing a diverse range of Odia films, theatre, devotional music and shows into a single, accessible space. This collaboration isn’t just about wider distribution—it’s about honouring the preferences of Odia viewers with a seamless, ad-free viewing experience that reflects their language, culture and the way they choose to engage with content.”

The new service slots into Tata Play’s expanding portfolio of entertainment and infotainment platform services across genres including entertainment, kids, learning, regional and devotion, catering to all age groups.

In short: one language, one screen, zero ads—and a clear signal that regional is where the real viewing power lies.

DTH

Binge strikes play as Tata Play adds Times Play to its OTT universe

MUMBAI: If streaming had galaxies, Tata Play Binge just opened a wormhole. In its latest move to become India’s most sprawling entertainment universe, the platform has now folded Times Play, Times Network’s digital-first OTT service, into its all-in-one subscription bouquet bringing Hollywood hits, snackable shorts, live news, lifestyle, entertainment, Pickleball and 11 live TV channels under a single roof.

The new addition means subscribers no longer need to hop between apps in Olympic-level finger gymnastics, Binge now pulls Times Network’s entire digital catalogue into one screen, one login, one bill. And in the era of attention overload, that’s practically a public service.

Times Play brings with it a distinctive blend of premium Hollywood cinema, web series, short-format videos, and Times Network’s formidable news muscle. Viewers can flip seamlessly between Romedy Now, Movies Now, MNX, MN+, Zoom, Times Now, Times Now Navbharat, ET Now, ET Now Swadesh, and even Pickleball Now, mirroring the growing Indian appetite for niche sporting entertainment.

On the long-form front, hits like Reunion, India’s Story, True Story of Angeline Jolie, Orphan First Kill, The November Man, Barely Lethal, Southpaw, The Hurt Locker, Transporter Refueled, and The Holiday sit alongside Times Network factual and current-affairs staples including Frankly Speaking, Sawaal Public Ka, and News Ki Paathshaala.

Describing the partnership, Tata Play chief commercial and content officer Pallavi Puri, said the aim remained unchanged to make content discovery effortless and reduce the modern curse of app overload. She noted that integrating Times Play enriches Binge’s already deep catalogue with a broader mix of premium films, originals and news programming “without juggling multiple apps or subscriptions”.

Times Network echoed the sentiment, calling the collaboration a natural extension of its mission to deliver credible entertainment and journalism at scale. It emphasised Tata Play’s reach, reliability and reputation as a key driver in bringing Times Play’s digital catalogue to diverse Indian households.

With the addition of Times Play, Tata Play Binge now boasts 30 plus OTT platforms on a single interface, a list that includes Prime Video, JioHotstar, Zee5, Apple TV+, Lionsgate, SunNXT, Discovery+, BBC Player, Aha, Fancode, ShemarooMe, Hungama, ManoramaMax, Nammaflix, Tarang Plus, Travel XP, Animax, Fuse+, ShortsTV, Curiosity Stream, and DistroTV, among others.

Notably, Netflix remains available as part of combo packs for DTH subscribers, while Amazon Prime Video can be unlocked as an add-on for Binge users with a Tata Play DTH connection. And for large-screen loyalists, all 30 plus apps can be streamed via LG, Samsung and Android Smart TVs, the Tata Play Binge+ set-top box, Amazon FireTV Stick – Tata Play edition, or through TataPlayBinge.com.

The expansion comes on the heels of recent integrations, including WAVES by Prasar Bharati and BBC Player, reinforcing Tata Play Binge’s ambition to remain India’s most diverse, most unified, and most fuss-free entertainment destination.

With Times Play now in the mix, Binge isn’t just aggregating content, it’s quietly aggregating the future of how India watches.

-

News Broadcasting6 days ago

News Broadcasting6 days agoMukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

-

I&B Ministry3 months ago

I&B Ministry3 months agoIndia steps up fight against digital piracy

-

iWorld1 week ago

iWorld1 week agoNetflix celebrates a decade in India with Shah Rukh Khan-narrated tribute film

-

MAM3 months ago

MAM3 months agoHoABL soars high with dazzling Nagpur sebut

-

iWorld12 months ago

iWorld12 months agoBSNL rings in a revival with Rs 4,969 crore revenue

-

MAM6 days ago

MAM6 days agoNielsen launches co-viewing pilot to sharpen TV measurement

-

iWorld3 months ago

iWorld3 months agoTips Music turns up the heat with Tamil party anthem Mayangiren

-

Film Production2 weeks ago

Film Production2 weeks agoUFO Moviez rides high on strong Q3 earnings