MUMBAI: Imagine opening your paycheck and finding an unexpected bonus—except this time, it’s courtesy of the taxman. Looks like all...

Reliance and BlackRock chiefs map the future of investing as global capital eyes India

Super Bowl pilot to refine how shared TV audiences are counted

MUMBAI: Netflix is celebrating ten years in India with a slick anniversary film voiced by Shah Rukh Khan, a nostalgic...

Gurugram: Delhivery’s boardroom is being reset. Deepak Kapoor, chairman and independent director, has resigned with effect from April 1 as...

SINGAPORE: Anuvrat Rao has taken charge as APAC head of commerce and signals partnerships at Meta, steering monetisation deals across...

Bengaluru: Brnd.me, the global consumer brands company formerly known as Mensa Brands, has entered the European market following strong momentum...

NATIONAL: TechnoSport has launched on Slikk, the ultra-fast fashion app offering 60-minute delivery, as the activewear brand accelerates its push...

MUMBAI: Jitendra Singh has been appointed senior vice president and division head – special projects at Reliance Industries Limited, marking...

MUMBAI: Dating, it turns out, is less about grand gestures and more about shared moments. The song you both hum,...

MUMBAI: This Republic Day, Godrej brought modern washing technology to the care of Indian handlooms. The appliances business of Godrej...

BENGALURU: Wipro Limited hosted the 15th edition of the Wipro earthian Awards 2025 at Azim Premji University, recognising schools and...

Gurugram: Blinkit has elevated Tulasi Mohan Padavala to associate director, capping a three-year climb inside the quick-commerce firm and signalling...

Noida: Haldiram’s has tapped a seasoned brand builder to sharpen its quick-service ambitions. Rajiv Singh has joined the snacks-to-sweets giant...

MUMBAI: When the stakes rise and seconds matter, even payments need a match-winning finish. That’s the cue for Bharatpe, which...

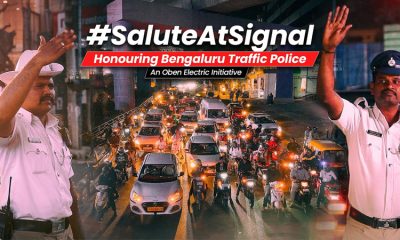

BENGALURU: In a city where red lights usually test patience and tempers, Oben Electric decided to give them a new job....