NEW DELHI: The GSAT-11 spacecraft, a first generation high throughput communication satellite, is to be launched towards the end of 2016 or the first quarter of...

NEW DELHI: The Cable and Satellite Broadcasters Association of Asia is holding its next convention in Macao later this year for senior executives from across the...

NEW DELHI: The Cable and Satellite Broadcasters Association of Asia is holding its next convention in Macao later this year for senior executives from across the...

MUMBAI: Satellite services provider O3b Networks has been recognized as “Satellite Operator of the Year” for 2015 at the Via Satellite Excellence Awards during Satellite 2016....

MUMBAI: Satellite services provider O3b Networks has been recognized as “Satellite Operator of the Year” for 2015 at the Via Satellite Excellence Awards during Satellite 2016....

New Delhi: Antrix, the commercial wing of Indian Space Research Organization, earned revenue of 80.6 Million Euros through launching of 28 international customer satellites. The Cryogenic...

New Delhi: Antrix, the commercial wing of Indian Space Research Organization, earned revenue of 80.6 Million Euros through launching of 28 international customer satellites. The Cryogenic...

NEW DELHI: Antrix Corporation Limited (Antrix), the commercial arm of Indian Space Research Organisation (ISRO), has signed Launch Services Agreement with American company PlanetIQ for launching...

NEW DELHI: Antrix Corporation Limited (Antrix), the commercial arm of Indian Space Research Organisation (ISRO), has signed Launch Services Agreement with American company PlanetIQ for launching...

MUMBAI: Eutelsat Communications and ViaSat Inc have inked a joint venture agreement to expand satellite broadband in Europe. The JV will see Eutelsat’s current European broadband...

MUMBAI: Eutelsat Communications and ViaSat Inc have inked a joint venture agreement to expand satellite broadband in Europe. The JV will see Eutelsat’s current European broadband...

MUMBAI: Eutelsat Communications’ new multi-mission satellite – Eutelsat 65 West A is on track for launch on 9 March by an Ariane rocket. Lift-off of the...

MUMBAI: Eutelsat Communications’ new multi-mission satellite – Eutelsat 65 West A is on track for launch on 9 March by an Ariane rocket. Lift-off of the...

MUMBAI: Intelsat S.A. has appointed Jacques Kerrest as executive vice president and chief financial officer. Kerrest will report to Intelsat CEO Stephen Spengler and will...

MUMBAI: Intelsat S.A. has appointed Jacques Kerrest as executive vice president and chief financial officer. Kerrest will report to Intelsat CEO Stephen Spengler and will...

MUMBAI: Satellite services provider Intelsat S.A. has launched the first of the Intelsat EpicNG high throughput satellites – Intelsat 29e successfully from French Guiana aboard an...

MUMBAI: Satellite services provider Intelsat S.A. has launched the first of the Intelsat EpicNG high throughput satellites – Intelsat 29e successfully from French Guiana aboard an...

MUMBAI: Harmonic and AsiaSat have inked a partnership to launch a new Ultra HD (UHD) channel 4K- SAT2/HVN, which will be AsiaSat’s second free-to-air UHD channel...

MUMBAI: Harmonic and AsiaSat have inked a partnership to launch a new Ultra HD (UHD) channel 4K- SAT2/HVN, which will be AsiaSat’s second free-to-air UHD channel...

MUMBAI: The Indian Space Research Organisation’s (ISRO) Polar Satellite Launch Vehicle, PSLV-C31, successfully launched the 1425 kg IRNSS-1E, the fifth satellite in the Indian Regional Navigation...

MUMBAI: The Indian Space Research Organisation’s (ISRO) Polar Satellite Launch Vehicle, PSLV-C31, successfully launched the 1425 kg IRNSS-1E, the fifth satellite in the Indian Regional Navigation...

MUMBAI: AsiaSat 6 has received a permit to provide video services in Mainland China. The State Administration of Press, Publication, Radio, Film and Television of...

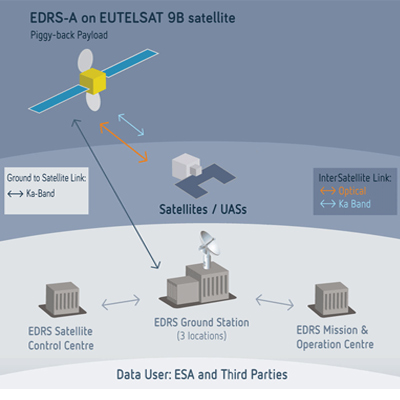

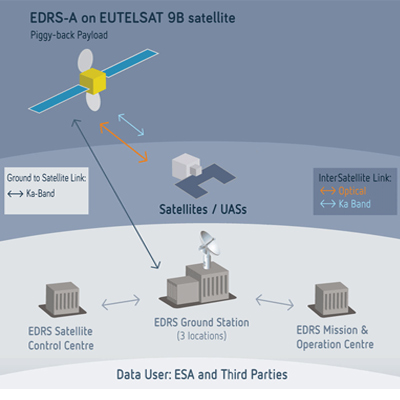

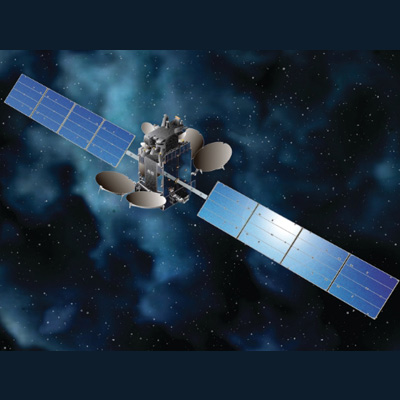

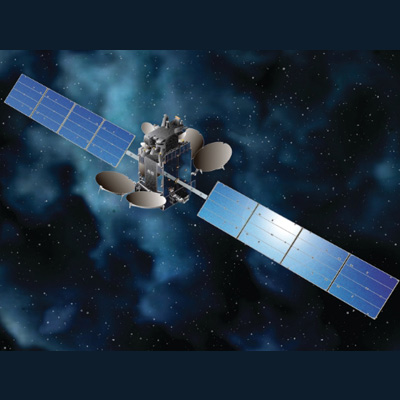

MUMBAI: Eutelsat Communications’ 9B satellite is on track for launch by an ILS Proton rocket on 28 January. Lift-off of the five-ton satellite built by Airbus...

MUMBAI: Intelsat S.A. has appointed Naren Mansharamani as vice president of financial planning & analysis (FP&A). In his role, Mansharamani will lead Intelsat’s FP&A and...

MUMBAI: MEASAT Satellite Systems (MEASAT) has named Prashant Butani as senior sales director – South Asia. In his new role, Bhutani will be responsible for...

MUMBAI: Azercosmos and Intelsat have chosen Arianespace to launch the Azerspace-2/Intelsat 38 telecommunication satellite. The satellite will be launched by an Ariane 5 launch vehicle from...

MUMBAI: Intelsat S.A. and Sky Perfect JSAT Corporation have signed an agreement to form a joint venture that will launch a new satellite with optimised C-band...

MUMBAI: Indonesian system integrator for TV stations PT. Graha Pratama Sejahtera (GPS) has chosen Asia Satellite Telecommunications to launch a bouquet of 14 television channels on...

MUMBAI: Satellite operator Asia Satellite Telecommunications Co. Ltd. (AsiaSat) launched its first Ultra-HD (UHD) television channel 4K-SAT at 122°E on AsiaSat 4, marking a new era...

MUMBAI: Space Systems/Loral (SSL), which is a provider of commercial satellites, is selected to provide a communications satellite to Azercosmos, the national satellite operator of Azerbaijan....

MUMBAI: Intelsat S.A. chief financial officer (CFO) Michael McDonnell has resigned from the company. McDonnell is slated to leave mid-December 2015 and will join as...

MUMBAI: Asia Satellite Telecommunications Co. Ltd. (AsiaSat) and Rohde & Schwarz have partnered to advance next-generation Ultra-HD (UHD) TV technologies by implementing the first free to...

MUMBAI: Eutelsat Communications and Facebook are partnering on a new initiative that will leverage satellite technologies to get more Africans online. Under a multi-year agreement...

NEW DELHI: Indian Space Research Organisation’s (ISRO) commercial arm Antrix has been ordered to pay compensation and damages totalling $672 million to Devas Multimedia. The directive...

NEW DELHI: MEASAT Satellite Systems has appointed Santosh Desai as sales director – Africa. Desai will be responsible for opening new markets in Africa, developing sales...

MUMBAI: Satellite companies Eutelsat Communications and SES S.A, engaged in the global video distribution market, have launched a new, industry-wide initiative to develop and promote next-generation video...

NEW DELHI: The Indian Space Research Organisation (ISRO) will receive the Gandhi Peace Prize for the year 2014. The prize will be presented by President...

MUMBAI: Full-service satellite and fibre communications solutions provider ST Teleport, based in Singapore, has expanded its capacity commitment and strategic partnership with Asia Satellite Telecommunications (AsiaSat)...

MUMBAI: Malaysian communication satellite operator, MEASAT and New York-based Fashion One Television LLC have launched Fashion One 4K, the first English language Ultra HD channel in the...

MUMBAI: Asian satellite operator Thaicom Plc has appointed Paiboon Panuwattanawong as the new CEO and authorised director of Thaicom, effective from October 1. Panuwattanawong has been serving...

MUMBAI: The Indian Space Research Organisation (ISRO) has successfully launched the communication satellite GSLV-D6. GSLV-D6 will launch 2117 kg GSAT-6, an advanced communication satellite, into a...

MUMBAI: Asian satellite operator Asia Satellite Telecommunications Co. Ltd. (AsiaSat) has reached an agreement with in-flight entertainment and connectivity service provider Aircom Pacific, Inc. for using...

NEW DELHI: With five Direct-to-Home (DTH) service providers using transponder capacity leased from foreign satellites, the Indian Space Research Organization (ISRO) is taking measures to augment...

NEW DELHI: A sum of approximately Rs 9 crore has been spent over the last three years by the Indian Space Research Organization (ISRO) to provide...

NEW DELHI: The turnover of Antrix Corporation Limited, the commercial arm of the Indian Space Research Organisation (ISRO), was Rs 1860.71 crore (unaudited) during 2014-15 as...

MUMBAI: Satellite operator Asia Satellite Telecommunications (AsiaSat) has announced an enhancement of its sales development and support activities in order to improve the solutions it delivers...

NEW DELHI: A National Space Act for India for regulating space activities in India; facilitate enhanced levels of private sector participation and offering more commercial opportunities...

NEW DELHI: The satellite proposed to be launched by India for the South Asian Association for Regional Cooperation (SAARC) member nations will have 12 Ku-Band transponders....

NEW DELHI: The Polar Satellite Launch Vehicle PSLV-C28 successfully launched three identical DMC3 commercial Earth Observation Satellites along with two smaller satellites from United Kingdom into...

MUMBAI: Bright Lights Media has selected Globecast to provide a comprehensive suite of services for the launch of a new High Definition pay-TV channel in Southeast...

This will close in 10 seconds