MUMBAI: A long audit trail just got a lot shorter. India’s broadcast audit regime is being rewired, with the Telecom...

NEW DELHI: Artificial intelligence is no longer a buzzword waiting for its moment in Indian telecom. That moment, regulators and industry leaders agreed, is already here....

Mumbai: Mumbai’s mobile networks have been run hard and measured closely, and the results are blunt. A fresh drive test by the Telecom Regulatory Authority of...

NEW DELHI: India’s telecommunications watchdog has emerged from a whirlwind year of regulatory upheaval, pushing through sweeping reforms whilst clamping down hard on spam calls that...

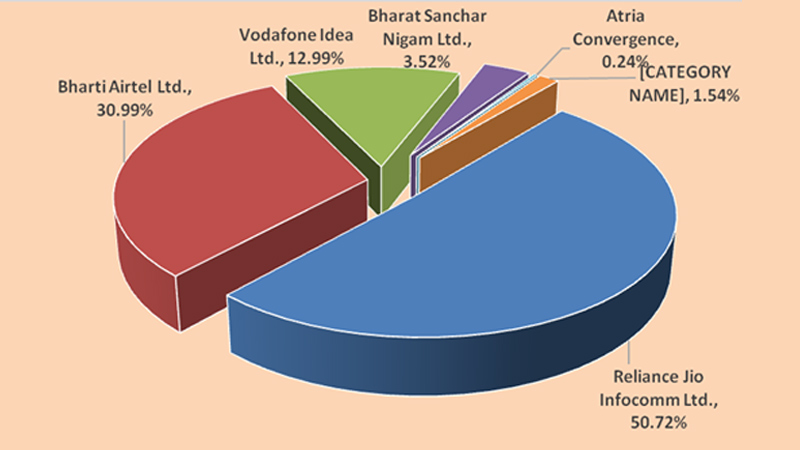

MUMBAI: Dialling up the numbers, India’s telecom story added a few more bars in November. As the year wound down, the country’s telecom networks stayed busy,...

NEW DELHI: India’s digital revolution hit a milestone in November 2025 that would have seemed fanciful a decade ago: one billion broadband subscribers. That is 100...

MUMBAI: Sometimes regulation doesn’t tighten the screws, it oils the engine. The Telecom Regulatory Authority of India (TRAI) has recommended a new, export-friendly framework that could...

NEW DELHI: The Telecom Regulatory Authority of India has switched on a small but significant experiment that could finally tidy up the messy world of promotional...

MUMBAI: India’s telecom numbers are ringing loud again, and this time the caller tune is pure growth. TRAI’s latest Indian Telecom Services Performance Indicator Report for...

MUMBAI: Call it a signal of the times, India’s telecom grid is buzzing louder than ever, and October 2025 may well go down as the month...

MUMBAI: A regulatory tug-of-war over how telecom operators should share subscriber data has prompted the Telecom Regulatory Authority of India to rewrite part of its own...

MUMBAI: The Telecom Regulatory Authority of India (TRAI) is giving its rulebook a reality check as it opens public consultation on the “Review of Existing TRAI...

MUMBAI: The Ministry of Information and Broadcasting (MIB) has turned the spotlight back on television ratings and this time, it’s rewriting the rulebook. In a move...

MUMBAI: Looks like creativity just got an extension. The Telecom Regulatory Authority of India (TRAI) has decided to give designers a little more breathing room for...

NEW DELHI: India’s television distribution platforms will have to race against the clock. The Telecom Regulatory Authority of India (TRAI) has fired a warning shot at...

MUMBAI: Spam beware, India’s digital regulators are tightening the screws. The Telecom Regulatory Authority of India (TRAI) convened the 9th Joint Committee of Regulators (JCoR) at...

MUMBAI: When it comes to India’s media and entertainment sector, the waves are getting bigger and TRAI Chairman Anil Kumar Lahoti is steering them with both...

MUMBAI: Static is out, digital is in. The Telecom Regulatory Authority of India (TRAI) has turned up the volume on the country’s radio landscape with fresh...

NEW DELHI: India’s telecom regulator has recommended sharp cuts in reserve prices for FM radio channel auctions, acknowledging the sector’s struggle against streaming services and stagnant...

MUMBAI: Dial M for Misuse: TRAI sounds alarm over scamsters impersonating its name. If you’ve recently received a call threatening “digital arrest” over telecom violations, don’t...

MUMBAI: India’s telecom dial tone got a bit louder this July, as the country added a net 2.7 million new telephone connections, taking the total subscriber...

MUMBAI: The Telecom Regulatory Authority of India (TRAI) has released its annual performance indicators report for 2024-25 and the numbers show a curious mix of gains,...

MUMBAI: Dialling up its digital growth, India’s telecom sector added 3.24 million new telephone subscribers in May 2025, pushing the country’s total subscriber base to a...

MUMBAI: India’s telecom sector is ringing loud and clear with growth in both reach and revenue. The Telecom Regulatory Authority of India (TRAI) has released its...

MUMBAI: India’s telecom scene in March 2025 was a tale of two Indias—rural Bharat rising on data dreams and legacy players like BSNL and MTNL gasping...

MUMBAI: In a country obsessed with skyscrapers, the Telecom Regulatory Authority of India (TRAI) is more interested in what’s inside the walls—signal strength. On 22 May,...

MUMBAI: If spam calls and scam messages are the villains of our digital age, India’s top regulators are teaming up like superheroes. On 25 April 2025,...

MUMBAI: The Telecom Regulatory Authority of India (TRAI) has issued a public warning over a rise in fraudulent calls and messages from scamsters posing as TRAI...

Department of Telecommunications (DoT) regarding several aspects of its September 2024 recommendations on the framework for service authorisations under the Telecommunications Act, 2023. The response follows...

MUMBAI: India’s telecoms regulator the Telecom Regulatory Authority of India (TRAI) has recommended comprehensive reforms in broadcasting service authorisations, marking the most significant regulatory change recommended...

MUMBAI: The Telecom Regulatory Authority of India (TRAI) has shaken up the telecom sector with fresh recommendations that redefine network authorisations under the Telecommunications Act, 2023....

Mumbai: The Telecom Regulatory Authority of India (TRAI) is taking a firm stance on unsolicited commercial communication (UCC) with its amended Telecom Commercial Communications Customer Preference...

MUMBAI: The Telecom Regulatory Authority of India (TRAI) took a step towards better digital connectivity inside buildings by hosting a webinar on 30 January. Led by...

MUMBAI: India has far been a cable and satellite TV country, apart from the single government-owned pubcaster Doordarshan which is the sole terrestrial network. That could...

MUMBAI: Industry watchdog the Telecom Regulatory Authority of India (TRAI) has got a new look online. It unveiled an upgraded website to broaden its reach to...

MUMBAI: Clear rules don’t stifle innovation – they build trust and confidence in uncharted territories. In a landmark step poised to reshape India’s telecom landscape, the...

MUMBAI: What happens when expectations collide with cold, hard realities? The Telecom Regulatory Authority of India’s (TRAI) latest open house discussion (OHD) on the audit clauses...

MUMBAI: Imagine walking a tightrope without a safety net, knowing that a single misstep could send you plummeting. That’s exactly the precarious position the Telecom Regulatory...

Mumbai: Ding, ding, ding—another spam message blows up your phone, drowning your screen in an avalanche of useless promotions. Sound familiar? Worse yet, you might miss...

New Delhi – In a mission towards curbing the menace of spam calls and SMS, the Telecom Regulatory Authority of India (TRAI) has implemented a series...

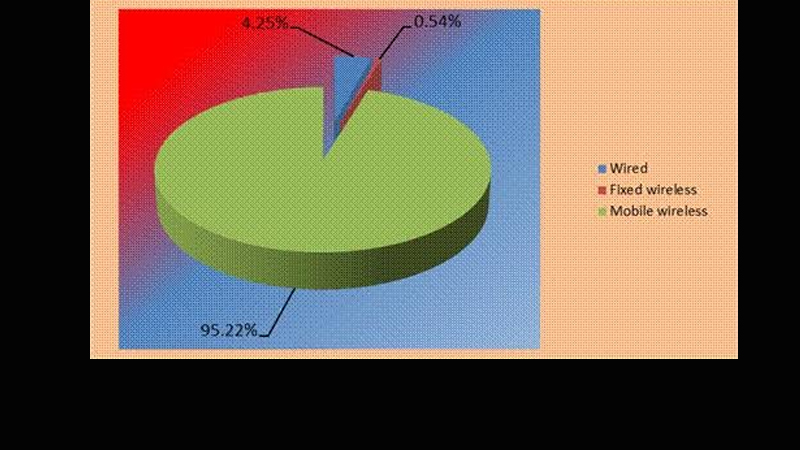

New Delhi: The Telecom Regulatory Authority of India (TRAI) unveiled its report on telecom subscription data as of 30 September 2024. The findings highlight trends across...

New Delhi – The Telecom Regulatory Authority of India (TRAI) released a consultation paper on Framework for Service Authorisations for provision of Broadcasting Services under the...

Mumbai: The Telecom Regulatory Authority of India (TRAI) has taken significant measures to curb the menace of spam calls and prevent the misuse of SMS headers...

Mumbai: The Telecom Regulatory Authority of India (TRAI) has released key insights into telecom subscription data as of August 31, 2024. During August, there were 14.66...

Mumbai: The Telecom Regulatory Authority of India (TRAI) releases Regulations namely “Rating of Properties for Digital Connectivity Regulations, 2024 “. The regulations aims to provide policy...

Mumbai: On 22 October, the Telecom Regulatory Authority of India (TRAI) released a consultation paper regarding the terms and conditions for network authorisations under the Telecom...

Mumbai: The Telecom Regulatory Authority of India (TRAI) has issued a consultation paper titled ‘Regulatory framework for ground-based Broadcasters’, inviting input from stakeholders on the need...

MUMBAI: Industry watchdog the Telecom Regulatory Authority of India (TRAI) released its quarterly Indian Telecom Services Performance Indicator Report yesterday for the quarter ending 30 June...

Mumbai: TRAI has released a consultation paper on terms and conditions for the assignment of spectrum for certain satellite-based commercial communication services. This initiative follows a...

Mumbai: TRAI has released a consultation paper to formulate a digital radio broadcast policy for private radio broadcasters. Currently, analogue radio broadcasting in India takes place...