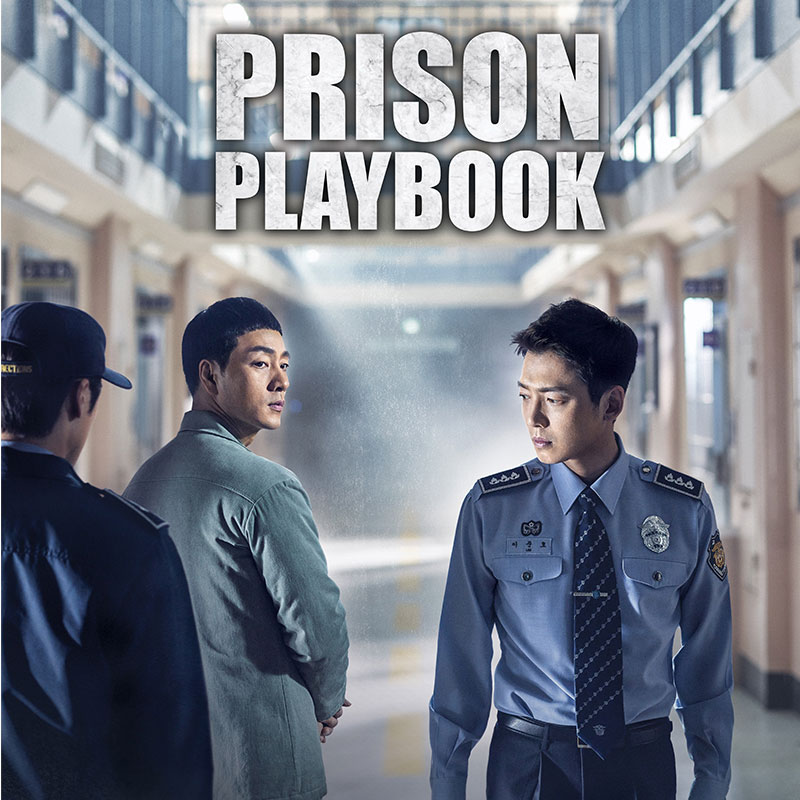

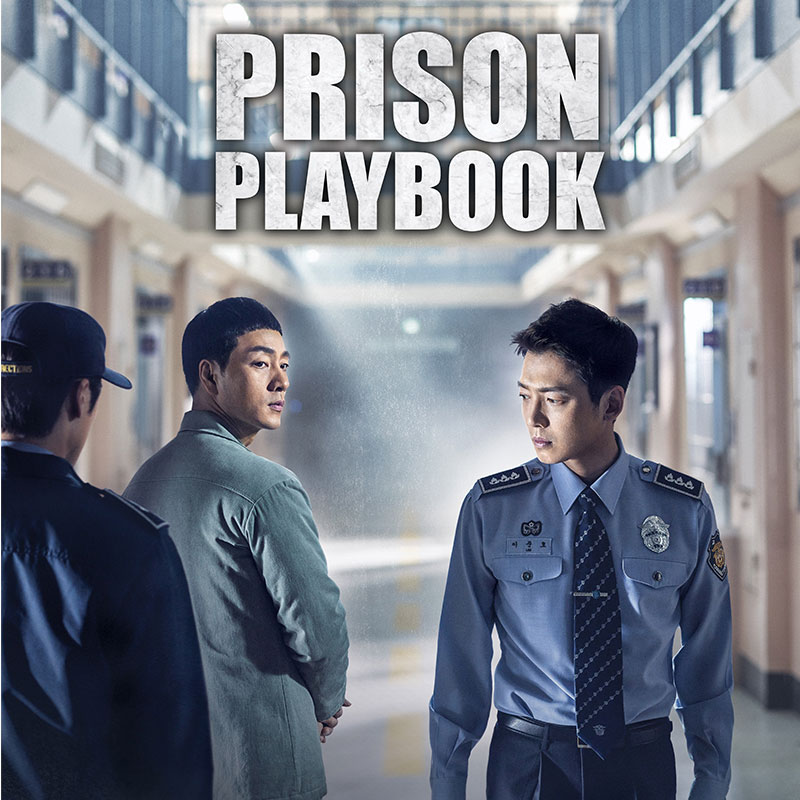

One Take Media Co brings yet another Korean drama series ‘Prison Playbook’ to the Indian audience in Hindi. ‘Prison Playbook’ is a captivating drama revolving around...

New Delhi: As part of the on-going #AajTakSabseTez campaign, the nation’s undisputed No.1 news channel AajTak, today launched the third film of the series. The film...

MUMBAI: Dream do come true, if you Belive! From the underbelly of a nation torn by war, poverty and chaos comes a truly inspiring movie that...

MUMBAI: Global character creation and animation production company YouNeedCharacter (spearheaded by CEO Minsu Song) has recently signed Indian cricket player, Ajinkya Rahane as the brand ambassador...

MUMBAI: As the assembly elections in the states of West Bengal, Assam, Kerala, Tamil Nadu and the Union territory of Puducherry draw near, CNN-News18 has lined-up...

India’s first holistic preventive pet care brand Wiggles.in, curated by vets for your pets continues to empower pet parents like never before. Celebrating women for their...

KOLKATA: Republic Media Network has now rolled out a new, game-changing and disruptive mobile news website. The rollout marks the Network’s successful implementation of the first...

MUMBAI: Zee Telugu is set to offer its viewers a unique, spiritual experience on the auspicious day of Mahashivratri this year. The channel is thrilled to...

MUMBAI: Every year International Women’s Day is observed on 8 March to celebrate women, their rights and their achievements. This year, Zee Kannada pledges unique women...

MUMBAI: Times Now has announced an unmatched programming line-up for the upcoming assembly elections under Mandate 2021. With its special programming, Times Now, India's election news...

MUMBAI: Two of the most inspiring icons of Bollywood and Cricket, Taapsee Pannu and Mithali Raj, have come together to share the important message of challenging...

MUMBAI: On the occasion of International Women’s Day (8 March ) this year, media consulting firm Ormax Media and entertainment platform Film Companion have released a...

Mumbai, 8 March 2021: ShowBox, a youth-centric music channel from the IN10 Media Network, has launched an original song, Swag Wali Naari, to pay tribute to...

NEW DELHI: As a part of its 26th year celebrations, SUN TV Network’s Telugu GEC Gemini TV is all set to broadcast Evaru Meelo Koteeswarulu –...

Mumbai: Republic Media Network’s Editor-in-Chief Arnab Goswami is proud to formally announce the launch of Republic Bangla– the Network’s hugely-awaited Bengali news channel. Republic Bangla will...

NEW DELHI: This International Women’s Day, ShortsTV celebrates women who strive to make the world a better place to live in. Available on platforms such as...

With 203 million subscribers around the globe and around 2 million in India alone, it’s fair to say that Netflix is one of the world’s most...

Earning the trust of the viewers and providing exceptional news coverage has kept ZEE Bihar Jharkhand a market leader for more than 4 years. The channel...

MUMBAI: Adding on to the festive vibes of the new year, Zee Telugu, one of the leading Telugu GEC, has announced the telecast of its special...

Today, in partnership with DreamWorks Animation and Universal Brand Development, Reebok has officially unveiled its Reebok x Kung Fu Panda full-family footwear and apparel collection. Celebrating...

Simmba fame, talented Marathi actor, dancer and performer, Siddharth Jadhav joins Planet Talent, a wing under the visionary Marathi entertainment banner Planet Marathi. Planet Marathi has...

NEW DELHI: Marking its leadership position in the digital sphere, ABP Network’s Marathi News Channel, ABP Majha has reached a whopping 7 million subscribers on YouTube....

Backed by Sauce Vc and the mentorship of Govind Shrikhande, XYXX, the leading homegrown industry player of the Indian men’s comfortwear market brought on board ace...

As a nation, we have always been fascinated by crime stories – the unpredictable nature of a case, analyzing the crime scene, and the thrill of...

ViewSonic Corp., a leading global provider of visual solutions, announced its collaborations with Ingram Micro, the world’s largest provider of technology logistics services and solutions. Ingram...

MUMBAI: 2021 will tell a different story as the action and adrenaline never stops with heart-throbbing superstars flocking to your screens this month to bring to...

Just days after introducing premium-quality tower speaker Tornado 101, French pioneering lifestyle brand ZOOOK has now launched a new multimedia 2.1 speaker system in India. Called...

Mumbai: Reverse Thought Creative Studios takes web development a notch higher by developing a clean, precise and to-the-point website for Allcargo Logistics – India’s largest integrated...

MUMBAI: The new year is upon us, and Zee Thirai is all geared up to ring in the new year with a bang. Zee Thirai’s tag...

Life insurance has become a necessity in life, especially during the COVID19 pandemic. Keeping that in mind, people rush towards the nearest insurance company’s office or...

Everyone is hoping that 2021 will bring relief and it is more important than ever. Taking a big leap, Bhuvan Bam has launched Youthiapa 2.0, Bhuvan...

In a bid to rally all those who have had to put their fitness goals on pause due to COVID 19, HealthifyMe, India’s leading AI-led health...

MUMBAI: Committed to satiating the diverse entertainment needs of the Tamil audiences, leading Zee Tamil has announced its festive line-up to usher in the fresh and...

As the deadline for filing income tax returns in India looms closer, many people are rushing to file their ITRs this month. The Central government has...

MUMBAI: Zee TV has been a front-runner in revolutionising television content over the past three decades and it is all set to change the face of...

MUMBAI: January, February, Lockdown, December –sums up 2020 for all of us! Not only did the pandemic grip the world and a ‘masked’ reality took over...

TVS Motor Company, a reputed manufacturer of two-wheelers and three-wheelers in the world, today introduced the 2021 TVS Apache RTR 160 4V with Bluetooth enabled TVS...

MUMBAI: With a promise to keep viewers enthralled like never before, Zee Telugu is all set to present a wholesome entertainment experience this Sunday from 8-...

In the true spirit of bringing good cheer and optimism, the very tenets of Christmas celebrations, Select CITYWALK, the most popular shopping centre in Delhi NCR,...

Ayushakti, one of the leading and most trusted ayurvedic health centers around the world, co-founded by Ayurveda expert Dr. Smita Naram has announced a free webinar...

ET NOW, India’s leading English business news channel, launches Season 9 of India’s largest entrepreneurship platform, Leaders of Tomorrow (LoT). Driving the theme ‘Empowering A Billion...

Mirchi, India’s leading entertainment company and Smule Inc, the global leader in interactive music creation, today announced the highly anticipated third season of “Smule Mirchi Cover...

MUMBAI: Shakuntala Devi’s quest for knowledge was unmatched. And so was her love for Mathematics. Sony Max, a premium Hindi movie channel is all set to...

MUMBAI: They’re the kid’s favourite cat-toons and rightly so. The popular cat duo Honey-Bunny, with their hilarious camaraderie and antics have delighted and amused kids. Sony...

Checkbrand, an online sentiment analysis company today announced the data about online sentiments of top movie stars in the country. This is the first quarterly analysis...

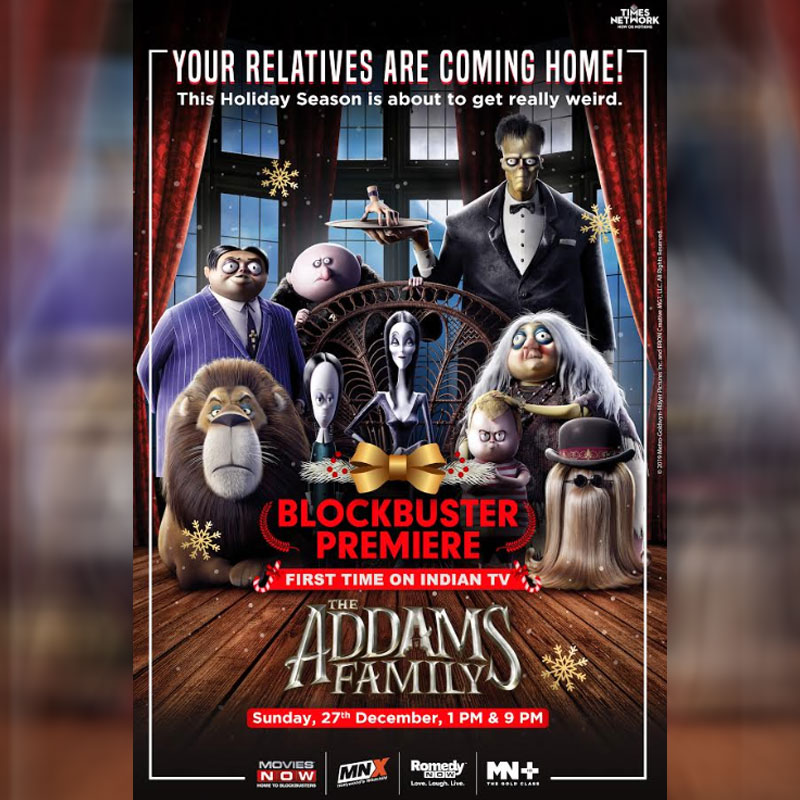

MUMBAI: The festive season calls for uninterrupted family time and what better way to celebrate it with an animated family comedy movie with your loved ones....

New Delhi, 21 December 2020: Skootr, India’s foremost ‘Premium Managed Office Space’ provider today announced the launch of its new brand identity. Skootr will now have...

This year has been difficult for most with the majority of the year going in adjusting to the new demands of a new world. CRED, keeping...

Almost a month after launching a 4G LTE Mifi router S-4GMR, country’s leading security and surveillance solution provider Secureye has now introduced S-4GWL, a 4G LTE...

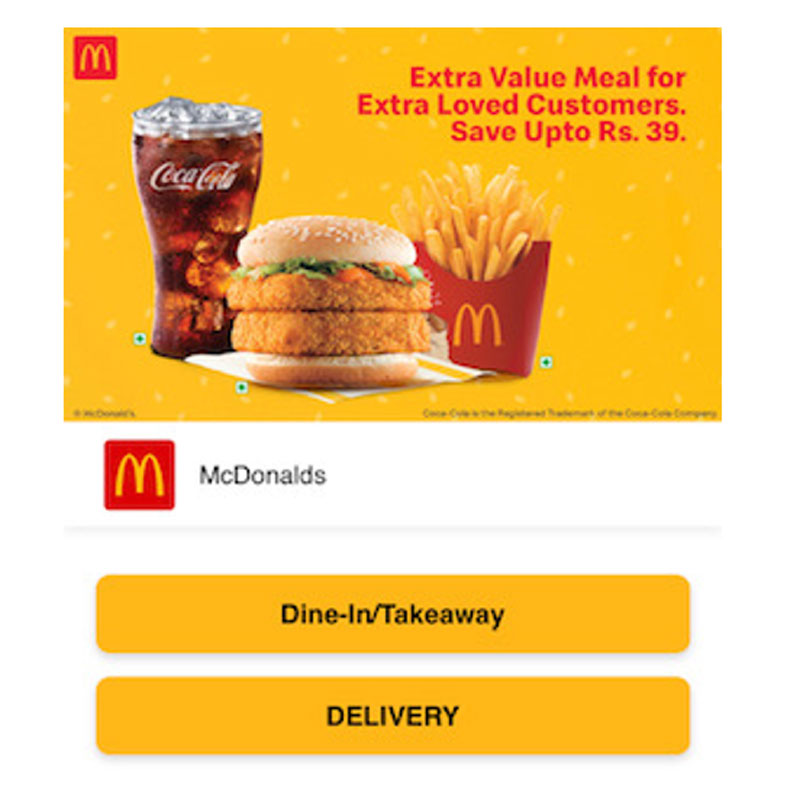

Love McDonald’s but too lazy to browse through multiple platforms. Well! McDonald’s India – North and East is making ordering food super easy. McDonald’s has introduced...