The e-learning application Tata Studi has retained Gozoop Group as its digital agency. The independent marketing group has been working with the brand since 2020. Gozoop...

Mumbai: Leading visual communication design company Trip Creative Services have been instrumental in designing the launch campaigns for Skoda Auto India’s new car launches, the ‘Skoda...

MUMBAI: After a career spanning over 22 years, dentsuMB Group CEO Sidharth Rao has moved on from the agency. Rao will be leaving the business in...

Former Indian cricket head coach, Ravi Shastri’s fondness for alcohol is well known. Shastri himself has never shied away from acknowledging that a good brew of...

Mumbai: Iodex, the leading body pain expert from GSK Consumer Healthcare and a renowned household name in India for over 100 years, partners with Cult.fit for...

Mumbai: Bata India has released a new campaign to announce the launch of its new versatile 24×7 casual collection. The 360-degree campaign titled ‘It’s Got To...

Mumbai: AI solutions company, Yellow.ai announced on Tuesday the appointment of Surbhi Agarwal, as its senior vice president (SVP) of global marketing. Agarwal joins Yellow.ai from...

Mumbai: The digital specialist of Madison World, HiveMinds won the digital marketing mandate for the leading gold tech platform Rupeek. The agency won this mandate following...

Mumbai: The fashion clothing brand MADAME has launched a video campaign featuring actress Tara Sutaria to promote the brand’s summer collection. The campaign is based on...

Mumbai: India’s leading omnichannel travel services, Thomas Cook announced its financial results for the quarter ended 31 March 2022 reflecting a strong rebound with sustained improvement...

Mumbai: Marico Limited has announced a strategic investment in HW Wellness Solutions Private Limited with an acquisition of a 54 per cent equity stake through primary...

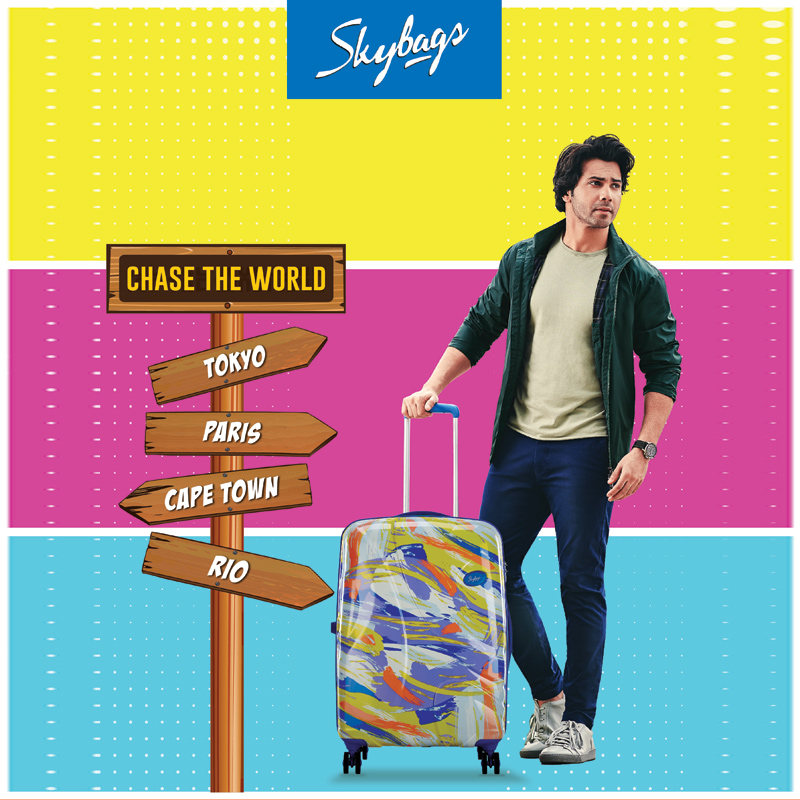

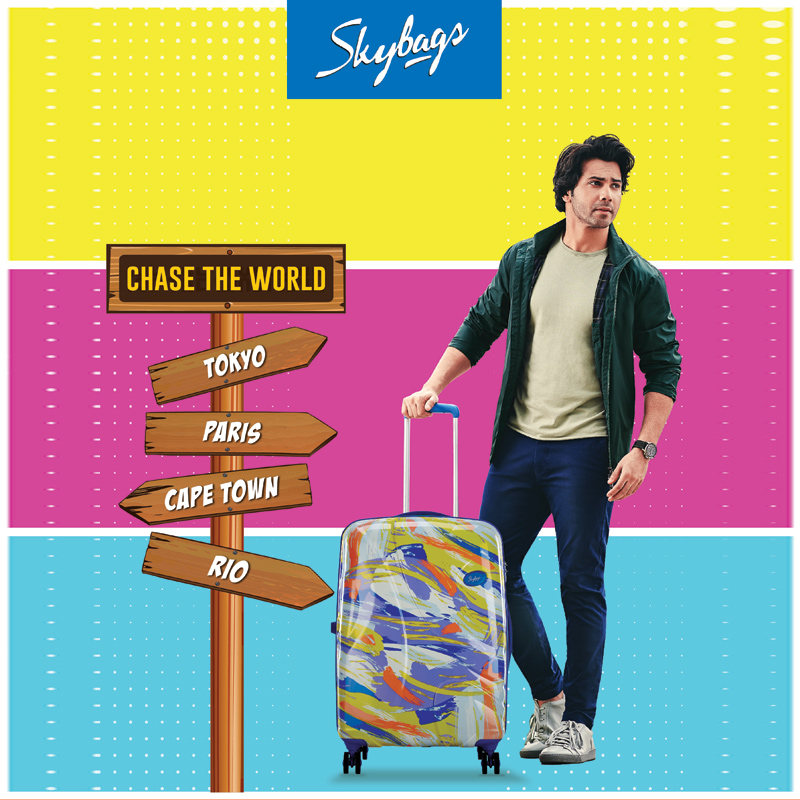

Mumbai: Skybags has unveiled a new brand campaign “Chase The World” with Varun Dhawan, highlighting three of its recently launched most stylish range of luggage bags...

Mumbai: Protinex, the flagship brand of Danone India, has unveiled a new television and digital commercial to drive conversations around the critical need to maintain adequate...

The D2C brand SleepyCat has launched a new campaign for Ultima Mattress featuring stand-up comedian & actor, Vir Das. Designed with a revolutionary CoolTEC™ fabric and...

Mumbai: Digital agency, SoCheers has partnered with MindPeers, a leading mental strength platform. This association is the agency’s constant and ever-going attempt to create a thriving...

MUMBAI: Edtech major Byju’s has onboarded Jiten Mahendra as the new vice president & head marketing. Before joining the edtech company, Mahendra was with retail and...

Mumbai: FCB India wins India’s first Fusion Pencil at the coveted One Show 2022! The agency won this honour for their campaign The Nominate Me Selfie...

MUMBAI: Ten-minute grocery delivery app and the youngest entrant on the quick commerce scene, Zepto launched its latest IPL campaign last week. Crafted by L&K Saatchi...

MUMBAI: The world is now entering the third connected age and it is going to have a huge impact on various areas of advertising and marketing....

MUMBAI: The leading customer engagement platform, Exotel, has onboarded Udit Agarwal as vice president and global marketing head. He will be responsible for strategic and tactical...

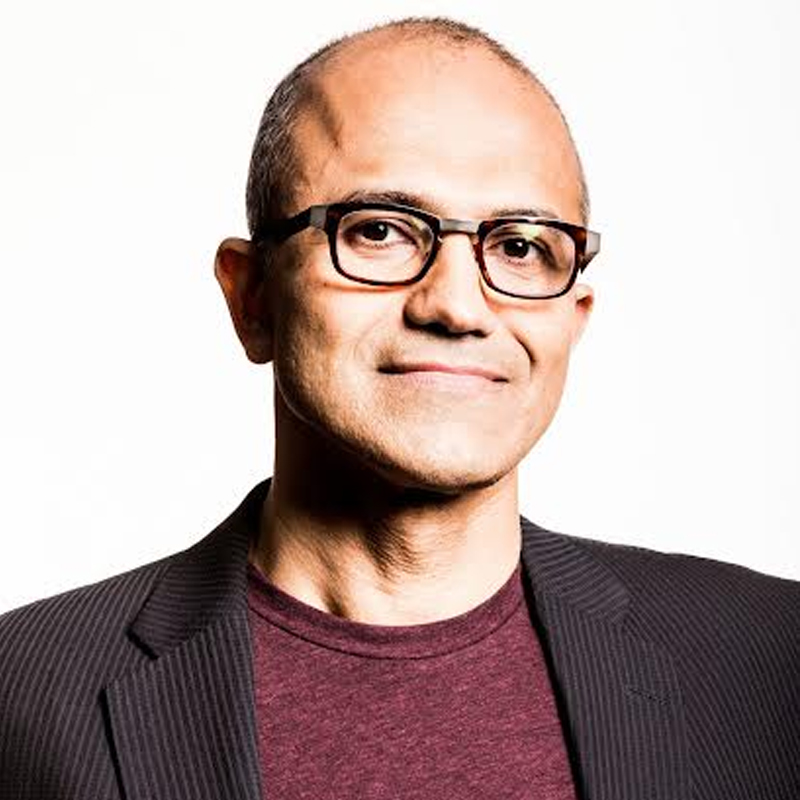

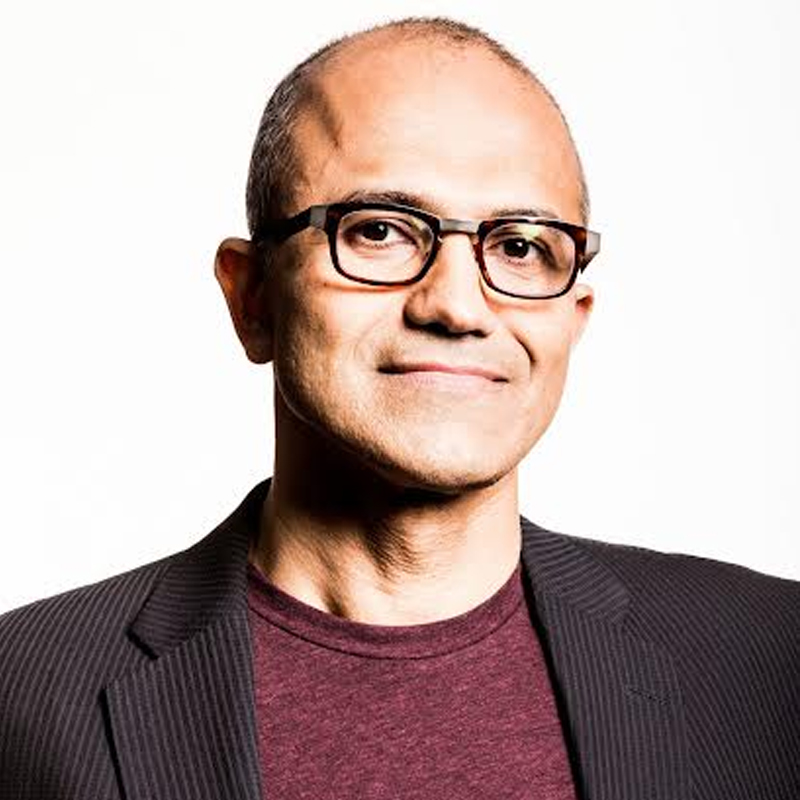

MUMBAI: Microsoft CEO Satya Nadella is the leading investor in the $44 million Series A and A1 fundraising round by New York-based Major League Cricket (MLC),...

Mumbai: Dentsu Webchutney, the digital creative agency from dentsu creative group India has once again demonstrated creative excellence with its outstanding performance at ‘The One Show...

With another weekend upon us, it’s the time to unwind with some tete-e-tete that peeks into the mind of a corporate executive. An attempt to get...

MUMBAI: As per a global study by MMA, a 1 percent improvement in marketing capability fit is associated with a 2.5 percent increase in sales growth...

MUMBAI: Homegrown used car corporate leasing and subscription company, PumPumPum announced the expansion of its leadership team with the appointment of Nikhil Sharma as the assistant...

The popular dating app QuackQuack has witnessed a massive jump of 2 million users in the past five months and currently stands at 17 million registered...

MUMBAI: 22feet Tribal Worldwide has announced the appointment of Vishnu Srivatsav as national creative director. Prior to this, he was the creative head of DDB Mudra’s...

Mumbai: In a first, online startup community for older adults, Evergreen Club has rolled out a social networking platform exclusively for the 50 plus populace called...

Mumbai: The retention cloud leader, CleverTap on Thursday has announced that it has signed definitive agreements to fully acquire San Francisco based Leanplum, a leading multi-channel...

Mumbai:The crypto neo bank, Cashaa, has announced its exit from Unicas. This is Cashaa’s maiden attempt to enter the personal crypto-banking market after becoming a market...

Mumbai: The digital marketing agency, PivotRoots has acquired DeepFlux, a MarTech consultancy, for an undisclosed amount. The company will integrate DeepFlux into its Martech lab and...

Mumbai: Auto-tech company CarDekho Group has appointed Parthasarathy Vankipuram Srinivas as an independent director. The appointment is in line with the company’s objective of strengthening its...

Mumbai: The digital subsidiary of TVS Automobile Solutions Ki Mobility has appointed Madison World’s Madison Media Omega for its media AOR. The account was won in...

Mumbai: Digital cross-border trade finance platform Drip Capital Inc. has announced that Shweta Madhusudan has joined its leadership team as global head, talent development and compensation....

Mumbai: SEO company Infidigita has won the SEO mandate for Khatabook, a Bangalore-based SaaS FinTech company. The partnership aims to help Khatabook achieve its marketing objectives...

Industry veteran YS Guleria has resigned from the position of director, sales and marketing, Honda Motorcycle and Scooter India (HMSI). He will continue in his position...

Mumbai: First Partners has won the communications mandate for Games24x7. First Partners will be responsible for managing the brand reputation for Games24x7. Founded by New York...

Mumbai: Taboola, a front-runner in powering recommendations for the open web, today released the readership insights for the month of April, 2022. These insights from Taboola’s...

Mumbai: The leading pharmaceutical company Mankind Pharma has announced the launch of Docflix, an OTT platform only for doctors. Along with building scientific content through the...

Mumbai: The full stack agency Art-E Mediatech has won the digital technology partner mandate for Pidilite Industries Ltd, a market leader in adhesive, industrial and construction...

Mumbai: Blink Digital has announced its full-fledged footing into the decentralised world that will cover metaverse, NFTs and web3 applications. The integration of virtual reality, augmented...

Mumbai: Finolex Cables Limited has announced Kartik Aaryan and Kiara Advani as its brand ambassadors along with a brand refresh and the launch of a 360-degree...

Mumbai: Greaves Cotton on Tuesday announced the appointment of Dr Arup Basu as deputy managing director of Greaves Cotton Ltd and Sanjay Behl as CEO and...

Mumbai: Sony Sports Network has launched its new campaign for cricket that provides the chance to celebrate India’s favourite game in 2022. The sports network launched...

Mumbai: The OTT sector in India has witnessed a massive surge in viewership during the pandemic era with a host of new players and paid subscribers...

Mumbai: Personalised audio streaming service Pocket FM has announced Shubh Bansal’s appointment as VP-growth and Rahul Nag as head of communications. Both Bansal and Nag will...

Mumbai: The parent company of Mamaearth and The Derma Co., Honasa Consumer has acquired skincare brand Dr. Sheth’s. Through this acquisition, the company has control of...

Mumbai: Neo HBM on Monday roped in Saif Ali Khan as its brand ambassador. As a part of this partnership, the actor will promote HBM Gold...

Mumbai: Homegrown FMCG brand Rage Coffee has announced the launch of its rebranded logo, colors, aesthetics, and packaging. The brand comes with a new visual identity...

Mumbai: The client solution company Spring Bio Solutions has assigned its social media duties to Verve Media. The media agency will be responsible for the company’s...

This will close in 10 seconds