MUMBAI: Twelve companies have been shortlisted by PEMRA to bid for the award of three DTH licences on 23 November which is anticipated to fetch around US$400 million. Initially the authority will issue license for a period of 15 years, which will be extended as per agreement.

No TV channel would be allowed to be a part of the licence directly. The base price for the bid offering was PKR 20 million.

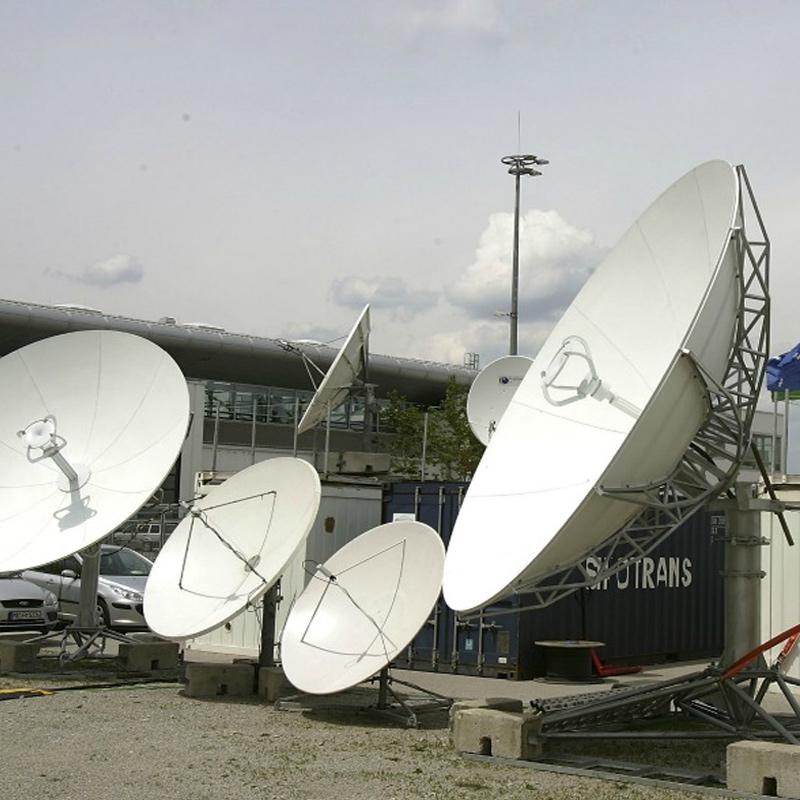

The Pakistan Electronic Media Regulatory Authority is expecting indirect and direct investment of PKR 4194 crore (INR 2720 crore) through bidding of Direct to Home licenses during the next three years. PEMRA officials said the body will open the bidding process at the PEMRA headquarters to give away three licenses, for which 12 companies including Chinese, Russian and UAE firms out of 16 had been selected, Pakistani newspapers reported.

The short-listed companies are:

Mag Entertainment Lahore

Orient Electronics Lahore

Skyflix Islamabad

Startimes Communications Islamabad

Smart Sky Islamabad

Sardar Builders Islamabad

Parus Media and Broadcast Islamabad

Naya Tel Islamabad

Shahzad Sky Islamabad

Maestro Media Distribution Islamabad

HB DTH Islamabad

IQ Communications Karachi

PEMRA had fixed the price of DTH service box PKR 2,500 to PKR 3,000 and its subscription fee will be only PKR 550 a month.

Countrywide, this decision is forecast to create 1,500 direct and 15,000 indirect employment opportunities. PEMRA officials said DTH had captured maximum 25 per cent market while the rest was being served by digital cable suppliers.

There are around three million consumers, using Indian DTH, and the government aims to eliminate it through local facilities and save about PKR 24 billion in capital flight to India.

A PEMRA official said that a Chinese firm was keen to establish a company in Pakistan to manufacture set-top box for DTH and digital cable TV. The Pakistani cable market is primarily analogue, and the most of the operators have not adequately invested in upgrading their networks.

Cable operators in Pakistan had launched an anti-DTH campaign. The Cable Operators Association had staged a protest last week against the DTH bidding. Association chairman Khalid Arain said that the PEMRA chairman had assured the association that PEMRA would not launch DTH in the next two years, warning it to stop the bidding or face the consequences.

Meanwhile, Christian Post reported that PEMRA had banned all 11 Christian TV channels airing in the country and arrested at least six cable operators for defying the order.

PEMRA does not grant landing rights for religious content, allowing the airing of Christian messages only for Christmas and Easter.

However, the Christian channels had been operating for over 25 years. PEMRA has now formally labelled the Christian channels as illegal, the Post reported quoting UCAnews.