KOLKATA: One would imagine that cable operators would be a happy lot, considering the country is on the threshold of the last two phases of digitisation....

MUMBAI: Channel 4’s 4oD has become the latest terrestrial catch-up TV service to launch on Sky’s NOW TV Box, which already offers access to BBC iPlayer...

KOLKATA: The process of shifting from analogue to digital feed is not without its share of problems; a key issue being the resultant tug-of-war between local...

KOLKATA: With cable operators liable to pay 12.36 per cent of the subscription amount collected per month from customers as service tax to the government, 12...

MUMBAI: Time Warner Cable and Comcast Corp are likely to close an acquisition deal that could be worth $58 billion. It is learnt that the duo...

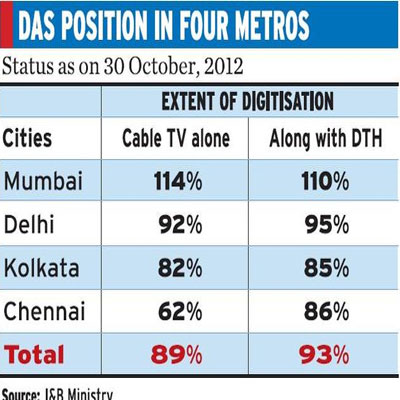

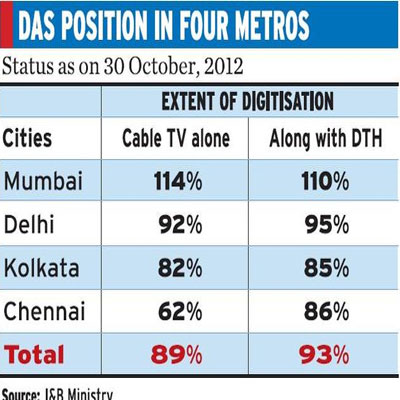

MUMBAI: Back in 2012, when India kicked-off the process of digitisation, local cable operators (LCOs) were an unhappy lot; approaching state high courts for respite from...

MUMBAI: Constituted just over a year ago to protect cable operators and safeguard their business, the Maharashtra Cable Operators’ Federation (MCOF), today organised its first business...

MUMBAI: If one thought that the local cable operators (LCOs) would give up without a good fight for their rights, one was surely mistaken. When around...

MUMBAI: As many as 40,000 cable operators in Assam await a final decision on the issue of monthly payment for using electric poles to lay cable...

MUMBAI: The noose is tightening around those operating in digital addressable system (DAS) phase II areas. The Telecom Regulatory Authority of India (TRAI) today stated that...

MUMBAI: Indiantelevision.com earlier today reported on Star Sports Network filing eight FIRs against GTPL Hathway in Maharashtra, Gujarat, Bihar and Jharkhand for illegal transmission of its...

MUMBAI: Star Sports has come out with a pan India notice against India’s Multisystem operator Siti Cable. The notice that was issued in select newspapers on...

KOLKATA: Looks like cable TV consumers in Howrah will have to sacrifice on their favourite shows with few multiple system operators (MSOs) deciding to switch off...

MUMBAI: The Gujarat Cable Operators Association (GCOA) has approached the High Court of Gujarat against the Telecom Regulatory Authority of India (TRAI), the central government of...

MUMBAI: India is just a year into the process of digitisation, and, in another year, it is quite likely all of the nation’s 100-odd million cable...

MUMBAI: Multi system operators (MSOs) have bought themselves some more time to collect duly filled consumer application forms (CAF) from cable subscribers across 38 cities falling...

MUMBAI: Even as industry prepares for phase III of digitisation, here comes a technology that is likely to get more than a warm welcome from cable...

MUMBAI: It was at indiantelevision.com & MPA’s (Media Partners Asia) India Digital Operators Summit (IDOS) that Mumbai-based cable TV heavyweight and MCOF (Maharashtra Cable Operators Federation)...

MUMBAI: Charter Communications launched its first mobile TV streaming app on Tuesday, offering a lineup of more than 100 live TV channels in the home, though...

KOLKATA: To DAS or not to DAS? That is the question in West Bengal’s Howrah. Howrah, which is among those regions that are under phase II...

KOLKATA: To DAS or not to DAS? That is the question in West Bengal’s Howrah. Howrah, which is among those regions that are under phase II...

KOLKATA: In a bid to expand its reach, SitiCable Network plans to launch seven to eight server-based TV channels in the eastern region. Of which, a...

BENGALURU: Investors in TV18 Broadcast Limited (TV18) have a reason to smile and cheer, though the stock market has not reacted positively to the Q2-2013 results...

MUMBAI: Revlon, the cosmetic company, has launched a new digital campaign for its make-up range PhotoReady. The campaign includes a Facebook application, Twitter handle and online...

MUMBAI: Festive season is the time when channels make the best use of the opportunity served to them. This time, it’s also happening overseas as StarHub...

MUMBAI: The experience of RTL CBS Entertainment HD channel now reaches Philippines. With Sky Cable and RTL CBS Asia Entertainment Network announcing a carriage deal, consumers...

52-year old Peter Chernin does not come across like your typical media CEO. No flamboyance, no arrogance, no showing off. Just a regular business guy. The...

KOLKATA: Odisha-based multi-system operator, Ortel Communications Limited is looking at investing in expansion of its existing network as well as to new locations in the region....

KOLKATA: This year, not only has the economic recession dampened Kolkata’s festive fervour, customers are now complaining about the inability to view their favourite television...

KOLKATA: This year, not only has the economic recession dampened Kolkata’s festive fervour, customers are now complaining about the inability to view their favourite television channels...

MUMBAI: Hathway Cable and Datacom, the largest cable broadband company in India, has launched the Docsis 3.0 ultra High speed network. Docsis 3.0 is a widely...

MUMBAI: A mid- week holiday is always welcome and is a good time to catch up with friends and family as well as your favourite TV...

MUMBAI: Golf is fast becoming one of the most popular sports globally with an appeal that stretches from the wide-eyed adolescent to the ageing retiree. Recognising...

MUMBAI: The show that enthralled viewers across the country and touched a billion hearts, a journey which started with 86 contestants who came from across India...

KOLKATA: The Kolkata based Multi System Operators (MSOs) and local cable TV operators (LCOs) had uninvited guests last week. They were taken by surprise when the...

MUMBAI: Apple and Microsoft have added new channels to their streaming video devices that boost their available content. It’s a step forward for both gadgets but...

KOLKATA: Kolkata is seeing some frenetic activity on the cable TV front. The city’s multisystem operators (MSO) have started switching off signals in several pockets in...

Cable TV digitisation has forced the entire television ecosystem to come face to face with some gut-wrenching changes. Each one of the players has come under...

MUMBAI: Time Warner Cable is trying out a traditional solution to its longstanding CBS blackout problem. The cable operator has started offering free television antennas to...

KOLKATA: With the Telecom Regulatory Authority of India (TRAI) pressuring service providers in Kolkata to disconnect the television connections of customers for not submitting the subscriber...

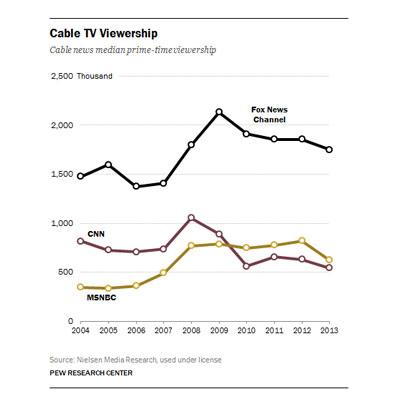

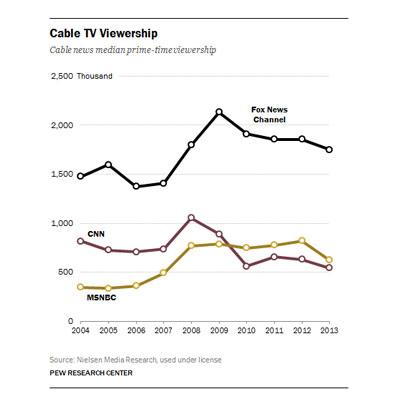

MUMBAI: According to recently released FCC data from their annual report on cable industry competition, the cable industry lost roughly 2.5 million video subscribers between 2010...

KOLKATA: The kingpin of the Multi System Operator (MSO) ecosystem in the East, Manthan Broadband Services has drawn an aggressive plan to secure its current position....

MUMBAI: Cable companies have been rolling out their own apps for years now. But Cox Communications’ new Contour experience, which incorporates a tablet app, aims to...

KOLKATA: Multi System Operators (MSOs) and local cable operators (LCOs) in Kolkata are busy collecting the consumer application forms (CAF) and feeding in details for the...

MUMBAI: Turner International India has announced the launch of HBO Defined and HBO Hits on two of the country’s leading digital cable platforms, Hathway and GTPL....

NEW DELHI: Comcast Cable and Time Warner Cable have joined hands to manage the Reference Design Kit (RDK) software being used in set-top boxes (STBs). The...

KOLKATA: At a time when some cable television viewers in Kolkata are worried about their TV sets going blank for not filling up consumer application forms...

MUMBAI: With Last Mile Operators (LMOs) viewing digitisation as a threat and legal tussles between them and Multi System Operators (MSOs) on the rise, the Maharashtra...

KOLKATA: Ritika Saha, a city based Gujarati engineer, recently installed a set top box (STB) at a cost of Rs 1,400 and has still not been...

MUMBAI: The blackout dispute between CBS and Time Warner Cable has shifted from the TV set to the tablet. In their latest heated exchange, TWC claims...

This will close in 10 seconds