Almost a-year-and-a-half ago Hinduja Ventures Limited (HVL) brought Tony D’silva – a man with more than four decades of experience across sectors such as media, FMCG and pharma – on board as the president of the company to spearhead its Headend in the Sky (HITS) business.

Now, D’Silva has been given responsibility as MD & group CEO of IndusInd Media & Communications Ltd (IMCL) with long time MD & CEO of HVL’s flagship cable company Ravi Mansukhani stepping down earlier this week. As he takes on a bigger role, he is looking at betterment of the company with introduction of newer services. He sounds quite optimistic while suggesting prepaid model for billing and doesn’t hesitate in saying that he wants to give the local cable operators (LCOs), the rightful ownership of their subscribers.

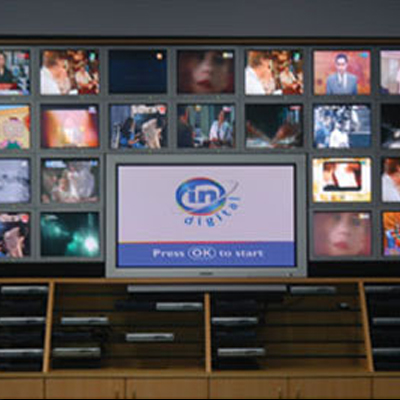

In an exclusive interview with Indiantelevision.com’s Seema Singh, D’Silva talks about his plans for InCable and HITS.

Excerpts:

What does becoming the MD and CEO of IMCL and CEO of Hinduja Group-media mean to you? How is this development going to change Hinduja Group’s media businesses and your life professionally? What are your immediate challenges?

I have mixed feelings because the challenges are very steep. The future is exciting but there are grey areas to be covered before we achieve the state of growth with digitisation and monetisation. While I am looking forward to the challenges, I am wary of the fact that many hurdles need to be crossed. Bringing along processes is difficult and ultimately to monetise this business, the only way is to go prepaid.

The industry must refocus itself to become customer friendly and start customer care services. Everybody in the digitised world is looking at increased revenues. The only way to make more money is by starting packaging, bundling and including small packages with regional and sports channels. The customers need to be segmented. Those who can afford to pay more can take higher priced packages, while those who can’t can opt for the basic pack. Unfortunately, there is a mental block in the mind of the consumers towards cable TV. They are not ready to shell out much for cable TV experience, but there is no such block to pay for broadband or triple play or video on demand (VOD).

That’s where the entire industry should move. They should look at offering more value added services (VAS) and TV Everywhere services. This is what needs to be monetised. My focus will be on bringing the infrastructure to meet these requirements, putting procedures and making the whole business transparent so that every stakeholder in the value chain gets a share of the revenue.

As the Group CEO – media and MD & CEO of IMCL, you will be responsible for restructuring the entire media business and value creation, how are you planning to do that?

We have two-three different businesses. My role is to monetise all these businesses so that the value of the group’s media businesses can grow. While phase I and II of digitisation was all about packaging, bundling etc, phase III and IV is all about HITS. I am very clear that ultimately it is the local cable operator who should own the network. Even in the HITS business, Grant Investrade Ltd (GIL) will be the white label which will be a pure technology service provider, with VOD and VAS.

My aim is also to push the broadband segment which is lagging so far. We have a vast infrastructure for broadband which hasn’t been utilised. It is one area we will start developing now. We are not using that broadband, we are renting it out and they are monetising it. Now, we will restructure that segment as well.

I will look at restricting the business to area specific responsibility. Our focus will be on customer care, which involves interface with customers through call centres and backend support. We will also focus on the LCO: MSO relationship as cable operators are another crucial part of our business model. The third is the broadband and new services.

I would also want to make all our centres, profit centres.

As far as HITS is concerned, it is a separate business with a different team and focus.

Recently, Grant Investrade Ltd announced an investment of Rs 300 crore in the cable distribution business. How do you plan to utilise that investment? Will your approach for the growth of the company be different from your predecessor? How will you ensure HITS turns out to be profitable?

The previous management did a great job. There is no other way than HITS to deal with phase III and IV. With HITS, the average cost of delivering data that comes to be Rs 18 per customer through optical fibre will go down to Rs 8.

The HD box is the future and we will give HD boxes in the price of SD boxes. The operator in the HITS business is competing with DTH. The LCOs have the money but they face difficulty in buying bulk boxes. Thus, we are giving them the option of cash and carry. The operator has the option of buying boxes as per his need.

My profit is by profit of numbers. As my subscribers increase, my cost will come down. Initially, I may incur losses but then it’s a volume game for me. If we are serious about digitisation, the government should have first cleared our HITS project. We are saying the LCOs can own the consumers and can do the packaging. We will help them seed boxes. It is different than JAINHITS. We have three to four different boxes and they get an option to choose.

How much has been invested in HITS? Is more investment needed? When do you see the licence being cleared by the Information and Broadcasting Ministry?

We have been waiting since 14 months to get the licence. We have already spent close to $10 million in the technology which is handled by Castle Media and people. Another $100 million will be invested in HITS project. This investment will happen once we get the licence.

We are suffering because of the wait. When we started the project, the dollar rate was close to Rs 43, now it is Rs 63. Who will take the responsibility to pay for the escalation?

There is a turf war going on between the LMOs and MSOs? Are you looking at resolving these issues?

We are losing the focus in this fight, which is the customer. Industry is beginning to realise that just having subscriber numbers is not enough. We may not be the largest MSO in the country, neither am I aiming for that. My mission is to make InCable the most respected MSO in India. And that’s what the business model should be.

By when will the VAS and VOD services come in to effect? Will HITS benefit IMCL? Do you think the customer in phase III and phase IV will readily pay for these services?

A lot of this is application and we have a full fledged plan. Hopefully, when we launch HITS we will launch it with these services. These services will also be provided on InCable. IMCL will be HITS’ customer. The values and charges will be the same for IMCL as for other LCOs.

The content requirement differs in phase III and phase IV and so HITS becomes an important platform. We will provide different packages based on the requirement. In fact we are encouraging LMOs and MSOs to strike their own deal with broadcasters.

The customers in phase III and IV has money as well. We are targeting 20-25 per cent of the phase III and IV market through HITS. And that market is available.

Phase III and IV need 90 million STBs. How many of these will be seeded by IMCL? Is DTH a competition for phase I and phase II? Will you set up new headends for phase III and IV?

We will not seed STBs if our licence is not cleared.

It is true that in phase I and II cities, the MSOs have to up their antennas and come up with VAS services. 70 per cent of the boxes are SD boxes when the market world over is moving to HD. Are we expected to replace all the boxes later? That will be an expensive proposition. Most part of DTH and mobile is pre paid, so we should move towards that. This will promote transparency. We should be launching prepaid in couple of months. HITS will be a complete prepaid model.

No new headends will be set up in phase III and IV.

In how much time can we expect changes at IMCL?

I have given myself two months to at least start changing the process, procedures and start customer friendly actions by upscaling our call centres like those of DTH players.

By when will the ARPUs for MSOs go up? What would the increase be? Do you see it rising to Rs 500 in the next one year?

The customer will pay if you give him the services he wants. He has no restriction on the amount of money he pays for his mobile phone services. So there is no restriction on the money he pays. But don’t expect the ARPUs to go up if you do not upscale your services.

With gross billing, will there be more transparency in the system? Are you ready to share the carriage fee with LCOs?

I have serious concerns with gross billing. Who is responsible for service tax and entertainment tax? I do not have a problem if it is a prepaid model. The authorities have to realise that relevant issues need to be addressed before gross billing begins.

As of today, the carriage fee has supported the business model for the MSOs. We get the money from there. If the model changes, we will be happy to share the carriage fee.

Can we expect the launch of local cable TV channels from your end? Any numbers you are looking at?

We already have local cable TV channels. But now, as per regulation, these channels need to be encrypted. In InCable, we are revamping the system and encrypting the local channels. We have a separate company that deals with these channels.

In HITS, the local cable TV channels will be handled by the LCOs.

How do you plan to strengthen your broadband service? Any expansion plans in newer regions? Is there a plan to launch Docsis 3.0 broadband? What will differentiate you?

Broadband is one of the key to monetising. We have broadband, but not well utilised. We will use DOCSIS 3.0 and promote it now. We need to focus on the requirements.