DTH

DTH focus shifts to ARPU from subscriber numbers

MUMBAI: In the last six months, the direct-to-home (DTH) industry has faced lots of challenges. The industry saw big DTH players consolidate, shutting down of a player and fights between DTH operators and broadcasters.

In the early days, customer acquisition was the key for most distribution platform operators but, currently, their eyes are set on cost-efficiencies.

An industry source tells Indiantelevision.com, “The biggest worry in the market right now is the elephant in the room, which is Reliance Jio. In the last three quarters, DTH growth has been very muted and is not growing as actively as it should have. The challenge for DTH players right now is pushing up the average revenue per user (ARPU) and push high definition (HD) subscription. Tata Sky, for instance, is pushing HD channels to 110 and trying to create HD packs. It is not trying to increase the subscriber base but planning towards increasing the ARPU.”

Tata Sky came up with a Make My HD pack for as low as Rs 30 per month and a regional HD Access pack at Rs 50 per month for users subscribed to regional SD channels. The channel targeted the south market with a special pack at Rs 290. Dish TV campaigned for HD in all homes by removing the access fee on it and advertising a cost as low as Rs 169 per month (excluding taxes). Countering DD FreeDish, the oldest DTH player also introduced a free to air (FTA) pack with a price translating to Rs 32 a month.

After more than a year of twists and turns, Dish TV and Videocon d2h are set to formalise a merger to create India’s largest DTH company valued at around $2.4 billion and the world’s second largest in terms of subscribers with 29 million, just behind AT&T’s DirecTV. According to the original plan, Dish TV shareholders will own 55.4 per cent in the combined entity, to be named Dish TV Videocon, while Videocon d2h shareholders will hold 44.6 per cent in the company.

“After the deal, there will be group content deals since they are thrice strong with Dish TV, Videocon d2h and Siti Cable. If they go to the broadcaster for the content deal, the pricing leverage will be much higher,” the source adds.

India accounted for 65 per cent of revenue for regional pay-TV channel groups in 2017, led by large local channel businesses owned and operated by 21st Century Fox, Sony and Viacom as per a Media Partners Asia (MPA) report.

“The whole landscape is undergoing a change. The cable operators are facing many challenges and are punching back hard. They are focussing on growing ARPUs from the rural market in phase 3 and 4 and the subscriber base. ARPU in the rural market is still very low which is around Rs 40-45. If they make it equal to urban around Rs 70-75 with a subscriber base of 1 million, then also it will give them an extra Rs 35 million every month. So everyone is working on a strategy, but they are not saying it upfront,” the source points out.

Videocon d2h saw ARPU at Rs 208 for Q3 2018 (September – December 2017), higher than the Rs 212 in the previous quarter. Dish TV’s ARPU stood at Rs 144 for the same quarter, lower than Rs 148 in the trailing quarter. The highest ARPU among listed companies was with Airtel Digital TV with Rs 233.x

Dish TV CMD Jawahar Goel says that the industry is on the pay channels’ side. “The MSOs have different pricing in the market. Whereas for DTH it is a very steep charge and this is the reason for the shutdown of Reliance BIG TV,” he says.

KCCL CEO Shaji Mathews says that if DTH had been launched in India in the year 1997 as envisaged by some of the leading media companies, cable TV would have been a minority player today. “Ever since its launch half a decade later, DTH thrived on the deficiencies in analog cable. Another decade later when digitisation commenced, again DTH pitched to take a share from cable and become the majority player. However, cable withstood the challenge and retained its position at the end of 2017,” he says.

The scenario emerging is that of media players consolidating to face the challenge from telecom. However, Mathews says that in this fight, historically, cable TV has been the partner that media companies can rely upon. “The polarisation is evident from the exit of non-media Videocon and Rcom, though the latter has other reasons also,” he highlights.

Media Partners Asia VP Mihir Shah shows two reasons for growth in the industry. “As BARC continues expanding its coverage, it has pushed up the value of rural reach for broadcasters, which today is primarily delivered through DTH. With this merger, the DTH market has consolidated with top three players accounting for 90 per cent share of the paying subscriber base. These two structural developments will improve DTH’s subscriber economics in the coming year,” he said. “Warburg Pincus’ investment in Airtel Digital last year and now Dish TV-Videocon d2h merger going through serves as a confident booster for the sector.”

The active DTH subscriber base in India is over 50 million as of December 2017. Sun Direct is a major DTH player in the south holding about 40 per cent of the area. Southern subscribers also make up 97 per cent of its total. Sun Direct took up an HEVC media solution from Harmonic to increase its HD channel number to 80 recently.

On 16 February, Star had issued a disconnection notice to Bharti Telemedia for non-signing of the subscription agreement, non-payment of subscription fees and non-submission of subscribers reports. However, even before the broadcaster gave effect to its disconnection notice, the DTH operator decided to temporarily discontinue Star India channels from its subscription packs from 8 March as it had not been able to arrive at mutually acceptable terms with the broadcaster.

“Due to failure to arrive at mutually acceptable terms with Star India, with effect from 8 March 2018, all Star network channels will be temporarily discontinued from your packs,” the DTH operator informed its subscribers.

In the latest update, the Telecom Disputes Settlement Appellate Tribunal (TDSAT) has asked Star India and Airtel DTH to negotiate and enter into an agreement. The tribunal also directed the DTH operator to pay all lawful dues in accordance with the agreement by the due date as indicated in Star’s letter dated 7 March, except the amount of Rs 9.8 crore.

As competition within the industry as well as the fight for the pie continues with MSOs, DTH players will have to focus on giving value add at reasonable rates. Increasing ARPUs will also enable the red to turn black on the company balance sheet, which is what most of them are currently sweating about.

Also read:

TDSAT tells Airtel DTH, Star to negotiate

Airtel Digital TV disconnects Star India channels

Madras HC gives split verdict in Star India versus TRAI case

DTH

Dish TV Q3 revenues fall 20 per cent, Ebitda turns negative

NOIDA: When the remote stops working, you don’t throw it away, you change the batteries. Dish TV is trying something similar. Faced with falling subscription revenues and a fast-shrinking DTH universe, India’s once-dominant satellite broadcaster is flipping channels, betting on smart TVs, OTT aggregation and a hybrid future even as the numbers flash red.

For the quarter ended 31 December, 2025, Dish TV India reported operating revenues of Rs 2,991 million, down 19.8 per cent year-on-year from Rs 3,730 million. Subscription revenues, still the backbone of the business, fell sharply by 32.2 per cent to Rs 2,245 million, reflecting industry-wide cord-cutting and persistent churn. The pain shows up clearly below the line.

Ebitda swung to a loss of Rs 415 million, compared with a profit of Rs 1,227 million a year earlier. Total expenditure climbed 36.1 per cent to Rs 3,406 million, pushing costs to nearly 114 per cent of operating revenues. The quarter closed with a loss before tax of Rs 2,762 million, weighed down further by exceptional items of Rs 700 million. Yet the company insists this is not a business stuck buffering, but one deliberately loading a new format.

Dish TV is repositioning itself from a pure DTH operator into what it calls a connected-home entertainment platform, stitching together live television, OTT apps and smart devices. The centrepiece of that strategy is the nationwide rollout of VZY smart TVs, offering a unified DTH-plus-OTT experience.

Amazon Prime Video has now been integrated across Dish TV’s ecosystem, including Watcho and VZY. Watcho, the company’s in-house OTT super app, has crossed millions of downloads and paid subscribers, aggregating more than 25 content apps.

Fliqs, its creator-driven content platform, is being pitched as a home for premium regional and international programming. Brand visibility has also been boosted through splashy partnerships with Bigg Boss Hindi and Bigg Boss Kannada: high-decibel bets in a crowded attention economy.

“Indian home entertainment is undergoing a structural shift,” said CEO and executive director Manoj Dobhal arguing that Dish TV’s hybrid model improves convenience while keeping customers within a single ecosystem. The revenue mix shows early signs of diversification, even if it is not yet compensating for falling subscriptions.

Marketing and promotional fees rose 27.3 per cent to Rs 399 million, while advertisement income, still small, nearly doubled to Rs 48 million. Other operating income surged 267.6 per cent to Rs 298 million, softening the overall revenue decline.

On costs, the company is tightening the screws. It has renegotiated transponder contracts, rationalised call-centre and general expenses, and improved asset discipline by boosting set-top box recovery beyond 30 days, reducing swap frequency and replacement capex.

New customer activations are being driven through a no-subsidy Rs 999 set-top box, a move management says materially improves unit economics and cash flow. Still, risks remain stubbornly in view. Churn continues to shadow the business, and scaling Watcho while balancing content spend will demand execution discipline.

Cost cuts, the company admits, must not erode service quality: a delicate act in a market where customer loyalty is already thin. For now, Dish TV’s numbers tell a story of strain.

DTH

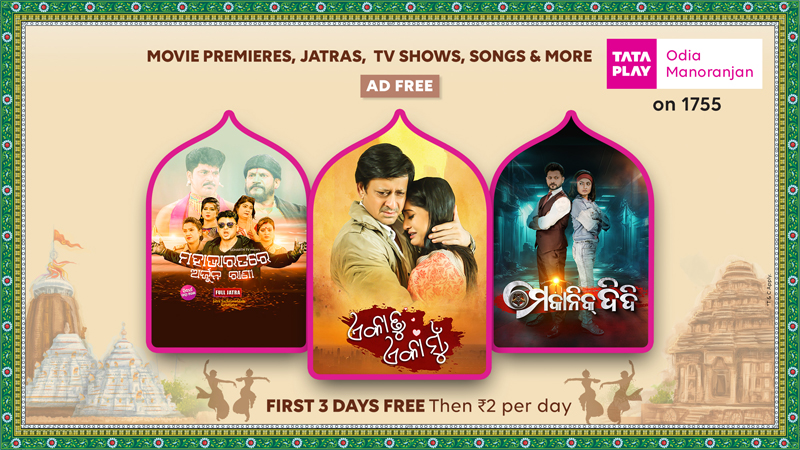

Tata Play deepens Odia push with ad-free ‘Odia Manoranjan’ platform

MUMBAI: Tata Play is doubling down on regional loyalty. India’s leading DTH player has launched Tata Play Odia Manoranjan, a new value-added service that corrals Odia entertainment into a single, ad-free destination, available on television and the Tata Play mobile app.

Powered by Sidharth TV, one of Odisha’s most popular Odia-language GECs, the platform serves up a hefty catalogue: over 180 movies, 100+ Jatras, around 20 television shows and a library of more than 12,000 songs spanning devotional, folk, film and non-film genres. From vintage favourites to contemporary titles, the mix is pitched squarely at Odia-speaking households, with particular pull in tier-3 and tier-4 markets.

Subscribers get 24×7, full-screen SD viewing without ad breaks on channel number 1755, with live TV and VOD access across screens. The price point is deliberately sharp: Rs 2 a day.

Pallavi Puri, chief commercial and content officer at Tata Play, framed the move as a bet on language and culture. “India’s strongest viewing loyalties are rooted in language and lived culture. Tata Play Odia Manoranjan brings together the many expressions of Odia entertainment—from films and Jatras to devotional programming and music—into one clearly defined destination. With this launch, Tata Play further elevates its regional content offering by giving Odia audiences a single, definitive home for their stories and traditions.”

For Sidharth TV Network, the partnership is about reach without compromise. Sitaram Agrawalla, owner and chairman, said: “For decades, Odia families have trusted our entertainment platforms for stories that feel like home, and for moments that bring us together. Tata Play Odia Manoranjan builds on this trust by placing a diverse range of Odia films, theatre, devotional music and shows into a single, accessible space. This collaboration isn’t just about wider distribution—it’s about honouring the preferences of Odia viewers with a seamless, ad-free viewing experience that reflects their language, culture and the way they choose to engage with content.”

The new service slots into Tata Play’s expanding portfolio of entertainment and infotainment platform services across genres including entertainment, kids, learning, regional and devotion, catering to all age groups.

In short: one language, one screen, zero ads—and a clear signal that regional is where the real viewing power lies.

DTH

Binge strikes play as Tata Play adds Times Play to its OTT universe

MUMBAI: If streaming had galaxies, Tata Play Binge just opened a wormhole. In its latest move to become India’s most sprawling entertainment universe, the platform has now folded Times Play, Times Network’s digital-first OTT service, into its all-in-one subscription bouquet bringing Hollywood hits, snackable shorts, live news, lifestyle, entertainment, Pickleball and 11 live TV channels under a single roof.

The new addition means subscribers no longer need to hop between apps in Olympic-level finger gymnastics, Binge now pulls Times Network’s entire digital catalogue into one screen, one login, one bill. And in the era of attention overload, that’s practically a public service.

Times Play brings with it a distinctive blend of premium Hollywood cinema, web series, short-format videos, and Times Network’s formidable news muscle. Viewers can flip seamlessly between Romedy Now, Movies Now, MNX, MN+, Zoom, Times Now, Times Now Navbharat, ET Now, ET Now Swadesh, and even Pickleball Now, mirroring the growing Indian appetite for niche sporting entertainment.

On the long-form front, hits like Reunion, India’s Story, True Story of Angeline Jolie, Orphan First Kill, The November Man, Barely Lethal, Southpaw, The Hurt Locker, Transporter Refueled, and The Holiday sit alongside Times Network factual and current-affairs staples including Frankly Speaking, Sawaal Public Ka, and News Ki Paathshaala.

Describing the partnership, Tata Play chief commercial and content officer Pallavi Puri, said the aim remained unchanged to make content discovery effortless and reduce the modern curse of app overload. She noted that integrating Times Play enriches Binge’s already deep catalogue with a broader mix of premium films, originals and news programming “without juggling multiple apps or subscriptions”.

Times Network echoed the sentiment, calling the collaboration a natural extension of its mission to deliver credible entertainment and journalism at scale. It emphasised Tata Play’s reach, reliability and reputation as a key driver in bringing Times Play’s digital catalogue to diverse Indian households.

With the addition of Times Play, Tata Play Binge now boasts 30 plus OTT platforms on a single interface, a list that includes Prime Video, JioHotstar, Zee5, Apple TV+, Lionsgate, SunNXT, Discovery+, BBC Player, Aha, Fancode, ShemarooMe, Hungama, ManoramaMax, Nammaflix, Tarang Plus, Travel XP, Animax, Fuse+, ShortsTV, Curiosity Stream, and DistroTV, among others.

Notably, Netflix remains available as part of combo packs for DTH subscribers, while Amazon Prime Video can be unlocked as an add-on for Binge users with a Tata Play DTH connection. And for large-screen loyalists, all 30 plus apps can be streamed via LG, Samsung and Android Smart TVs, the Tata Play Binge+ set-top box, Amazon FireTV Stick – Tata Play edition, or through TataPlayBinge.com.

The expansion comes on the heels of recent integrations, including WAVES by Prasar Bharati and BBC Player, reinforcing Tata Play Binge’s ambition to remain India’s most diverse, most unified, and most fuss-free entertainment destination.

With Times Play now in the mix, Binge isn’t just aggregating content, it’s quietly aggregating the future of how India watches.

-

News Broadcasting1 week ago

News Broadcasting1 week agoMukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

-

News Headline1 month ago

News Headline1 month agoFrom selfies to big bucks, India’s influencer economy explodes in 2025

-

iWorld5 months ago

iWorld5 months agoBillions still offline despite mobile internet surge: GSMA

-

Applications2 months ago

Applications2 months ago28 per cent of divorced daters in India are open to remarriage: Rebounce

-

iWorld2 weeks ago

iWorld2 weeks agoNetflix celebrates a decade in India with Shah Rukh Khan-narrated tribute film

-

Hollywood6 days ago

Hollywood6 days agoThe man who dubbed Harry Potter for the world is stunned by Mumbai traffic

-

I&B Ministry3 months ago

I&B Ministry3 months agoIndia steps up fight against digital piracy

-

MAM3 months ago

MAM3 months agoHoABL soars high with dazzling Nagpur sebut