MAM

Loan Against Property – A Practical Way to Unlock the Value of What You Own

You may need sizeable funds to scale a business, renovate your home, or consolidate existing liabilities. In such situations, selling assets may not always be the preferred option. This is where a loan against property can offer a practical alternative. By leveraging the value of a property you already own, you can access substantial funds while continuing to retain ownership of the asset.

What Is a Loan Against Property

A loan against property is a secured loan in which a residential or commercial property is mortgaged in favour of the lender. The loan amount sanctioned is based on the market value of the property and your financial and personal profile.

Why Borrowers Choose a Loan Against Property

One of the primary reasons borrowers opt for a loan against property is feasibility. Compared to personal loans, loan against property interest rates are usually more competitive due to the presence of collateral. This makes it suitable for larger funding requirements where lower interest outgo can make a meaningful difference over time.

Another advantage lies in flexibility. Funds raised through this route can be used for purposes such as housing expenses, business expenses and more, depending on lender policies, making it a versatile financing option for both planned and urgent needs.

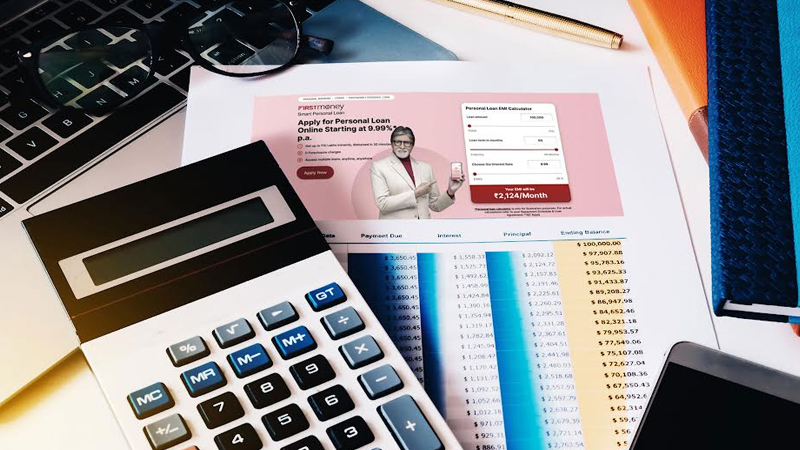

Using a Loan Against Property EMI Calculator

A loan against property EMI calculator can help you estimate monthly instalments by factoring in the loan amount, applicable interest rate, and chosen tenure.

By adjusting these inputs, borrowers can explore different repayment scenarios and identify an option that fits comfortably within their income and long-term financial plans. Many calculators also provide an amortisation schedule, showing how each EMI is divided between principal and interest over time.

Applying Loan Against Property Online

With digitisation, it has become easier to apply for a loan against property online. The process is designed to be convenient and transparent, allowing borrowers to initiate applications from anywhere.

Typically, the process begins with checking eligibility and estimating EMIs using online tools. This is followed by submitting personal, financial, and property details through a digital application form. Required documents are shared for verification, after which the lender carries out a credit assessment and property valuation. Once approved, the sanctioned amount is disbursed as per agreed terms.

A loan against property can help you meet urgent business or housing requirements. Understanding loan against property interest rates, using an EMI calculator, and reviewing the eligibility criteria can help you avail of it easily.

With thoughtful planning, a loan against property can fund your long-term goals while retaining your ownership.

MAM

Nielsen launches co-viewing pilot to sharpen TV measurement

Super Bowl pilot to refine how shared TV audiences are counted

MUMBAI: Nielsen is taking a fresh stab at one of television’s oldest blind spots: how many people are actually watching the same screen. The audience-measurement giant on February 4 unveiled a co-viewing pilot that uses wearable devices to better capture shared viewing, starting with America’s biggest broadcast stage.

The trial begins with Super Bowl LX on NBC on February 8, 2026, before extending to other high-profile live sports and entertainment events in the first half of the year. The goal is simple but commercially potent: count viewers more accurately, especially during live spectacles that pull families and friends to one screen.

The new approach leans on Nielsen’s proprietary wearable meters, wrist-worn devices that resemble smartwatches. These passively capture audio signatures from TV content, logging exposure to shows, films and live events without requiring viewers to sign in or self-report. In theory, fewer clicks, fewer lapses, better data.

Karthik Rao, Nielsen’s ceo, cast the move as part of a broader measurement push. He said the company’s task is to keep pushing accuracy as clients invest heavily in live programming that draws mass audiences. The co-viewing pilot, he added, builds on upgrades such as Big Data + Panel measurement, out-of-home expansion, live-streaming metrics and wearable-based tracking.

Co-viewing is not new territory for Nielsen, which has long tried to estimate how many people sit before a single set. What is new is the heavier integration of wearables and passive detection to reduce reliance on active inputs from panel homes.

For now, the pilot comes with caveats. Co-viewing estimates from the trial will not be folded into Nielsen’s Big Data + Panel ratings, which remain the industry’s trading currency. Instead, pilot findings will be shared with clients a few weeks after final Big Data + Panel ratings are delivered. Clients may disclose those findings publicly.

More impact data will follow later this year. Full integration into Nielsen’s marketing-intelligence suite is slated as a longer-term play, with a target of bringing co-viewing into currency measurement for the 2026–2027 season. This is only phase one, with further co-viewing enhancements planned beyond 2026 and additional timelines to be announced.

The push fits a wider pattern. Nielsen has in recent years expanded big-data integration, adopted first-party data for live-streaming measurement and broadened out-of-home tracking. It also positions itself as the reference point for streaming metrics through products such as The Gauge and the Nielsen Streaming Top 10.

In a market where billions of ad dollars hinge on decimal points, counting who is in the room matters. If Nielsen can pin down shared viewing, the humble sofa could become prime measurement real estate. The race to count every eyeball just found a new wrist to watch.

Brands

Delhivery chairman Deepak Kapoor, independent director Saugata Gupta quit board

Gurugram: Delhivery’s boardroom is being reset. Deepak Kapoor, chairman and independent director, has resigned with effect from April 1 as part of a planned board reconstitution, the logistics company said in an exchange filing. Saugata Gupta, managing director and chief executive of FMCG major Marico and an independent director on Delhivery’s board, has also stepped down.

Kapoor exits after an eight-year stint that included steering the company through its 2022 stock-market debut, a period that saw Delhivery transform from a venture-backed upstart into one of India’s most visible logistics platforms. Gupta, who joined the board in 2021, departs alongside him, marking a simultaneous clearing of two senior independent seats.

“Deepak and Saugata have been instrumental in our process of recognising the need for and enabling the reconstitution of the board of directors in line with our ambitious next phase of growth,” said Sahil Barua, managing director and chief executive, Delhivery. The statement frames the exits less as departures and more as deliberate succession, a boardroom shuffle timed to the company’s evolving scale and strategy.

The resignations arrive amid broader governance recalibration. In 2025, Delhivery appointed Emcure Pharmaceuticals whole-time director Namita Thapar, PB Fintech founder and chairman Yashish Dahiya, and IIM Bangalore faculty member Padmini Srinivasan as independent directors, signalling a tilt towards consumer, fintech and academic expertise at the board level.

Kapoor’s tenure spanned Delhivery’s most defining years, rapid network expansion, public listing and the push towards profitability in a bruising logistics market. Gupta’s presence brought FMCG and brand-scale perspective during a period when ecommerce volumes and last-mile delivery economics were being rewritten.

The twin exits, effective from the new financial year, underscore a familiar corporate rhythm: founders consolidate, veterans rotate out, and fresh voices are ushered in to script the next chapter. In India’s hyper-competitive logistics race, even the boardroom does not stand still.

MAM

Meta appoints Anuvrat Rao as APAC head of commerce partnerships

At Locofy.ai, Rao helped convert a three-year free beta into a paid engine, clocking 1,000 subscribers and 15 enterprise clients within ten days of launch in September 2024. The low-code startup, backed by Accel and top tech founders, is famed for turning designs into production-ready code using proprietary large design models.

Before that, Rao founded generative AI venture 1Bstories, which was acquired by creative AI platform Laetro in mid-2024, where he briefly served as managing director for APAC. Alongside operating roles, he has been an active investor and advisor since 2020, backing startups such as BotMD, Muxy, Creator plus, Intellect, Sealed and CricFlex through a creator-economy-led thesis.

Rao spent over eight years at Google, holding senior partnership roles across search, assistant, chrome, web and YouTube in APAC, and earlier cut his teeth in strategy consulting at OC&C in London and investment finance at W. P. Carey in Europe and the US.

-

iWorld4 days ago

iWorld4 days agoNetflix celebrates a decade in India with Shah Rukh Khan-narrated tribute film

-

I&B Ministry3 months ago

I&B Ministry3 months agoIndia steps up fight against digital piracy

-

iWorld3 months ago

iWorld3 months agoTips Music turns up the heat with Tamil party anthem Mayangiren

-

iWorld12 months ago

iWorld12 months agoBSNL rings in a revival with Rs 4,969 crore revenue

-

MAM3 months ago

MAM3 months agoHoABL soars high with dazzling Nagpur sebut

-

News Broadcasting2 months ago

News Broadcasting2 months agoCNN-News18 dominates Bihar election coverage with record viewership

-

MAM3 months ago

MAM3 months agoKapil Sethi joins Network18 as head of technology

-

eNews2 months ago

eNews2 months agoAarohi crosses Rs 1,000 crore as women-led credit gathers pace