e-commerce

Trading Steady 5paisa Keeps Its Balance in a Volatile Market

MUMBAI: In a market where momentum has been patchy, 5paisa Capital Limited has chosen consistency over drama. The digital brokerage firm reported unaudited consolidated results for the quarter and nine months ended December 31, 2025, showing resilient profitability despite softer topline momentum and higher operating costs. For the December quarter, total income stood at Rs 793.37 crore, compared with Rs 853.10 crore in the same period last year, reflecting lower fees and commission income amid changing market conditions.

Revenue from operations for the quarter came in at Rs 792.75 crore, with interest income of Rs 347.24 crore and fees and commission income of Rs 445.51 crore. While trading-led income moderated year-on-year, cost control helped cushion the impact. Total expenses for the quarter were contained at Rs 628.04 crore, resulting in a profit before tax of Rs 165.32 crore.

After accounting for tax expenses of Rs 42.33 crore, net profit for the quarter stood at Rs 122.99 crore, compared with Rs 161.77 crore a year earlier. Earnings per share for the quarter were reported at Rs 3.94 (basic) and Rs 3.93 (diluted).

For the nine months ended December 31, 2025, 5paisa posted total income of Rs 2,344.11 crore, down from Rs 2,884.39 crore in the corresponding period last year. Net profit for the nine-month period came in at Rs 333.30 crore, compared with Rs 581.67 crore in the year-ago period, mirroring a broader slowdown in retail trading activity.

Despite the moderation, the balance sheet remained healthy. As of December-end, the company reported a net worth of Rs 639.17 crore, with a debt-equity ratio of 0.45 times and a current ratio of 1.50 times, indicating comfortable liquidity. Operating margins for the period stood at 19 percent, while net profit margin was 14 percent, underscoring the firm’s ability to protect profitability in a tougher environment.

On a full-year basis, for the year ended March 31, 2025, 5paisa had reported a net profit of Rs 682.33 crore, providing a strong base despite the subsequent cooling off in market activity. The company’s earnings per share for the nine-month period were reported at Rs 10.67 (basic) and Rs 10.64 (diluted).

Commenting through the results announcement, 5paisa Capital Limited managing director and CEO Gaurav Seth signed off the numbers on January 13, 2026, as the brokerage continues to navigate a phase marked by cautious investor sentiment and recalibrated trading volumes.

While the headline numbers point to a softer year compared to the trading boom cycles of the past, 5paisa’s latest results suggest a business that remains profitable, well-capitalised and steady on its feet, even when the markets refuse to cooperate.

e-commerce

Tulasi Mohan Padavala elevated to Associate Director at Blinkit

Gurugram: Blinkit has elevated Tulasi Mohan Padavala to associate director, capping a three-year climb inside the quick-commerce firm and signalling confidence in an executive steeped in ecommerce, category management and on-ground sales execution.

Padavala shared the update publicly, saying he was “happy to share” the promotion, a succinct announcement that nevertheless marks a notable step up within one of India’s fastest-moving delivery platforms. The new role follows nearly three years at Blinkit, where he most recently served as senior category manager from February 2023 to January 2026, focusing on strategic sourcing and assortment planning.

The promotion places Padavala in Blinkit’s mid-to-senior leadership tier at a time when the company continues to expand its rapid-delivery footprint and sharpen category economics. His brief tenure as associate director began in January 2026, with responsibilities expected to span category growth, supplier strategy and cross-functional execution.

Before Blinkit, Padavala spent a short but intensive stint as global ecommerce manager at Wholsum Foods, the parent of Slurrp Farm and Millé, between November 2022 and February 2023. There he worked on digital marketplace expansion and online retail operations, adding a direct-to-consumer and international ecommerce layer to his résumé.

A longer stretch at Amazon shaped much of his cross-border commerce experience. As business development manager for Amazon’s India Global Selling programme from February 2021 to October 2022, Padavala helped Indian D2C brands enter the North American market. His remit ranged from seller recruitment and category revenue management to coordination with industry bodies, regulators and logistics partners. Key outcomes included launching more than 50 D2C consumable brands in the United States, driving a cumulative gross merchandise sales figure of $1m in FY21-22, tripling sales for participating brands during Prime Day through marketing and visibility levers, growing the monthly recurring revenue of more than 10 newly launched sellers from zero to an average $20,000 each, and negotiating ecommerce partnerships that reduced initial launch costs by 20 per cent.

Padavala’s earlier career was forged in the field rather than the dashboard. At Coffee Day Group, he spent close to five years across multiple sales leadership roles. As sales manager in the Greater Delhi Area from July 2019 to January 2021, he led vending-machine and consumables sales for small and medium enterprises with a team of more than 15 assistant and territory sales managers, managed over 2,000 clients, drove upselling and cross-selling, maintained channel partnerships and ensured timely collections. Prior to that, he served as area sales manager in Delhi between May 2018 and June 2019, handling south and east Delhi markets, and earlier in Hyderabad from April 2016 to May 2018, where he led Andhra Pradesh sales for the vending division, supervised service and logistics functions and managed a base of more than 600 machines with a four-member team.

His professional arc began with internships that combined analytics and process improvement. At Boehringer Ingelheim in 2015, Padavala analysed the impact of brand extension on the drug Pradaxa, identified key performance indicators through market research and assessed sales forecasts, recommendations that drew positive responses in pilot studies. Earlier, at Genpact in 2014, he automated manual sales-order backlog reporting using VBA and Excel, increasing efficiency by 800 per cent, and worked on benchmarking metrics within supply-chain planning processes.

From automating spreadsheets to scaling cross-border ecommerce and now steering quick-commerce categories, Padavala’s trajectory tracks the evolution of India’s retail economy itself. Blinkit’s bet is clear: blend data, discipline and delivery speed. The promotion formalises what his career already suggests. In the race for instant commerce, experience that moves from warehouse floors to global dashboards is no longer optional. It is the engine.

e-commerce

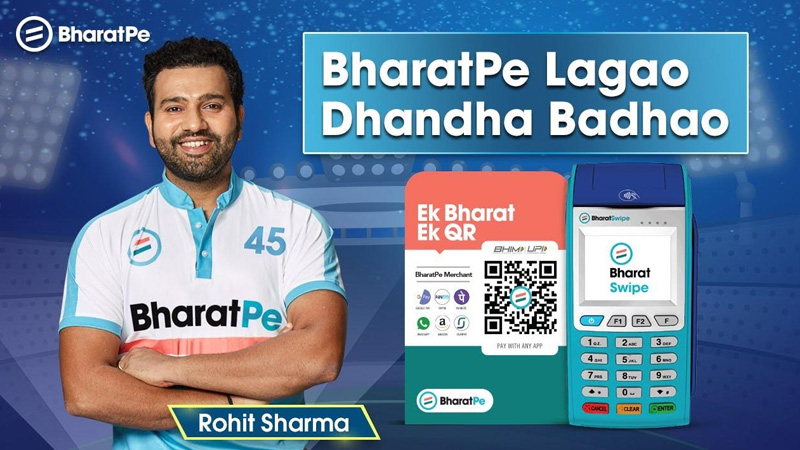

Bharatpe plays a super over as Rohit Sharma fronts T20 push

MUMBAI: When the stakes rise and seconds matter, even payments need a match-winning finish. That’s the cue for Bharatpe, which has rolled out Super Over, a nationwide campaign led by Indian cricket captain Rohit Sharma, timed neatly ahead of the ICC Men’s T20 World Cup.

The campaign draws a straight line between the pulse of cricket and the pace of everyday digital payments. A new brand film taps into India’s emotional bond with the game, while positioning UPI as the quiet hero that keeps daily transactions ticking along at match speed.

As part of Super Over, users making payments via Bharatpe UPI can bag daily rewards ranging from match tickets and signed merchandise to a chance to watch a T20 World Cup fixture alongside Rohit Sharma himself. Both consumers and merchants are also assured Zillion Coins on every eligible transaction, adding a little extra sparkle to routine payments.

Behind the scenes, Bharatpe is also batting for safety. The platform is backed by Bharatpe Shield, a fraud-protection layer designed to offer enhanced security, comprehensive coverage and dedicated support aimed at helping users transact with greater confidence as digital payments scale up.

Announcing the campaign, Bharatpe head of marketing Shilpi Kapoor said Super Over mirrors the aspirations of everyday Indians, combining speed, security and instant rewards to make UPI transactions feel both reliable and rewarding.

The campaign will play out across digital platforms, social media and on-ground activations nationwide, staying live through the T20 World Cup season proof that in cricket, as in payments, timing is everything.

e-commerce

Ahead of budget 2026, KoinX highlights crypto tax disconnect

MUMBAI: As the Union Budget 2026 looms, India’s crypto tax regime is back in the spotlight, and not in a flattering way. A new report by KoinX suggests that for many investors, the taxman walked away with more cheer than their portfolios did.

According to India’s Crypto Tax Story 2025, nearly half of Indian crypto investors ended FY25 in the red. Yet many still paid taxes. The report draws on anonymised data from close to seven lakh Indian users and paints a picture of a system that taxes activity rather than outcomes.

At the heart of the debate is the 1 per cent tax deducted at source. While the levy has improved transaction reporting, KoinX argues it has also frozen capital by skimming every trade, profit or loss notwithstanding. The result is a growing dependence on refunds and a steady squeeze on liquidity.

In FY25 alone, total TDS collected across the crypto ecosystem stood at Rs 511.83 crore. KoinX users contributed Rs 130.16 crore of this amount, but their actual tax liability was only Rs 91.64 crore. That leaves an estimated Rs 38.52 crore locked up as excess deductions.

The burden is unevenly shared. Less than 5 per cent of traders accounted for 87 percent of total TDS collections. Thin margins mean even high volume traders often overpay upfront, while smaller investors feel the pinch in proportion.

KoinX founder and CEO Punit Agarwal said the solution is not scrapping TDS but resizing it. He advocates a uniform cut to 0.1 percent, arguing it would free trapped capital, reduce the drift to offshore platforms and keep compliance intact.

The bigger fault line, however, lies in capital gains taxation. The report shows a near perfect split in outcomes. Around 51 per cent of users posted net gains, while 49 percent booked net losses. Yet taxable gains ballooned to Rs 3,722 crore because losses cannot be set off.

As a result, investors who collectively lost Rs 1,178 crore still paid tax on Rs 180 crore of gains. In plain terms, many paid capital gains tax without any capital gains to show for it.

Agarwal calls this a break from first principles. Across asset classes, no net gain means no capital gains tax. Treating crypto differently, he warns, distorts behaviour and risks driving both traders and liquidity offshore.

As policymakers fine tune the Budget 2026 numbers, KoinX hopes its data offers a timely nudge. The message is simple. A tax system that moves with outcomes, not just volumes, could make crypto less taxing for everyone.

-

iWorld3 months ago

iWorld3 months agoTips Music turns up the heat with Tamil party anthem Mayangiren

-

iWorld12 months ago

iWorld12 months agoBSNL rings in a revival with Rs 4,969 crore revenue

-

I&B Ministry3 months ago

I&B Ministry3 months agoIndia steps up fight against digital piracy

-

MAM3 months ago

MAM3 months agoHoABL soars high with dazzling Nagpur sebut

-

MAM2 months ago

MAM2 months agoBest Lightweight Sunscreens for Daily Use in India

-

AD Agencies1 month ago

AD Agencies1 month agoDivya Parkhi steps into client lead role at WPP Media

-

Brands3 months ago

Brands3 months agoCasio times it right for modern love this wedding season

-

Brands3 months ago

Brands3 months agoTCS unveils Team SDG Universe for young learners