News Broadcasting

A Question of Balance

The public have an insatiable curiosity to know everything. Except what is worth knowing. Journalism, conscious of this, and having tradesman-like habits, supplies their demands.

– Oscar Wilde (1854 – 1900)

The great playwright passed away over a hundred years back, but the essence of the statement is being much debated in India. With reason.

Over the last few months, a section of the news channels have been showcasing content that one would’ve never quite expected to see on an offering that’s supposed to air news and current affairs.

Purists are aghast, but many in the business see nothing wrong.

With peculiar Indian curiosity to know about the minutest detail of the lives of the others, the appetite and consumption of news is on its growling pounce. News channels – at least a section of them – satiate the curiosity which derives voyeuristic pleasure from gossip and rumours.

Because it is this cacophony of subjects of coverage that offers something for everyone, that is driving up not just the ratings, but also revenues for Hindi news channels. And while there are those who wonder when the Hindi news engine will start to lose its steam, most are in agreement that it is not going to be any time soon.

Because it is this cacophony of subjects of coverage that offers something for everyone, that is driving up not just the ratings, but also revenues for Hindi news channels. And while there are those who wonder when the Hindi news engine will start to lose its steam, most are in agreement that it is not going to be any time soon.

The statistics though are telling. The advertising revenue of the new segment in the fiscal year 2006-07 is Rs 9.8 billion. In FY 08 it has touched Rs 12 billion and expected to grow to Rs 14.5 billion by the fiscal end.

According to industry research body Tam, in the January-June 2008 period, 54.2 per cent of the content on Hindi news channels was not news. And among English channels, the number is 38.4. This evidently seemed to help the ad volume. As per Tam Adex, ad volume growth in Hindi and English news channels which stood at 47,449 seconds in 2006 jumped to 62,173 in 2007. In the six-months period from January to June, it has already clocked 36,398 seconds.

According to industry research body Tam, in the January-June 2008 period, 54.2 per cent of the content on Hindi news channels was not news. And among English channels, the number is 38.4. This evidently seemed to help the ad volume. As per Tam Adex, ad volume growth in Hindi and English news channels which stood at 47,449 seconds in 2006 jumped to 62,173 in 2007. In the six-months period from January to June, it has already clocked 36,398 seconds.

The share of ad volumes of news channels in the overall TV advertising pie has been growing steadily. It went up 16 per cent in 2007 from 15 per cent in 2006. Says MCCS CEO Ashok Ventaramani, “The advertising revenue of the market has been growing with a CAGR of 18 per cent since the last five years.”

There is no doubt that advertising is the fuel that drives the satellite boom and India’s burgeoning news channels trade.

The consumption of news too has increased. From 6.9 per cent in 2006, the Hindi news genre has surged to 7.4 per cent to end-2007 (Tam, c&s, HSM, 15+). In the first half of 2008, it is well-placed at 7 per cent as compared to 32 per cent covered by the Hindi entertainment channels (GECs).

The consumption of news too has increased. From 6.9 per cent in 2006, the Hindi news genre has surged to 7.4 per cent to end-2007 (Tam, c&s, HSM, 15+). In the first half of 2008, it is well-placed at 7 per cent as compared to 32 per cent covered by the Hindi entertainment channels (GECs).

| Rank | Top Advertisers in 2007 |

| 1 | Hindustan Unilever Ltd |

| 2 | Bharti Airtel Ltd |

| 3 | Tata Teleservices |

| 4 | Paras Pharmaceuticals Ltd |

| 5 | Tata Motors Ltd |

| 6 | Homeshop18 |

| 7 | Reliance Communications Ltd |

| 8 | Bharat Sanchar Nigam Ltd |

| 9 | Coca Cola India Ltd |

| 10 | Emami Limited |

|

Source:Tam

|

|

With the genre of the TV news consumption getting expanded, the advertising trend has also changed in a short span of two years. In 2006, the top advertisers rooster which was ruled by categories like car/jeep, corporate (brand image), social advertisements, suiting, hosiery and pan masala or gutkha no longer feature in it . The top categories in 2007 and 2008 have been replaced by categories like cellular services, internet and SMS services.

In 2008, direct-to-home (DTH) service and real estate are the unique categories that feature in the top advertisers. Advertisers like Biswanath Hosiery which topped the list in 2006 have been replaced by cellular services like Reliance Communication, Vodafane Essar in 2007 and 2008. In the first half of 2008, the top five advertisers slots are filled up by cellular services.

In 2008, direct-to-home (DTH) service and real estate are the unique categories that feature in the top advertisers. Advertisers like Biswanath Hosiery which topped the list in 2006 have been replaced by cellular services like Reliance Communication, Vodafane Essar in 2007 and 2008. In the first half of 2008, the top five advertisers slots are filled up by cellular services.

| Rank | Top Advertisers in 2008 (H1) |

| 1 | Reliance Communications Ltd |

| 2 | Vodafone Essar Ltd |

| 3 | Hindustan Unilever Ltd |

| 4 | Bharti Airtel Ltd |

| 5 | Bharat Sanchar Nigam Ltd |

| 6 | Reckitt Benckiser (India) Ltd |

| 7 | British Broadcasting Corporation |

| 8 | Life Insurance Corporation of India |

| 9 | Tata Teleservices |

| 10 | Idea Cellular Ltd |

|

Source:Tam

|

|

The entry of a new set of viewers is attributed as the reason for newer categories of advertisers mostly targeting mostly to Sec A and Sec B. They have higher purchasing power, making them more attractive clients for advertisers. As per Tam, 51 per cent of news channels viewers are from 35+ years, 28 per cent comes from 15-24 years and the rest 22 per cent are from 25-34 years.

What’s on the menu?

To a large extent, revenue flows determine how content is produced, packaged and put on airwaves by news channels. This leads to a permanent tension between the journalistic and commercial imperatives of media entities and affects the very nature of news programming.

To a large extent, revenue flows determine how content is produced, packaged and put on airwaves by news channels. This leads to a permanent tension between the journalistic and commercial imperatives of media entities and affects the very nature of news programming.

According to Tam, from January to June in 2008, Hindi news channel have covered 45.8 per cent of news bulletin followed by reviews and reports (15.8 per cent), religious and devotional stories (9.9 per cent), cricket match (9.2), action and thriller (4.9 per cent), comedies (4.1 per cent), film based magazines (2.6 per cent).

English news channels have covered 61.6 per cent news and bulletins, reviews and reports (8 per cent), film based magazines (7 per cent), cricket matches (6.8 per cent) and comedies (1 per cent).

In various Hindi news channels, cricket has been featured differently in Ye Cricket Kuch Kehta Hain (Aaj Tak), Nach Le Cricket (Aaj Tak), Disco Cricket (Star News) while Khali has seen a variety of presentations like Khali Ki Khalbali, Khali Karega Khatma and Khali Sae Bali. Gods blessed the news channels in shows like Zinda Hain Rawan, Sabko Mil Gaye Ram and Kaise Dekhe Ram.

Star News claims that in the week ending 1 March, 41 per cent of the content in its channel was news bulletin while the rest was religious, crime and cricket-centric stories. Religious stories were 8 per cent while sports reviews, comedies, business shows, crime and thrillers were 7 per cent each. Cricket-based shows grabbed 10 per cent while film shows managed 1 per cent of the entire content pie.

Star News claims that in the week ending 1 March, 41 per cent of the content in its channel was news bulletin while the rest was religious, crime and cricket-centric stories. Religious stories were 8 per cent while sports reviews, comedies, business shows, crime and thrillers were 7 per cent each. Cricket-based shows grabbed 10 per cent while film shows managed 1 per cent of the entire content pie.

Times Now editor-in-chief Arnab Goswami scoffs at the suggestion that viewers go away if channel don’t go strong on soft stories. He cites the example of the Khali episode. “Times Now did not devout a single second to Khali, yet we did not lose out on viewers and market share.”

News channels are realising this fast enough. Recently, Zee Group chairman Subhash Chandra announced that his channel is bringing news back in its original form . With the new positioning of ‘Zara Socheye’, Zee News promises to shun stories on godmen and superstitions.

News channels are realising this fast enough. Recently, Zee Group chairman Subhash Chandra announced that his channel is bringing news back in its original form . With the new positioning of ‘Zara Socheye’, Zee News promises to shun stories on godmen and superstitions.

Says Zee News CEO Barun Das, “It is high time someone realise that a news channel is meant for only news. He stresses on the fact that after the repackaging of Zee News, he has managed to make it “non-entertaining” yet “non-boring”.

How channels stack up?

In the Hindi news genre, from January to June 2008 six month period, long-time leader Aaj Tak still rules the roost with an average relative market share of 18.98 (Tam, c&s, HSM, 15 +) per cent, followed by Star News with 17.94 per cent. In the third spot is India TV in terms of average relative market share (14.43 per cent).

However, a closer look on month-on-month index puts India TV on the forefront in the month of May and in June shares the top spot with Aaj Tak (19 per cent each). Aaj Tak has been almost consistent with 19 per cent market share in the six month period. Its sister concern channel Tez has averaged 5.55 per cent.

However, a closer look on month-on-month index puts India TV on the forefront in the month of May and in June shares the top spot with Aaj Tak (19 per cent each). Aaj Tak has been almost consistent with 19 per cent market share in the six month period. Its sister concern channel Tez has averaged 5.55 per cent.

India TV opened the year with 14 per cent to gradually move upto 19 per cent. Star News which was so far on the channel is meant for only news. He stresses on the fact that after the repackaging of Zee News, he has managed to make i t “non-entertaining” yet “non-boring”.

The six-month average of IBN7 is 8.92 per cent while NDTV India has an average of 8.11 per cent. Samay has 4.91 per cent from January to June. Newly launched channel News24 has an average of 4.42 per cent, Live India average 3.24 per cent while public broadcaster Doordarshan managed to pull 3.14 per cent.

The English news segment still continues with a three-way tussle. Six-month average places CNN-IBN with 29.09 per cent (Tam, c&s, All India, 15+) , NDTV 24X7 with 28.91 per cent while Times Now is at 28.58 per cent. Headlines Today stands at 13.34 per cent.

Blame it on distribution?

Advertising is central to privately owned news businesses across the world and in India Indian TV channels derive roughly 70 per cent of their revenues from advertising and about 30 per cent from subscriptions.

Advertising is central to privately owned news businesses across the world and in India Indian TV channels derive roughly 70 per cent of their revenues from advertising and about 30 per cent from subscriptions.

Venkataramani says, “Depending upon the band preferences of the channel, the distribution cost of a national channel can range anything between Rs 200-800 million.”

A large proportion of subscription revenue is consumed by cable operators and since broadcasters do not control their own distribution they can not pinpoint the exact number of viewers. Ratings therefore become vital as the currency of success.

A senior executive at a news channel who request anonymity vehemently opposes the Tam rating system. He argues that content is mainly driven by the Tam ratings. Explaining further, he says that most of the time, the editorial is forced to do stories which categorically caters to the places or states where Tam peoplemeters are placed.

A senior executive at a news channel who request anonymity vehemently opposes the Tam rating system. He argues that content is mainly driven by the Tam ratings. Explaining further, he says that most of the time, the editorial is forced to do stories which categorically caters to the places or states where Tam peoplemeters are placed.

The ratings, however do not represent all the states with a limited number of peoplementer which are absent in states like Bihar, North East and Jammu and Kashmir. This factor alone has tremendous impact on the content, programme packaging and imperative of selling airtime advertisers.

A man hit by a bull in the streets of Delhi will get more coverage and footage than five men killed in Darjeeling or Assam. The reason is only that peoplemeters are located in Delhi and not in the hill zones.

For a Delhiwallah, the neighbourhood report naturally gets more hits in the peoplemeter. “The content is thus decided by the geographical placement of the peoplemeter to get spikes in the ratings.

Hence, some parts of India (where the peoplemeter is absent) and some stories are left untouched or given very little importance,” says the executive.

Over and above this constraint, with most news channels being free-to-air and hence not making any monies from subscriptions, their dependence on advertising and hence ratings is total.

A frequent complaint of news broadcasters is the heavy distribution cost.Broadcasters say more than half of the outlay goes in paying for reach, which cuts other costs like human resources. That is why a reporter cannot be placed in the interiors as it has its own costs. A virtual studio ultimately becomes the easy answer.

Says IBN7 managing editor Ashutosh, “Distribution costs have gone up tremendously because of the clutter of channels. This is in fact affects quality as a lot of money from a fixed budget goes into distribution, and channels compromise on quality. If only we could be patient, a lot of difference could come in.”

“The single biggest problem in the industry today is distribution. It is getting more and more competitive, as more and more channels come into business. The cost is enormous and growing wildly, and it is hurting every broadcaster from the biggest to the smallest, free-to-air (FTA) or pay.

“In this battle, multi-system operator (MSO) and local cable operator (LCO) point fingers at each other, but either way it is costing the broadcaster. And money that could and should have been spent on content is getting spent on distribution instead, and it weakens the industry,” said a the broadcasting executive.

India is the only country in the world with more than 80 24-hour TV channels broadcasting programmes on news and current affairs, barely a quarter-century after the world‘s first 24-hour TV news channel (CNN or Cable News Network) came up in 1980.

The challenge for the news broadcasters in 2008 would be to turn the tables – lower the carriage fees and churn out revenue from subscription. Till the dependence on advertising revenue hangs on, there will be more breaking stories, exclusive stories, Amitabh Bachchan going to Shirdi, Siddhivinayak Temple et al, Salman Khan’s doings and live do or die, battle between godmen and rationalists.

The story first appeared in Indiantelevision.com‘s The NT Magazine. The PDF of the magazine can be accessed at http://www.ntawards.tv/y2k8/nt_mag.pdf.

News Broadcasting

Barc forensic audit in TRP row awaits as Twenty-Four probe gathers pace

KERALA: A forensic audit commissioned by the Broadcast Audience Research Council (BARC) India has emerged as the centrepiece of the government’s response to fresh allegations of television rating point manipulation involving a regional news channel in Kerala, with both the audit findings and a parallel police investigation still awaited.

Replying to a query in the Lok Sabha, minister of state for information and broadcasting L Murugan, said Barc had appointed an independent agency to conduct a forensic probe into the conduct of senior personnel allegedly linked to the case.

The move followed media reports claiming that a Barc employee had accepted bribes to manipulate viewership data in favour of a regional television news channel.

“The report from BARC is still awaited,” Murugan told Parliament, signalling that the forensic exercise remains ongoing.

Industry specialists say forensic audits are crucial in alleged TRP fraud cases, as they examine internal controls, data access trails, panel household integrity, staff communications and financial transactions. The outcome could determine whether the alleged manipulation was an isolated breach or a deeper systemic weakness in India’s television measurement framework.

Running alongside the audit, the Kerala Police has formed a special investigation team to probe the allegations. The ministry has sought a preliminary report from the state’s director general of police, including details of action taken on the first information report. That report, too, is yet to be submitted.

The episode has revived long-standing concerns over the vulnerability of India’s TRP system, particularly in regional news markets where competition for ratings is fierce and advertising revenues hinge on weekly viewership rankings.

India’s sole television audience measurement body Barc, has faced scrutiny before, most notably during the nationwide TRP controversy involving news channels in 2020. While tighter compliance norms were introduced in the aftermath, the latest allegations suggest enforcement challenges may persist.

On regulatory consequences, the government said any punitive action against television channels, including suspension or cancellation of uplinking and downlinking permissions, would be governed by the Policy Guidelines for Uplinking and Downlinking of Television Channels issued in November 2022, and would depend on investigation outcomes and due process.

The ministry also pointed to ongoing efforts to overhaul the ratings ecosystem. Television measurement continues to be regulated under the Policy Guidelines for Television Rating Agencies, 2014. Draft amendments were released for public consultation in July 2025, followed by a revised version in November 2025, aimed at tightening audit mechanisms and improving transparency and representativeness.

In November 2025, Barc said it had taken note of allegations aired by Malayalam news channel Twenty-Four, which linked an internal employee to irregularities in audience measurement. The council said it had engaged a “reputed independent agency” to conduct a comprehensive forensic audit, underscoring the seriousness of the claims.

The ratings system sits at the heart of India’s broadcast advertising economy, shaping billions of rupees in annual ad spends. With trust in audience data once again under strain, advertisers, broadcasters and regulators are closely watching the outcome of the investigations.

Barc has urged industry stakeholders and media organisations to exercise restraint while the probe is underway, calling for an end to “unverified or speculatory claims” and reiterating its commitment to integrity and accountability.

Until the forensic audit and police findings are submitted and reviewed, the government said it would refrain from drawing conclusions.

News Broadcasting

Rajat Sharma defamation row: Delhi court summons Congress leaders Ragini Nayak, Pawan Khera and Jairam Ramesh

NEW DELHI: A Delhi court has ordered the summoning of senior Congress leaders Ragini Nayak, Pawan Khera and Jairam Ramesh in a criminal case filed by veteran journalist Rajat Sharma, sharpening a legal battle over alleged defamation and doctored digital content.

The order was passed on Monday by Devanshi Janmeja, judicial magistrate first class at Saket Courts, after the court found prima facie grounds to proceed under multiple sections of the Indian Penal Code, including forgery, creation of false electronic records and defamation.

Sharma, chairman and editor-in-chief of India TV, had approached the court over allegations made in June 2024 that he had used derogatory language against Congress spokesperson Ragini Nayak during a live television debate. He denied the charge, claiming it was fuelled by a manipulated video circulated online.

According to the complaint, a clipped version of the broadcast carrying superimposed captions, which were not part of the original programme, was first shared on social media platform X by Nayak and later amplified through retweets and public statements by Khera and Ramesh. Sharma said the viral spread caused serious reputational harm and personal distress.

The court took note of forensic science laboratory findings that pointed to visible post-production alterations in the video, including added titles and captions. It also cited witness testimonies from those present during the live broadcast, who stated that no abusive or objectionable language had been used.

In a related civil matter, the Delhi High Court had earlier observed a prima facie absence of abusive remarks and directed the removal of the disputed social media posts.

With criminal proceedings now set in motion, the case adds to mounting scrutiny around political messaging, digital manipulation and accountability on social media platforms.

News Broadcasting

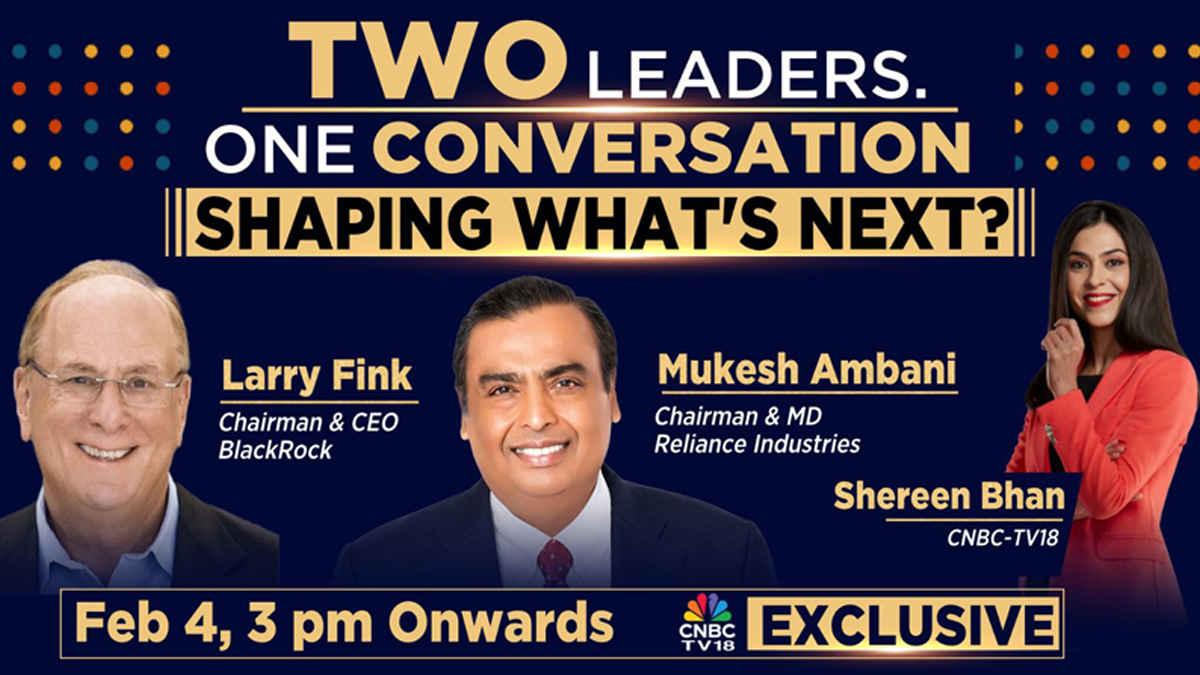

Mukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

Reliance and BlackRock chiefs map the future of investing as global capital eyes India

MUMBAI: India’s capital story takes centre stage today as Mukesh Ambani and Larry Fink sit down for a rare joint television conversation, bringing together two of the most powerful voices in global business at a moment of economic churn and opportunity.

The Reliance Industries chief and the BlackRock boss will speak with Shereen Bhan, managing editor of CNBC-TV18, in an exclusive interaction airing from 3:00 pm on February 4. The timing is deliberate. Geopolitics are tense, technology is disruptive and capital is choosier. India, meanwhile, is pitching itself as a long-term bet.

The pairing is symbolic. Reliance straddles energy transition, digital infrastructure and consumer growth in the world’s fastest-expanding major economy. BlackRock, the world’s largest asset manager, oversees more than $14 tn in assets and sits at the nerve centre of global capital flows. When the two talk, markets tend to listen.

Fink’s appearance marks his third India visit, a signal of the country’s rising strategic weight for the Wall Street-listed firm, which carries a market value above $177 bn. His earlier 2023 trips included an October stop in New Delhi, where he met both Ambani and Narendra Modi.

India is now central to BlackRock’s expansion plans, notably through its joint venture with Jio Financial Services. Announced in July 2023, the 50:50 venture, JioBlackRock, commits up to $150 mn each from the partners to build a digital-first asset-management platform aimed at India’s swelling investor class.

The backdrop is robust. BlackRock ended 2025 with record assets under management of $14.04 tn, helped by $698 bn in net inflows, including $342 bn in the fourth quarter alone. Scale gives Fink both heft and a long lens on where money is moving.

He has been openly bullish on India. At the Saudi-US Investment Summit in Riyadh last year, Fink argued that the “fog of global uncertainty is lifting”, with capital returning to dynamic markets such as India, drawn by reforms, demographics and durable return potential.

Expect the conversation to range beyond balance sheets, into technology’s role in finance, access to capital and the mechanics of sustainable growth in a fracturing world order. For investors and policymakers alike, it is a snapshot of how big money is thinking about India.

At a time when capital is cautious and growth is contested, India wants to be the exception. When Ambani and Fink share a stage, it is less a chat and more a signal. The world’s money is still looking for its next big story, and India intends to be it.

-

News Broadcasting6 days ago

News Broadcasting6 days agoMukesh Ambani, Larry Fink come together for CNBC-TV18 exclusive

-

I&B Ministry3 months ago

I&B Ministry3 months agoIndia steps up fight against digital piracy

-

iWorld1 week ago

iWorld1 week agoNetflix celebrates a decade in India with Shah Rukh Khan-narrated tribute film

-

iWorld3 months ago

iWorld3 months agoTips Music turns up the heat with Tamil party anthem Mayangiren

-

MAM3 months ago

MAM3 months agoHoABL soars high with dazzling Nagpur sebut

-

iWorld12 months ago

iWorld12 months agoBSNL rings in a revival with Rs 4,969 crore revenue

-

MAM6 days ago

MAM6 days agoNielsen launches co-viewing pilot to sharpen TV measurement

-

Film Production2 weeks ago

Film Production2 weeks agoUFO Moviez rides high on strong Q3 earnings